Opportunity in Industrial Conglomerates, Aerospace and Defense, and Agricultural Firms

Defense contractors could be a smart play in this volatile environment.

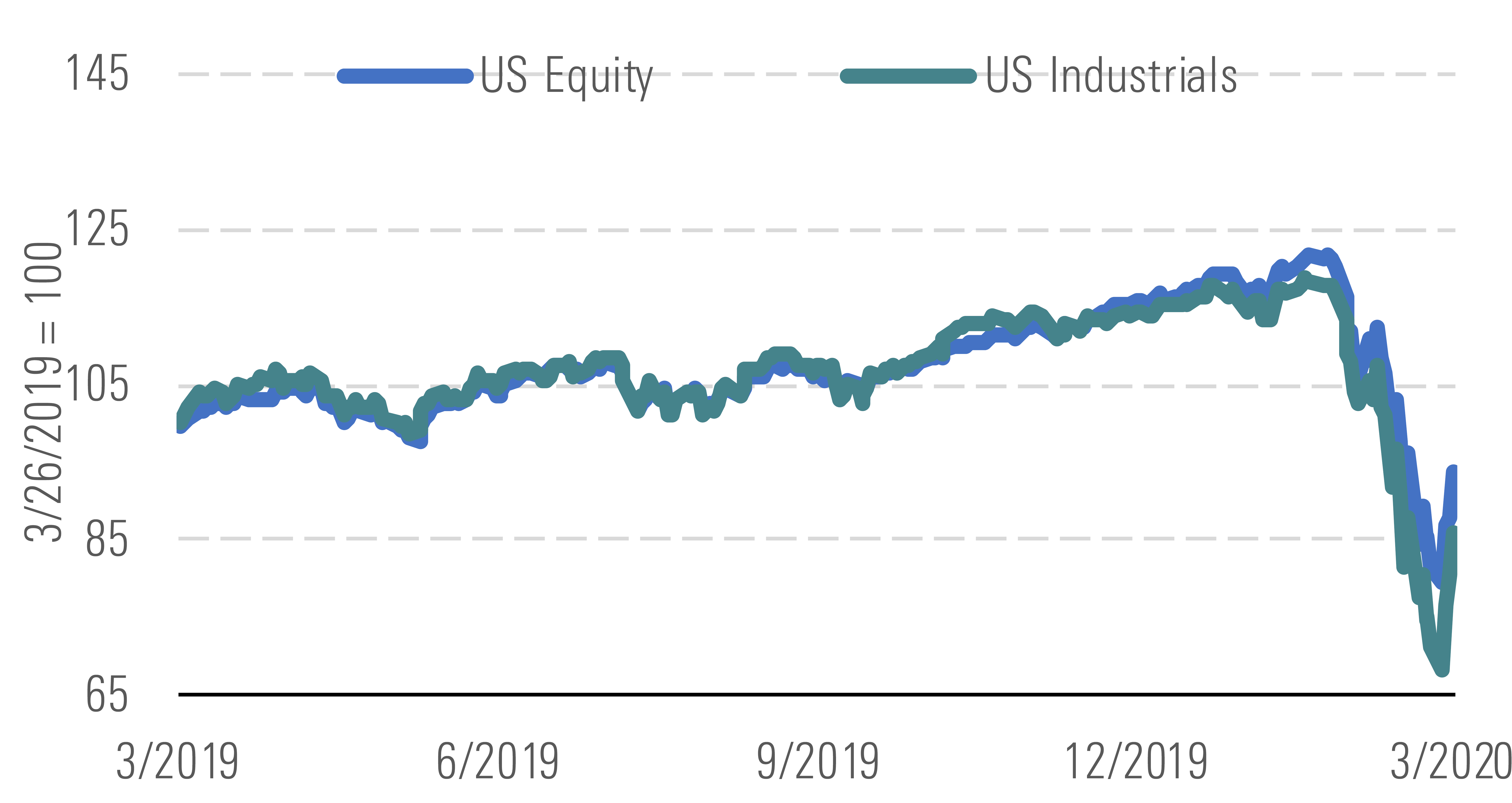

The Morningstar US Industrials Index has underperformed the broader U.S. equity market in early 2020 amid investor concerns about trade tensions, COVID-19, and a potential economic downturn.

Industrials have underperformed the broader U.S. equity market. - source: Morningstar

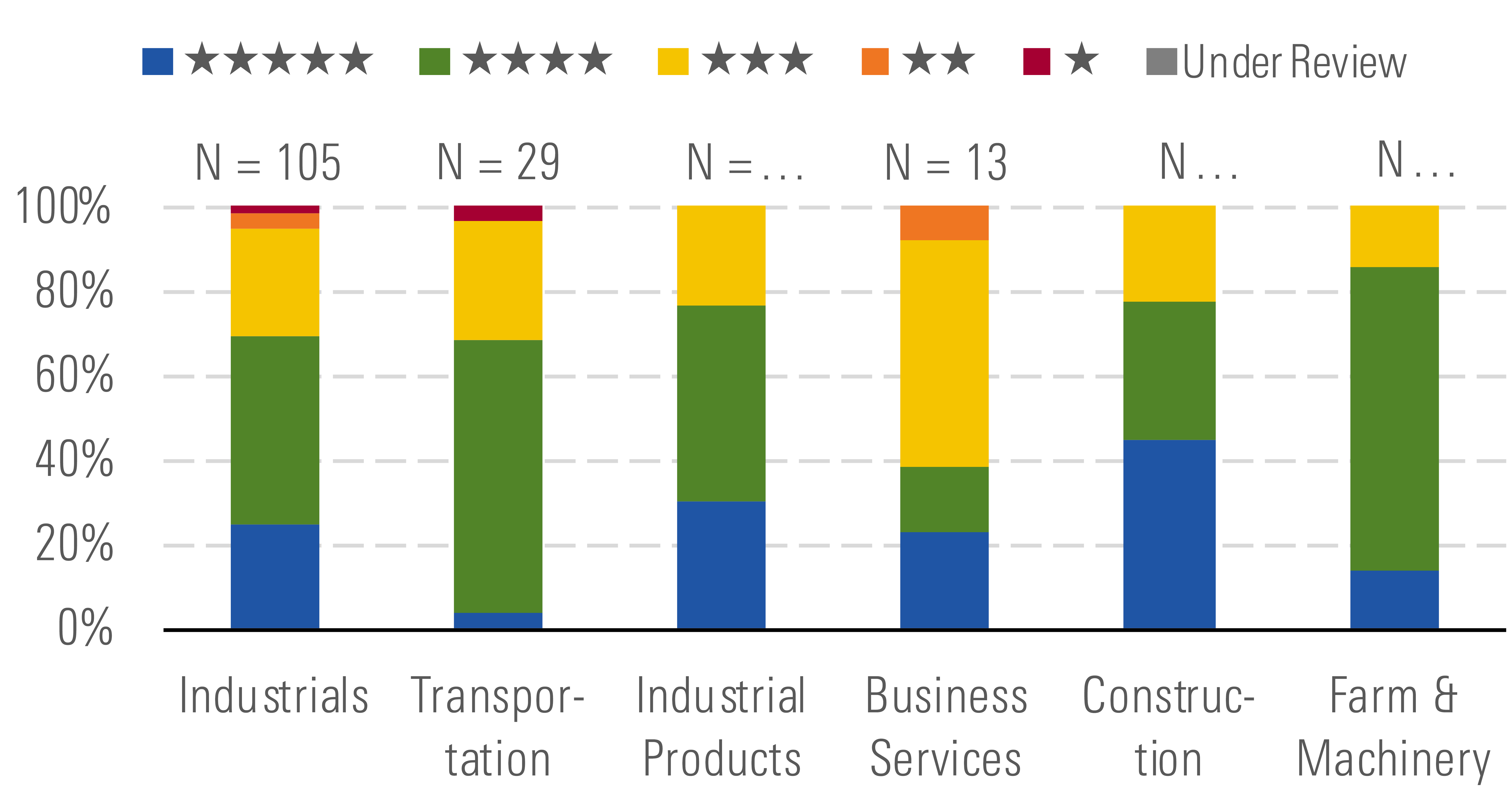

Given current market conditions, we see many opportunities in the industrials sector, with most stocks in our coverage trading in 4- or 5-star territory. The median stock we cover is priced at a 0.80 price/fair value ratio, and industrial conglomerates, construction, and aerospace and defense are the most undervalued industries.

Shares undervalued; majority in 4-star or 5-star territory. - source: Morningstar

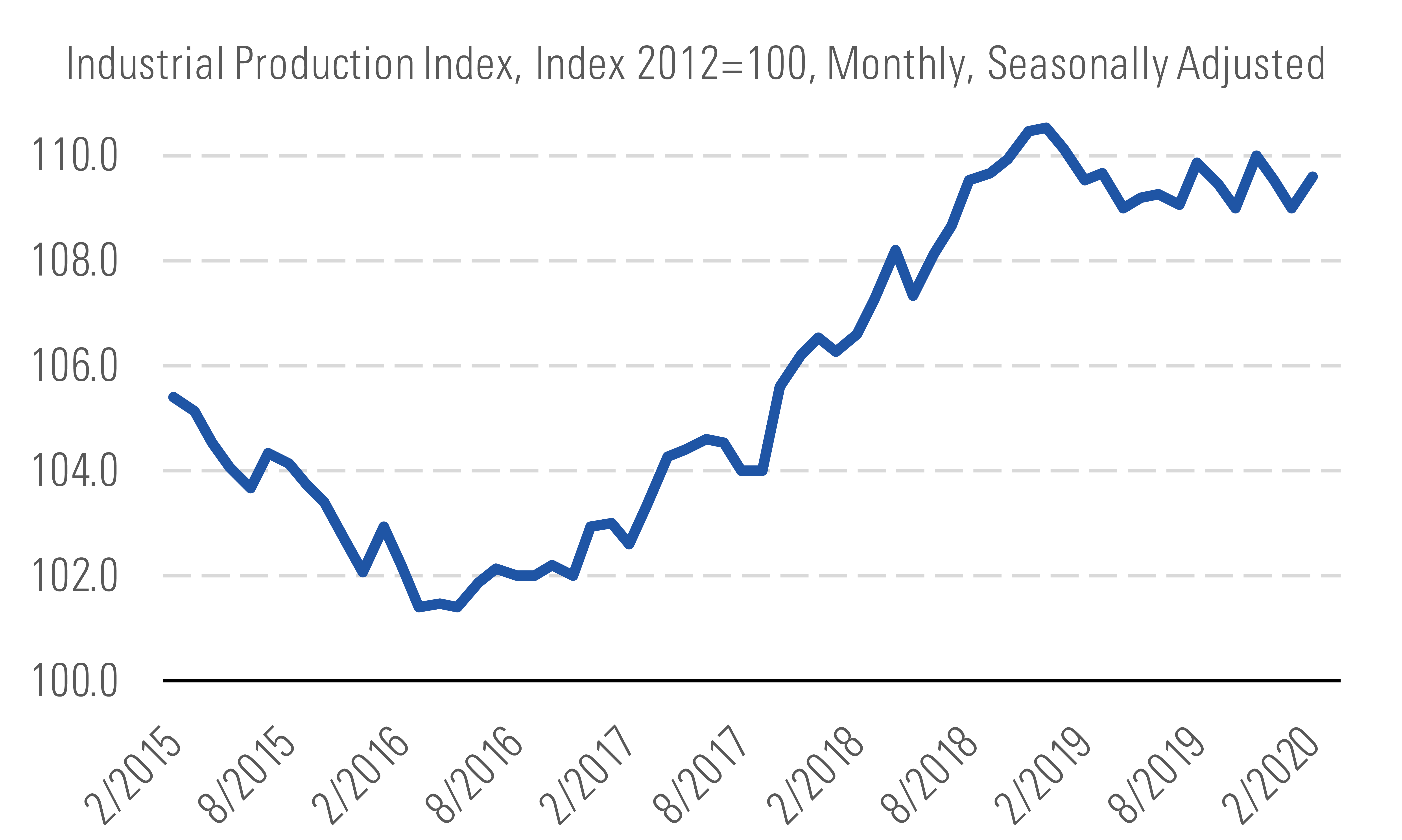

Industrial production appears poised to further contract from the late 2018 peak amid a likely global economic slowdown. While many industrials firms will be adversely affected over the short run, we see many long-term opportunities across the U.S. industrials sector as the virus abates and business conditions normalize.

Industrial production likely to fall amid economic slowdown. - source: Morningstar

Industrial conglomerates like General Electric and 3M have substantial healthcare exposure, which tends to be stable compared their more cyclical industrial counterparts, an attractive quality given current market volatility. 3M and Honeywell also have sizable personal protection segments, which will certainly see revenue growth as global demand for facemasks and respirators exceeds supply. 3M already intends to increase production by about 30% over the next 12 months.

We think defense prime contractors are a smart play for investors concerned with unfavorable cyclical turns for a few reasons. First, defense primes are not exposed to the business cycle, as revenue is largely funded by U.S. and international government spending. Second, increased focus on great-powers competition through the National Defense Strategy indicates that the military will continue prioritizing modernization. Third, customers fund much of the research and development, so defense firms can consistently return substantial free cash flow to shareholders.

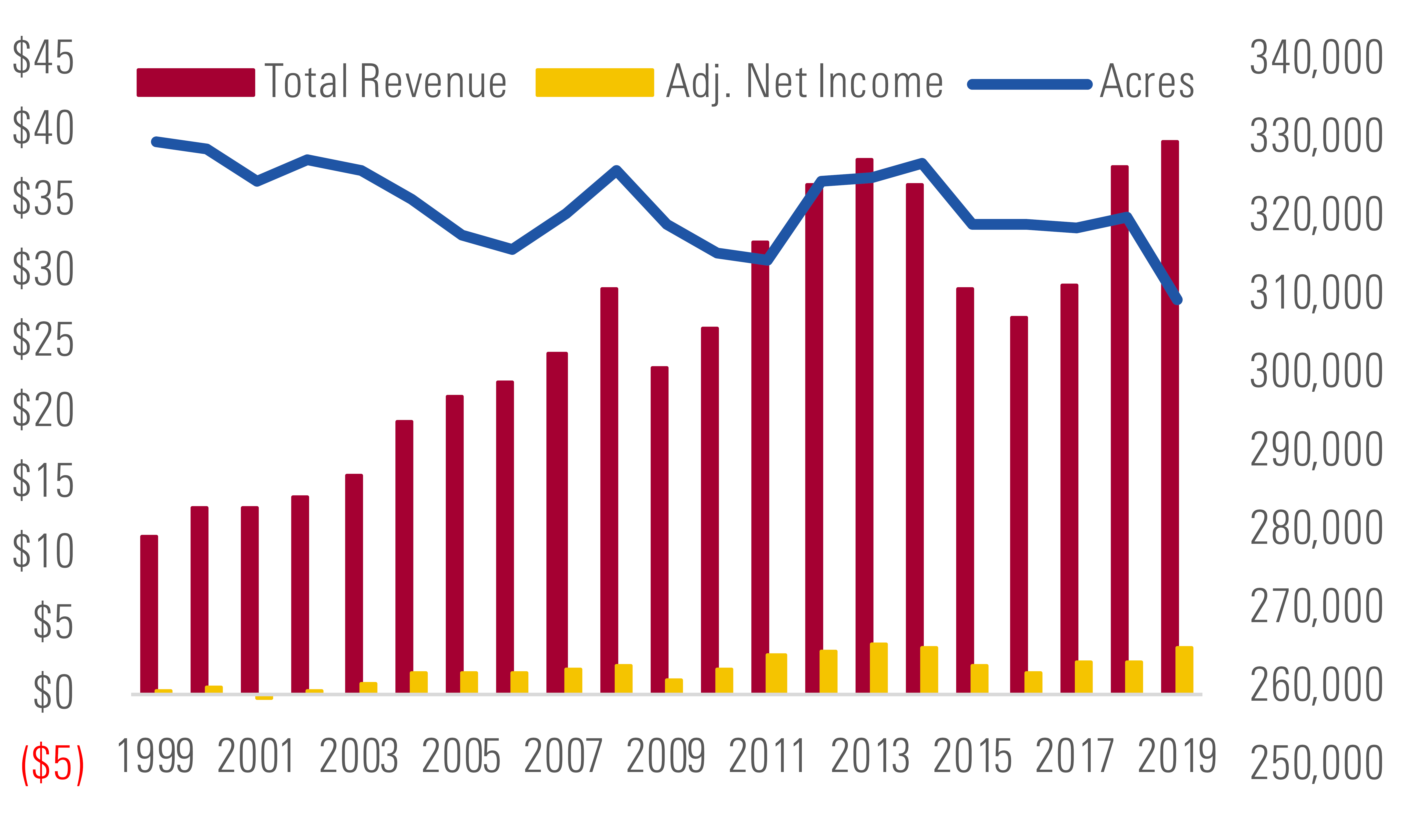

In our view, it is hard to see how U.S. agricultural commodity production will be affected by COVID-19. U.S. acres planted remains relatively constant over time as demand for agricultural commodities varies less than discretionary goods. Furthermore, firms like Deere are federally designated critical infrastructure businesses and may continue operations even as the coronavirus pandemic persists.

U.S. acres planted relatively constant over time. - source: Morningstar

Top Picks

3M MMM Economic Moat Rating: Wide Fair Value Estimate: $186 Fair Value Uncertainty: Medium

In our view, coronavirus fears offer potential 3M investors an uncommon opportunity to own the shares of a well-run, defensive franchise that offers safety of principal and yield, and the potential for modest capital appreciation. The effects of the virus will likely hurt 3M's supply chain and short-term results, given its large geographic exposure to China. That said, we think the valuation remains too attractive to pass on. We specifically point to 3M's personal protective equipment division: It plans to increase manufacturing capacity for its N95 respirator masks, which could drive greater-than-expected division revenue growth.

Lockheed Martin LMT Economic Moat Rating: Wide Fair Value Estimate: $429 Fair Value Uncertainty: Medium

Lockheed Martin’s exposure as the prime contractor on the F-35 program as well as its missile business render it the highest-quality defense prime contractor, in our view. The F-35 program accounts for 30% of the firm’s revenue and will carry it through 2070. Lockheed's dividends per share have increased at about a 7.9% CAGR since 2015, and the company has spent about $9.85 billion buying back shares over the same periods, reducing the average diluted share count by roughly 9.8%. We see F-35 sustainment, a large potential contract win on the Future Vertical Lift program, and hypersonic missiles as large stock-specific growth opportunities.

Deere DE Economic Moat Rating: Wide Fair Value Estimate: $174 Fair Value Uncertainty: Medium

As a result of Deere’s diverse streams of revenue, including aftermarket parts, financial services, and technology, it has only experienced two annual losses in 30 years—in fiscal 1991 and 2001. Deere continues to expand its Apple-like ecosystem that encourages farmers to stick with Deere products over competitors. We believe its investments in Deere Labs in San Francisco will permanently lift the margin profile throughout the cycle. Deere is a strong play due to its U.S. focus, dispersed farmers, and the fact that its U.S. customers have already taken the brunt of the China trade war.

Data as of March 26, 2020.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)