Muni Funds See Record Inflows in 2019

Investors' appetite for municipal bonds soared last year, helping push already low muni yields even lower.

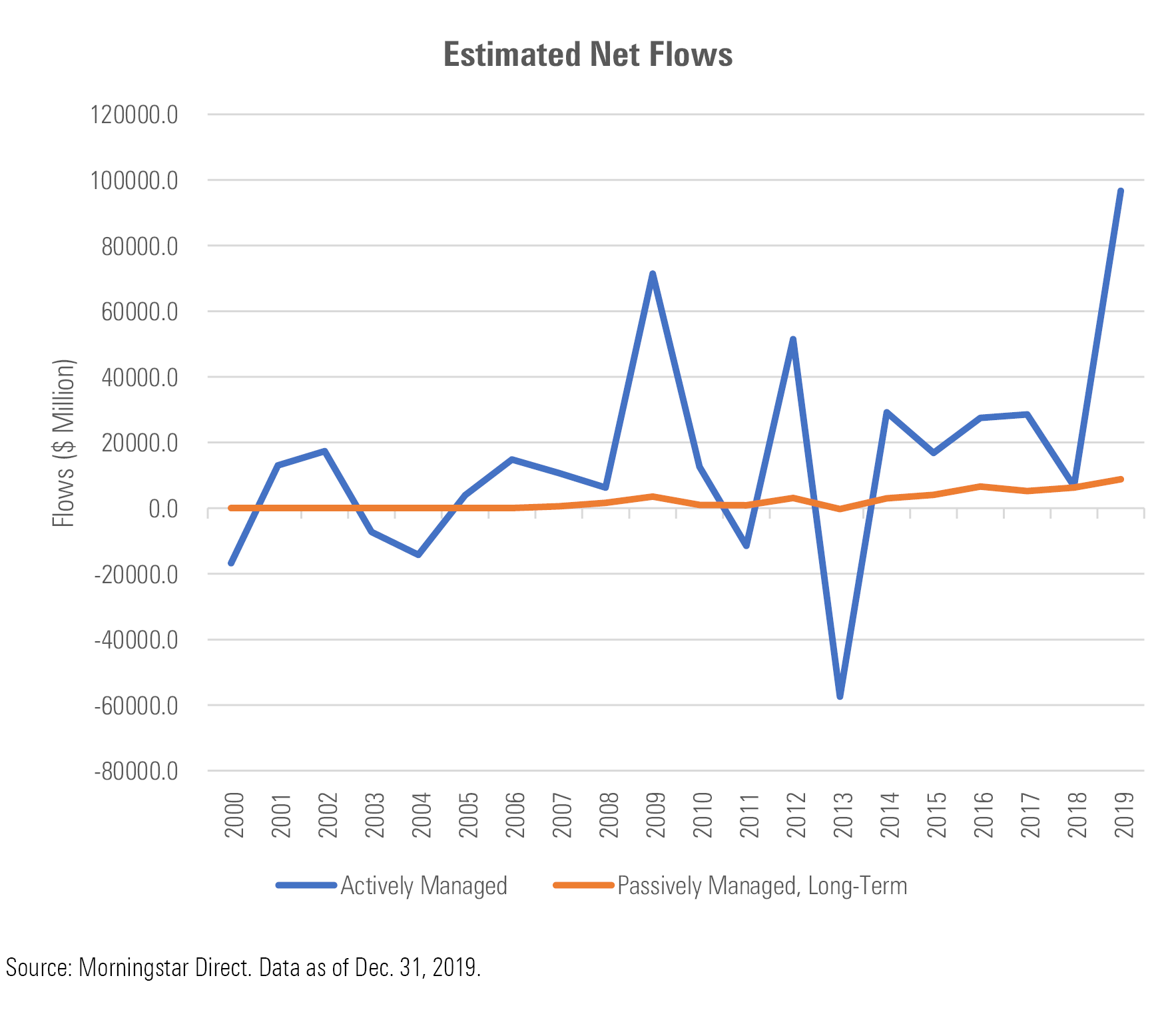

Municipal-bond funds saw record inflows in 2019, as investors poured a massive net $105.5 billion into muni open-end mutual funds and exchange-traded funds during the year. That amount dwarfed the annual gains of each of the past 25 years, including the group's previous boom year of 2009, which brought in roughly $75 billion.

Demand remained high throughout the year, as muni funds saw 12 straight months of net inflows over $5 billion, and by midyear had gathered 10 times the assets that flowed into those strategies in all of 2018.

Roughly 90% of 2019's flows went into actively managed mutual funds, yet a substantial $8.7 billion went to passive strategies, mainly muni ETFs, which have continued to gain prominence since they first arrived on the scene in 2000.

A variety of factors stoked investors' fervent demand, including continued economic growth in many parts of the United States, which supported solid credit fundamentals and low default rates of muni issuers. And those attracted to the sector for its tax-free income had some extra incentive to invest, as American taxpayers saw the impact of the Tax Cut and Jobs Act of 2017 on their tax bills for the first time beginning in April 2019. That tax reform package curbed the deduction of state and local taxes, which led to higher tax bills for many individuals, and particularly those in high-tax states such as California and New York. Interest earned on municipal bonds is typically exempt not only from federal taxes but also from state and local taxes, depending on where that investor resides, and may offer some relief to those facing a higher tax burden under the new law.

Tax reform also eliminated some benefits of refinancing debt for muni-bond issuers beginning in 2018, which contributed to a reduced supply of new tax-exempt issuance in the past two years. Strong demand and several years of muted supply have pushed muni yields lower and credit spreads tighter, while boosting returns. For example, the median return for funds in the high-yield muni Morningstar Category was 9.1% in 2019, while the muni-national intermediate and muni-national long categories gained 6.9% and 8.4%, on average.

Furthering its status as a giant in the muni industry, Vanguard topped the list of firms that experienced the most significant muni inflows in 2019, adding an additional $24.5 billion in muni assets across its fund lineup. That figure brought the firm's total muni open-end fund and ETF assets up to $195 billion. Vanguard's 2019 haul was roughly twice the amount collected by BlackRock (with iShares, $13.0 billion) and Nuveen ($12.5 billion), which rounded out the top three muni-asset-gathering firms last year.

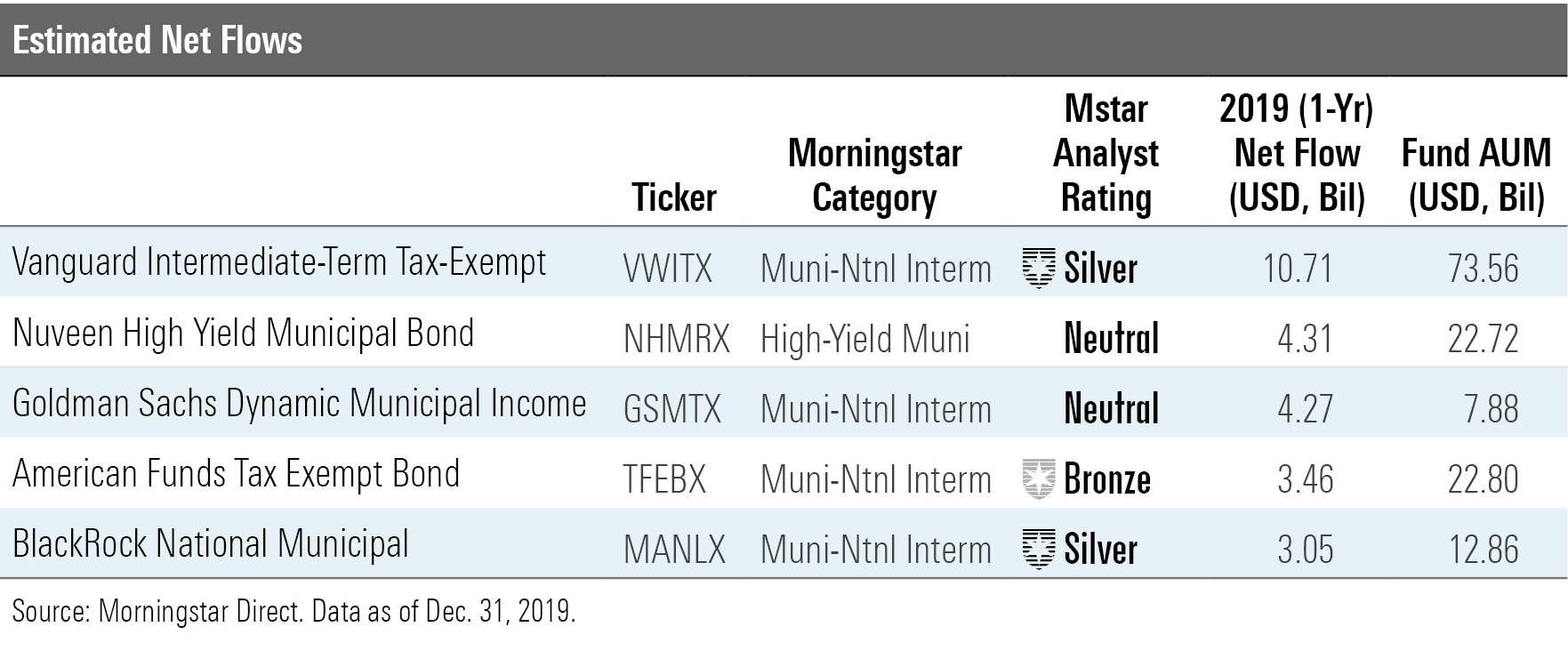

Investors who've piled into muni funds haven't necessarily chased yield. Case in point: Vanguard Intermediate-Term Tax-Exempt VWITX, which has a Morningstar Analyst Rating of Silver, was the top-selling muni fund in 2019. The strategy brought in a sizable $10.7 billion, bringing the fund's total assets to a massive $73.6 billion by the end of the year. Investors in this strategy benefit from a repeatable and risk-aware investment process that results in a carefully constructed portfolio with a focus on high-quality holdings. Like other offerings in the firm's muni suite, it's available at a low fee relative to peers, allowing its managers to take on less risk while generating compelling risk-adjusted returns over longer periods.

However, some investors did show a healthy appetite for yield by choosing funds that are more adventurous when it comes to taking credit risk, including Nuveen High Yield Municipal Bond NHMRX and Goldman Sachs Dynamic Municipal Income GSMTX. Both saw roughly $4.3 billion of net inflows in 2019, bringing their respective asset totals to $22.7 billion and $7.9 billion. While the Nuveen strategy boasts a deep analyst team and experienced management, we think its aggressive approach may sting in market downturns (as it did in 2008) and warrants caution. We also note that Goldman Sachs Dynamic Municipal Income's pivot to a more flexible mandate in 2015 is still relatively new, and its modestly sized staff has seen some turnover. While the portfolio has mostly kept exposure to below-investment-grade and nonrated bonds at around 15% combined since the shift, that stake got as high as 24% in mid-2017, which is an aggressive posture for its muni-national intermediate category. Both funds earn Analyst Ratings of Neutral on their cheapest share classes.

The two bestselling passively managed muni strategies last year were Silver-rated iShares National Muni Bond ETF MUB and Gold-rated Vanguard Tax-Exempt Bond ETF VTEB. Net inflows of $2.9 billion and $2.7 billion brought the funds' total assets to $16.2 billion and $7.1 billion, respectively. Both strategies offer investors broad, market-value-weighted exposure to the muni market by closely tracking the S&P National AMT-Free Municipal Bond Index for just a few basis points each. Against the backdrop of today's low muni yields, these funds' low fees give them a big head start over their actively managed competition.

/s3.amazonaws.com/arc-authors/morningstar/11772336-913b-401e-8a52-aceef6752c90.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11772336-913b-401e-8a52-aceef6752c90.jpg)