Inflation and Your Retirement

Contributor Mark Miller unpacks the impact inflation has on retirees and how to prepare for it.

Next month, Social Security officials will deliver a reminder to retirees about one of the most important retirement planning challenges: inflation.

I’m betting inflation isn’t a topic you’ve thought much about lately. That’s understandable because consumer prices have been fairly quiet since the early 1980s. But the Social Security cost-of-living adjustment, or COLA, for 2020, to be announced in mid-October, offers a good opportunity to consider inflation and your retirement plan.

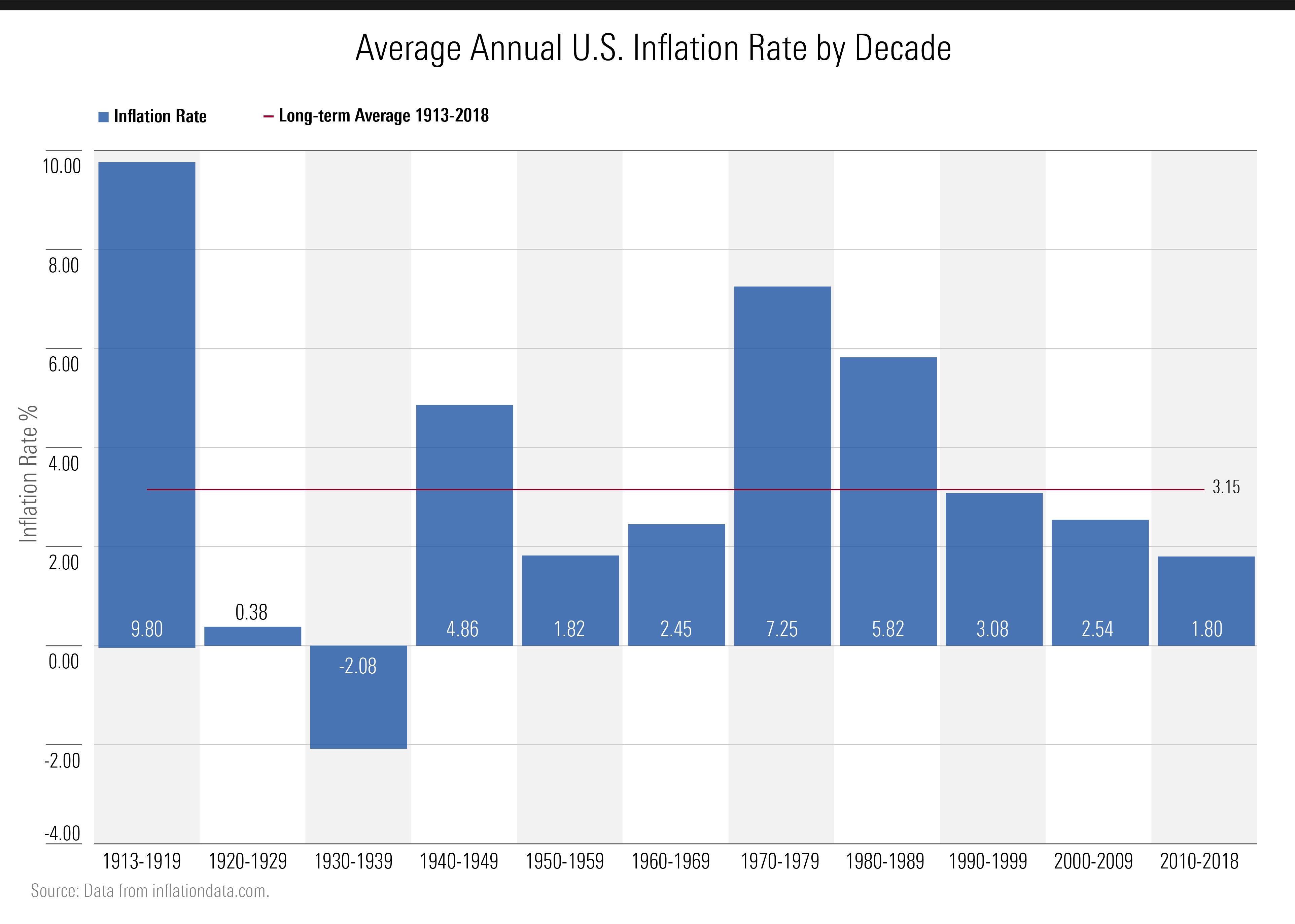

Retirement researcher Dirk Cotton noted in a recent blog post that compounded inflation rates by decade from 1900 to the present averaged 3.15%--but there were four periods (1913 through 1919, the 1940s, the 1970s, and 1980s) when inflation was significantly higher than the average. Those spikes typically arrive without any advance warning.

Even average rates of inflation can take a large toll. For an illustration, try out the U.S. Census Bureau's inflation calculator. It shows, for example, that $1,000 in January 2000 had the same buying power as $1,519 in August this year.

The Social Security COLA is expected to come in at 1.6%, according to a forecast by The Senior Citizens League. That's not much of an increase, but the COLA is determined by an automatic formula tied to the annual fluctuations of the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W.

An annual study by the league has consistently found that the CPI-W fails to keep seniors even with the inflation they experience. The league's report on the buying power of seniors looks at a market basket of goods, including prescription drugs, housing, health insurance, food, and various taxes. The most recent report found that Social Security benefits have lost 33% of their buying power since 2000.

The league looks at prices that retired and disabled households pay for goods and services, and it conducts an annual survey of older American to collect general household expenditure information. Last year, the COLA was a relatively healthy 2.8%, which boosted the average monthly Social Security benefit of $1,400 by about $39. But most survey respondents said their monthly expenses rose much more than that. For example, 22% said their monthly expenses ticked up "$79 to $119," and 36% said their costs increased "More Than $119."

Among the 10 fastest-growing costs cited in the survey were prescription drugs, homeowners insurance and property taxes, several food items, and Medicare premiums.

Looking to the future, two categories of spending look worrisome: housing and healthcare costs.

Most seniors own their own homes--79%, according to the Joint Center for Housing Studies of Harvard University. Homeowners are protected from the rising cost of housing, to the extent that they have fixed-rate mortgages or own their homes outright; they still are subject to rising costs of property taxes, insurance, and maintenance, though. Homeownership rates for younger households headed toward retirement have declined steadily since 2004 and especially since the Great Recession, according to JCHS. For example, among households aged 50-64, some 74% owned a home in 2017, off sharply from 79% in 2007.

That means fewer of these younger households are participating in the wealth-building typically associated with homeownership. And fewer will be able to tap home equity as a backstop in retirement to fund large expenses such as long-term care. Finally, it means more people will be exposed to the volatility of rental rates, which have been on a tear in recent years and show no signs of abating.

Healthcare also poses some risks. For example, Medicare’s trustees are forecasting that the standard Part B premium will jump an average of 5.28% annually between now and 2028--substantially more than general inflation. (This year, the standard Part B premium is $135.50. In 2028, it will hit $226.)

Medicare has the salutary effect of smoothing out much of your healthcare spending in retirement. But, as I noted in a recent column, it makes sense to shop Medicare policies carefully and to take advantage of the fall open-enrollment season. It’s also important to consider ways to mitigate the risk of an outsize long-term-care expense.

Inflation-Protection Strategies What strategies are available for protecting yourself from inflation in retirement? Unfortunately, the options are limited--but again, I'd start by considering Social Security and its very valuable COLA, which is unique as a source of retirement income. Some public-sector defined-benefit pension plans feature inflation adjustments, and some annuity products can be bought with inflation protection. But that's about it.

The COLA effectively makes Social Security benefits behave like an inflation-adjusted annuity. That’s a product that is nearly impossible to find in the commercial market

In fact, Cotton recently co-authored a paper with economist Zvi Bodie of Boston University, examining inflation-adjusted annuities--specifically, why there is almost no market for them. A number of annuity providers sell annuities with riders providing annual fixed-rate increases, but just one--Principal Life Insurance Company--sells one that is indexed to the Consumer Price Index. And Morningstar's David Blanchett has argued that this type of annuity is too expensive to be practical.

All of which argues powerfully in favor of optimizing Social Security benefits through delayed claiming and smart coordinated filing strategies. Effectively, you are buying a very inexpensive inflation-adjusted annuity, and you receive roughly 8% more income for every 12 months that you delay filing past full retirement age. The “cost” is the money needed to pay living expenses while delaying, either from savings or wages from work.

Other Strategies The other options boil down to an argument about the value and importance of an inflation hedge versus the lost upside of a nominal investment. Treasury Inflation-Protected Securities, or TIPS, offer one such option.

Equities are another option, of a sort. Maintaining a decent allocation to stocks in retirement can help you keep up with inflation, but they are not a hedge because equity returns are not correlated with inflation. And they come with sequence of return risk.

Public Policy Advocates for expanding Social Security benefits would like to see a more generous COLA formula that takes into account the higher inflation that seniors experience. A reform plan advancing in the U.S. House of Representatives would shift the COLA's inflation measure to the CPI-E (the E stands for elderly). Like the CPI-W, it is maintained by the U.S. Bureau of Labor Statistics. Reform plans proposed by Sen. Bernie Sanders (I-Vt.) and Sen. Elizabeth Warren (D-Mass.), both presidential candidates, also would move to the CPI-E.

Social Security's actuary estimates that the CPI-E would increase retiree benefits by two tenths of a percentage point annually. So, it is no panacea--but every little bit would help.

Mark Miller is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)