Global Payments-TSYS Merger Is the Best of the Bunch

This combination will help the company exploit some key trends.

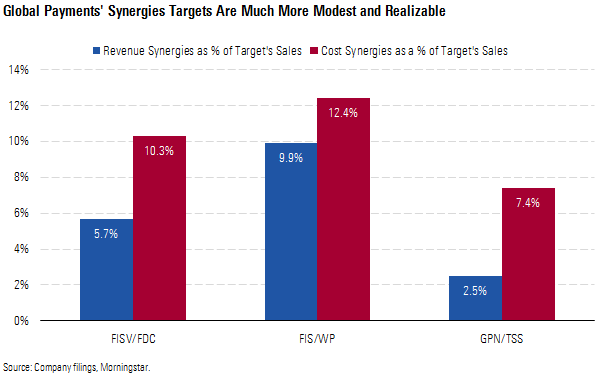

M&A has been the name of the game in the acquiring industry this year, with Fiserv FISV and Fidelity National Information Services FIS snatching up First Data and Worldpay, respectively, and Global Payments GPN merging with Total System Services, or TSYS, in a deal that closed in mid-September. We think the Global Payments-TSYS combination is the most attractive. The targeted cost synergies are the most modest, but we think the deal has the most capacity to reduce costs without impeding growth. Additionally, of the three deals, this merger is the only one involving two companies that both have acquiring operations. Given that we believe scale is critical to competitive positioning in the industry, this combination should immediately strengthen Global Payments’ economic moat.

The acquiring industry continues to evolve, and we think this merger will better position Global Payments to adapt to these changes. First, we think international expansion will be an increasing area of focus for acquirers. The United States is relatively advanced in its shift toward electronic payments, and expanding into new markets will be necessary to maintain growth and ultimately to protect scale advantages and moats. The two companies should be able to leverage each other’s global footprints.

Second, e-commerce is now a force that is too large for traditional acquirers to ignore, and merchants are increasingly looking for omnichannel solutions. Fraud is a key issue for online transactions, and we think combining data from both the merchant and consumer sides will help Global Payments combat fraud and move closer to online solutions that resemble the successful PayPal model. Finally, the industry has shifted to a focus on integration with business software. The all-stock nature of the deal leaves Global Payments with modest leverage and more flexibility to potentially pursue software acquisitions and strengthen its portfolio of owned business software in key industry verticals.

Our relatively dour view of the Fiserv-First Data and FIS-Worldpay combinations is in line with our opinion that both stocks are materially overvalued, as we don’t believe the market has factored in that those deals were not done from a position of strength. On the other hand, we believe the current market valuation for Global Payments looks fair, providing a viable option for investors with an attraction to a space with moaty characteristics and good growth opportunities.

Payment Processing Has Some Attractive Qualities While there are elements of technology, acquiring is fundamentally a fairly simple business. Payment networks rely on both consumer and merchant participation to function. Acquirers handle the merchant side, historically doing the legwork to sign up merchants, get point-of-sale devices installed, and connect merchants into the system. For their efforts, they take a small percentage of every transaction, and therefore could be looked at as a prototypical tollbooth business. They are largely agnostic between methods of electronic payments and earn money off any transaction that requires a connection to an electronic payment network. On the other side of the transaction is the card issuer. For the card issuers, processing payments is not a core activity, and they often turn to other companies such as TSYS to handle it. In this respect, TSYS has essentially functioned as a mirror of the acquiring side.

Payment processing of any type is a highly scalable business, as once a payment platform is established, there is little incremental cost to additional transactions. As a result, a handful of acquirers have come to dominate the industry. Recent mergers and acquisitions have further consolidated the space, and Global Payments has actively participated in this trend, acquiring main rival Heartland in 2016, a move that meaningfully bulked up the company’s size.

First Data is the largest U.S. player; if its joint ventures with Bank of America and Wells Fargo are included, it has about 40% share, followed by Worldpay at 22%. We estimate Global Payments’ domestic market share at 6%.

However, we think an acquirer’s competitive position must be determined in the context of the merchant class it serves. We think Global Payments’ small-merchant focus leaves it operating in a distinct niche that shields it from its larger competitors, and in this niche, it is a clear leader. The company believes its sweet spot in terms of size is merchants that generate $200,000-$650,000 in annual payment volume, a range that is materially lower than the area of focus for larger providers but higher than the micromerchants being serviced by newer upstarts such as Square SQ. We see Global Payments’ position in this niche as sustainable and believe the company’s scale and the resulting cost advantage lead to a narrow moat for the business.

The difference among acquirers is clearly seen in revenue as a percentage of payment volume. Worldpay and First Data, for instance, have rates of about 25 basis points, demonstrating the leverage larger merchants enjoy. To some extent, this mitigates their scale advantages. Global Payments, focusing on smaller merchants, has a rate of about 50 basis points but has built out a defensible and profitable position for itself. Further, it has been able to effectively scale in this smaller niche, thanks in part to a higher level of pricing. Going further downscale, Square enjoys pricing of over 100 basis points, reflecting the limited options of its micromerchant customers.

In terms of competitive dynamics, the issuer side is similar to the acquiring side, with scale as the defining factor, but there is one key difference. Unlike the acquiring side, which has millions of merchants to potentially serve, the card issuer market is relatively concentrated, with the top eight controlling about 80% of the market. TSYS was the clear leader in serving these companies, and due to the relative lack of potential customers, it didn’t have many rivals, although First Data also has some operations on this side. Customer concentration is a potential negative for this business, and TSYS had two customers that each accounted for over 10% of revenue in this segment, although this issue was somewhat mitigated by TSYS’ other segments, and no customer accounted for 10% or more of TSYS’ overall revenue. A related point is that TSYS’ card issuer customers had a fair amount of leverage, and we believe pricing concessions when contracts are renewed limited the company’s growth. Over the past five years, we estimate that TSYS’ issuer business grew at a 5% compound annual rate, while many of the leading acquirers saw low-double-digit growth.

String of M&A Has Brought the Two Sides Together The issuer and acquiring sides historically have been somewhat separate, but a wave of M&A in 2019 has brought them together. In January, Fiserv announced it would acquire First Data in a deal valued at $41 billion. Then in March, Fidelity National Information Services announced that it would gobble up Worldpay for $44 billion. Finally, in May, Global Payments and TSYS announced they would merge. The Global Payments-TSYS deal differs from the others in a couple of main respects. First, Fiserv and FIS are bank technology providers and intersect with the card ecosystem primarily by processing debit card transactions for banks, whereas TSYS primarily worked with credit card issuers. Second, the Global Payments-TSYS deal was an all-stock merger that left TSYS shareholders with 48% of shares and created no new debt. Of these three deals, we think the Global Payments-TSYS merger was the most attractive. We think the synergies from this combination are the most realizable, and the merger positions Global Payments to better exploit some of the key trends driving the acquiring space.

Conservative Targets Creates Potential for Positive Surprises As part of the rationale for the spurt of M&A in this area, the companies have pointed to substantial synergies arising from these deals. This is not terribly surprising, as we believe management teams typically feel the need to defend large-scale M&A with outsize benefits. However, Global Payments' synergy targets are much more modest than the other two deals. In a relatively high-growth and evolving area such as payment processing, we have concerns that a focus on aggressive cost-cutting, while it might maximize margins and earnings in the near term, could ultimately prove value-destructive as it limits long-term growth. The industry-lagging growth that First Data generated in the wake of its 2009 leveraged buyout and the resulting focus on cost reductions is a prime example of this type of risk. Global Payments' modest synergy targets minimize concerns on this front. Further, in our view, Global Payments should, if anything, have more potential for cost reductions, given more operational overlap and the history of the companies.

Given the scalability of the acquirer business model and payment processing in general, we think that there should be greater scope for cost reductions between more similar enterprises. On this score, the Global Payments-TSYS merger stands out in a positive way, as it is the only combination where both companies had sizable acquiring operations. Global Payments is essentially a pure-play acquirer, while TSYS derived about a third of its revenue from its acquiring segment. Further, the two acquiring operations look like a good fit, as both companies focus on smaller merchants. The other two deals do not feature significantly overlapping operations.

A further consideration is that Global Payments and TSYS, unlike the companies involved in the other deals, don’t have a recent history of aggressive cost reductions. First Data was forced to cut costs for years following its leveraged buyout and outsize debt load. In the other deal, Worldpay and Vantiv had completed a merger just a little over a year before the acquisition by FIS and had realized a significant amount of synergies from that merger. That both of the acquired companies in the other two deals had been cutting costs before their acquisitions suggests they might be much closer to hitting bone than Global Payments.

In sum, we think it is reasonable to believe that Global Payments has the greatest capacity to exceed its cost synergy target and, at a minimum, realize its target without impeding its longer-term growth.

Additionally, given the importance of scale in determining competitive positions, the combination strengthens the company’s moat, even without considering any other factors. But we think the benefits of the mergers go further.

Merger Will Help Facilitate International Expansion and Extend Growth The primary factor driving growth in the payments industry has been the ongoing shift toward electronic payments. A couple of years ago, electronic payments eclipsed cash and check payments on a global basis for the first time. However, the U.S. is more advanced, with electronic payments making up about 75% of all consumer payments by dollar volume.

The shift toward electronic payments domestically is still not complete, but we are getting close enough to start to glimpse the end. The Nilson Report projects the compound annual growth rate in all electronic payment types to be 7% from 2017 to 2022. For the foreseeable future, this should allow for solid growth for industry participants, but over time, growth in the U.S. will start to converge on overall economic growth and the industry will mature domestically. To maintain current growth rates for a longer period, we believe industry participants will have to look internationally.

Acquirers rely on internal or external salesforces to reach clients, so opening shop in a new country typically requires either acquiring an existing local salesforce or building a new one, which is not an easy process. As a result, acquiring markets tend to be national, and the large acquirers in the U.S. remain fairly centered on the U.S. We believe this is changing, as comments from companies such as Worldpay suggest an increasing interest in international expansion. Still, Global Payments is relatively advanced on this score, with about a fourth of its premerger revenue coming from outside North America.

Over the next several years, expanding internationally will help boost growth, but in the very long run it might be necessary in order to maintain moats. We see scale as a key factor in determining competitive position. Currently, card payments are clustered in developed economies in North America and Europe, with these two regions accounting for 56% of purchase transactions. But as emerging markets shift toward electronic payments, the U.S. and Europe will be much less dominant, with these regions expected to decline to 37% of global purchase transactions by 2027. If the leading domestic acquirers don’t act soon to expand internationally, they could ultimately find the situation reversed, with foreign acquirers utilizing the heft they can build over time in their own markets to compete in the U.S. and Europe.

While we don’t think the merger of Global Payments and TSYS completely changes the game for these companies when it comes to international expansion, we do think the combination makes Global Payments stronger in this respect, as it should be able to leverage the footprint of the two companies to expand the two sides of the business. The issuer and acquirer sides do serve different customer bases (card issuers and merchants), but we think the combined company should have opportunities to utilize the foothold developed by one side to build upon the other side. We would note that it is more common in some other markets for companies to combine issuer and acquirer services under one roof, suggesting there is some value in combining the two sides.

Global Payments has a physical presence in 31 countries outside the U.S., while TSYS has 13. While there is a significant amount of overlap, there are a number of substantial markets where only one has a physical presence, such as Germany, Philippines, South Africa, and Spain. We think there could be a meaningful opportunity for the combined company to leverage its new footprint.

Better Positioned to Participate in Rise of E-Commerce Traditional point-of-sale acquirers such as Global Payments were slow to move into online acquiring, and as a result those two markets have historically been somewhat distinct. However, with e-commerce growing quickly, the online market has simply become too important for any acquirer to ignore, and merchants increasingly are looking for omnichannel (both point-of-sale and online) solutions from acquirers. Global Payments, along with its peers, has embraced this trend in recent years. E-commerce hit a key point in the first quarter of 2019, making up 10% of all retail sales for the first time, according to the Department of Commerce. Given that cash payments are not a factor in online transactions, e-commerce's share in card transactions is even higher. Further, e-commerce offers another venue for acquirers to extend their growth, as e-commerce has been growing at a midteens rate over the past couple of years.

However, for point-of-sale acquirers, controlling fraud is a key issue when approaching the online space. Global card fraud costs were $29 billion in 2018, or $0.07 for every $100 in transactions. While card-not-present transactions are less than 15% of all card payments, they account for over half of all fraud costs. Using those figures, we can estimate that fraud costs are about $0.04 per $100 for point-of-sale transactions and $0.24 per $100 for card-not-present transactions. Given that Global Payments’ revenue is roughly equal to $0.50 per $100, it’s clear that controlling fraud costs in online transactions is fairly critical, and antifraud capabilities could meaningfully improve the service they offer to merchants. According to The Nilson Report, the recent rise in fraud costs is driven by organized, professional criminals who are simply more adept at navigating the digital world than merchants or financial institutions. Fraud costs are expected to come down over time, but we believe that projection presumes a more concerted effort by the industry to address the issue. Better use of data could be a key component in that effort.

In our view, one of the reasons PayPal became such a strong online force is that its unique business model gives it access to information on both sides of the transactions, merchant and consumer. We believe that having more complete data on the entire transaction helps it control fraud. By combining the issuer and acquirer businesses at Global Payments and TSYS, the combined company could have access to a similar level of information, which could in turn make it a much more potent player in the online space.

With the online and point-of-sale markets converging and scale remaining the dominant driver of competitive position, we think participating on the online side will be necessary for the leading point-of-sale acquirers to maintain their scale advantages and moats. In our view, despite the fast rise of e-commerce, the bulk of the payment volume in the acquiring industry will remain on the point-of-sale side for a long time to come, which should favor players on this side if they can develop effective online solutions, and the evolution toward omnichannel solutions should help maintain their moats. While the company has not provided a lot of information on how it will harness the ability to see both consumer and merchant information to control fraud, we think this dynamic was one of the drivers behind this deal, and we like that Global Payments’ management is positioning the company to evolve along with the industry.

More Flexibility to Adapt to an Evolving Industry Our confidence in this merger and management's ability to adjust to a changing industry is supported by the successful shift that Global Payments has made historically. Over the past several years, the company has almost completely shifted its distribution methods without any major interruption to its growth.

Along with omnichannel capabilities, merchants are increasingly looking for more holistic solutions and want their payment processing seamlessly integrated into their business software, which is often customized for their industry. We think Global Payments has proactively adjusted, and despite its focus on smaller merchants, which presumably could have come late to these trends, the company is well positioned to adjust to a changing competitive environment. The company has actively moved past its historical reliance on independent sales organizations, which now account for only 5% of revenue, and shifted toward partnering with software providers.

In our view, while acquirers have always enjoyed a mild switching cost advantage, the shift from selling acquiring services on a stand-alone basis toward integrating acquiring within a more holistic software offering for merchants will increase switching costs and turn this into a more meaningful source of competitive advantage. On this front, we think Global Payments compares well with peers in terms of the scope of its offerings, and this trend could further consolidate the industry.

This evolution has also required a shift to an internal salesforce in cooperation with these software referral partnerships. Further, the company has acquired its own software offerings in verticals such as education, restaurants, event management, and private physician practices.

This evolution was driven in large part through M&A, with the 2016 $3.9 billion merger with Heartland, Global Payments’ closest peer, providing a substantial internal salesforce. This was followed in 2017 by the $1.2 billion acquisition of Active Network (which provides software for event organizers). Then, in 2018, Global Payment acquired AdvancedMD (software for physician practices) for about $700 million and Sicom (software for restaurants) for about $400 million.

While we like the strategic path the company has pursued, the string of M&A has increased leverage, and the company’s size relative to its larger peers potentially created some limits on how aggressively the company could remake itself and build out its internal software lineup. To this end, we like the all-stock structure of the TSYS merger. TSYS’ relatively unleveraged balance sheet and the now larger size of the company should significantly enhance the combined company’s ability to pursue M&A, if Global Payments finds it needs to more fully flesh out its internal software offerings.

On a pro forma basis, debt/EBITDA will be 2.5 times. Global Payments expects to receive and maintain an investment-grade rating, which could be a limiting factor on future M&A, but with a larger earnings base and lower leverage, we think the company’s flexibility overall will be significantly improved.

/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)