Best Ways to Reach for Value, Whenever it Shines

This factor has a good long-term track record.

Editor’s note: An earlier version of this article contained incorrect versions of the factor profiles.

Value investment strategies buy stocks when they are cheap relative to their fundamentals, such as earnings, sales, and book value. This investment style is intuitive and has paid off over the long term, though it has hit a rough patch in recent years. While it’s tough to predict when value will outperform, well-constructed, low-cost value strategies are worth sticking with for the long term.

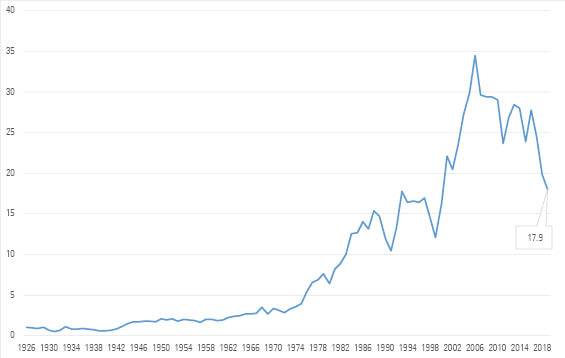

A Strong but Bumpy Record A dollar invested at the end of 1926 in a portfolio that targeted the cheapest quintile of U.S. stocks based on price/book ratio would be worth 18 times a dollar invested in a portfolio that targeted the most expensive quintile.

Exhibit 1: Value of $1 Invested in the Cheapest Quintile versus Most Expensive Quintile of Stocks Since 1926

Source: French Data Library.

Value investing may have paid off due to mispricing from excessive optimism about fast-growing stocks and excess pessimism about firms with less favorable prospects. An alternative explanation is that stocks that trade at low valuations often do so for good reason. Investors may have required higher expected returns to compensate them for the risk of holding these less desirable companies.

Despite its strong long-term record, value investing can undergo lengthy periods of underperformance, which can be difficult to forecast. For example, the Russell 1000 Value Index has lagged the Russell 1000 Growth Index by 4.54 percentage points annualized over the trailing 12 years through January 2020. That’s painful, but it doesn’t necessarily mean that value investing is broken. Research Affiliates pushed some work that suggests much of that underperformance owes to a widening valuation gap between value and growth stocks, which shouldn’t continue indefinitely. Investors should be cautious not to abandon a style that stood the test of time.

Strong Investment Options

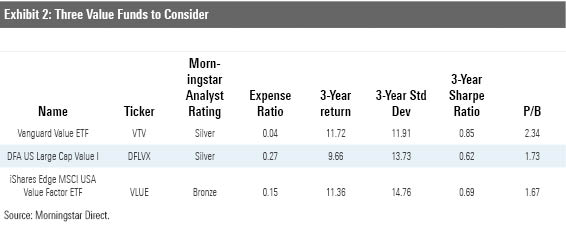

Although no one can predict when value may outperform growth, there are some good value funds worth sticking with for the long term. These include Vanguard Value ETF VTV, with a Morningstar Analyst Rating of Silver; Bronze-rated iShares Edge MSCI USA Value Factor ETF VLUE; and Silver-rated DFA US Large Cap Value I DFLVX.

Of the three funds, VTV is the cheapest option at 0.04%, which makes it tough to beat. It targets U.S. large-cap stocks representing the cheaper and slower-growing half of the market and weights them by market capitalization. This approach effectively diversifies risk, mitigates turnover, and accurately represents the large value Morningstar Category. Additionally, the fund minimizes transaction costs by applying generous buffering to minimize turnover and spreading trades over five days when it rebalances. While there’s a lot to like about this strategy, market-cap weighting pulls the fund toward the largest value stocks, which are not necessarily the cheapest. This approach could decrease the fund’s exposure to stocks as they become cheaper, which typically accompanies a decline in market capitalization.

Certain sectors tend to persistently display lower valuations compared with other sectors. Consequently, this fund tends to overweight financial services and underweight technology. These sector tilts are sources of risk the market may not compensate.

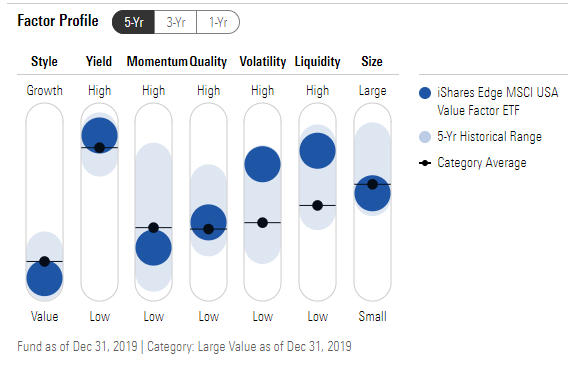

VLUE addresses this issue by targeting the cheapest stocks within each sector. However, this fund is not for the faint-hearted. Compared with VTV, VLUE applies a more demanding selection criterion and incorporates the strength of each company’s value characteristics in its weighting approach, giving it the most potent value tilt of the three funds. This should set the fund up to outperform its peers when value is in favor. However, investors must be able to stomach a potentially gut-wrenching ride with VLUE as this is one of the most volatile funds within the category. Its sector-neutrality also comes with a cost--higher turnover which translates into higher transaction costs. The fund charges 0.15%.

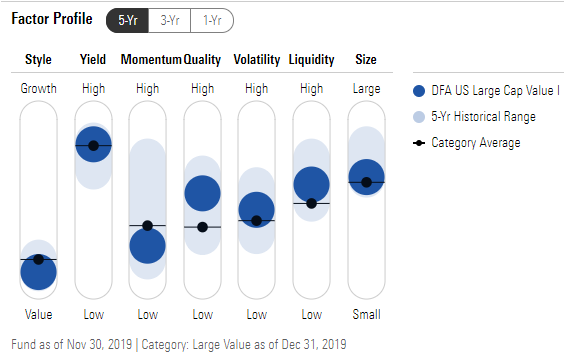

Exhibit 3: Morningstar Factor Profiles for Three Funds

Source: Morningstar Quick Takes.

Unlike VLUE and VTV, which incorporate multiple valuation metrics in their selection process, DFLVX only uses price/book ratio to screen for value. While price/book is a more stable metric than alternatives like price/sales or price/earnings, the fund risks being too narrow in its assessment of value. Price/book is heavily influenced by the accounting practices, which can vary across firms. Additionally, book value may not be an accurate gauge for companies that have significant intangible assets that don’t always show up on the balance sheet.

The fund makes up for this drawback in other ways. Its traders have the flexibility to substitute an eligible security with a similar alternative to mitigate costs. Like VLUE, this fund also has a robust value tilt; however, it also tilts toward more profitable stocks. This defensive tilt should serve as a safeguard to avoid the riskiest holdings in the portfolio while staying true to the value style. This is evident in the fund’s Morningstar Factor Profile, as DFLVX has the highest-quality tilt of the three funds. Unlike VLUE, this fund has experienced lower turnover as it links its holdings’ weightings to market prices and uses price/book to select stocks, which is fairly stable. It does have a higher fee of 0.27%.

As shown in Exhibit 2, all three funds are Morningstar Medalists and are among the best options within the large-value category. However, they may be most suitable for different types of investors. Those who prefer lower costs and a milder value tilt may choose VTV, while investors who prefer a more potent value tilt while avoiding unintended sector bets may prefer VLUE. DFLVX may be more appropriate for those who prefer a potent value tilt that considers quality to reduce risk.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)