6 Questions to Ask Before Buying a Strategic-Beta Bond Fund

Alex Bryan offers a framework for evaluating strategic-beta bond funds.

Traditional broad, market-cap-weighted bond index funds have a lot going for them. They harness the market’s collective wisdom, charge low fees, tend to have low transaction costs, and don’t face key-person risk. But the idea of assigning larger weightings to larger debtors isn’t intuitively appealing. In some cases, this approach, together with differences in how the opportunity set is defined, has made these bond indexes a low hurdle for active managers. For example, this market-cap weighting gives broad investment-grade bond benchmarks heavy exposure to low-yielding Treasuries and agency debt.

Strategic-beta fixed-income funds are index-based strategies that attempt to combine the best of active and passive. Most of these attempt to deliver better performance than traditional bond indexes in a more cost-efficient, transparent, and systematic manner than actively managed alternatives. But they face some challenges. Limited data availability has led to slower product development and adoption of strategic-beta bond funds than among stock funds. And it isn’t always clear that strategic-beta funds offer differentiated exposure. Credit- and interest-rate risk are the biggest drivers of bond returns, and many of these funds just repackage these risks, which may be available more cheaply through traditional cap-weighted index funds.

Morningstar recently published a report outlining the landscape of strategic-beta bond funds and a framework for evaluating their approaches to portfolio construction. The framework consists of the following questions, which investors should ask before buying any strategic-beta bond fund.

What is the fund's investment universe? The starting universe is the opportunity set from which the fund builds its portfolio. This provides a rough idea of a strategy's riskiness and potential role in a portfolio. It can also be a useful performance benchmark for the fund.

What factors does the fund target? While credit- and interest-rate risk are the most important drivers of bond returns, most strategic-beta funds don't explicitly target high-risk bonds to dial up returns. Instead, the two most common approaches are to target bonds that are cheap and/or high quality. Both approaches have sound economic rationales, but they tend to pull in opposite directions on the credit-risk spectrum, so many funds use them together.

What metrics does the fund use to select its holdings? There are trade-offs with any selection metric. While one set of metrics isn't necessarily better than another, it is important to understand those trade-offs. For example, a fund can use accounting data, like changes in profit margins and leverage, to assess quality, or it could accomplish that task with market data, like credit spreads. Accounting data isolates particular dimensions of quality that might be predictive of default risk, but it is also backward-looking and could be stale. In contrast, market data is forward-looking and quicker to detect changing fundamentals. However, the market doesn't always get things right, and in some cases this approach can limit the section universe, particularly for funds that rely on equity market data.

Regardless of the metrics the fund uses, they should be:

- Simple

- Transparent

- Clearly representative of the targeted investment style

How aggressively does the fund pursue its targeted factors? Funds that pursue their factor tilts more aggressively have greater active risk: more room to both outperform and underperform. Funds can strengthen their factor tilts by setting more demanding thresholds for inclusion and incorporating factor characteristics into their weighting approach. However, departing from market-value weighting can increase transaction costs and make the fund's index more difficult to track because most alternative weighting approaches overweight smaller and more thinly traded issues.

Tracking error relative to the fund’s starting universe or category benchmark is a good way to gauge how much active risk a fund takes. This metric shows how much the fund’s performance deviated from that of its opportunity set, due to its active bets. Strategic-beta funds that focus on investment-grade debt tend to have lower active tracking error than those that focus on high-yield bonds.

What portfolio constraints are in place, if any? While they tend to moderate the strength of a fund's factor tilts, constraints on a portfolio are usually prudent because they often limit risk and improve diversification. Without them, a fund may be susceptible to unintended bets and poorly compensated risks. Constraints can prevent a value strategy from becoming too aggressive, or a quality fund from being overly conservative. The most common constraints include limits on:

- Turnover

- Tracking error to the starting universe

- Duration

- Credit risk

- Sector exposure

- Issuer weightings

How much credit- and interest-rate risk does the fund take? There's a good chance that funds that regularly deliver market-beating returns are taking greater risk than the market. While credit- and interest-rate risk tend to pay off over the long term, they don't always. And it's important to keep in mind that credit risk is positively correlated with equity risk, so funds that take greater credit risk may be less effective at diversifying equity risk.

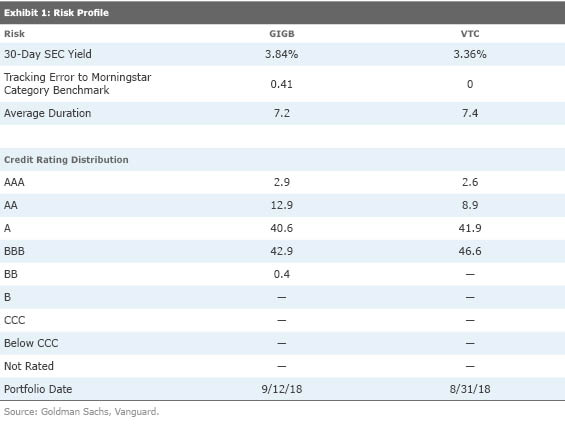

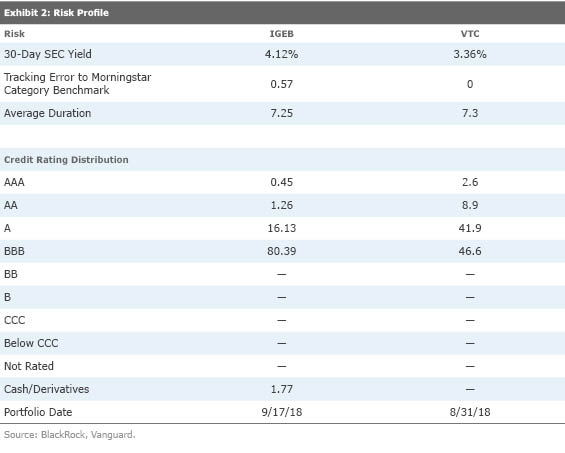

To gauge duration and credit risk, it’s useful to compare the average duration of the fund’s holdings, as well as the distribution of their credit ratings, to a benchmark that can serve as a proxy for its starting universe.

Yield is also a good proxy for risk. This could be a fund’s SEC yield or the average option-adjusted spread of its holdings. If a bond is offering a high yield, it’s almost always indicative of some sort of risk (credit, duration, liquidity, or something else). Usually, the fund’s benchmark-relative yield will align with its relative credit- or interest-rate risk. If it does not, it’s necessary to do more digging.

A returns-based factor regression analysis can help paint a more complete picture of a fund’s credit- and interest-rate risk and whether it outperforms after controlling for those risks. This approach requires at least three years of monthly return data for the fund, or the index it tracks (preferably five). The model we use attempts to explain the fund’s excess returns (returns over the risk-free rate) as a function of its exposure to credit, duration, and residual market risk. Further details are available in the full paper linked above.

A couple of examples will help illustrate how this framework works in practice.

Goldman Sachs Access Investment Grade Corporate Bond ETF GIGB This fund doesn't swing for the fences. It owns most of the corporate bonds from the starting universe and weights them by market value, so it should perform similarly to the broad U.S. corporate bond market most of the time. However, it attempts to slightly reduce risk by avoiding the lowest-quality corporate bond issuers (the lowest-ranking 10% in each sector). This defensive posture may cause the fund to sacrifice a little return when credit risk pays off. Overall, it isn't clear that there is a material benefit to this approach.

Starting universe: FTSE Goldman Sachs Investment Grade Corporate Bond Index (this is a broad U.S. dollar investment-grade bond benchmark)

Targeted factor(s): Quality

Selection metrics: Year-over-year change in profit (EBIT) margin and debt/enterprise value

Strength of factor pursuit (low, medium, high): Low

Constraints: None

Credit and duration risk: We would expect this quality-oriented fund to have slightly less credit risk than Vanguard Total Corporate Bond ETF VTC, which tracks the broad Bloomberg Barclays US Corporate Bond Index. Consistent with this expectation, it has slightly lower exposure to BBB-rated bonds, and slightly greater exposure to AA-rated bonds. However, the regression analysis suggests that the index the fund tracks has tended to exhibit slightly higher exposure to credit risk. And while the average duration of the fund's holdings is currently comparable to VTC's, the regression suggests that the strategy has historically carried slightly greater interest-rate risk.

Because the fund offers a higher yield than VTC, it is likely that it is taking on a bit more risk, even if that isn't apparent from the credit ratings distribution and duration of its holdings. This could be due to differences in their starting universes.

IShares Edge Investment Grade Enhanced Bond ETF IGEB This investment-grade corporate bond fund effectively combines quality and value, which gives it a good chance to beat its category benchmark. Within each credit rating bucket lower than AAA, the fund filters out the issuers that BlackRock estimates have the highest probability of default (removing 20% of BBB-rated issuers, and 10% of A- and AA-rated issuers). It then uses an optimizer to maximize the portfolio's default-adjusted spread score, subject to several constraints designed to limit risk relative to the starting universe. This dual focus on quality and value should allow the fund to boost returns while keeping risk in check.

Selection universe: Liquidity-screened investment-grade bonds denominated in U.S. dollars with at least one year to maturity

Targeted factor(s): Quality and Value

Selection metrics: Probability of default (relative to credit rating group), Default-Adjusted Spread [OAS - (probability of default x recovery rate)]

Strength of factor pursuit (low, medium, high): Low/Medium

Constraints:

- One-way turnover is limited to 6%

- Duration times spread is limited to 95%-105% of the starting universe

- Issuer weightings are constrained to between 100 basis points underweight and 50 basis points overweight relative to the starting universe

- Duration is limited to 100%-110% of the starting universe

Credit and duration risk: The fund takes greater credit risk than VTC, as its pursuit of yield appears to have a stronger influence on the composition of the portfolio than its quality screen. However, it doesn't dip into high-yield territory. The regression analysis reveals that the fund's index has tended to be a little more sensitive to interest-rate risk than the index the Vanguard fund tracks, though they currently have a similar average duration.

Look Under the Hood There are no free lunches in the bond world--funds that consistently deliver market-beating returns almost certainly take greater risk. Risk is not necessarily bad. What's important is that the fund is deliberate about the types of risks it takes, that it delivers its intended exposures in a cost-efficient manner, and that its approach to portfolio construction is grounded in sound economic rationale.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)