The Morningstar Factor Profile: A New Lens for Analyzing Funds

The Morningstar Factor Profile complements the Morningstar Style Box, incorporating additional factors that further explain funds’ exposures to well-documented sources of long-term returns.

In 1992, Morningstar introduced the Morningstar Style Box as a means of classifying stock funds based on the size and value/growth orientation of their holdings. This framework has since been widely adopted as a means of categorizing and analyzing funds. In the nearly three decades since the style box debuted, our understanding of the different factors that explain stock returns has advanced. While size and value/growth exposures can help explain the difference between funds’ long-term returns, they don’t tell the full story. The Morningstar Factor Profile is a new lens that complements the Morningstar Style Box, incorporating additional factors that further explain funds’ exposures to well-documented sources of long-term returns.

Painting a Fuller Picture The Morningstar Factor Profile provides a snapshot of funds' exposures to seven different factors. These factors are common characteristics of stocks that can help to explain their long-term returns relative to the broader market. Each has been well-documented and vetted in academia and implemented by investment practitioners.

The familiar size and style factors that define the dimensions of the Morningstar Style Box bookend the set of seven featured in the Factor Profile. In the middle are five additional factors (yield, momentum, quality, volatility, and liquidity) that provide a deeper understanding of the drivers of stock funds’ returns.

Definitions Do Vary Funds' exposure to these factors depends in part on the makeup of their portfolios and partly on how the factors themselves are defined and measured. Our own definitions were selected based on consistency with commonly used definitions from academic research, simplicity, and transparency. Here is a brief definition of each of the seven factors that appear in the Factor Profile:

Size Stocks' risk and return profile varies across the market-cap spectrum. We use the raw size score from the Morningstar Style Box as the input for calculating stocks' size exposure. This ensures that the size ranking of the Factor Profile is consistent with that of the style box.

Style Similarly, to be consistent with the ranking from the Morningstar Style Box, we use the raw style scores from the style box as the input for calculating stocks' value-growth exposure.

Momentum The momentum effect has been well documented. This describes the tendency for stocks that have recently performed well to continue to do so and for those that have performed poorly to continue to fall.

Liquidity The liquidity factor captures the extra returns investors receive as compensation for holding illiquid assets.

Quality Historically, higher-quality stocks (as measured in terms of profitability and financial leverage) have tended to outperform their lower-quality counterparts.

Yield Beginning yields, measured as the sum of trailing 12-month dividend and buyback yields in this case, can help to explain stocks' long-term returns.

Volatility Although theoretically stocks with higher risk should earn higher expected return, research has shown that less-volatile stocks tend to outperform their more-volatile counterparts--after adjusting for risk.

Morningstar Factor Profile analyzes these factor exposures for each stock in a fund's portfolio for which we have sufficient data. It calculates stocks' factor scores each day and then rolls those scores up to holdings-weighted figures for individual funds. (Those interested can find the complete methodology document. This is the complete methodology document for Morningstar Direct and Office clients.) The result is a richer picture of funds' exposures to a broader palette of known drivers of long-run returns.

How Can Investors Use Factor Profile? Investors can use the Factor Profile to better understand the different sources of returns that stock funds are attempting to harness and assess how effectively they are targeting them.

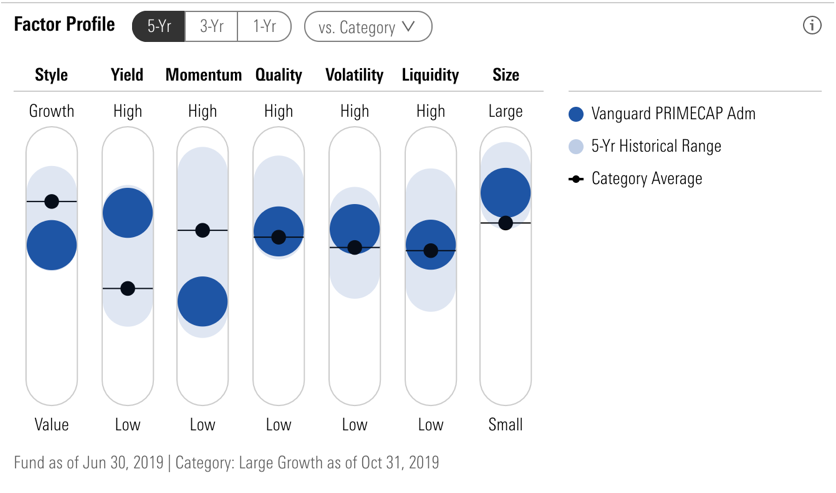

Looking at an individual fund in isolation, Factor Profile can be used as a check on process. Do the fund’s factor exposures align with the way that a manager describes the investment approach? Is a strategic-beta fund capturing the factor it is designed to target?

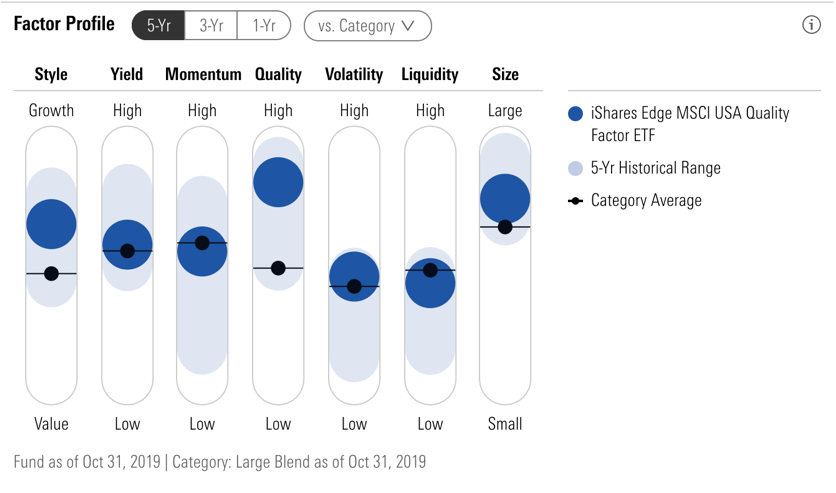

Exhibit 2 is the Factor Profile for iShares Edge MSCI USA Quality Factor ETF QUAL, which carries a Morningstar Analyst Rating of Silver. The fund targets large- and mid-cap U.S. stocks with the highest profitability (measured by return on equity), strongest balance sheets, and most consistent earnings growth within each sector. The Factor Profile readout in Exhibit 2 shows that the fund has been effective at delivering a level of exposure to the quality factor that has been consistently above the large-blend Morningstar Category average.

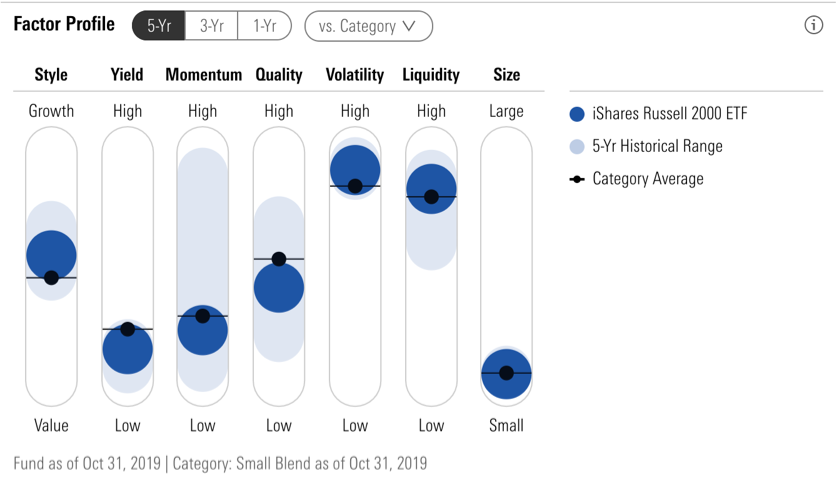

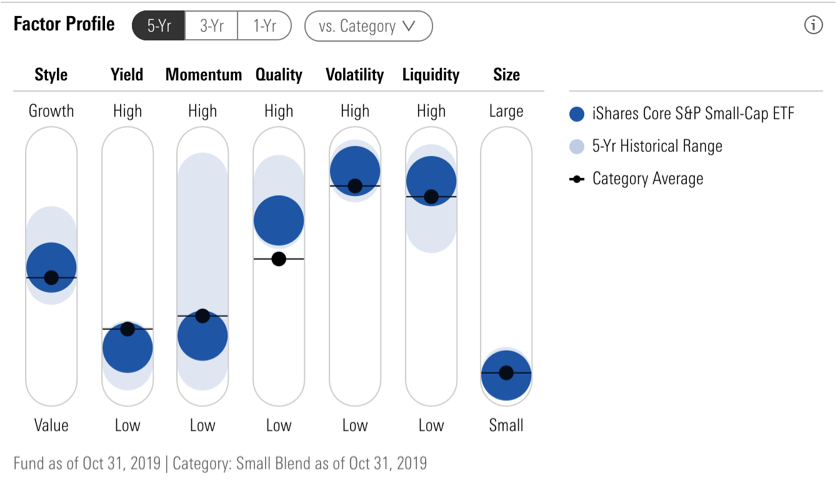

The Factor Profile can be more helpful yet in comparing similar funds. For example, Bronze-rated iShares Russell 2000 ETF IWM and Gold-rated iShares Core S&P Small-Cap ETF IJR both land within the small-blend Morningstar Category. As you might suspect based on the differences in these two funds’ Analyst Ratings, there are important differences in their profiles. One of the most noteworthy of these is revealed when comparing these funds’ Factor Profiles, shown in Exhibit 3 and Exhibit 4 below.

On most measures, these two funds appear to be substantially similar. The most noteworthy difference between the two appears in their exposure to the quality factor. IJR’s exposure to the quality factor tends to be high and has resided above the category average over the past five years. IWM’s quality exposure has been relatively lower and has tended to fall below the category average. This is symptomatic of important differences in the methodologies of these funds’ underlying indexes. IJR’s quality bias stems from the fact that it requires new index constituents to have positive earnings over the prior quarter and the past year before they can be added to the index. IWM’s benchmark, the Russell 2000, doesn’t apply a similar filter. As such, it skews toward smaller, unprofitable, lower-quality names.

Key Takeaways 1. The Morningstar Factor Profile provides a snapshot of funds' exposures to seven different factors. These factors are common characteristics of stocks that can help to explain their long-term returns relative to the broader market.

2. Funds’ exposure to these factors depends in part on the makeup of their portfolios and partly on how the factors themselves are defined and measured. Our own definitions were selected based on consistency with commonly used definitions from academic research, simplicity, and transparency.

3. Investors can use the Factor Profile to better understand the different sources of returns that stock funds are attempting to harness and assess how effectively they are targeting them.

This tool can be found on the Morningstar.com fund quote pages under the “Portfolio” tab. The underlying data, along with the tool, is available in Morningstar Direct Morningstar Office.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)