100 Must-Know Statistics About Women and Retirement

We look at some of that data that paint a troubling picture about the state of women's retirement preparedness.

Editor's note: This article is part of our Women and Investing special report.

The data are clear: Women are much more likely than men to have a savings shortfall in retirement. By extension, they’re also more likely to rely exclusively on Social Security for their in-retirement living expenses.

The contributing factors are many. Investing behaviors may be a contributor--specifically, women tend to invest less and hold more cash than their male counterparts. But the major root cause for women falling short in retirement owes to lower lifetime earnings. Not only do women earn less than men, on average, for similar jobs, but caregiving responsibilities cause gaps in earnings. Lower lifetime earnings translate into a savings gap.

To be sure, there are glimmers of positive news--for example, the percentage of employers offering paid family leave has increased substantially over the past several years. But the pandemic has been hard on women financially, with many more women than men leaving the workforce, often to attend to childcare obligations. In aggregate, the data paint a sobering picture about women’s retirement readiness in the United States.

Pandemic Effects 2.3 million: Number of job losses experienced by women since the start of the pandemic. 55%: Percentage of job losses in 2020 that were experienced by women. 47%: Percentage of jobs occupied by women in 2020. 59.2%: Labor force participation rate, women over age 20, December 2019. 57.2%: Labor force participation rate, women over age 20, December 2020. 2.8%: Unemployment rate, white women, February 2020. 5.4%: Unemployment rate, white women, November 2020. 4.9%: Unemployment rate, Hispanic women, February 2020. 8.2%: Unemployment rate, Hispanic women, November 2020. 4.8%: Unemployment rate, Black women, February 2020. 9.0%: Unemployment rate, Black women, November 2020. 8.4%: Unemployment rate, immigrant women, December 2020. 5.8%: Unemployment rate, women born in the U.S., December 2020. 22%: Percentage of women in jobs that allow them to telecommute. 28%: Percentage of men in jobs that allow them to telecommute. 20%: Percentage of single parents in jobs that allow them to telecommute. 40%: Percentage of married people with children in jobs that allow them to telecommute. 32.1%: Percentage of working women ages 25-44 who say they're not working because of childcare demands. 12.1%: Percentage of working men ages 25-44 who say they're not working because of childcare demands. 4.7 hours: Average fewer hours worked by mothers with children age 6-12 than fathers, February 2020. 6.2 hours: Average fewer hours worked by mothers with children age 6-12 than fathers, April 2020.

The Earnings Gap

: Median earnings of working-age women who worked full-time, year-round, 2019.

: Median earnings of working-age men who worked full-time, year-round, 2019.

: Percentage of hourly wage that women earn versus men, 1980.

: Percentage of hourly wage that women earn versus men, 2018.

: Percentage of hourly wage that women ages 25-34 earn versus men ages 25-34, 2018.

: Amount of extra work per year it would take women to earn an equivalent amount of pay to men given the hourly wage gap.

: White female average earnings as a percentage of white male earnings.

: Black female average earnings as a percentage of white male earnings.

: Hispanic female average earnings as a percentage of white male earnings.

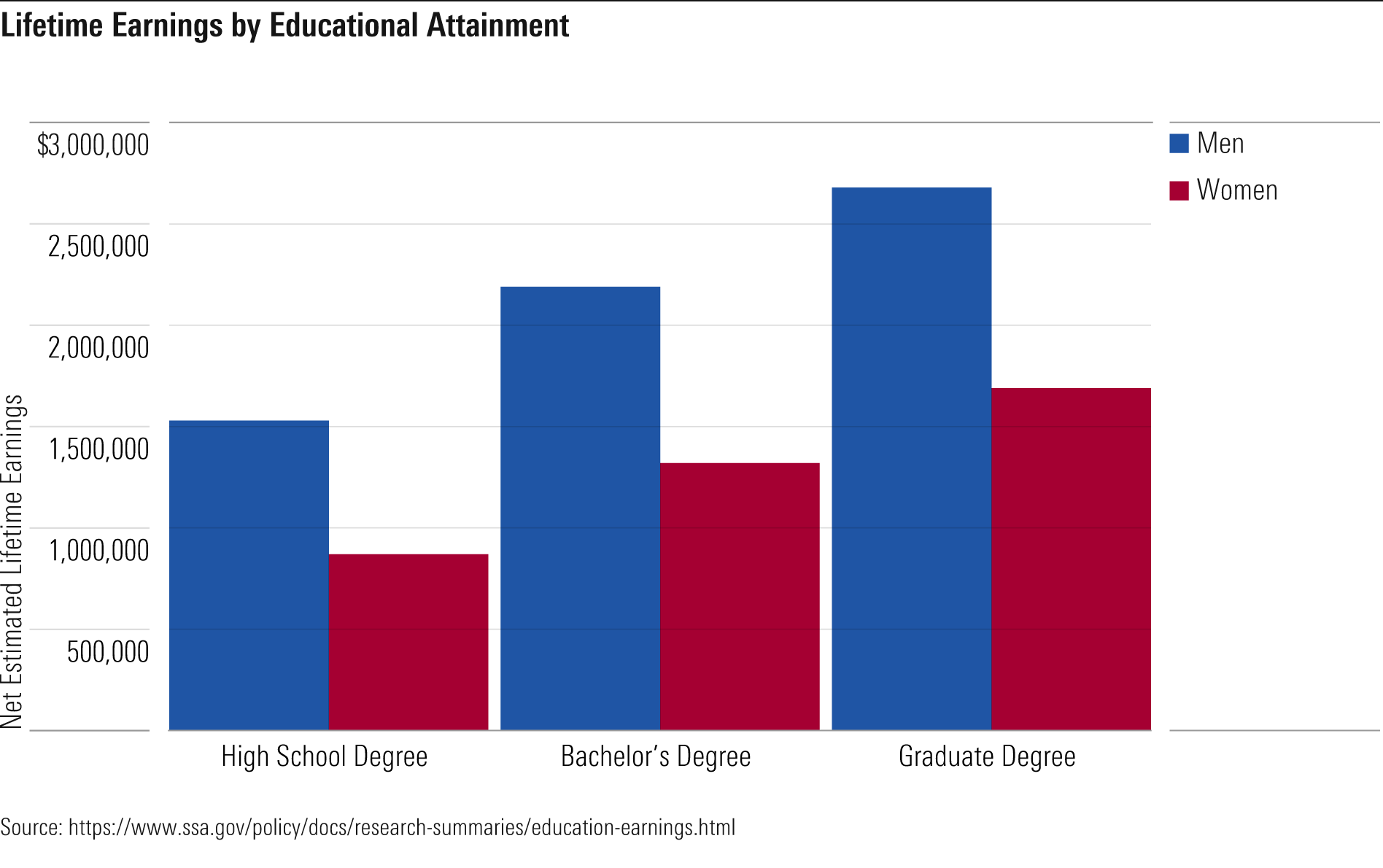

: Net estimated lifetime earnings for men with a high school degree.

: Net estimated lifetime earnings for women with a high school degree.

: Net estimated lifetime earnings for women with a bachelor’s degree.

: Net estimated lifetime earnings for men with a bachelor’s degree.

: Net estimated lifetime earnings for women with a graduate degree.

: Net estimated lifetime earnings for men with a graduate degree.

: Average age at which women’s earnings peak.

: Average age at which men’s earnings peak.

: Peak average earnings for women.

: Peak average earnings for men.

Causes and Contributors

: Percentage of working women who said they have experienced gender discrimination at work.

: Percentage of women who said they accepted the salary they were offered and didn’t negotiate.

: Percentage of men who said they accepted the salary they were offered and didn’t negotiate.

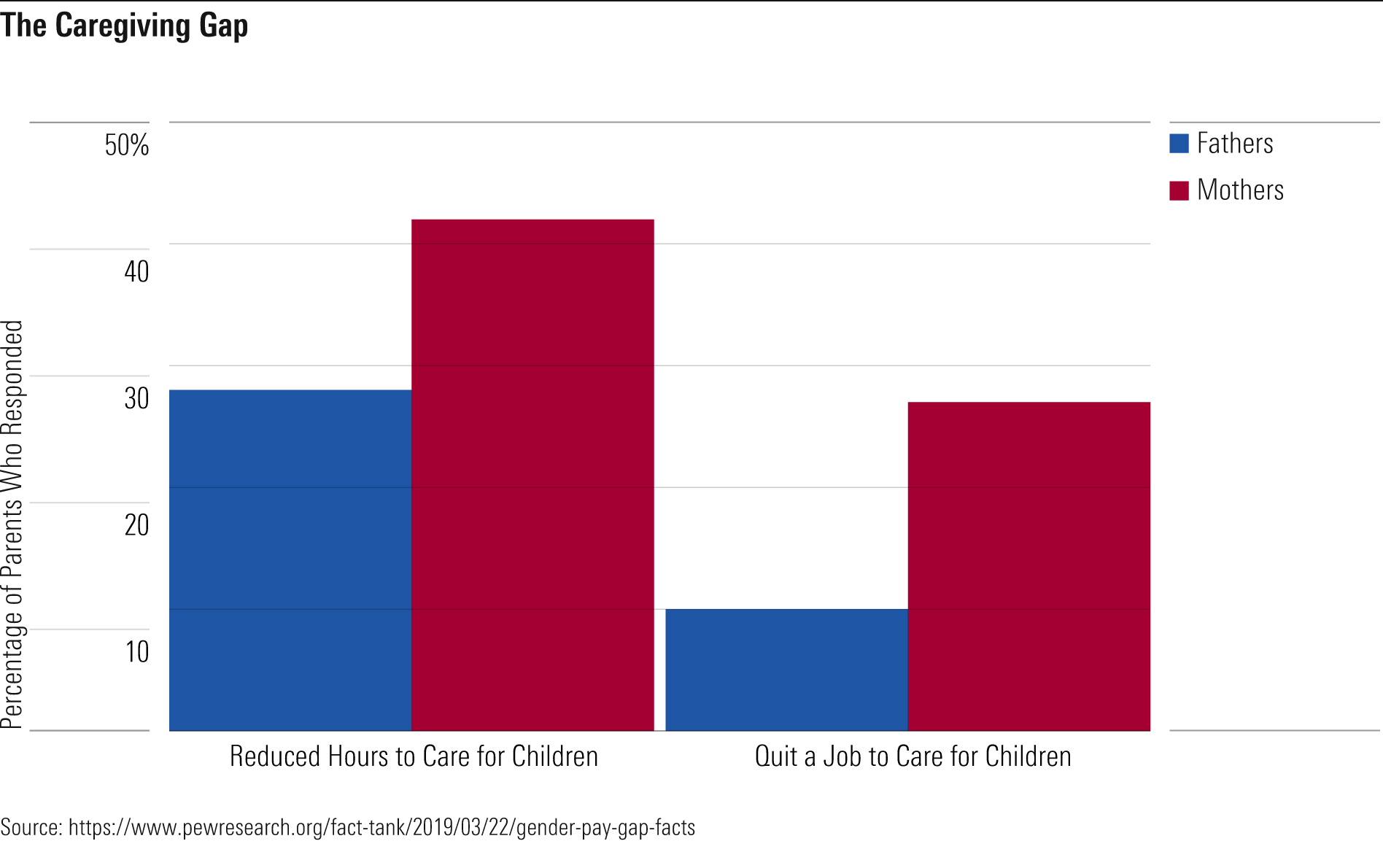

: Percentage of mothers who said they reduced work hours to care for a child or family member.

: Percentage of fathers who said they reduced work hours to care for a child or family member.

: Percentage of mothers who said they quit a job to care for a child or family member.

: Percentage of fathers who said they quit a job to care for a child or family member.

: Percentage of employers that offered paid parental leave, 2015.

: Percentage of employers that offered paid parental leave, 2018.

: Percentage of care delivered to older adults that is provided by family members or friends.

: Percentage of long-term caregivers who are female.

: Percentage of informal long-term care services provided to elderly parents by adult daughters.

: Percentage of informal long-term care services provided to elderly parents by adult sons.

: Average number of hours per week worked by unpaid caregivers who have jobs in addition to caregiving.

: Percentage of caregivers who suffered work-related difficulties due to their caregiving duties.

Retirement/Retirement Savings 70%: Percentage of women saving in a 401(k) or similar plan, or outside the workplace. 81%: Percentage of men saving in a 401(k) or similar plan, or outside the workplace. 27: Average age when men began saving for retirement. 26: Average age when women began saving for retirement. $47,244: Median total income from all sources, single women over age 65, 2016. $57,144: Median total income from all sources, single men over age 65, 2016. 5: Where women placed retirement savings on their financial priority list, below meeting daily living costs, paying off debts, covering housing costs, and general-purpose savings. 1: Where men placed retirement savings on their financial priority list. 55%: Percentage of women who expect to retire after age 65 or do not plan to retire. 84%: Percentage of women who expect to retire after age 65 who say they are doing so for financial reasons. 39%: Percentage of women who are confident they'll have enough resources to last 25 years into retirement. 54%: Percentage of men who are confident they'll have enough resources to last 25 years into retirement.

Role of Social Security $13,505: Average annual Social Security benefit received by women 65 years and older, 2019. $17,374: Average annual Social Security benefit received by men 65 years and older, 2019. 47%: Percentage of income that Social Security composes for unmarried women age 65 and older (including widows), 2017. 34%: Percentage of income that Social Security composes for unmarried men age 65 and older (including widowers), 2017. 48%: Percentage of elderly unmarried females receiving Social Security who rely on Social Security for 90% or more of their income, 2017. 63.9%: Percentage of Social Security beneficiaries age 85 and older who are women.

Women and Healthcare/Long-Term Care 16%: Percentage of women age 71 and older who have Alzheimer's disease and other dementias. 11%: Percentage of men age 71 and older who have Alzheimer's disease and other dementias. 2.5 years: Average number of years women who need long-term care will need it. 1.5 years: Average number of years men who need long-term care will need it. 47%: Estimated percentage of men 65 and older who will need long-term care during their lifetimes. 58%: Estimated percentage of women 65 and older who will need long-term care during their lifetimes. 70%: Percentage of people in nursing homes who are women. $19,700: Average annual spending on healthcare expenses by women 65 and over. $18,331: Average annual spending on healthcare expenses by men 65 and over.

Longevity 21.5: The number of years a 65-year-old woman in 2019 is expected to live. 19.1: The number of years a 65-year-old man in 2019 is expected to live. 78.5: Life expectancy for a 40-year-old woman in the lowest 1% of income. 88.8: Life expectancy for a 40-year-old woman in the highest 1% of income.

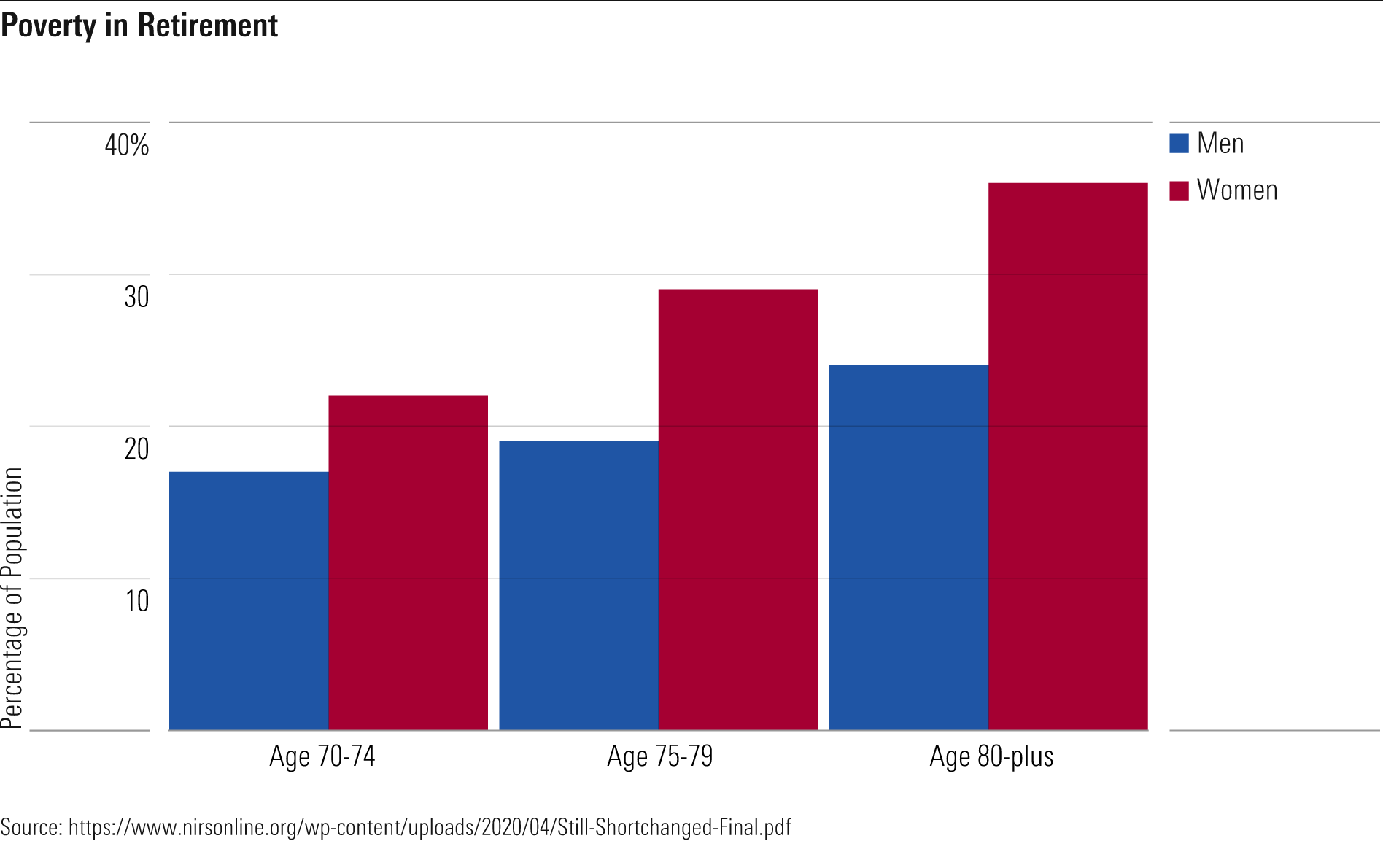

Older Women and Poverty

: Percentage of women age 70-74 who are poor or near-poor.

: Percentage of men age 70-74 who are poor or near-poor.

: Percentage of women age 75-79 who are poor or near-poor.

: Percentage of men age 75-79 who are poor or near-poor.

: Percentage of women age 80-plus who are poor or near-poor.

: Percentage of men age 80-plus who are poor or near-poor.

: Percentage of the elderly poor who are women.

: Percentage of never married women over age 65 who live in poverty.

: Percentage of Black women over age 65 who live in poverty.

: Percentage of Hispanic women over age 65 who live in poverty.

Role of Advice 37%: Percentage of women who use a professional financial advisor. 90%: Percentage of women who will manage assets on their own at some point during their lifetimes. 70%: Percentage of women with financial advisors who will change advisors within one year of their partners' deaths. 33.5%: Percentage of financial advisors who are female, 2018.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YBH7V3XCWJ3PA4VSXNZPYW2BTY.png)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)