The Morningstar Rating for Stocks Do's and Don'ts

Here's how to correctly use this iconic measure.

You’re considering investing in company ABC. You’re familiar with the brand, and you know the company produces high-quality products. The company has been in business for decades and is clearly ahead of the competition. From everything you’ve heard on TV and from other people, there is a buzz growing about how the company is poised to keep growing over the next few years. There aren’t any lawsuits or media smears that you know of against the firm. All this makes you think that ABC is probably a great company to invest in, so you look up the details about it on Morningstar.com and--surprise!--it has a 1-star rating. What gives?

Ratings are often misunderstood--and that means they are often misused. It’s common for people to assume they know how to interpret a rating, and then when they find themselves in the wrong, they blame the rating for misleading them. A screwdriver is very bad at driving nails into walls, but that doesn’t make it a bad tool. To be a good builder, you need to know which tools are best for which job. Likewise, to be a smart investor, you need to know the right metric to use to answer the appropriate question. So today, I’m going to give you a crash course in how to read and interpret the Morningstar Rating for stocks so that you can use them to your advantage and avoid being led astray by false assumptions.

Stars Don't Tell You About the Health or Strength of a Company When we're talking about movies, restaurants, or hotels, star ratings are a quick way to get a sense of the quality of the product. This is not the case for stocks. While there may be some underlying correlation with the strength and health of a company, the stars don't measure financial health.

This may surprise many people, given that we’re conditioned to think about stars as a measure of underlying quality. The fact is, a well-run company can have a 1-star rating, and a poorly run firm could be rated at 5 stars. To equate stars with the fundamental quality of a company is a basic misunderstanding of their meaning and purpose.

Stars DO Tell You if the Price Is a Good One Star ratings are a quick way to tell whether the price of a stock is a good one, and that is separate from whether the company itself is a good one. A star rating has to do with how much the stock is selling for relative to its fair value estimate.

Watch: The Morningstar Fair Value Estimate

Let’s use cars as an analogy. If you want to buy a pre-owned car, you need to consider the quality of the car and its fair resale value. Then, based on what you know about what a fair price for that car would be, you can compare the prices you see from different sellers against that fair value. If you know that the make, model, and year of the car you are looking for is fairly valued at $15,000, you would probably not respond to the ad that lists one at $20,000. Instead, you would keep looking for one that is selling closer to the fair value, or--even better--one that is in great shape but selling for a little less than $15,000. You want a good car at a good price. You use Edmunds or Kelly Blue Book to figure out the fair price, and then you can judge the sales price against that value.

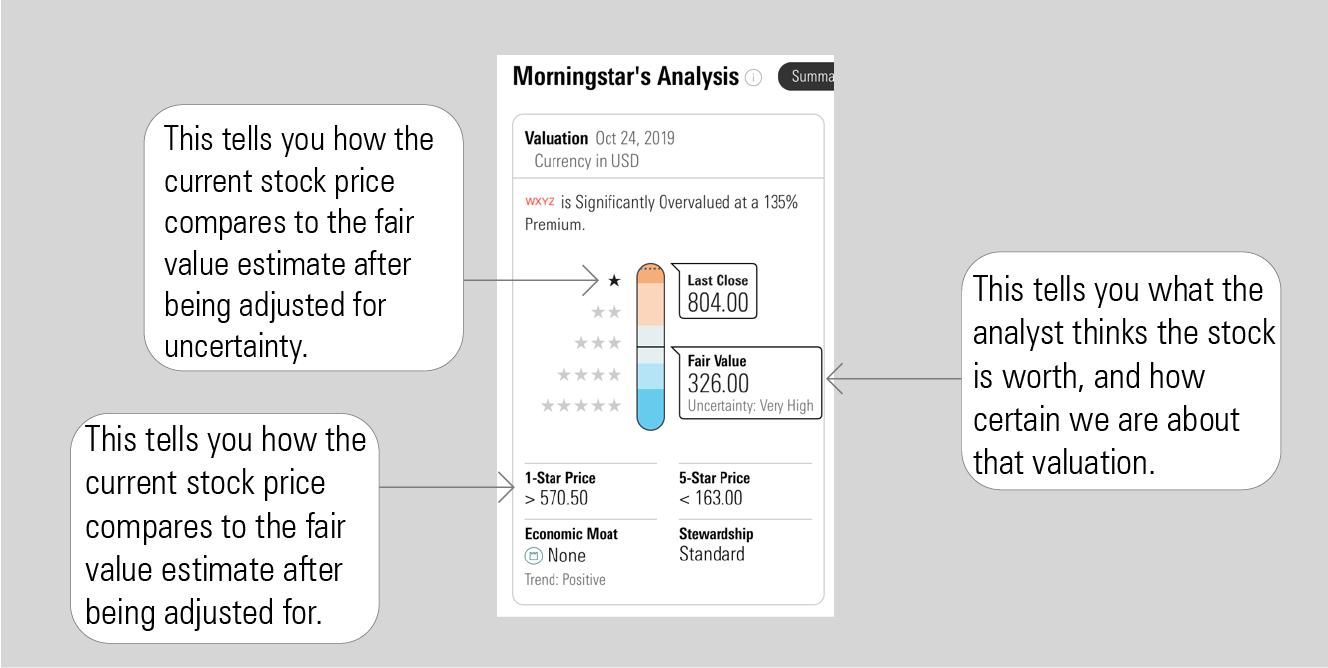

In the same way, Morningstar analysts assign fair value estimates to stock based on the fundamental analysis of the company. The star rating is then based on how far off the market price is from that fair value estimate, adjusted for what we call uncertainty. A stock with a 5-star rating is one whose market price is well below the fair value estimate after being adjusted, and a 1-star stock is one whose stock price is far higher than the adjusted fair value estimate. A 3-star stock is one that's about fairly valued.

Watch: The Morningstar Rating for Stocks

Below is a snapshot of what you would see if you looked at Morningstar’s valuation of WXYZ company:

Sometimes, the market “overvalues” some stocks and “undervalues” others. Stocks trading at 1-star levels are currently selling for more than what Morningstar thinks they’re worth, and 5-star stocks are selling for less than their fair values. A quick way to interpret this is to say that 1-star stocks are overpriced, and 5-star stocks are “on sale.”

Will 5-Star Stocks Always Outperform 1-Star Stocks? No. Sometimes, a stock's price may rise even if the stock is overvalued--or may fall even if it's undervalued. But over time, one would expect a stock's price to revert to something closer to fair value. So why take on the price risk of investing in an overpriced stock when you can instead invest in something that's undervalued?

To recap: Star ratings don't tell you if a company is a good one. Rather, they tell you if the price is good relative to the FVE. A great stock can sell at a bad price and vice versa. Star ratings are meant to be used in conjunction with the Morningstar Economic Moat Rating and other fundamental metrics to help you make a decision about investment based on many factors. In future articles, I'll delve deeper into some of our other rating metrics: Moats, globes, Morningstar Style Boxes, and stewardship grades are all meant to help you make informed comparisons when deciding how to invest. Remember, though, that a tool only helps when you know how to use it. Used correctly, stars can help you avoid overpriced stocks, and recognize good deals when they arise.

/s3.amazonaws.com/arc-authors/morningstar/6c608d29-bb89-4580-943a-7819645ad538.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6c608d29-bb89-4580-943a-7819645ad538.jpg)