Quit Chasing Unicorns: Consistent Fund Performance Is Overrated

Persistence studies suggest you need to outperform like clockwork to be elite. Balderdash!

Every six months, S&P Dow Jones puts out a "persistence scorecard" that measures the consistency of active funds. The study works more or less as follows: It tallies the number of funds that outperform in one period and then tracks those outperformers over subsequent periods to see how many were able to repeat that feat. What S&P finds is that nearly every active fund flunks this simple test. Not surprisingly, it uses that finding as ammo to argue against active funds in favor of indexing.

I don't quarrel too much with that conclusion (like S&P, I think most investors are better off going passive), but it has nothing to do with "persistence," which is a red herring for a couple of reasons:

1) The most successful active funds over the long term weren't persistent.

2) Most index funds also fail persistence tests.

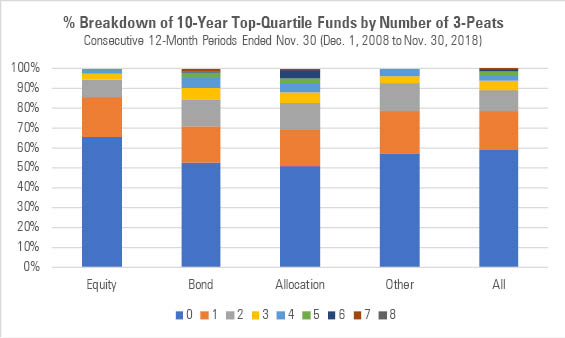

Good Isn't Always Good Let's start with the most successful active funds, those that landed in the top quartile of their peer group over the 10 years ended Nov, 30, 2018. There were 1,188 of these elite funds. Of those, how many landed in their Morningstar Category's top quartile three years in a row at some point during that 10-year period, and how many times did they pull off that "three-peat"?

Source: Morningstar. We measure performance using the nonoverlapping 12-month periods ended Nov. 30 of each calendar year; thus, there are eight possible three-peats during the 10-year period.

All told, 702 of these top-quartile funds didn't three-peat even once during the 10-year period ended Nov. 30, 2018. Of the 486 funds that managed to three-peat, 229 did so exactly once. Just 73 of these 1,188 long-term outperformers three-peated four or more times.

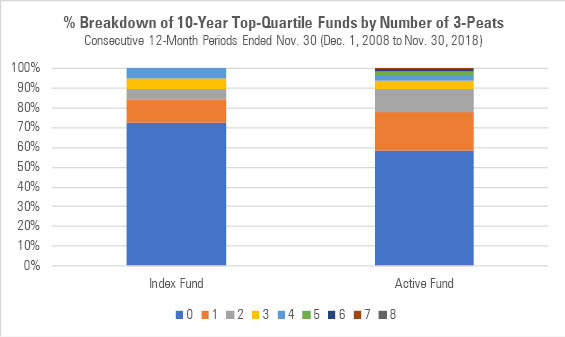

Did that picture change any when we broke down outperforming funds between active and passive? No, it didn't. In fact, index funds were even less likely to three-peat than active funds over the 10-year period we examined--just 16 of the 58 top-quartile index funds did so even once, whereas 470 of the 1,130 active funds three-peated once or more.

Source: Morningstar.

It's not like these funds were strangers to success during the 10 one-year periods that constituted the decade ended Nov. 30, 2018. In fact, the average outperformer had nearly five top-quartile years over this span. It's just that they didn't usually put up three standout showings in a row.

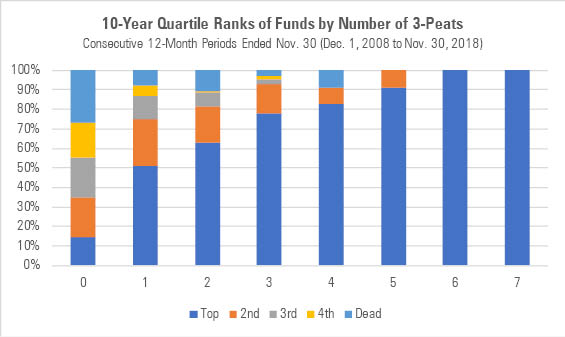

Consistency: Overrated Now let's peer through the other end of the looking glass, examining the long-term performance of funds that three-peated at least once versus those that never did so.

As one would expect, funds that three-peated--that is, those that landed in the top quartile of their peer group in three consecutive 12-month periods ended Nov. 30--were much more likely to survive and outperform over the 10 years ended Nov. 30, 2018, than funds that didn't.

Source: Morningstar.

About 60% of funds that three-peated at least once landed in their category's top-quartile over the full 10-year period while only 8% of those funds died before reaching the end of that 10-year span. Contrast that with funds which didn't three-peat--only 15% of those funds landed in the top-quartile over the full 10-year period and more than a fourth died.

So, should we favor three-peating funds to maximize our odds of succeeding over the long haul? No, bad idea, for you need to be able to predict which funds will three-peat in advance, something that's exceedingly difficult to do given how few funds three-peat. Indeed, only 14% of the funds we examined three-peated even once. What this means is that you'd have had a better chance of choosing a top-quartile 10-year performer at random, as 21% of all funds that began the 10-year period survived to the end and landed in their category's top-quartile.

Putting those odds aside, are index funds likelier to three-peat than active funds? No. We found that only 11% of index funds three-peated at least once versus 15% of active funds. What's more, only about 48% of three-peating index funds went on survive the full 10-year period and land in their category's top quartile by the end, versus 61% of active funds.

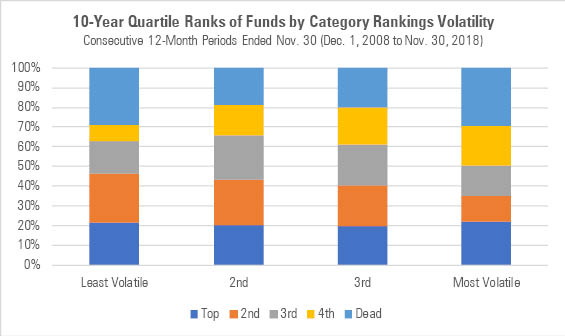

What if instead of emphasizing consecutive top-quartile showings--that is, persistence--we broadened to consider the consistency of funds' rankings in general? Are more-consistent performers--whether they be consistently good, bad, or mediocre--likelier to outperform in the end?

To examine this, we ranked funds based on the standard deviation of their annual peer-group rankings, "least volatile" being the funds whose rankings varied the least and "most volatile" those whose rankings swung the most. Then we tracked the 10-year performance of the funds in those volatility quartiles.

Source: Morningstar.

What we found is that funds in the least-volatile cohort--that is, those whose rankings see-sawed the least--were a bit likelier to outperform their average peer than other funds. But the steadiest funds landed in the top quartile after 10 years about as often as funds whose rankings swung around more.

Conclusion Studies like the S&P Persistence Scorecard put consistent performance on a pedestal. It doesn't belong there. Even the most durably successful funds have bouts of underperformance and thus flunk tests like these. What's more, inconsistency isn't an active-fund problem, per se. If anything, index funds are just as prone to inconsistency, if not more so. There are a number of reasons to index--wide diversification and low fees among them--but consistency isn't one of them.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)