Energy: Most Undervalued Sector Heading Into the Quarter

Oilfield services look particularly attractive.

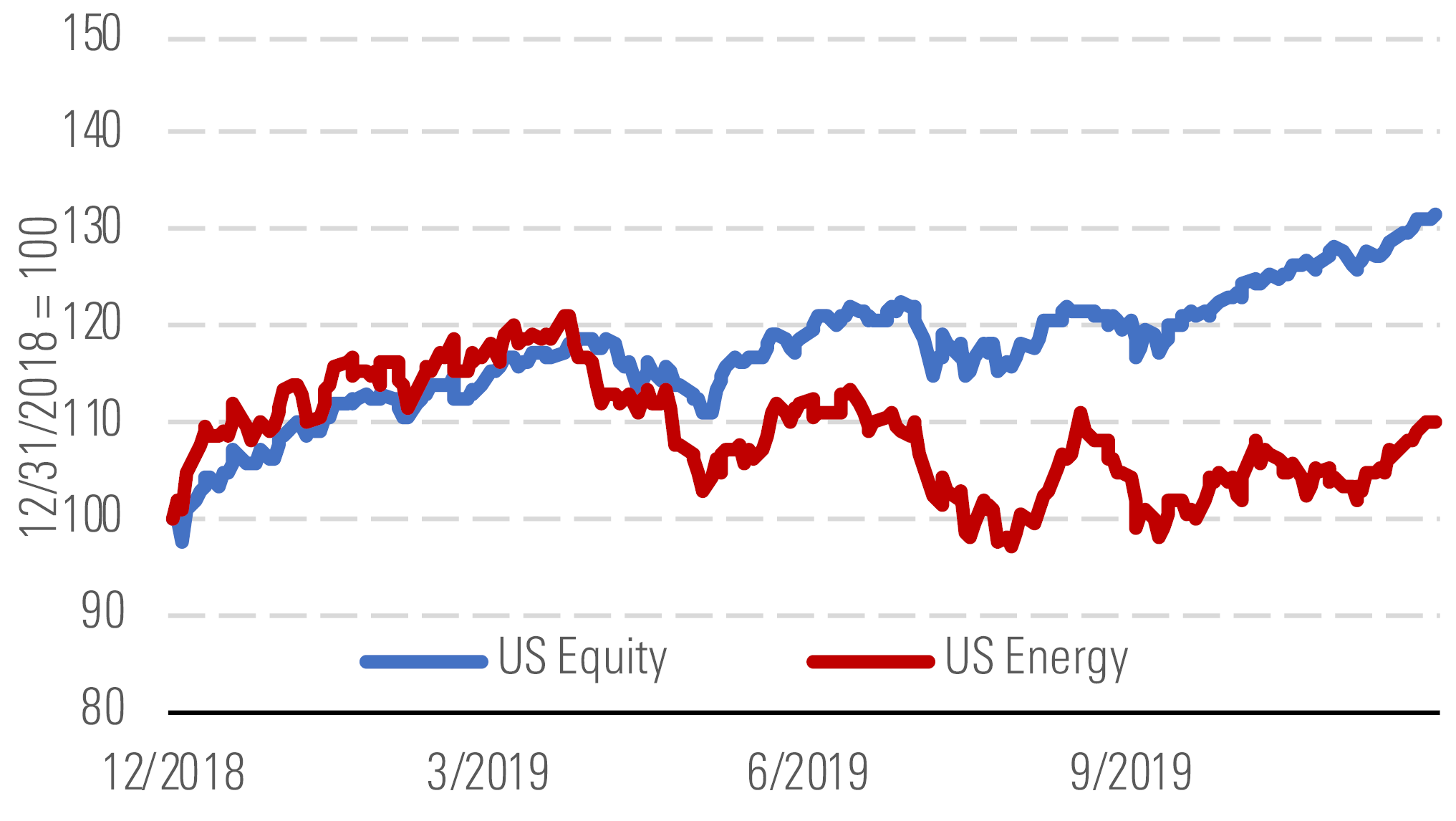

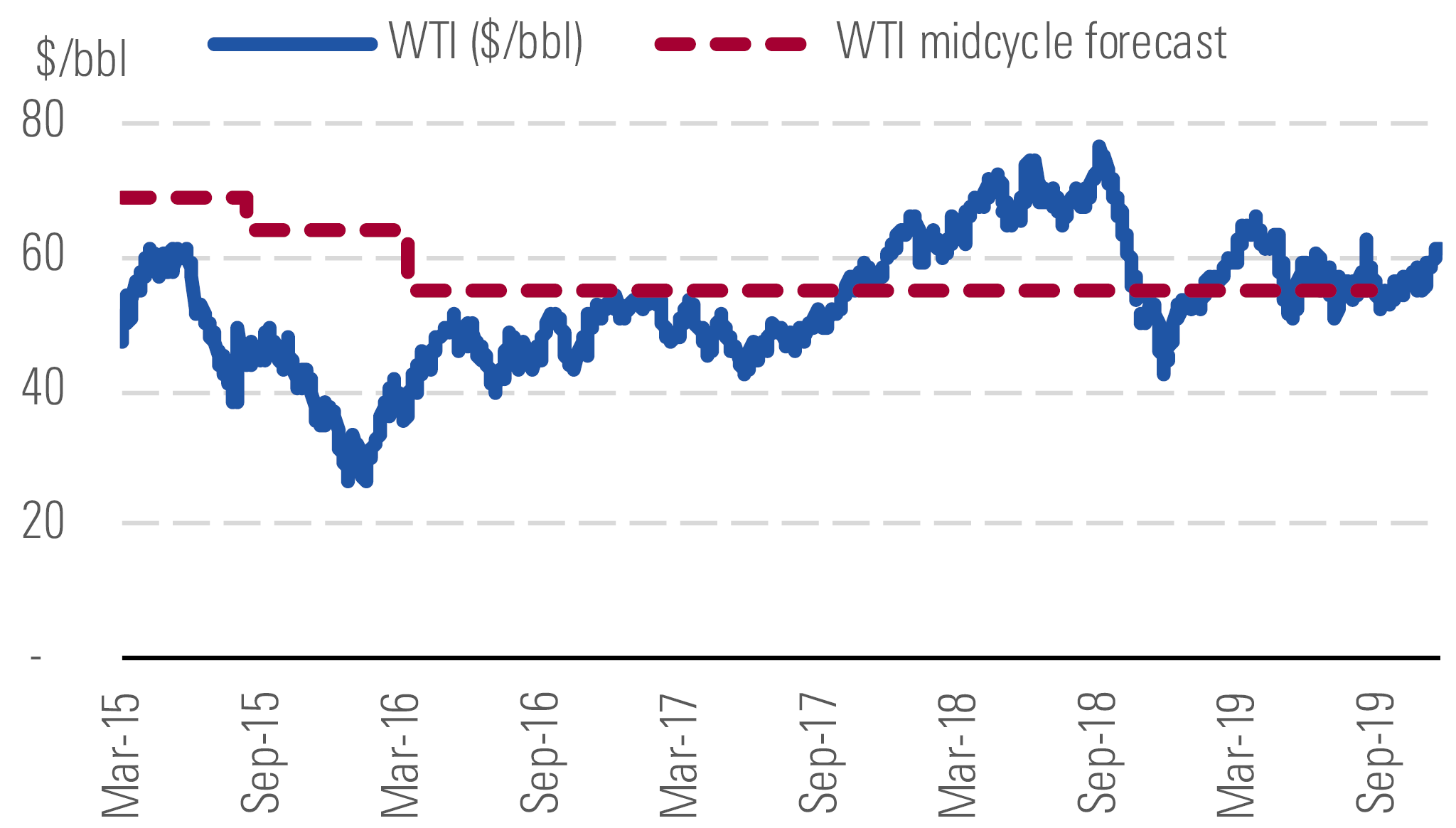

The Morningstar US Energy Index continues to underperform the market, rising just 5.7% versus the overall domestic market’s 9.0% gain in the fourth quarter (Exhibit 1). Through 2019, the sector displayed more volatility than the market and ended with a 10% gain over the prior year, trailing the market’s 31% return. While investors have remained pessimistic on oil and gas stocks in 2019, the recent (albeit slight) uptick reflects a 13% increase in spot prices for West Texas Intermediate over the quarter (Exhibit 3).

U.S. energy index lags the U.S. equity index. - source: Morningstar

Oil prices rose in the fourth quarter and sit above our midcycle forecast. - source: Morningstar

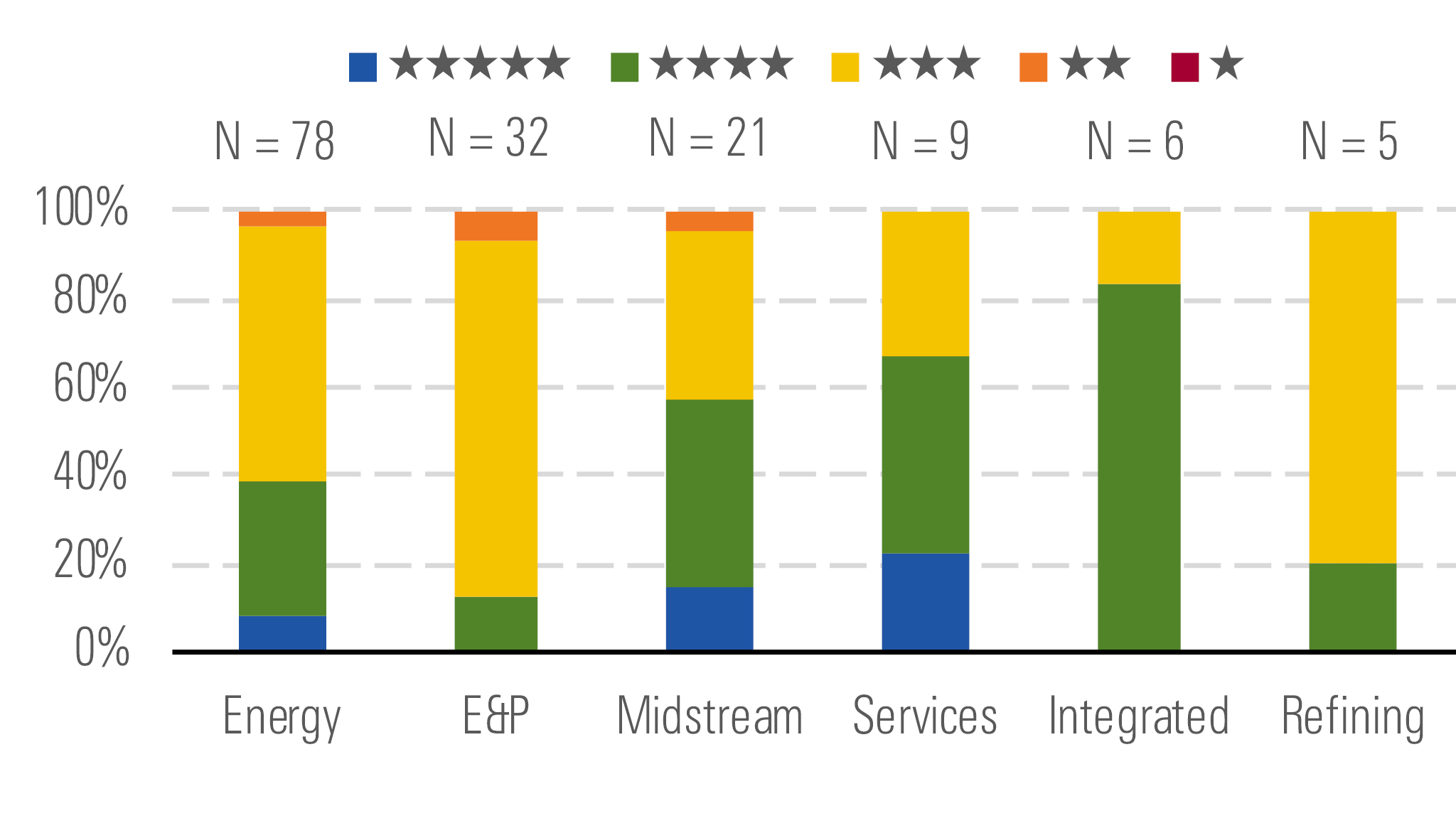

Even with spot prices 11% above our midcycle price forecast, we continue to see investment opportunities, as energy remains the most undervalued sector, trading at a 10% discount (Exhibit 2). Oilfield-services stocks in particular trade at a 16% discount, offering a lucrative buying opportunity.

We see buying opportunities across all industries. - source: Morningstar

We think $55 is the fully loaded cost for the marginal barrel of oil that will balance global supply and demand in the long run, and we expect this marginal barrel to come from a U.S. shale well. Shale wells today are much cheaper on a per barrel basis than the large, complex megaprojects that would have set prices in a world without U.S. shale. Over the long run, we think U.S. shale well cost inflation will remain subdued, owing greatly to the no-moat nature of many shale services, and that wider adoption of current technologies coupled with decades of attractive drilling opportunities will contain unit break-evens.

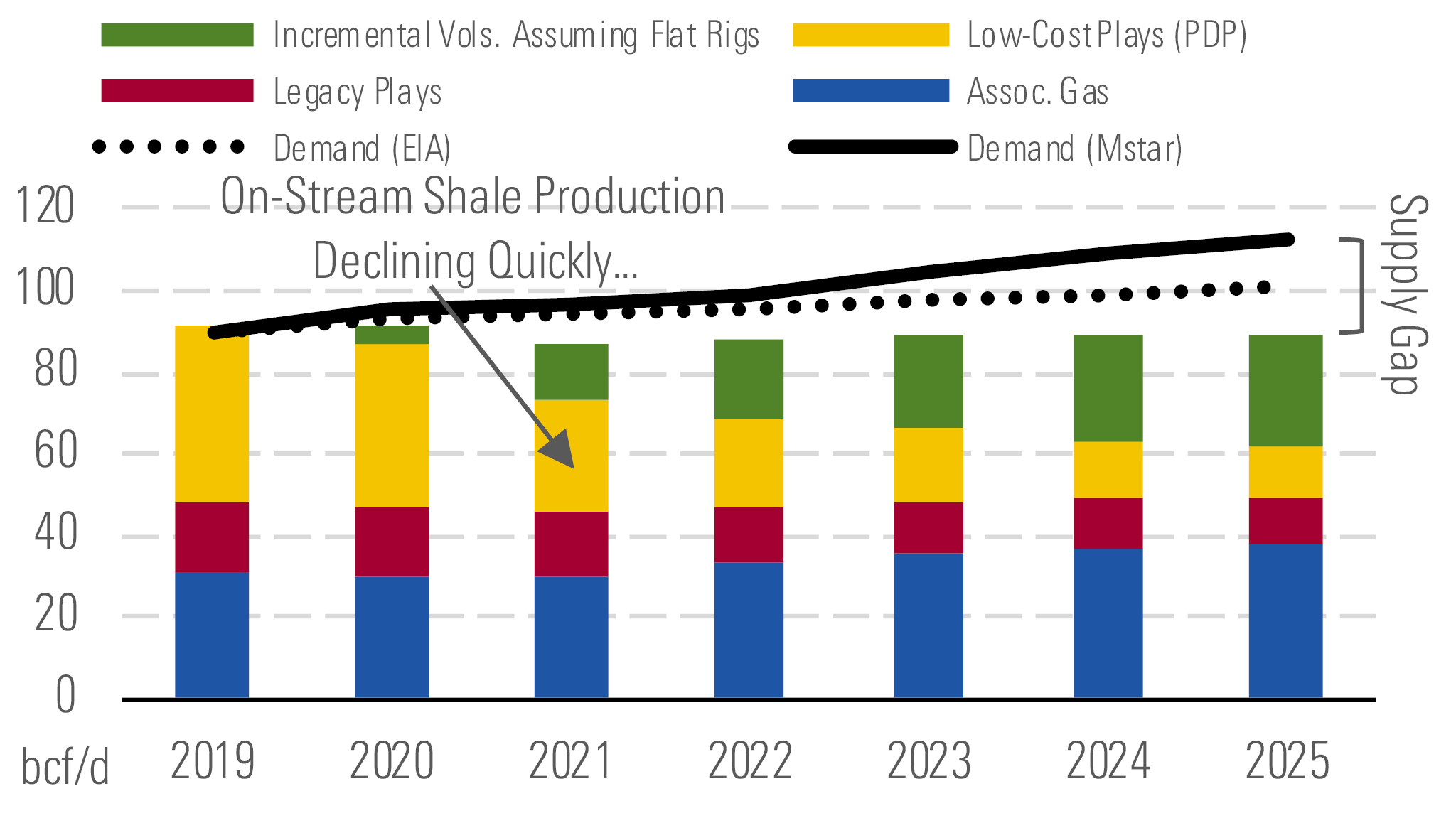

In December, we published an update to our long-term view on U.S. natural gas prices, reflecting our sentiment on the prolonged depression of Nymex gas prices. At current prices, only the highly productive "sweet spots" of each shale basin are profitable, and producers have responded with significant spending cuts. Consequently, a supply gap is emerging (Exhibit 4). We think the market is underestimating the build-out and utilization of U.S. liquefied natural gas export facilities, which are a sink for U.S. natural gas, and domestic demand growth will also surprise to the upside because of rising consumption in the electric power sector. So, to keep the market balanced, U.S. producers must accelerate operations in low-cost shale plays. Our marginal cost estimate for U.S. natural gas, $2.80 per thousand cubic feet, is the midcycle level that we think will induce the right level of activity.

Unless gas-directed drilling picks up, a supply gap should emerge. - source: Morningstar

Top Picks

Enbridge ENB Economic Moat: Wide Fair Value Estimate: $47 Fair Value Uncertainty: Medium

We see 20% upside in wide-moat Enbridge’s stock. We believe the market doesn't realize the full potential of the company's growth portfolio, which is highlighted by the Line 3 replacement project. Even though Line 3 continues to face opposition and delays, we expect the pipeline to be built. Additionally, safeguards remain in place in the unlikely scenario that the project is canceled. Enbridge can recoup the capital spent on the project plus a healthy return on capital through toll surcharges. Enbridge offers an attractive dividend, which is yielding 6.3% at current levels.

Cheniere Energy LNG Economic Moat: Wide Fair Value Estimate: $78 Fair Value Uncertainty: Medium

We think Cheniere looks cheap. Concerns over a slowdown in Chinese LNG demand because of trade tensions and the resulting loss of direct LNG exports to China miss the mark, in our view. Given the destination freedom allowed in U.S. LNG contracts, European demand has simply picked up the slack, and higher Chinese LNG demand has simply been satisfied by other countries as China efficiently avoids U.S. tariffs. We also like Cheniere's capital-allocation efforts as its current plans involve funding its new trains with 50% equity, reducing debt by $3 billion-$4 billion, and buying back $1 billion in stock over the next three years.

Schlumberger SLB Economic Moat: Narrow Fair Value Estimate: $60 Fair Value Uncertainty: High

Schlumberger remains our top oilfield-services pick. It has the highest international share of revenue among peers, making it the best positioned to take advantage of the coming capital expenditures rebound in international markets, which the market is neglecting. Also, we think the company is poised to gain market share and improve margins via its efficiency-boosting integrated project initiatives.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)