Flowmageddon: Why Investors Should Watch Fund Flows

With money still flowing out of mutual funds, Morningstar's Russ Kinnel sees both pluses and warning signs for shareholders.

This article was published in the November issue of Morningstar FundInvestor.

There’s a little of that Roaring ‘20s feeling to the fund industry these days.

A nine-year bull market has made fund companies tremendously profitable. You’ve heard about the move from active to passive funds, but today there is $11.7 trillion in actively managed funds. That’s huge increase from the first quarter of 2009. Obviously, appreciation has more than made up for outflows.

Yet, beneath the surface there are signs that the industry faces tremendous challenges, and that will likely affect funds you own in the coming years.

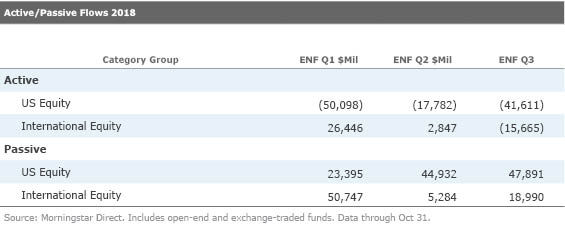

Today, 66% of actively managed U.S. equity funds are in outflows over the trailing 12 months ended in September. That’s remarkable considering the tremendous bull market. Across all asset classes, about $410 billion left actively managed funds from the start of 2015 through September 2018. However, that has been overcome by strong returns. The S&P 500 has gained 50% over that same time period and has nearly tripled since the start of 2009.

So far, then, flows aren’t much of a problem. But the industry is very vulnerable to a bear market. If the market falls 30% and outflows accelerate to 25%, then you are looking at a tremendous decline.

Another troubling sign for active funds: Until recently, the move to passive had been contained within domestic equity. However, in the third quarter, passive international equity funds saw $19 billion in net inflows and active international equity funds suffered $15 billion in net outflows. Passive funds from Vanguard and Fidelity (which launched zero-fee index funds) are big draws of late, while

Of course, you and I own funds, not fund companies, so their profitability only matters when it affects the funds. I think outflows will have both positive and negative effects. Either way, flows will increasingly have an impact on funds. Let’s start with the good stuff.

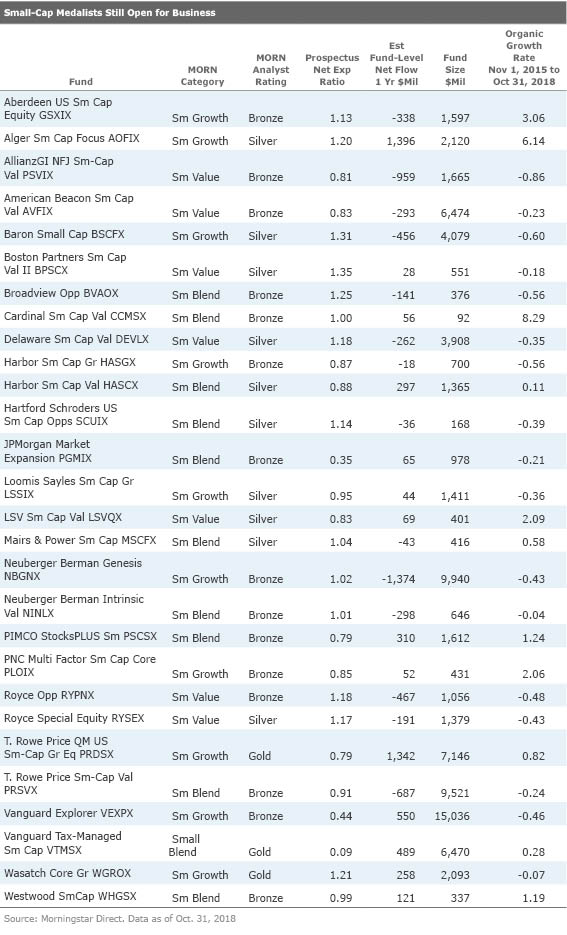

Good Small-Cap Funds Remain Open Normally at this stage of a bull market, nearly all the good actively managed small-cap funds would be closed in order to keep asset size from harming a manager's ability to execute his strategy. Yes, some good ones are closed, but 19 small-cap, actively managed Morningstar Medalists are open.

For example, two small-cap funds with Morningstar Analyst Ratings of Gold,

There are also eight Silver-rated small-cap funds still open to new investors in the Morningstar 500, including

Your Bloated Large-Cap Fund Is Getting Less Bloated The ideal scenario for active behemoths is to have a steady trickle of outflows. Nothing too dramatic, mind you, but a modest bit of shrinkage is good because it means the managers need fewer new ideas to add to the portfolio, can have greater weightings in top names, and can move down modestly in market cap.

The 20 largest actively managed funds across all asset classes cumulatively have shed about 20% of assets under management over the past three years. If investors want to give more wiggle room to managers of some giant funds at American, Fidelity, and Vanguard, then I’m all for it.

And no, that doesn’t mean the funds charge more. Of those 20 largest funds, only one is charging more today than three years ago:

Index Funds Will Be Better Off Naturally, all those inflows mean index funds will keep getting cheaper, though there is not much room for the cheapest to cut. Alarmists have said that if too much money is in index funds, the funds will be harmed by the lack of price discovery and returns will lag. I'm not buying it. First, most money is still in active funds. Second, a lot of the money in index funds today would have been in very low-turnover pension funds 25 years ago. Is the effect really different? No.

Now the Bad Stuff The coming shrinkage in active assets will bring consolidation. As I write this, Oppenheimer has agreed to be bought by Invesco. Fund company mergers are a mixed bag: They can lead to lower fees, and sometimes funds are moved from weaker to better teams as the new firm chooses who survives the merger. However, they also can lead to manager departures (Oppenheimer lost a manager to Artisan just as the news was coming out) and cost-cutting that hurts performance. In addition, mergers require more work from fundholders, who have to keep a sharp eye on their funds to make sure that manager or strategy changes haven't been quietly implemented months after the company-level merger.

Fees May Rise Of course, economies of scale work in reverse, too. Outflows can lead to higher expense ratios. However, the move to passive has meant many active firms have gotten religion on fees. Fidelity and BlackRock, for example, have been cutting fees.

Reviewing funds with three-year organic growth rates of worse than negative 50%, I found five that had significant increases in expense ratios over the past three years. For example,

Redemptions Can Hurt Performance

As I mentioned, a trickle out of

Domestically, I can see a few funds where redemptions must be challenging.

Bronze-rated

Perritt MicroCap Opportunities PRCGX plies less-liquid names, so I do have some concerns about outflows, even though they are a modest $51 million on a $163 million asset base. For example, its top holding is Northern Technologies International NTIC. It holds 204,165 shares, but the stock typically trades about 7,000 shares a day. In fact, it looks like the fund didn’t trade the stock at all in the second quarter. In addition, this fund is reaching the point where it might not be profitable to run. The industry rule of thumb is about $100 million, and funds at that level or lower are much more likely to be merged out of existence.

Silver-rated

Threat to Firms Many firms are prosperous now, but we've already seen a few firms either shut down entirely or give up on the mutual fund side of their business. In a bear market, I would expect many more of these cases as well as more mergers.

The Upshot Clearly, flows are something investors should watch, and they will become much more of an issue in a down market. If you want to make a contrarian bet on a fund that has been out of favor for a while, be sure that the fund will be around for the rebound.

You can do that by choosing a giant fund company, or you can bet on a smaller one, but be sure to watch for layoffs and outflows. Of course, Morningstar analysts will be doing those things, too, and we’ll downgrade a fund if we think layoffs or outflows have impaired a fund’s ability to add value.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)