Measuring ETFs' Tax Efficiency Versus Mutual Funds

ETFs' structure makes them more tax-efficient than their mutual fund counterparts.

Exchange-traded funds tend to be more tax-efficient than mutual funds, chiefly because they tend to distribute fewer (if any) and smaller capital gains. ETFs’ tax efficiency has been a key selling point for tax-sensitive investors who prefer greater control over the timing and magnitude of the capital gains bills from the funds in which they invest.

Exchange-traded funds' tax efficiency should not be conflated with tax immunity. Investors in ETFs will still pay taxes on regular distributions of income, and they will be on the hook for capital gains taxes when they sell an ETF for more than they paid for it. Also, some ETFs will distribute capital gains, though they tend to be less frequent and of lesser magnitude than those their mutual fund counterparts generate. So, while ETFs are more tax-efficient--thanks mostly to their unique structure and with some help from their underlying strategies--they are not immune to taxation. Their primary benefit from a tax perspective is that they can allow investors to defer the realization of capital gains taxes.

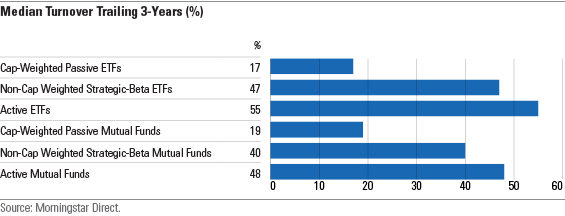

Low turnover partially explains ETFs’ tax efficiency. As of March 2019, 84% of ETF assets were invested in funds underpinned by market-cap-weighted indexes. These funds’ turnover was markedly lower than any other cohort we examined--save for index mutual funds tied to similar benchmarks.

Exhibit 1 shows the median annual turnover over the past three years for ETFs and mutual funds tracking cap-weighted indexes; those following non-cap-weighted strategic-beta benchmarks; and actively managed ones. The median turnover among the cohort of market-cap-weighted index ETFs was 17% over the three years through 2018. This is significantly lower relative to every other group except for the cap-weighted index mutual funds.

The low turnover of market-cap-weighted index funds is natural, as market prices determine the weightings of their holdings. The only changes to the composition of these portfolios that require trades are driven by index changes, which tend to result from corporate actions (such as mergers and acquisitions), movements across a target market-cap threshold, or changes in style classification. Ultimately, less buying and selling results in fewer taxable events.

Passive, low-turnover strategies are a contributor to--but not the primary driver of--ETFs’ tax efficiency. Also, they are not a differentiating feature, since many mutual funds offer exposure to similar indexes.

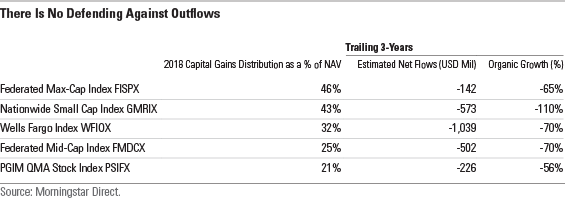

There Is No Defending Against Outflows Low turnover will tend to precipitate fewer taxable gains, but even the lowest-turnover strategies can't fully shield investors from the tax consequences of large redemptions.

Exhibit 2 features five examples of just how tax-inefficient low-turnover index funds can be in some circumstances. These five represent the index mutual funds tied to cap-weighted benchmarks with the largest 2018 capital gains distributions as a percentage of their net asset value. While many of the largest index mutual funds tracking similar bogies didn't distribute a penny of capital gains in 2018 (nor have some of them done so in years), these funds were paying out dollars' worth of gains. As is apparent in the data, outflows can wreak havoc on index funds' tax efficiency.

Outflows alone aren't enough, however. The magnitude and timing of these funds' outflows have been particularly problematic. During the past three years, each of these funds' asset bases has been more than halved by a shareholder exodus.

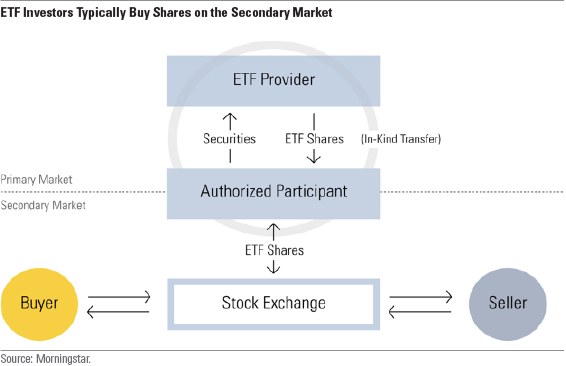

The second and more meaningful source of ETFs’ tax efficiency is structural. It springs forth from the in-kind creation-and-redemption mechanism by which ETF shares are brought into and removed from the market.

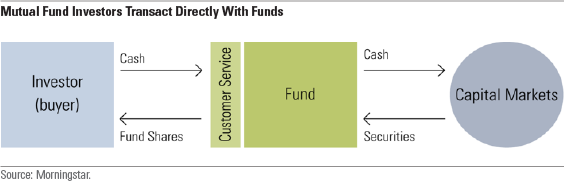

The ordinary creation-and-redemption process in a traditional mutual fund is straightforward.

But this buying and selling of underlying holdings, prompted by investors regularly entering and leaving the fund, comes at a cost.

That cost has a few different components:

- There is the frictional cost of portfolio turnover, which comprises things like brokerage commissions, bid-ask spreads, and market impact--where trades move market prices away from the manager

- There is the opportunity cost of holding cash to meet regular redemptions.

- Taxable capital gains distributions are also a meaningful part of this cost equation. As funds liquidate securities to meet redemptions or to free up cash to invest in new securities, they will often realize sizable taxable capital gains, which are passed on to shareholders.

The creation-and-redemption mechanism for ETFs is a completely different animal. The ETF market is split in two: a primary market for ETF shares and a secondary one.

But this buying and selling, prompted by investors regularly entering and leaving the fund, comes at a cost.

Measuring ETFs’ Tax Efficiency Versus Mutual Funds

There is no doubt that ETFs’ structure should make them more tax-efficient than mutual funds. This study seeks to measure the magnitude of that tax advantage.

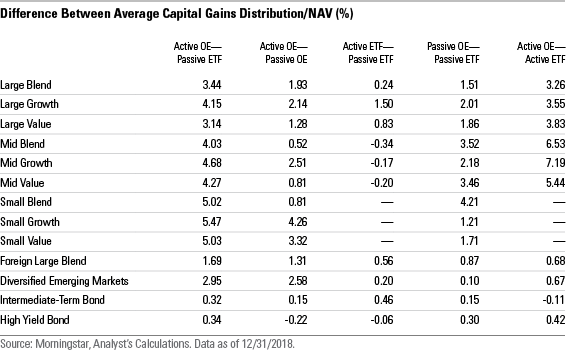

Comparing the tax efficiency of ETFs and mutual funds isn’t always straightforward. Most ETFs track indexes and most mutual funds are actively managed. To control for these differences and facilitate cleaner comparisons between ETFs and mutual funds, this study grouped the funds in each of the Morningstar Categories shown in Exhibit 5 into four buckets, based on vehicle type (open-end mutual fund or ETF) and whether the fund tracks an index (active or passive):

- Active Open-End

- Passive Open-End

- Active ETF

- Passive ETF

We calculated the average capital gains distribution as a percentage of each fund’s average net asset value from 2004 through 2018.

As expected, over the past 15 years passive open-end funds on average made smaller capital gains distributions relative to their NAV than their active counterparts in every category except high-yield. And in nine of the 13 categories, passive open-end funds were less likely than active open-end funds to make capital gains distributions.

On these measures, both passive and active ETFs were more tax-efficient than their open-end counterparts in most categories, as the last two columns in this exhibit show.

Passive ETFs were even less likely to distribute capital gains than passive open-end funds, and when they did, they made smaller distributions relative to NAV. The same was true of active ETFs compared with active open-end funds. That said, the sample of active ETFs was much smaller than the number of active open-end funds, which have less of a history and have had less time to build up unrealized capital gains. And despite active ETFs’ higher turnover, they only distributed higher capital gains relative to NAV than passive ETFs in six of 10 categories, and they made slightly lower distributions in the remaining four.

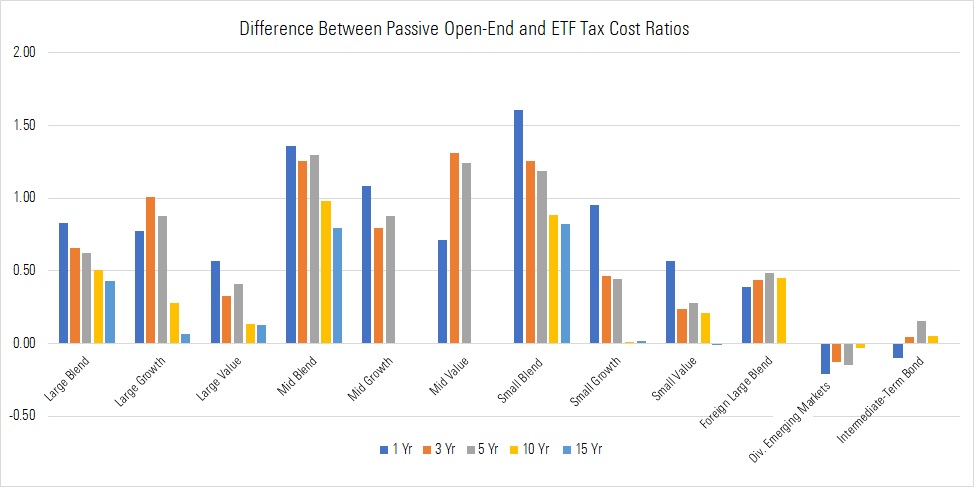

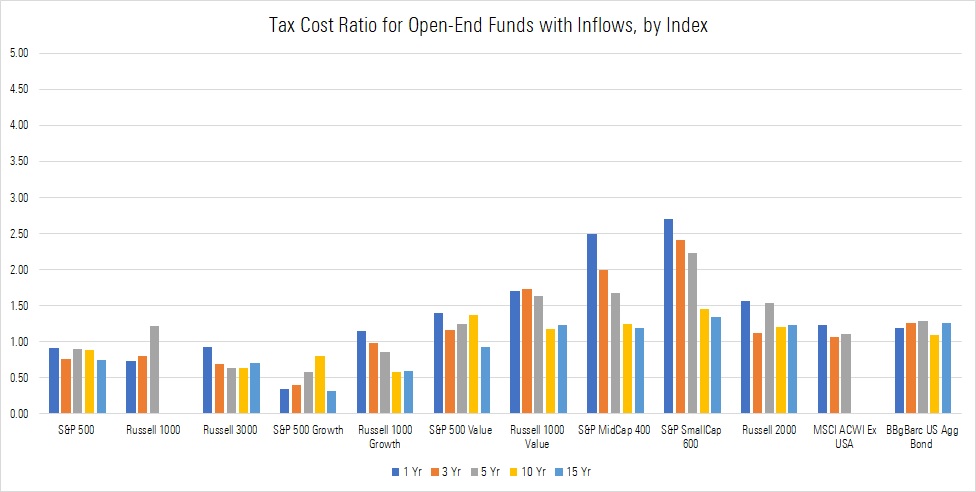

Morningstar tax-cost ratios offer another way to gauge tax efficiency. These compare a fund’s before-tax and aftertax returns (pre-liquidation), based on the highest marginal tax rates. This measures the potential impact of taxes on returns.

To supplement the capital gains distribution analysis, we calculated the average one-, three-, five-, 10-, and 15-year tax-cost ratios (where available), as of March 2019, for each of the four fund groups in the Morningstar Categories outlined above. Unlike the capital gains analysis, this analysis has survivorship bias, since funds need to survive the entire period to calculate a tax-cost ratio.

Consistent with the previous findings, passive open-end funds had lower tax-cost ratios than their active counterparts in most categories and time frames, despite their lower expense ratios. Similarly, passive ETFs had lower one-year tax-cost ratios than active ETFs in six of 10 categories and lower three-year ratios in five of six categories. And, as before, both passive and active ETFs appeared more tax-efficient than their open-end counterparts.

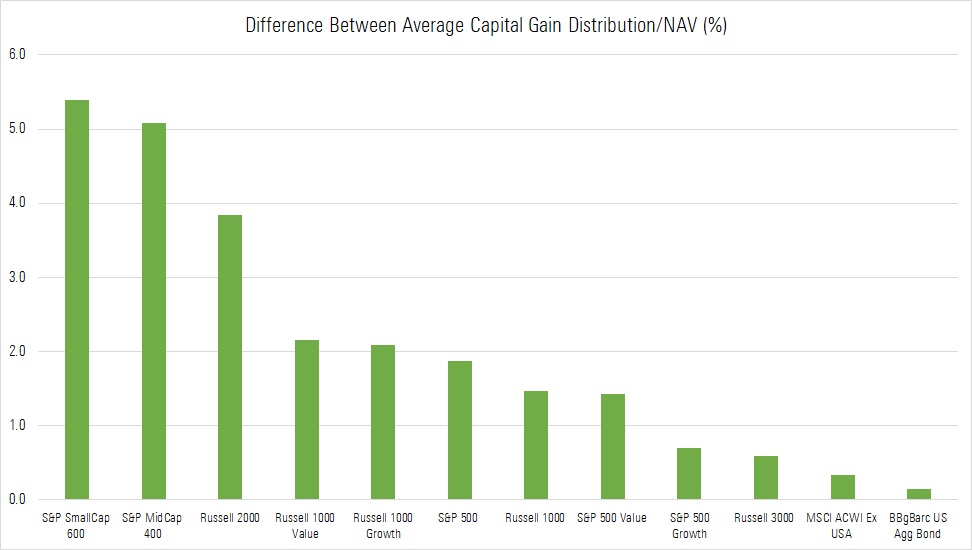

To facilitate cleaner comparisons and to better isolate the impact of the ETFs’ structure on tax efficiency, we narrowed our sample to passive ETFs and open-end funds that track 12 broad, market-cap-weighted indexes. As before, this sample includes both surviving and nonsurviving funds using data through March 2019.

This exhibit shows the average differences between the values for ETFs and open-end funds that track the same indexes for years when the data overlap.

Assessing the Impact of Flows

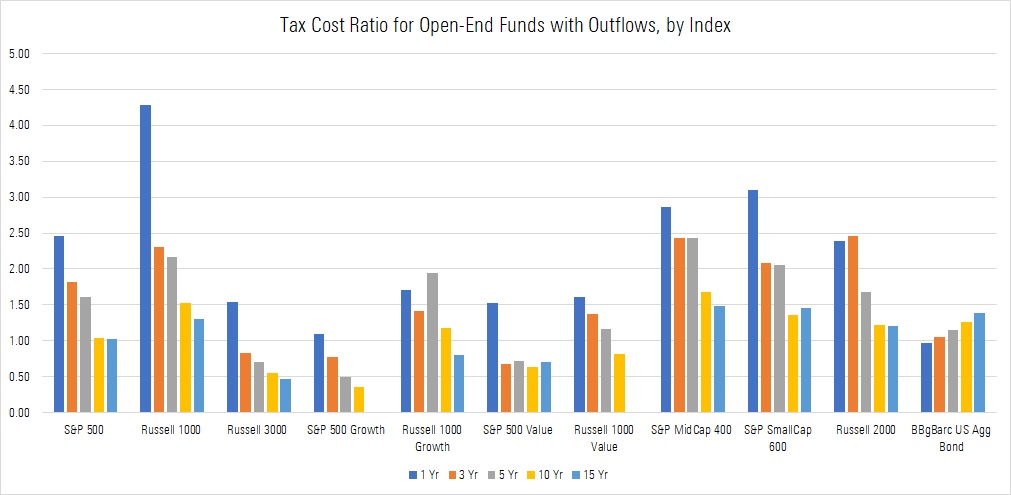

Flows can have a big impact on the tax efficiency of open-end funds--and even on low-turnover index funds--because outflows often require managers to sell securities, which increases the likelihood that they may realize capital gains that must be distributed. In contrast, ETFs can mitigate the impact of outflows by using the in-kind redemption process to meet withdrawals and remove low-cost-basis shares from the portfolio in a nontaxable transaction.

Overall, both passive ETFs and open-end funds tended to enjoy net inflows over most of the sample period. To further investigate the impact of flows on tax efficiency, we subdivided the open-end and ETF funds that tracked each index in Exhibit 24 into two groups each year: those with net inflows and those with net outflows. We then recalculated the tax efficiency metrics for those groups.

Open-end funds with outflows had higher tax-cost ratios than those with inflows in five of 10 categories over the trailing 10 years through March 2019. It’s also worth noting that ETFs with inflows were still more tax-efficient than index-matched open-end funds with inflows.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)