Basic Materials Among Most Undervalued Amid Continued Underperformance

Compelling opportunities in building materials and agriculture firms, which are less exposed to macroeconomic headwinds.

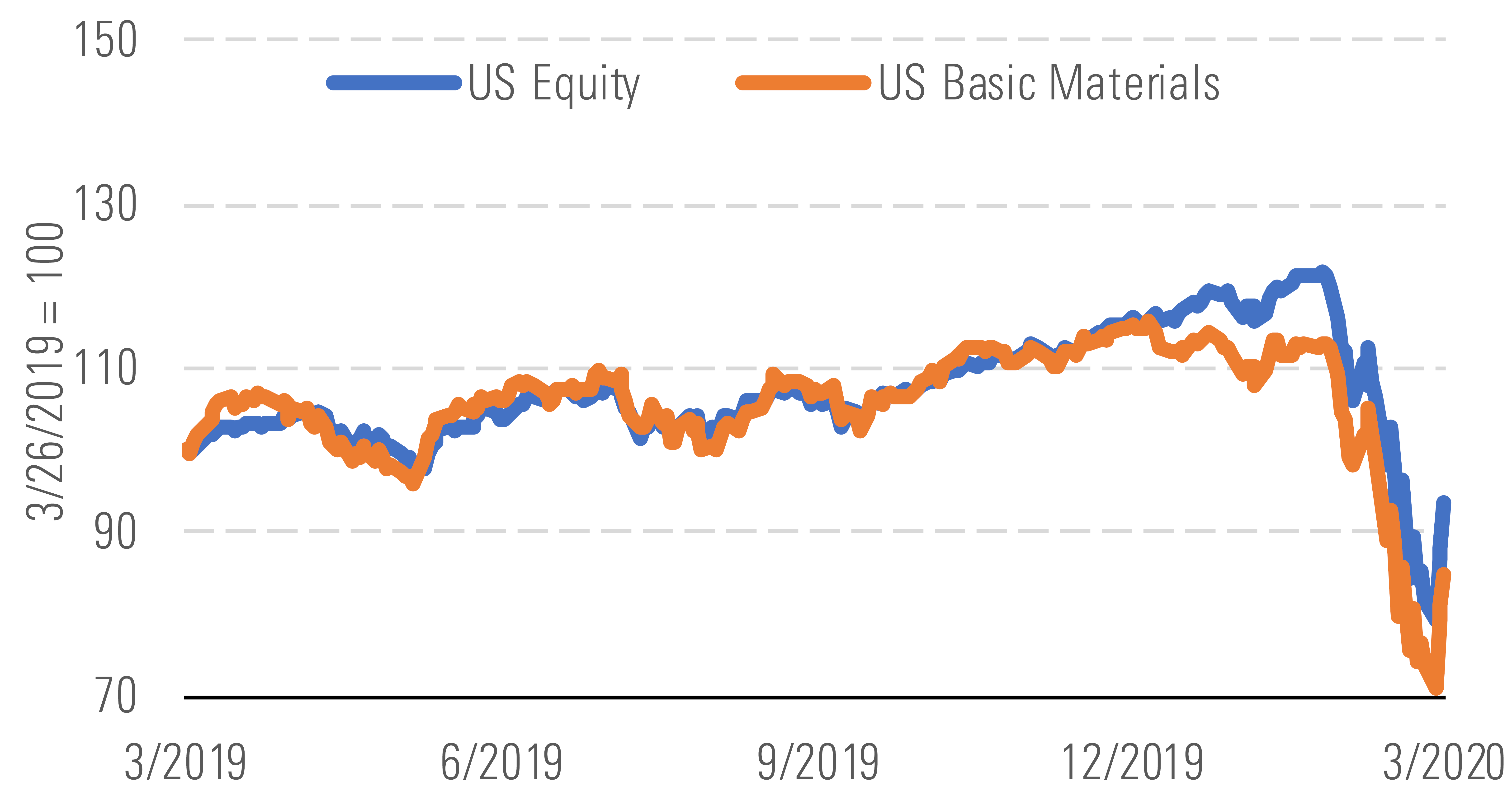

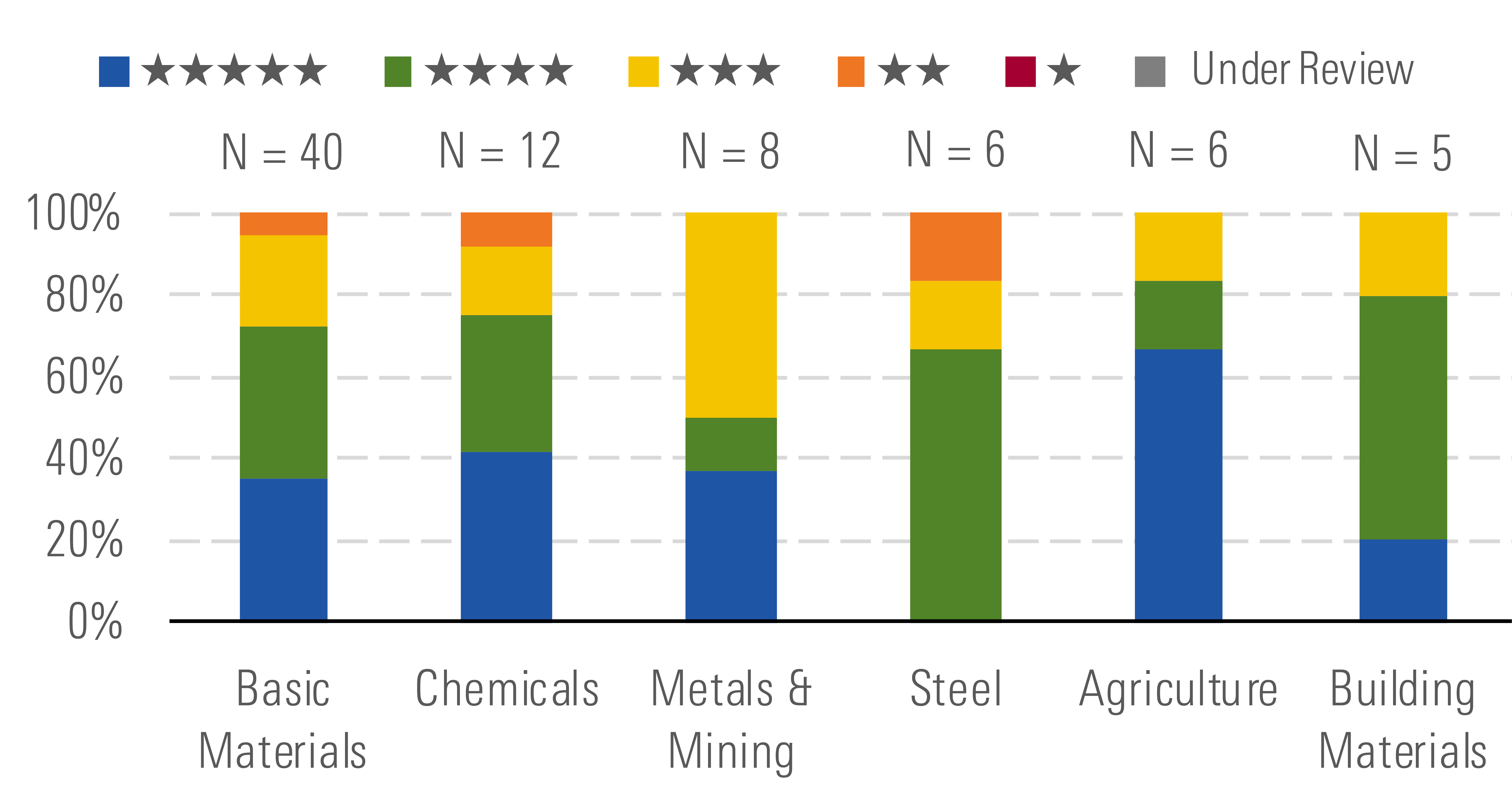

The Morningstar US Basic Materials Index’s underperformance has accelerated in 2020. Year to date, the sector has now lagged the Morningstar US Market Index by more than 740 basis points, driving trailing one-year underperformance of more than 860 basis points. As a result, more than 70% of the U.S. basic materials stocks we cover now trade in 4- and 5-star territory. COVID-19 has caused a massive and dramatic slowdown economywide. However, we think investors can find attractive risk-adjusted opportunities in sectors such as building materials and agriculture, which are less exposed to the macroeconomic environment.

Continued Underperformance Has Created Opportunities - Morningstar

More than 70% of materials stocks trade at attractive discounts. - Morningstar

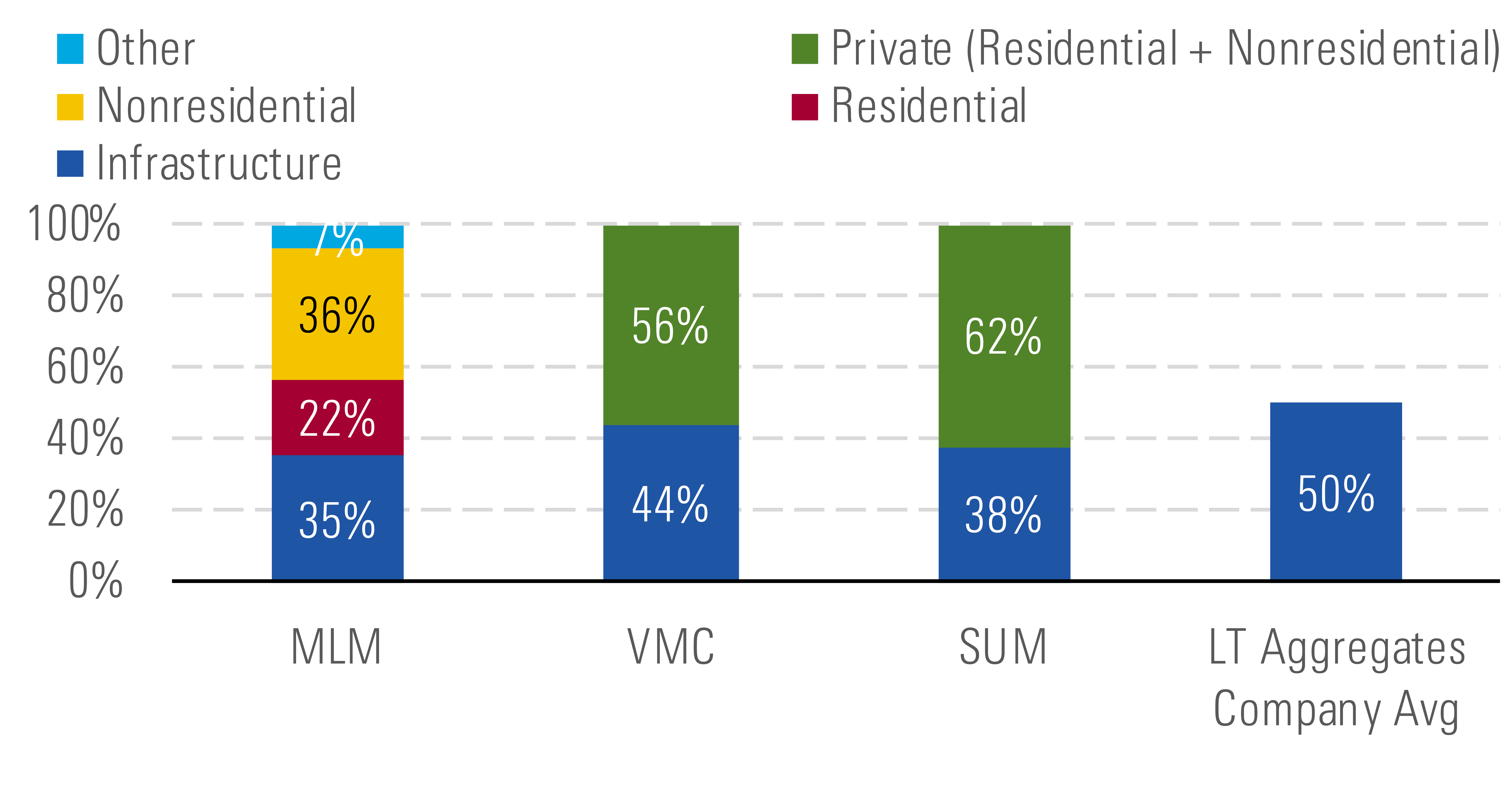

Building materials stocks have performed well over the last several years, stemming from a delayed recovery following the Great Recession. Nonresidential construction has been the primary driver for strong aggregates and cement demand in the U.S., so fears of an economic slowdown are legitimate. However, infrastructure is historically the largest end market for aggregates, and potential fiscal stimulus in the form of increased public construction spending would fill the demand vacated by nonresidential construction.

Infrastructure’s aggregates demand remains below historical levels. - Morningstar

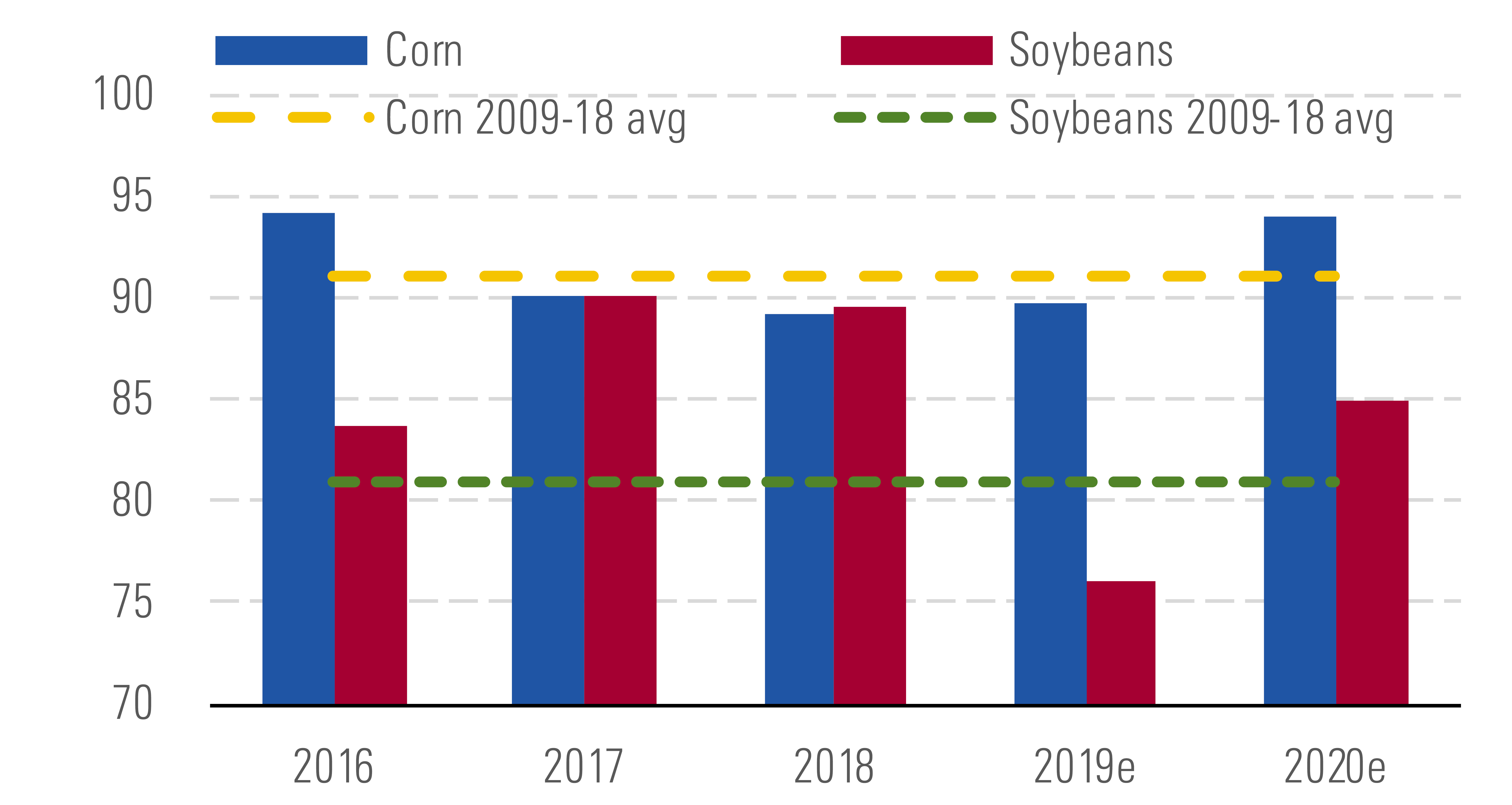

We see little demand impact across the agriculture sector, as our base case for 2020 assumes farmers will still plant crops globally. As such, we continue to expect a significant rebound in U.S. acres planted following 2019's lowest total plantings in over a decade due to flooding. Further, the end of the South American growing season and beginning of the harvest has so far been underway with few disruptions, and we expect companies that sell ag inputs to South American farmers to see that business hold up well.

Corn and soybean acres planted are projected to rebound in 2020. - Morningstar

As diverse as chemicals themselves are, we expect a varying impact from COVID-19 across the producers as well. Some companies even stand to benefit. Specifically, cleaning chemicals used for food-service production will still be needed. Cleaning the "back of the house," such as ovens, grills, fryers, and so on, is still required for a restaurant to remain open even if it just sells takeout and delivery orders.

Top Picks

Vulcan Materials VMC Economic Moat Rating: Narrow Fair Value Estimate: $125 Fair Value Uncertainty: High

Vulcan Materials is our top building materials pick. While the company may see weaker demand from nonresidential construction, it would see great benefit from increased infrastructure spending that could come from fiscal stimulus. Infrastructure is an even better end market for demand, as it tends to be significantly more aggregates-intensive than residential or nonresidential construction. Shares of Vulcan now trade at nearly half our fair value estimate, offering investors significant risk-adjusted upside to U.S. infrastructure construction.

Corteva CTVA Economic Moat Rating: Wide Fair Value Estimate: $40 Fair Value Uncertainty: High

Our outlook for planted acres is largely unchanged, as we expect meaningful recovery from a historic low in 2019. We forecast strong demand for ag inputs, including seeds, crop chemicals, and fertilizers. In our view, the market sell-off has created an opportunity for long-term investors to pick up wide-moat Corteva, with the stock trading in 5-star territory, roughly 55% below our $40 per share fair value estimate.

Ecolab ECL Economic Moat Rating: Wide Fair Value Estimate: $191 Fair Value Uncertainty: Medium

Wide-moat Ecolab’s largest business is selling products and services to institutional customers, including restaurants, hotels, and long-term care facilities. Roughly half of Ecolab's institutional sales are to food-service providers, primarily restaurants, a fourth come from hotels, and the remainder from long-term care and other facilities. While we expect restaurant and hotel sales to decline, around 50% to 60% don't depend on in-store customer volumes. As a result, we think Ecolab will be relatively less affected by the restaurant and hotel slowdown than its food-service and lodging customers. At current prices, we view Ecolab as undervalued on a risk-adjusted basis, with shares trading in 4-star territory. We think the market sell-off provides a rare opportunity for long-term investors to pick up shares of Ecolab at a compelling discount to our fair value estimate.

Data as of March 26, 2020.

/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)