Alternatives to the Aggregate

As the bond market’s barometer has become increasingly conservative, new indexed options have emerged.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad, market-value-weighted index that includes U.S. dollar-denominated investment-grade corporate, government, and securitized (for example, asset-backed securities, mortgage-backed securities, and commercial MBS) debt with at least one year until maturity.

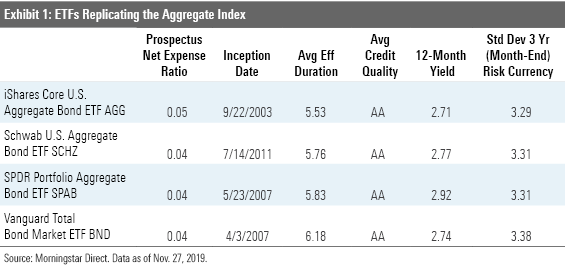

A passively managed fund replicating the Aggregate Index is a good option for a core bond holding. Given its conservative composition, returns will be less volatile than and uncorrelated to the equity market. The four exchange-traded funds in Exhibit 1 track the Aggregate Index (Vanguard Total Bond Market ETF BND actually tracks a float-adjusted version). All four have earned a Morningstar Analyst Rating of Silver on account of their broad diversification and low fees.

Like all indexes, the Aggregate Index evolves to reflect changes in the market it is meant to measure. Its composition changed significantly in the aftermath of the 2008 financial crisis as the U.S. Treasury department issued record amounts of debt. Although it still provides diversification and strong downside protection, today's Aggregate Index is even more conservative than it was before the crisis.

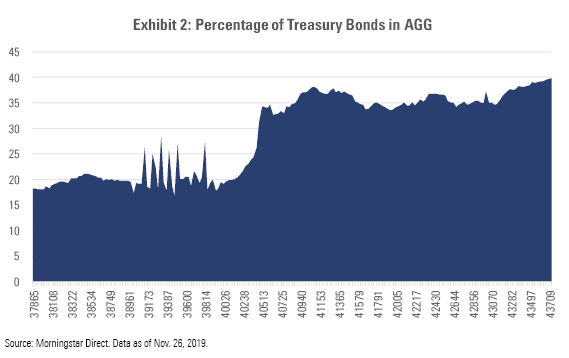

The Most Recent Evolution of the Aggregate Index According to data published by the Securities Industry and Financial Markets Association, Treasury bond issuance represented roughly 14% of all debt issuance annually from 1996 through 2007. From 2008 through 2018, that figure increased to nearly 31%. As a result, the Aggregate Index's allocation to Treasury bonds--as proxied in Exhibit 2 by iShares Core U.S. Aggregate Bond ETF AGG--has jumped from around 20% in the years preceding the financial crisis to nearly 40% today.

Treasury bonds are among the safest assets because they are backed by the full faith and credit of the U.S. government. That said, risk and return are often highly correlated in the fixed-income market. While the increase in the Aggregate Index's allocation to Treasury bonds has decreased risk, it has also decreased yield. Moreover, the benchmark has become increasingly less representative of how actively managed core bond funds construct their portfolios.

An analysis of funds in the intermediate core bond Morningstar Category revealed a stark difference between the composition of passively managed funds and their actively managed counterparts. On average, passively managed funds held (as of November 2019) 40% of their assets in Treasury bonds. The corresponding figure for actively managed funds was approximately 20%. Interestingly, the average allocation to Treasury bonds among active funds matches the amount held in the Aggregate Index prior to 2008.

A Pair of Passive Options That Better Emulate Their Active Peers As the Aggregate Index has evolved, new index alternatives have emerged. Here I will spotlight two of the more compelling among them. Both take different approaches than the Aggregate Index to providing broad bond market exposure. Both take additional credit risk, which could hurt their ability to provide downside protection or diversify stock risk, but they generate more yield. And both are also more representative of how active managers build core bond funds.

The first is a strategic-beta fund tracking an index that subdivides the Aggregate Index and optimizes it to generate the highest potential yield. The second is a traditional market-value-weighted fund that stands as an alternative because its benchmark casts a wider net than the Aggregate Index. Both funds are solid options for a core bond holding.

AGGY WisdomTree Yield Enhanced U.S. Aggregate Bond ETF AGGY tracks the Bloomberg Barclays U.S. Aggregate Enhanced Yield Bond Index, which carves the Aggregate Index into 20 components and then weights bonds using an optimizer to maximize yield.

The 20 components are defined by sector and years until maturity. The sectors include government (Treasury and agency bonds), credit (split along the lines of credit ratings), and securitized. There are three distinct maturity buckets: long (greater than 10 years), medium (five to 10 years), and short (one to five years). Constraints are applied to ensure the fund does not deviate too far from the Aggregate Index. For example, the index's duration must be within one year of the Aggregate Index's. Also, the weight of each sector is bound to stay within either 20% (for Treasuries, credit, and securitized bonds) or 10% (for agency bonds) of the Aggregate Index's weighting to each.

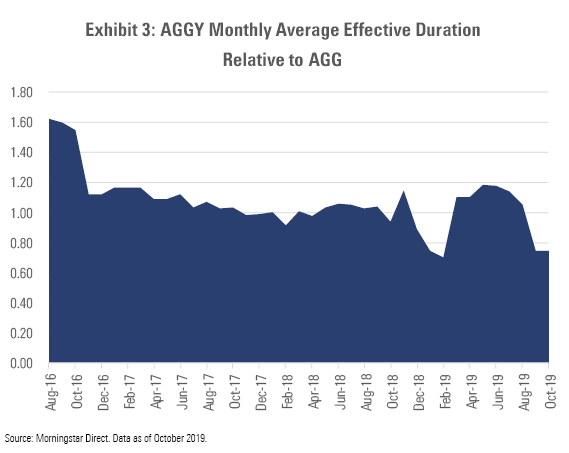

The net result is a tilt toward corporate bonds and away from Treasury bonds. While this will boost the fund's yield, it could diminish its diversification potential as the performance of corporate bonds is more highly correlated to equities as compared with Treasury bonds. Additionally, while its mandate limits its interest-rate risk relative to the benchmark, the fund has consistently assumed the maximum amount of interest-rate risk allowable. As shown in Exhibit 3, AGGY's duration has remained approximately one year longer than AGG's since the fund's inception in 2016.

IUSB IShares Core Total USD Bond Market ETF IUSB is another interesting alternative that could serve as a core-bond holding, although it falls in the core-plus bond category. This fund tracks the Bloomberg Barclays U.S. Universal Bond Index, which can be thought of as a parent to the Aggregate Index because it is incrementally broader--it includes junk bonds and dollar-denominated emerging-markets debt.

This fund's inclusion of below-investment-grade debt makes it more representative of how active managers build core bond funds. As of October 2019, slightly more than 6% of IUSB's portfolio was allocated to junk bonds, with the bulk split between the highest-rated tranches of below-investment-grade debt (BB and B).

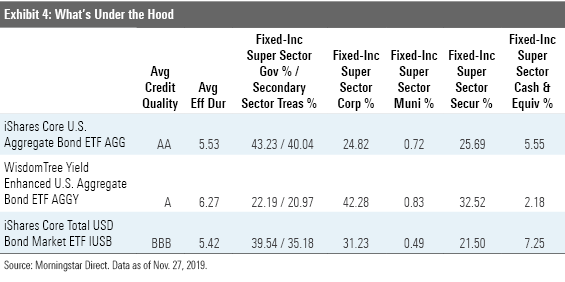

What's Under the Hood? Both AGGY and IUSB hold a greater percentage of their assets in corporate bonds relative to the Aggregate Index, But AGGY's allocation to corporate credits is 10 percentage points greater than IUSB's. AGGY appears to take more risk than IUSB, even though it maintains a higher average credit quality. While this should help AGGY outperform IUSB and the Aggregate Index during periods of economic growth, the fund should lag when conditions deteriorate, and credit spreads widen. Additionally, this could diminish AGGY's ability to diversify a portfolio because corporate bonds' returns are more correlated to the equity market than government bonds' returns. Exhibit 4 provides more detail on the contents of these funds' portfolios.

AGGY also takes more interest-rate risk than IUSB and the Aggregate Index. As discussed previously, AGGY's index is constrained to keep its duration within one year of the Aggregate Index, but the fund has constantly taken the maximum amount of interest-rate risk allowable.

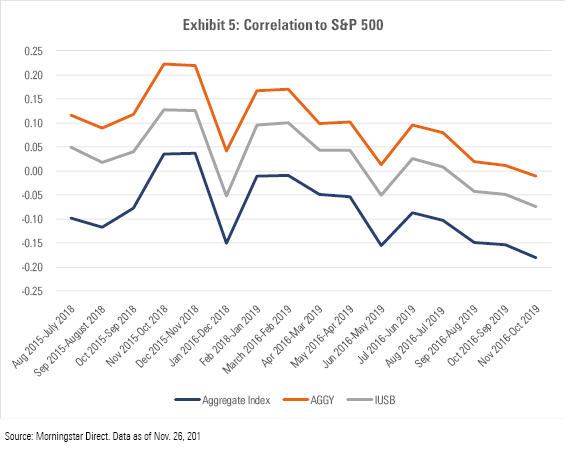

AGGY or IUSB as a Core Bond Holding One of the primary benefits of a core bond position is diversification. Although the performance of AGGY and IUSB are largely uncorrelated to the S&P 500, both show a greater degree of correlation to stocks than the Aggregate Index.

From August 2015 through October 2019, the Aggregate Index's performance was negatively correlated to the S&P 500, while the AGGY and IUSB were (barely) positively correlated to stocks. Exhibit 5 shows the rolling 36-month correlations to the S&P 500 for the Aggregate Index, AGGY, and IUSB from August 2016 through October 2019.

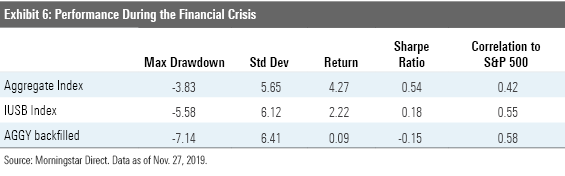

Neither AGGY nor IUSB existed in 2008, so they have not been tested during the worst stretches of a full market cycle. But IUSB's benchmark index launched in December of 1998. And while AGGY's index launched with the fund in June 2015, it contained backfilled data to August 2002. So, we can gauge how these funds may have fared during the worst market environment in recent memory. Exhibit 6 shows how these indexes held up from January 2008 through March 2009. It indicates that AGGY would have been hit the hardest. This is unsurprising given its tilt toward corporate bonds. It is also worth noting that each fund's correlation to the S&P 500 spiked higher during the crisis period.

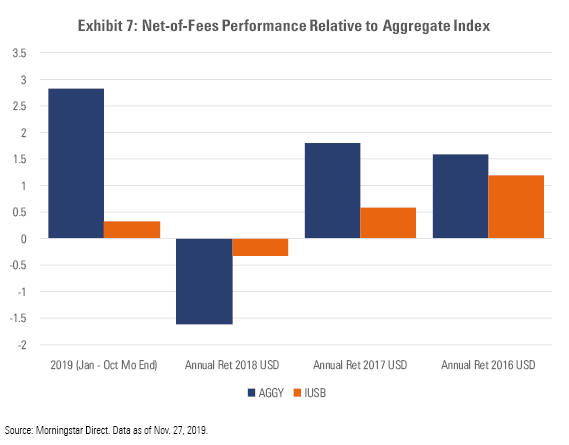

The performance of AGGY has been much more volatile relative to the Aggregate Index than IUSB. Since August 2015, the Aggregate Index has generated negative returns in 21 months, while AGGY and IUSB generated negative returns in 17 and 18 months, respectively. But the average loss for AGGY during negative months was 0.73%, while the average losses for IUSB and the Aggregate Index were 0.52% and 0.47%, respectively. As seen in Exhibit 7, AGGY has also been more volatile.

Conclusion A passively managed fund that tracks the Aggregate Index is a compelling choice as a core bond holding. However, the composition of the Aggregate Index has shifted since the financial crisis of 2008 and has become increasingly heavy in Treasury bonds. Investors concerned that their core bond holding has become more of a Treasury portfolio have options.

AGGY emphasizes yield in its construction and is probably a better choice for investors with a higher risk tolerance. But its credit-heavy portfolio makes it more susceptible to changing credit spreads. IUSB is a generic market-value-weighted index fund, but its target index contains a more broadly diversified opportunity set relative to the Aggregate Index. Its wider net is representative of how active core bond fund managers build their portfolios.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)