Five Upgrades and Downgrades to Kick Off Fall

In addition to rating changes, 88 ratings were affirmed and 10 new ratings debuted.

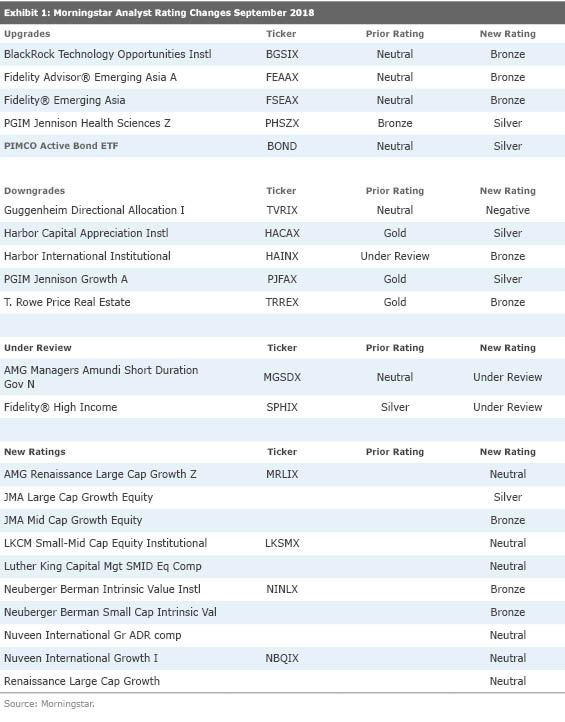

In September, Morningstar manager research analysts affirmed the Morningstar Analyst Ratings of 88 strategies, upgraded the ratings of five strategies, downgraded the ratings of five strategies, placed two strategies’ ratings under review, and assigned new ratings to 10 strategies. Below are some of September’s highlights, followed by the full list of ratings changes.

Upgrades

The ratings of

The rating for

Downgrades

The rating for

New Ratings

/s3.amazonaws.com/arc-authors/morningstar/08cbdaf4-9b79-4c95-ba7d-22ade66dc6fc.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08cbdaf4-9b79-4c95-ba7d-22ade66dc6fc.jpg)