Easier Muni Indexing Expands Investors' Choices

Improvements in technology and manager skill have made passively managed municipal index funds more desirable.

Index funds have many advantages. Chief among them is their relatively low costs. Rather than trying to beat the market, an index investor can simply free-ride off the collective efforts that others put in to setting prices.

Some segments of the market lend themselves better to indexing than others. For the advantages of a passive approach to hold, the costs of replicating an index must be minimal. These costs will vary depending on a variety of factors, including the breadth, depth, liquidity, and standardization of the market segment in question. The cost of indexing a broad, deep, liquid and standardized asset class like U.S. large-caps is low. The cost of building an indexed portfolio of a narrow, shallow, illiquid, and nonstandardized asset class like municipal bonds is relatively higher.

Here, I will explore the challenges of indexing the municipal market and how the market has evolved. I finish by spotlighting some Morningstar Medalist exchange-traded funds in the category.

Indexing Was a Late Bloomer in the Municipal Bond Market Indexing came late to the municipal bond market. The first index fund to offer municipal bond exposure was the State Farm Tax Advantaged Bond Fund (which has since been merged into the iShares Municipal Bond Index Fund). The fund launched in December 2000 and was the only show in town for nearly a decade. The next series of municipal bond index funds did not launch until the fall of 2007, when iShares National Muni Bond ETF MUB--the first municipal bond ETF--made its debut.

Part of the reason why municipal bond index funds were slow to arrive owes to the relative difficulty and costs involved in indexing this segment of the bond market. The number and variety of issuers in the municipal market is large, liquidity is thin, and the bonds are not uniform. For context, the ICE U.S. Treasury Core Bond Index is composed of 65 unique Treasury bonds and 192 Treasury notes with a variety of maturities and coupon rates, all of which--by virtue of being backed by the U.S. government--have received AAA ratings. By comparison, the ICE US Broad Municipal Index contains over 20,000 General Obligation bonds; 35,000 revenue bonds; and nearly 3,000 refunded bonds, with varying maturities and coupon rates. These bonds’ credit ratings span the entire investment-grade spectrum.

Liquidity relates to the ability to transact in a security without materially affecting its price. The less liquid a market is, the harder it is to index, because fund managers are more likely to push prices around as they buy and sell securities. The resulting costs can leave index portfolio managers short of their goal of tracking their benchmark with precision. How costly are muni trades? According to a study of the fixed-income markets by the Municipal Securities Rulemaking Board in 2017, the average transaction for an institutional client was 10 times more expensive when trading municipal bonds compared with transacting in 10-year Treasury bonds.

But owning every issue in an index is not compulsory for an index fund, and the best funds are able to create a portfolio of securities that mirrors the performance of a given index without owning each and every security contained therein. This is common in bond index funds. Portfolio managers will often own just a sample of the bonds contained in their benchmarks. Their aim is to match the characteristics of this sample (as measured by duration, credit, and so on) to deliver on their goal of precision tracking. While this is relatively straightforward for an index composed of Treasury securities, it is much more complicated for indexes composed of municipal securities because of the diverse body of bonds that are brought to market by municipalities.

Effectively sampling the municipal bond market is clearly more difficult than shadowing an index composed of Treasury bonds.

It's Getting Easier A review of the issues contained in the ICE US Broad Municipal Index during the trailing 10 years (through December 2019) would seem to indicate that the market has not become any easier to index. Most notably, the number of issuers has doubled since December 2009.

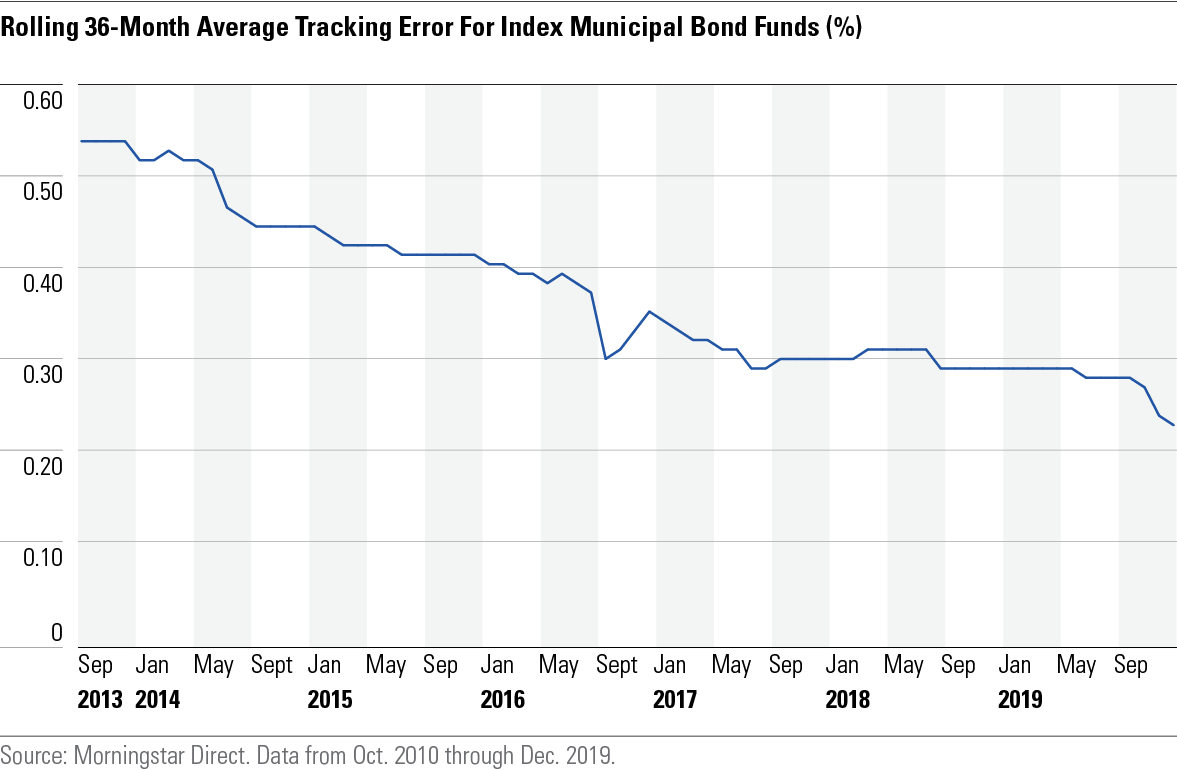

However, muni index funds have gotten better at tracking their bogies over this same span. As you can see in the table below, the average rolling 36-month tracking error for index municipal bond funds as measured versus their benchmark indexes has fallen from 0.57% during the 36-month period ended November 2013, to 0.35% over the three years through December 2019.

In 2018, my colleague Dan Sotiroff noted that indexing municipal bonds has improved in recent years, as managers have gained more experience and their funds have gotten larger (which makes samples larger and the practice of sampling more effective). Access to relevant market information (for example, the Electronic Municipal Market Access website maintained by the Municipal Securities Rulemaking Board) has also improved.

Additionally, advances in technology have improved liquidity in the fixed-income markets, which has made them easier to index. The price of liquidity in a market is often measured by the difference between the price at which a seller is willing to sell (the ask price) and a buyer is willing to buy (the bid price), which is known as the bid-ask spread. According to a study published by the MSRB in 2018, the average spread involved in a municipal bond transaction declined by more than 50% from 2005 to 2018 [1]. The MSRB found marketwide technological advancements were the main driver of this improvement.

A key technological development cited by the MSRB was the advent of electronic trading venues in the fixed-income market, such as alternative trading systems. An ATS is a non-exchange trading platform that helps improve liquidity because it provides a venue for buyers and sellers to connect. According to an article published by the Financial Times in May 2018 [2], the amount of bond trades conducted via MarketAxess, a leading ATS, had doubled since 2014.

In addition to improvements in market technology, other technological improvements have made it easier for managers of indexed bond portfolios. The most prominent example is Aladdin, an operating system developed by BlackRock and licensed to third parties which provides a centralized platform housing portfolio management, trade execution, operations, and risk-management functions in one structure. These tools have enabled fund managers to more effectively sample their indexes by simplifying the regular monitoring of funds’ key risk metrics and changes to funds’ benchmarks and helping to identify the specific securities available on the market which meet their needs.

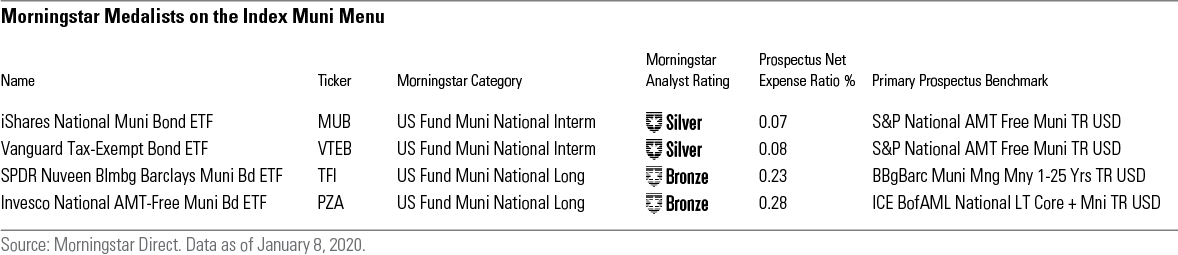

The Menu Has Grown All these improvements have led to an expanded menu of options for investors looking for indexed exposure to various corners of the muni bond market. At present, there are four Morningstar Medalist ETFs that fall within the national intermediate and long municipal bond Morningstar Categories. These funds track indexes that are broadly diversified and representative of their opportunity set, effectively providing exposure to the investment-grade municipal bond market for a low fee.

Both rated funds in the Intermediate category, MUB and Vanguard Tax-Exempt Bond ETF VTEB, track the same index--the S&P National AMT Free Municipal Bond Index. As a result, any difference in exposure between the two funds will be a result of the sampling method employed by the portfolio management team running the fund. For instance, as of September 2019, MUB carried slightly more interest-rate risk relative to VTEB, as its average effective duration was approximately 5.89 years while VTEB’s was 5.25 years.

Despite being in the national long category, neither the Invesco National AMT-Free Municipal Bond ETF PZA nor the SPDR Nuveen Bloomberg Barclays Municipal Bond ETF TFI take much more interest-rate risk than VTEB or MUB. As of January 2020, TFI maintained approximately 6.25 years while PZA maintained 7.90 years.

These funds are in the long-term category because their maturity limit stretches further out. TFI tracks the Bloomberg Barclays Municipal Managed Money 1-25 Years Index while PZA tracks the ICE Bank of America Merrill Lynch National Long-Term Core Plus Municipal Securities Index, which requires that issues have at least 15 years until maturity.

[1] Transaction Costs for Customer Trades in the Municipal Bond Market

[2] Bond Trading: Technology finally disrupts a $50 trillion market

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)