4 High-Quality, High-Yielding Stocks

We expect these high yielders to sustain their dividends in the future. Plus, they’re cheap.

Two weeks ago in this column, we examined undervalued dividend growth stocks. Specifically, we shared some stock ideas from the Morningstar U.S. Dividend Growth Index.

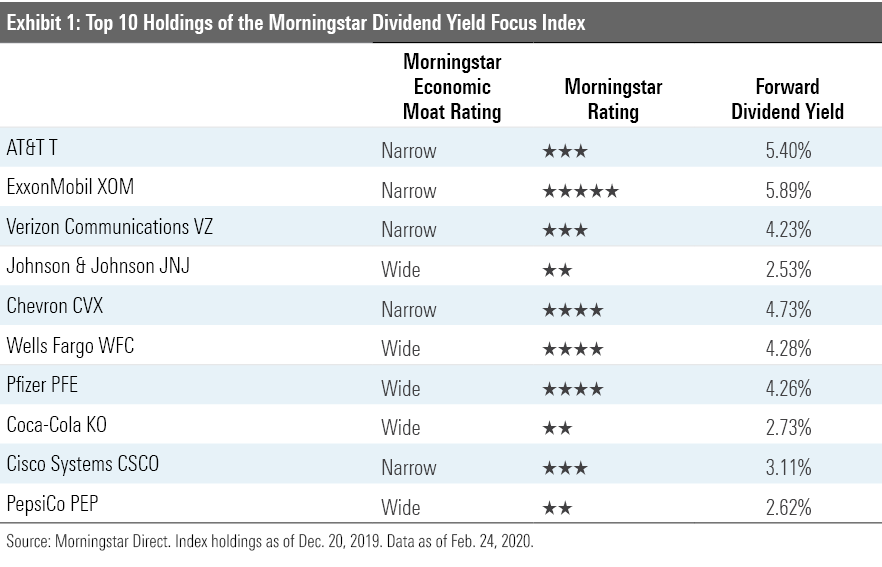

Today, we're looking for opportunities among dividend-paying stocks from another angle--from the holdings in the Morningstar Dividend Yield Focus Index. A subset of the Morningstar U.S. Market Index (which represents 97% of equity market capitalization), this index tracks the top 75 high-yielding stocks that meet our screening requirements for quality and financial health.

How are the index constituents chosen? For starters, only securities whose dividends are qualified income are included; real estate investment trusts are tossed out. Companies are then screened for quality using the Morningstar Economic Moat and Uncertainty ratings. Specifically, companies must earn a moat rating of narrow or wide and an uncertainty rating of low, medium, or high; companies with very high or extreme uncertainty ratings are excluded. We then screen for financial health using our Distance to Default measure, which uses market information and accounting data to determine how likely a firm is to default on its liabilities; it is a measure of balance-sheet strength. The 75 highest-yielding stocks that pass the quality screen are included in the index, and constituents are weighted according to the total dividends paid by the company to investors.

Here are the index's top 10 holdings as of the latest reconstitution in December. Four of the stocks are undervalued by our metrics as of this writing.

Here's a little bit from our analysts about the strength of the moats--and therefore the quality--for the four undervalued names.

ExxonMobil XOM "We continue to rate Exxon as the highest-quality integrated firm, given its ability to capture economic rents along the oil and gas value chain. While its peers operate a similar business model with the same goal, they fail to do so as successfully, as evidenced in the lower margins and returns compared with Exxon. Exxon generates its superior returns from the integration of low-cost assets (an intangible asset that we consider to be part of its moat source) combined with a low cost of capital; this combination produces excess returns greater than those of its peers. However, given our outlook for lower long-term oil and natural gas prices, we expect Exxon's returns to be lower than they have been in the past. Additionally, its decision to increase investment relative to peers during the next five years is also likely to narrow the gap in returns with peers. Consequently, our confidence that it can continue to deliver excess returns for longer is diminished, resulting in the company earning a narrow moat.

Although we believe Exxon has ceded some ground to peers as it has added higher-cost oil sands volumes, we think its overall upstream portfolio maintains a low-cost position. Its margins, reserve life, finding and development costs, and returns on capital have historically ranked amongst the best of the integrated group. While in the near term these metrics will suffer as investment increases in longer-dated production growth, ultimately these new projects should bolster its competitive position with an average break-even of $40/bbl. We also think Exxon distinguishes itself with greater integration amongst its downstream segment, which has also contributed to its higher returns on capital. This differentiator should become more valuable in capturing economic rents as it seeks to increase U.S. production volumes, where prices often trade at a discount to global benchmarks.

The size and physical integration between Exxon's refining and chemical manufacturing is a unique asset that creates an unequaled advantage that cannot realistically be duplicated. Approximately 80% of its refining capacity is integrated with chemical-manufacturing facilities. The integrated network delivers wider margins and returns than peers, thanks to a low-cost position derived from economies of scale and the ability to process a variety of feedstocks into the highest-value products. As a result, Exxon's downstream averaged returns on capital employed have historically far outpaced the group average." Allen Good, strategist

Chevron CVX "Although Chevron is an integrated energy company, its narrow economic moat rests on the quality of its upstream portfolio. Chevron's upstream segment holds a low-cost position based on an evaluation of its oil- and gas-producing assets, using our exploration and production moat framework. Its greater exposure to liquids and liquids-linked natural gas production has produced peer-leading cash margins during the past five years, and resulted in returns on capital employed of nearly 20%, among the highest of the group. New production from its LNG projects Gorgon and Wheatstone, offshore oil developments in the Gulf of Mexico and West Africa, and tight oil growth should preserve this exposure. We forecast that Chevron can deliver a midcycle cash operating margin of nearly $30/boe, the highest in its peer group.

While its reserve life of 11 years and finding and development costs of $12/boe over the past three years are not meaningfully superior to peers, those figures were negatively affected by Chevron's high level of investment in several large projects. Also, it has a better recycle ratio than its peers over the same period, demonstrating its superior margin profile. Additionally, as Chevron exits its current investment cycle and spending falls, we expect each metric to improve. It has one of the highest-quality reserve replacement opportunity sets in its peer group, and it holds 2.2 million acres in the Permian, primarily in the prolific Midland and Delaware basins, with an advantaged royalty rate. Its past exploration success in the Gulf of Mexico endows it with a large set of brownfield development opportunities that are economical at less than $45/bbl. Once up and running, its LNG projects--Gorgon and Wheatstone--will contribute 400 mboed of production that does not decline and requires little reinvestment.

Chevron's downstream operations consist of its refining and marketing portfolio, and its interest in the Chevron Phillips Chemical joint venture. We typically do not consider refining to be a business capable of earning a moat, with the exception of some U.S. refineries that hold a feedstock cost advantage. While Chevron does hold some refineries that qualify, the bulk of its capacity does not have such an advantage. In contrast, the CPChem joint venture is a high-quality chemical manufacturer with low-cost feedstock access in the U.S. and Middle East. However, its earnings contribution is small relative to the upstream segment, leaving it with little influence on the moat rating." Allen Good, strategist

Wells Fargo WFC "We believe Wells Fargo possesses a wide moat based on sustainable cost advantages and switching costs that are consistent with our bank moat framework. Wells Fargo is one of the largest U.S.-based banks by assets and has leading share and operations in many of the key areas in which it competes. It has the largest retail branch network in the U.S. and is one of the leading deposit gatherers in the country. Wells Fargo is also one of the largest U.S. issuers of credit and debit cards (with particular strength in debit), has one of the leading commercial banking franchises (with particular strength in the middle market), has a leading consumer franchise with products across roughly 70 million consumers and small businesses, and has significant asset and wealth management operations. Further, Wells Fargo has the lowest global systemically important bank surcharge among the big four, giving it a further structural return advantage from having to hold relatively less capital. Given the bank's higher capital levels since the crisis, the increasing importance of scale and scope with changes in technology, and robust fee income, we believe Wells Fargo will consistently earn returns that exceed its 9% cost of equity through the cycle.

Overall, we believe the bank's key advantage comes from its scale in certain fixed-cost, fixed-platform businesses, as well as the breadth of products it can offer to clients. This contributes to economies of scale and scope and can create switching costs for customers as they use the bank for more and more products. The bank has consistently been one of the top issuers of debit cards and is also in the top 10 for credit card balances in the U.S. In payments, many of the costs of running the platform are fixed and high in nature, leading to the need for scale. This has been borne out in the industry where much consolidation and concentration within the top performers has occurred. The same trend has occurred in the mortgage industry, where Wells remains one of the top bank players, and is also occurring for other consumer-based, mass-market products. Payments and other technology investments bleed over into the corporate payments space, where Wells' strong treasury and payments management platform has helped the bank maintain excellent share in the commercial market, particularly with middle-market business clients.

While all of these segments are strong on their own, we believe there are advantages to combining them under one banking roof. While the cross-selling strategy was poorly implemented in the recent past, we don't believe the overall idea of being able to expand a customer base with more products per customer is fundamentally flawed. The key is healthy implementation and execution. With that in mind, on the consumer side Wells Fargo is able to cross-sell multiple products, providing advantaged pricing to key customer segments (such as through its Portfolio banking program), and spread the overall costs of customer acquisition across more revenue streams. On the commercial side, similar dynamics apply; the bank is able to offer a complete package with national scale that few can compete with, while sending out armies of bankers to existing and new markets in an effort to win new business and maintain local relationships. In Wells Fargo's asset management and wealth management operations, while scale isn't necessarily a huge advantage, we do believe these segments can help contribute to economies of scope. The bank is able to be a one-stop shop, offering investing capabilities, advisory capabilities, and more traditional banking services to the same client base. Further, some of these capabilities have natural overlap, such as advising clients on selling their business and then helping them manage the large wealth inflow. Finally, the largest banks will be able to spend the most on technology and will have access to unique data on the largest client bases, and Wells Fargo is no exception. We believe Wells' ability for higher investment in tech platforms that can scale, as well as its access to customer data on millions of households, should bolster the bank's advantages over the longer run." Eric Compton, analyst

Pfizer PFE "Patents, economies of scale, and a powerful distribution network support Pfizer's wide moat. Pfizer's patent-protected drugs carry strong pricing power that enables the firm to generate returns on invested capital in excess of its cost of capital. Further, the patents give the company time to develop the next generation of drugs before generic competition arises. Additionally, while Pfizer holds a diversified product portfolio, there is some product concentration, with the company's largest product Prevnar representing just over 10% of total sales. However, we don't expect typical generic competition for the vaccine due to complex manufacturing and relatively low prices for the product. Further, we expect new products will mitigate the eventual generic competition of other key drugs. Also, Pfizer's operating structure allows for cost-cutting following patent losses to reduce the margin pressure from lost high-margin drug sales. Overall, Pfizer's established product line creates the enormous cash flows needed to fund the average $800 million in development costs per new drug. In addition, the company's powerful distribution network sets up the company as a strong partner for smaller drug companies that lack Pfizer's resources. Pfizer's entrenched consumer and vaccine franchises create an added layer of competitive advantage, stemming from brand power in consumer healthcare and manufacturing cost advantages in the vaccines division. Pfizer recently created a consumer healthcare joint venture with GlaxoSmithKline that could lead to an eventual divestment of the unit, but the potential divestment shouldn't have a material impact on the company's moat." Damien Conover, director

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)