Households Save More With 529s

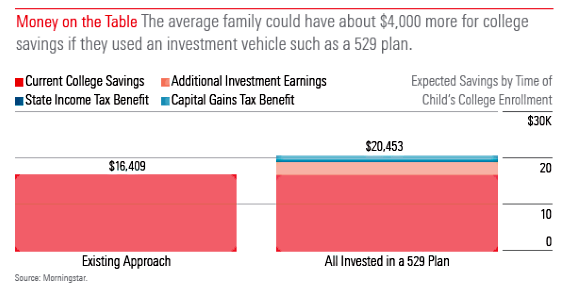

Parents without a plan leave money on the table.

The largest source of money U.S. families use to pay for college, after scholarships and grants, is loans. The challenge for many parents is simple: How can we borrow less and still pay for college?

In a recent Morningstar report, Michael Leung and I analyzed one such tool to help families afford college: the 529 college savings plan. The report, released in tandem with our 2018 ratings of 529 plans (and available on Morningstar.com), examined whom 529 plans would benefit, and why. Unlike most studies that examine hypothetical families, this report analyzed the finances of actual U.S. households, using two nationally representative surveys: the Federal Reserve Bank’s “Survey of Consumer Finances” and the Sallie Mae/Ipsos survey, “How America Saves for College.”

What We Did For each household with children under age 18, we simulated two scenarios. First, we forecast the total education savings each family would have by the time their children turned 18. In this simulation, families continued to save at the same rate and use the same savings or investment vehicles as they had thus far. In the second scenario, we examined what would happen if families had used 529s exclusively for their college savings from the day each child was born until the child turned 18. Those savings would be invested along a standard glide path that decreased stock exposure as the child approached college age.

In addition to that analysis, we conducted a novel experiment: If 529s are beneficial, how could policymakers and advisors increase their usage? We tested three ways of presenting information about 529s to a panel of U.S. parents with children under 18 (using the Prolific.ac online research platform) to determine if any of them could change people’s planned 529 contributions in 2019.

The Potential Boon of 529s In the first analysis, we estimated that, by the time their children are ready for college, U.S. households would collectively have $237 billion more in assets if they had used 529 plans. For the average family, this means $4,044 more per child without saving an additional penny. To look at this from another angle, families could save 25% less and still have the same amount available for college if they were exclusively to use 529s.

What drives this effect? It’s not the tax incentives that 529s are known for. The largest single benefit of 529 plans comes from moving existing savings into an investment account—and earning higher returns in exchange for additional risk. To be clear, that is not a benefit that occurs solely with 529s; it’s one that all investment accounts share. But many families use savings and checking accounts instead of investment accounts to hold their college savings, and 529s provide a simple way to invest those funds instead. The state and capital gains tax advantages of 529s do help, but have a smaller impact.

The $237 billion in additional wealth comes from three sources:

1. Unused state tax benefits: $26 billion.

2. Unused capital gains tax benefits: $50 billion.

3. The (post-tax) benefit of investing college savings: $161 billion.

And our experiment to increase usage? We found that two of our three presentations substantially increased 529 contributions—by more than 10%—relative to our randomly assigned control group: a table summarizing the benefits and drawbacks of 529s, which we designed to overcome the problem of information overload, and a graph comparing the financial benefits of 529s quantitatively against other account types, which we designed to overcome the challenge of calculating complex costs and benefits. Our presentation using an infographic—which educated participants on how to sign up and sought to make the process less daunting— didn’t significantly increase contributions.

Lessons to Learn What can policymakers and industry professionals, especially financial advisors, draw from this study? Four lessons:

1. An opportunity is waiting to be realized. A significant amount of money is being left on the table. Without saving an additional penny, parents collectively could have $237 billion more in savings by using better investment vehicles for their savings, including 529s.

2. Investing matters more than byzantine state rules. Despite considerable discussion in the field about the annoyances and complexities of variations in state deductions, this is not the most important aspect of 529s. Investing and capital gains incentives are. State rules can be a distraction for families and for the industry.

3. Personalized advice is essential. The aggregate story is not the same as the individual story. The right choice for a particular family depends on their specific financial circumstances and preferences—especially about whether the rewards of investing one’s college savings are worth the risk.

4. We can help families evaluate these choices. The 529 system is complex and clearly daunting to many families. Industry leaders and policymakers have two options. One is to make the system fundamentally less complex by federalizing it or standardizing rules across states. Our experiment offers hints of another, far easier and cheaper option: Learn how to present information about 529s more effectively.

Increased usage of 529s offers tremendous promise to American families. More work is needed to realize that promise, however. In our next post, we'll take a closer at how to help investors better understand 529s.

Note To learn more about the study, and the implications for financial professionals and policymakers, see www.morningstar.com/lp/529-left-on-the-table.

This paper is part of the Morningstar Investor Success Project. Learn more about the project and read our latest insights at www.morningstar.com/company/investor-success.

This article originally appeared in the December/January 2019 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)