Communication Services: We Like the Unloved

Traditional telecom has lagged, but the rest of the sector has been strong.

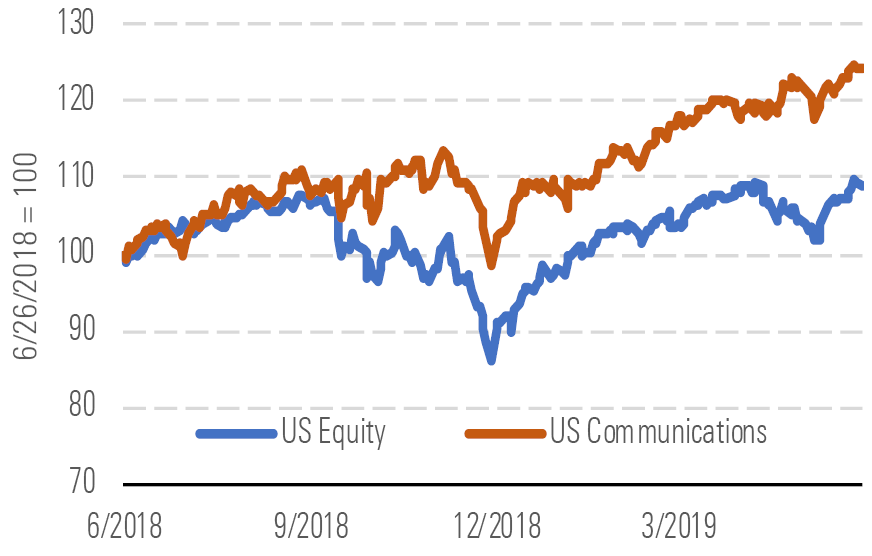

The Morningstar U.S. Communications Services Index (Exhibit 1) continues to perform well amid broader market volatility. The sector consists of four major types of companies: traditional phone companies, cable companies, wireless carriers, and infrastructure firms. Traditional phone companies AT&T and Verizon dominate the index. Verizon shares have stagnated this year after a fantastic run in 2018, while AT&T has roughly kept pace with the market, bouncing back from a rough sell-off after the Time Warner merger. We believe AT&T shares have more room to run.

In choppy markets, telecom generally offers a smoother ride - source: Morningstar Analysts

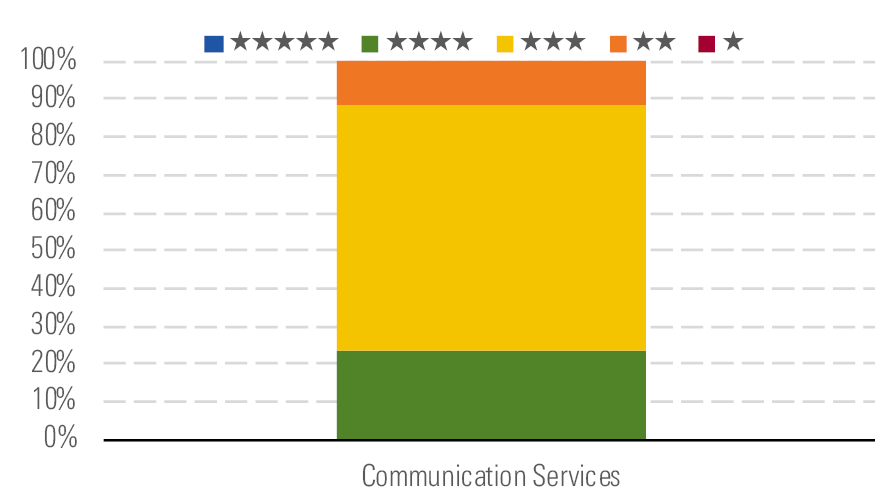

Most of the U.S. telecom sector is fairly valued or worse - source: Morningstar Analysts

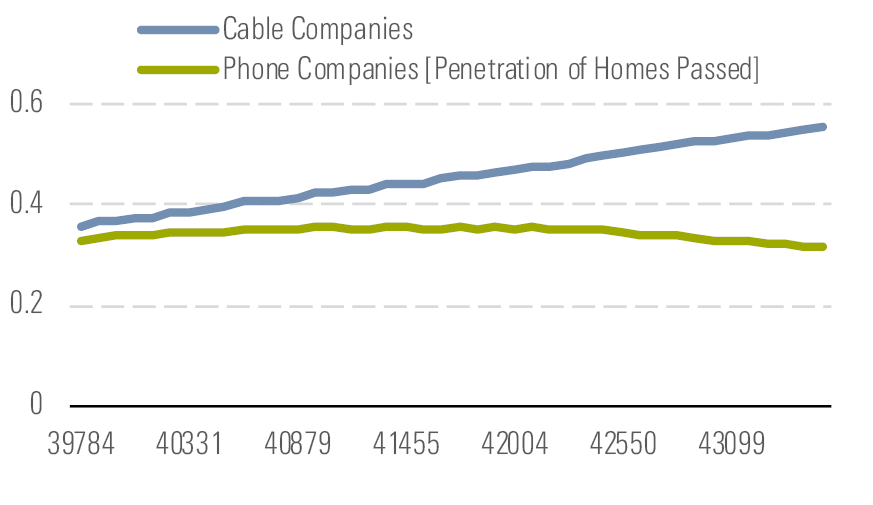

While traditional telecom has been lackluster, the rest of the sector has been on fire. Cable companies have continued to steal share in the Internet access market thanks to their superior network capabilities (Exhibit 3), offsetting fears of cord-cutting in the television business. Comcast has rebounded sharply from its own 2018 merger challenges, while more highly indebted firms like Charter and Altice USA have jumped 40% or more so far in 2019. Unfortunately for new investors, we believe cable stocks, in general, are fairly valued or worse, despite our expectation that these firms will continue to perform well.

Cable companies continue to gain internet access market share - source: Morningstar Analysts

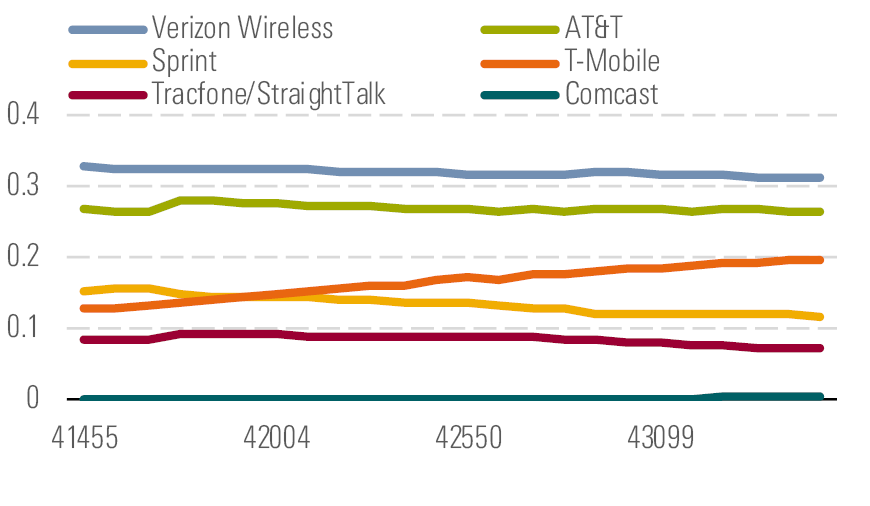

Sprint and T-Mobile shares have run after the Federal Communications Commission approved their planned merger. The Justice Department also appears set to bless the deal if the firms agree to sell off some of their wireless spectrum, among other assets. This prospect has buoyed shares of Dish Network, which has emerged as a potential bidder for these assets, possibly re-creating a fourth nationwide wireless carrier. While a deal like this could help Dish hold on to its spectrum licenses, we remain very skeptical of its ability to successfully enter a mature wireless market that would be dominated by three players (Exhibit 4). We don’t find any of these firms’ shares attractive.

AT&T, Verizon and a combined T-Mobile/Sprint would dominate wireless - source: Morningstar Analysts

The shares of telecom infrastructure firms like American Tower and Crown Castle have benefited from two factors: excitement around wireless networks, including a potential Dish buildout, and the decline in interest rates, which has made their stable cash flows and dividend potential more attractive. These stocks are now among the least attractive in the sector, in our view.

Top Picks AT&T T

Star Rating: 4 Stars

Economic Moat: Narrow

Fair Value Estimate: $37

Fair Value Uncertainty: Medium

We’ve long disliked AT&T’s capital-allocation decisions, but fears around its integration strategy and debt load have pushed the shares down to attractive levels, in our view. Also, given the size of the strategic moves AT&T has made recently and its emphasis on reducing leverage, we don’t expect another costly decision anytime soon. We believe that AT&T's wireless and media businesses remain well positioned competitively and will produce stable cash flow for years to come, enabling the firm to quickly repay debt. At current prices, AT&T shares offer a generous 6.3% dividend yield.

CenturyLink CTL

Star Rating: 4 Stars

Economic Moat: None

Fair Value Estimate: $18

Fair Value Uncertainty: Very High

While CenturyLink is well known as a residential phone company, three fourths of its revenue is derived from business customers. We expect revenue will decline in the coming years, especially in the consumer business, but we believe the market is overlooking the firm's substantial margin expansion opportunities as the business shifts to more modern technologies. At current levels, the stock is trading at about 4 times projected 2019 free cash flow and offers a dividend yield of 8.8%. We project free cash flow to remain steady over the next few years, which should allow the firm to avoid additional dividend cuts.

America Movil AMX

Star Rating: 4 Stars

Economic Moat: Narrow

Fair Value Estimate: $18

Fair Value Uncertainty: High

Mexican telecom carrier America Movil dominates its home market, with nearly 65% share in the wireless business, and holds a strong position across Latin America broadly. Movil serves 30% more wireless customers across the region than its closest rival, Telefonica, providing scale to ride out the inevitable political and economic bumps in the road. Adding stability, the firm has repaid debt in recent years, giving it a solid balance sheet. As consumers across Latin America continue to adopt wireless and fixed-line Internet and data services in the coming years, Movil should be a prime beneficiary.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)