ETFs Add Liquidity to the Bond Market, Not Risk

ETFs have brought a new level of transparency and order to bond markets which should benefit all fixed-income investors.

A version of this article previously appeared in the September 2019 issue of Morningstar ETFInvestor. Download a copy here.

Over the past decade, assets in fixed-income mutual funds and exchange-traded funds have more than doubled while traditional liquidity providers' role in bond markets has greatly diminished and trading volumes have shriveled. These opposing trends have fueled concerns that higher rates could result in mass selling into a market that appears ill-prepared to deal with a rush to the exits.

ETFs--particularly those investing in high-yield bonds and bank loans--have been singled out as an area of specific alarm, given their unique structure and perceived superior liquidity. Some of these fears could prove to be perfectly reasonable, though most of them aren't unique to ETFs. The ETF-specific concerns serve as evidence that many investors still don't fully comprehend the function fixed-income ETFs serve or how they work.

Liquidity Has a Price Liquidity is a measure of the cost and immediacy with which an asset can be bought or sold. Its most important dimensions are the time it takes to execute a transaction, the size of the trade, and the price at which it is executed. Together these represent the "cost" of liquidity. Investors like the option to execute trades quickly in large quantities with little effect on security prices. Liquidity is abundant and inexpensive in markets with ample buyers and sellers making frequent transactions. Stocks in the S&P 500 are very liquid, for example. Liquidity is relatively scarce and more costly in markets with fewer buyers and sellers that trade less frequently--like bond markets.

Bonds are not stocks. Bonds are often bought with the intention of being held until maturity. Thus, they are traded far less frequently than stocks. Also, there is no central exchange for bonds as there is for stocks. Bonds are traded over the counter. Buyers and sellers may link up over the phone or via instant messaging. The process can be time-consuming and expensive. Additionally, bonds are not standardized. Citigroup's C stock has a single listing, but the firm has more than 1,000 different bonds, each of them unique. This fragmentation further fosters illiquidity.

Liquidity also varies depending upon prevailing market conditions. In good times, it is plentiful and inexpensive. In bad times, it is hard to come by and costly.

If market fundamentals turn south and bond investors sell en masse, the cost of liquidity will rise as buyers tend to demand lower prices and bid-ask spreads widen to reflect increased risk. This will affect all sellers regardless of whether they have exposure to the asset class via individual securities, a traditional mutual fund, or an ETF. A downdraft would have a permanent effect on sellers (realized losses) and a temporary one on holders (paper losses), and it might present a buying (or arbitrage) opportunity for others. Thus, investors who should be most concerned about the effects of panic-selling in the bond markets are those with the greatest proclivity to panic and sell. Long-term investors and opportunistic buyers won't ultimately bear the direct costs stemming from the activity of their more-excitable counterparts. They may actually stand to benefit from it.

The New Kid on the Block ETFs are the new kid on the block in the bond market. The first fixed-income ETFs were launched in July 2002. The first high-yield ETF, iShares iBoxx $ High Yield Corporate Bond ETF HYG, made its debut in April 2007. More recently, there have been ETFs launched that track even less-liquid corners of the market. Invesco Senior Loan ETF BKLN listed in March 2011; it tracks a benchmark composed of bank loans.

The repackaging of relatively illiquid and risky instruments in a wrapper that boasts intraday liquidity has been welcomed by many investors, while others have viewed these funds as fraught with risk and singled them out as a potential source of incremental volatility and market instability. The latter group's worries center around the fact that ETFs trade intraday and can be redeemed daily (making them no different from traditional mutual funds). They often conjecture that a mass exodus from these instruments could put downward pressure on the price of the underlying holdings. As I see it, these fears are overblown and reflect a lack of understanding of ETFs.

Organized Chaos Fixed-income ETFs bring a semblance of order to a cluttered landscape. One of the chief functions that fixed-income ETFs serve is to organize liquidity. They assemble a collection of relatively illiquid, nonstandard securities or loans into a single standardized basket that trades like a stock on an intraday basis. In doing so, they create a new avenue for investors to attain exposure to a given segment of the fixed-income markets. This route is more efficient than sourcing individual securities or loans. It also provides a broader and deeper pool of potential liquidity. There are far more prospective buyers and sellers in the secondary market for ETF shares than there are in the markets for each of the underlying securities or loans that comprise these funds' portfolios.

Finally, because they are traded in real time during normal market hours, these funds provide an unprecedented level of transparency around fixed-income pricing. They trade far more frequently than their constituent bonds and thus serve as a price-discovery mechanism of sorts. In fact, some bond-pricing services now incorporate fixed-income ETFs' prices into their pricing models for individual bonds.

Everybody Sells Most of the trading activity in fixed-income ETFs takes place in the secondary market. This is where investors trade shares of ETFs back and forth. This trading activity does not involve any direct transactions in the funds' underlying components.

Concerns regarding fixed-income ETFs' potential effect on their underlying markets center on a mass-liquidation scenario. In this event, the supply of ETF shares on the secondary market would exceed demand (there would be more sellers than buyers). This would lead ETFs' prices to fall to below their net asset values (they would trade at a discount). In this event, the most likely providers of liquidity (buyers) would be market makers. Discounts will ultimately widen to the point where it becomes profitable for market makers to step in and buy ETF shares "low" with the prospect of subsequently selling the underlying securities "high." By exploiting this arbitrage opportunity, market makers will reduce the supply of ETF shares in the secondary market, the supply/demand balance will be restored, and discounts will ultimately collapse.

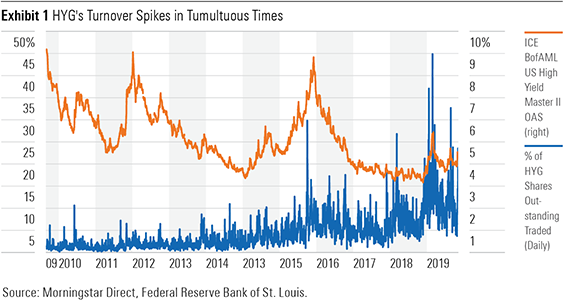

The scenario described above is not hypothetical. This process has been at work since the very first ETF, SPDR S&P 500 ETF SPY, was launched in 1993. Fixed-income ETFs, while still relative newcomers, have been stress-tested in real time. They functioned remarkably well during the worst days of the financial crisis. In fact, at certain points they were one of the only remotely reliable sources of liquidity and price information. This pattern has subsequently repeated, as evidenced by the spikes in fixed-income ETF trading that have coincided with intermittent bouts of volatility in the bond market--most notably, the 2013 taper tantrum and the 2015 high-yield sell-off.

But Liquidity Still Has a Price Fixed-income ETFs serve to organize liquidity and have functioned well in times of crisis, but they have not and will not change the fact that liquidity comes at a cost. In the case of fixed-income ETFs, that cost takes the form of bid-ask spreads, market impact (on the ETFs' prices), and premiums and discounts to net asset value. The cost of liquidity can be volatile and will surely increase in the face of a mass exodus from fixed-income markets. This is not unique to ETFs. What is unique about them is the level of transparency they provide (in the form of widely available intraday prices) and the additional layer of liquidity they've added to the market in the form of secondary market trading. The development of a full menu of fixed-income ETF offerings should be welcomed by investors, as it has given them a wide swath of low-cost tools to gain access to virtually every corner of this market and has created a new avenue for liquidity and greater price transparency--which should benefit all fixed-income investors, whether they use ETFs or not.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)