No Shortcuts to Investment Success

It's hard to beat the market, but that's not necessary for investment success.

A version of this article was published in the November 2018 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

I am honored to serve you as the new editor of Morningstar ETFInvestor. For those who don't know me, I joined Morningstar after graduating from Washington University in St. Louis a little more than 10 years ago. After stints in sales and data, and earning my Master of Business Administration from the University of Chicago, I spent the past six years on Morningstar's manager research team, first as an analyst and later as the leader of the North American passive strategies research team. I have been a regular contributor to this newsletter over the years, and I am excited to take the helm.

Investment Philosophy My perspective is rooted in the fact that it's hard to beat the market. Everyone's looking for high-return, low-risk opportunities, and if they arise, offers to buy will almost certainly flood in, quickly pushing up prices and cutting future returns to a level commensurate with their risk.

As a result of this competitive pressure, market prices tend to do a good job of reflecting information that's available to the public. Sure, some investors have better information than others, but it's hard to keep an informational edge in a world where it is illegal for corporate managers to selectively disclose information to some investors and not others. Competition between well-informed investors makes it hard to profit from fundamental research.

In other words, I think the market is pretty efficient and that the cheapest broad market-cap-weighted index funds are a great starting point. Investors who stick to these funds will probably do better than most who hire active managers over the long term, as they are cheaper and more tax-efficient, harness the market's collective wisdom, and never miss out on the market's big winners (which tend to more than make up for its many losers).

While I have a healthy respect for the difficulty of beating the market, I think it can be done. The market is not perfect because people are not perfect. We are all susceptible to fear and greed, which can cause us to do dumb things with our investments, like selling out of a position after a crash when it is priced to offer high returns going forward or losing our valuation discipline when things feel less scary in the midst of a long bull market.

Investors are not perfectly rational. We often exhibit systematic biases that can create mispricing, such as extrapolating past results too far into the future, underreacting to new information, focusing too much on the short term, and rolling the dice on risky stocks in hopes of winning big.

Institutional frictions can also create mispricing. For example, many investment-grade-bond fund managers aren't allowed to hold bonds rated below BBB. This can trigger forced selling that can push prices below fair value when investment-grade bonds are downgraded to junk status.

Even when there is no mispricing, it is often possible to earn market-beating returns by taking on greater risk. That's what many investment-grade-bond fund managers have done in the past few years, taking greater credit risk than the Bloomberg Barclays U.S. Aggregate Bond Index to boost returns.

Qualitative judgment and rules-based models could both parlay these effects into market-beating performance, but I put my faith in the latter. Models are more consistent and less prone to cognitive biases. Qualitative judgment relies on intuition: knowing when certain rules apply and when they do not. But as Daniel Kahneman points out in his book Thinking, Fast and Slow, it is tough to develop reliable intuition in an environment that is tough to predict (like the stock market) because the quality of feedback is low. That makes it hard to learn whether the insights you glean are valid.

Of course, many models are flawed, too. There are only a handful of truly distinctive stock characteristics (or factors) that have historically been predictive of market-beating performance and that I think will continue to pay off. These include value, momentum, quality, small size, and low volatility. We have written much about these factor strategies in the past and will continue to do so.

Focus on What You Can Control Beating the market is great if you can do it, but it's not a requisite for investment success. It's actually pretty far down the list of things to worry about. Even the best investment strategies can go through lengthy stretches of underperformance, and there's usually not much you can do about it. It's far more important to focus on things you can control: fees, tax efficiency, diversification, the amount of risk in your portfolio, and your behavior.

Successful investing starts with risk management. Never take more risk than you are comfortable with--and don't trust your first instinct here. It's easy to think you're more risk-tolerant than you are when everything has been going up for a long time, only to regret it after the market turns. So, before you load up on stocks, think back to your behavior during the last market downturn. If you sold out of your stock positions only to rebuild them during the subsequent rally, it might be worth considering a more conservative portfolio. This can be accomplished by shifting assets to bonds from stocks or tilting toward more-defensive stocks and bonds.

Whatever risk-management strategy you adopt, it's important to stick with it. Without that anchor, it's tempting to take too little risk in bad times after prices have fallen and too much risk when times are good. That is easier said than done. Uncertainty is a constant. The best defense is to prepare for bad times before they come and diversify. This will make it easier to stay invested and enjoy the benefits of compounding.

These will be recurring themes in the newsletter.

What to Expect ETFInvestor will continue to provide thoughtful and relevant content designed to educate and help you make better investment decisions. And we will continue to organize the articles around themes, striving to strike a balance between investment theory and application. As with most Morningstar research, we take the long view and avoid making market calls, as that is very difficult to consistently get right (and the costs of being wrong can be substantial). That means we won't tell you to get out of long-term bonds when rates are going up. Instead, we might highlight the risk and point out some of the better options to mitigate it.

This long-term focus also means that the investment ideas we like won't change very often. While it's tempting to react to market news, it's rarely prudent to make big changes to a portfolio based on changes in market conditions. That's counterintuitive, and it's a view I didn't have six years ago. But the more I learn, the more convinced I become that the best course of action is often to do nothing. By the time you hear about what the Federal Reserve is doing, the impact of tariffs, or most other news bites, the horse has already gotten out of the barn--market prices probably already reflect that information. It's hard to improve performance by acting on information that everyone else already knows.

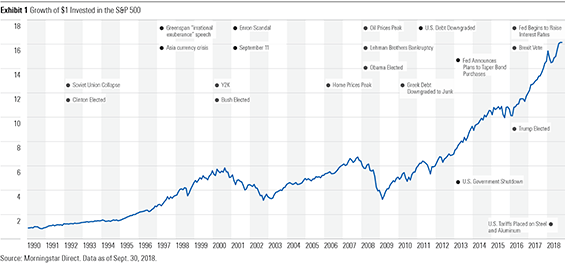

Take a look at Exhibit 1. Acting on those types of big headlines probably wouldn't have helped your long-term performance. The day's news rarely has an impact on long-term returns. The most important drivers of long-term returns are interest rates and the amount of compensation investors require to take risk. Prices reflect the market's best assessment of what the future holds, but of course, no one knows for sure. News is unpredictable. If things turn out better than expected, risky assets like stocks should outperform; if not, they will probably offer disappointing returns. Over the long term, positive and negative surprises tend to wash out, leaving diversified risk-takers with reasonable compensation for their courage.

This doesn't mean that tactical adjustments are off the table. Sometimes risk-taking, and risk-taking in specific areas of the market, is rewarded. Valuations matter. But if you do make tactical adjustments, it's best to be systematic about it, focusing on things that matter, like valuations and momentum. To make it easier to do so, we've added market data snapshots with key valuation and performance data.

As Ben Johnson mentioned in the October issue of ETFInvestor, there are other exciting changes in store, including the introduction of four model portfolios and an overhauled ETF Watchlist, with Morningstar's full universe of rated exchange-traded funds. These changes are part of our commitment to make the newsletter more useful, with clear recommendations and actionable investment ideas.

Click here to subscribe.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)