Closer Look at Hess' Guyana Stake Raises Our FVE

But while the expanded development plan is accretive to our net asset value, we still see little upside remaining.

We’ve been mostly bearish on

Guyana Will Drive Massive Growth for Hess There's little doubt that Hess' entry into Guyana will be transformative. The company holds a 30% stake in the Exxon-operated Stabroek Block, which encompasses 6.6 million acres. The first discovery, Liza, was announced in 2015 and is located about 120 miles offshore. In total, 13 exploration and appraisal wells have now been drilled (including two dry holes). Based on the results, the partnership has identified at least five potential development opportunities, with combined recoverable resources exceeding 4 billion barrels of oil, making Hess' share equivalent to almost 4 times its current proved reserves.

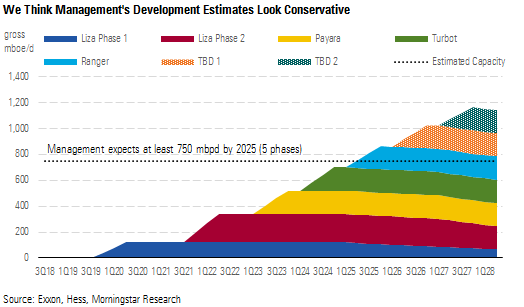

Hess recently outlined the current development plan, which calls for five phases based on the discoveries announced thus far. This will begin with Liza Phase 1, which was sanctioned in 2017 and is due online in late 2019. The project is based around a floating, production, storage, and offloading vessel, or FPSO, with a capacity of 120 mb/d. The four subsequent phases will be brought on line in a staggered fashion, bringing the project’s gross capacity to a level that management conservatively pegs at 750 mb/d by 2025 (225 mb/d net to Hess, which will by then represent 40% of the company’s total output).

However, a closer examination of the discoveries announced thus far reveals the potential for even further growth. The partnership has already revealed that the first three phases (Liza Phase 1, Liza Phase 2, and Payara) are slated for a combined gross capacity of 520 mb/d in the latest development plan. That implies an average capacity of just 90 mb/d for phases 4 and 5, which would be at least 25% smaller than any of the first three phases. But the most likely targets--Turbot, which also includes the Longtail discovery, and Ranger--appear to be large discoveries as well.

Thickness is admittedly a very rough indicator, but both contain oil columns of more than 200 feet. Hess management has already announced that the Turbot area contains at least 500 mmb of recoverable oil, putting it on equal footing with Payara (which will probably be developed with a 180 mb/d FPSO). Further, as the block is thought to contain at least 4 million recoverable barrels based on the discoveries to date, Ranger and Snoek must together account for resources of 1,850 million barrels. The latter has the thinnest column, at only 82 feet, and is less frequently mentioned in partnership commentary. In contrast, Ranger’s proven thickness is second only to Liza and further appraisal drilling is planned. We therefore assign the lion’s share of the remaining resources to Ranger.

The scale of these discoveries suggests that two relatively small FPSOs will be insufficient for full development. The capacity of phases 4 and 5 will probably exceed what’s implied by management’s 750 mb/d estimate for total gross output, and subsequent phases are likely, especially if further exploration delivers new discoveries--the Hammerhead prospect is on deck, with results expected later this year. We expect gross volumes to reach 860 mb/d by the end of 2025, and our peak output forecast is close to 1.2 mmb/d.

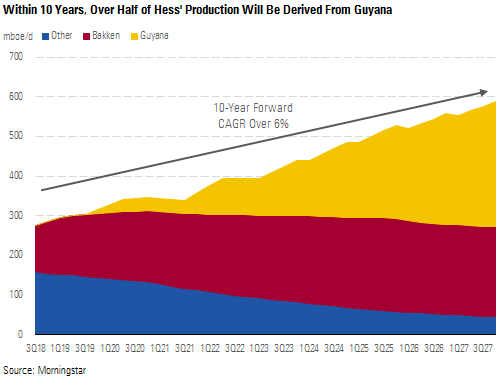

For Hess, the impact of a project on this scale is very substantial. We anticipate that the asset will account for more than half of the company’s production within 10 years, driving volumes up with a 6% 10-year forward compound annual growth rate (to a net peak of about 570 mboe/d in late 2026, which is more than double the company’s current output).

Valuation Implications In our updated sum-of-the-parts valuation, the asset's full potential is reflected in our unrisked case, which is consistent with a valuation of $71 per Hess share. This assumes the combined output of the first five phases reaches 860 mb/d by the end of 2025 (exceeding management's guidance for 750 mb/d, which we consider conservative, given the likely scale of the Turbot and Ranger discoveries). In addition, we give full credit for two further development phases, which could both reflect a second phase for Payara, Turbot, or Ranger. Alternatively, as the exploration program in the Stabroek Block remains in full swing, these to-be-determined phases could alternately be related to a future discovery that has yet to be announced (such as Hammerhead, if the upcoming exploration test proves successful).

However, exploration is inherently risky, even in a region with a strong record of discoveries. And as we noted, thickness is an extremely rough proxy for resource volumes. Thus, our logic that the capacities of Turbot and Ranger should exceed what’s implied by management’s 750 mb/d estimate could be flawed. The partnership has a clear information advantage, given that it has access to vast array of geological and geophysical data, and it may be lowballing these estimates for a reason. In addition, while most of the discovery wells encountered sandstone, the Turbot reservoir is a carbonate (limestone). This is typically tighter, with less permeability, and may perform differently when developed. We have thus incorporated risk factors into our current fair value estimate of $65 per Hess share (pegging Ranger at 75% of its net asset value and each TBD prospect at 50% of respective NAVs).

Favorable Mix Shift Boosts Pretax Profitability... As the Guyana wedge of Hess' output grows, we expect companywide profitability to improve on a pretax basis. The vast majority of production from the Stabroek Block will be oil; very little associated natural gas is anticipated, and much of the latter will be reinjected into the reservoir to act as a catalyst for oil extraction. Realized prices in Guyana will be based on the international Brent benchmark, reducing Hess' overall exposure to U.S. pricing (the West Texas Intermediate benchmark is currently discounted fairly heavily and should remain at least $5/bbl below Brent in the long run). Thus, we expect companywide unit revenue for Hess to strengthen over the next 10 years.

Unit operating expenses should decline over the same period. Production is likely to grow at a faster clip than overhead while the Stabroek assets are being developed, depressing unit general and administrative expense. Unit lifting costs, which reflect the direct cost of production, are also expected to be lower. We model $8.50/bbl, which is significantly lower than the company reports in other regions (bringing the weighted average lower as Guyana ramps). Finding and development costs, a proxy for unit capital, are impressively low in Guyana as well. Based on Liza Phase 1, which has resources of 450 mmb and a total budget of $3.2 billion, we expect this metric to average about $7/bbl. But as Hess’ corporate F&D was already close to that level in 2017, aided by a positive revision to reserves, there is little scope for improvement on that measure.

The pretax unit margin is the remainder after these costs have been subtracted from revenue, and the net effect is a widening of more than $10/bbl in the next 10 years (assuming three years of strip prices followed by $60/bbl Brent).

...But Fully Loaded Guyana Economics Still No Match for Shale The 2015 Liza discovery is by far the most significant find in Guyana's history and has the potential to jump-start the country's fledgling oil industry (it has very little current production). To entice rapid development by the Exxon-Hess partnership, and to encourage further exploration in a region where further large discoveries are now considered likely, the government has offered relatively generous fiscal terms: a 2% royalty and a 50% profit share after cost recovery, which may not exceed 75% of revenue but can be carried forward.

This, combined with the relatively low cost of development ($7 per recoverable barrel), has convinced many that the Stabroek Block will be exceptionally lucrative for Hess. We disagree. When Liza Phase 1 is compared with a Bakken development of equivalent scale, it is the latter that delivers the stronger cash flows, when all royalties and taxes are included. Therefore, investors should not expect a step change in Hess’ corporate profitability after taxes when Guyana volumes become significant.

In addition, while the operator believes that Liza Phase 2 costs will be even lower than Phase 1, the timing of these discoveries was particularly serendipitous. Coming out of a major downturn in global crude prices, demand for offshore development services and equipment is still at a cyclical trough (even though onshore capacity utilization has already ticked up). To be sure, later development phases can be executed even more efficiently, as each FPSO won’t need designing from the ground up. But the specter of cost inflation is likely to offset the benefit and could even drive up net unit costs.

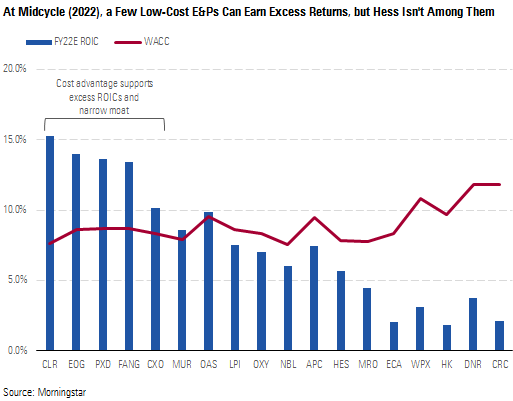

Hess Still Has No Moat, Despite Guyana Contribution Hess has been criticized in the past for poor capital efficiency. This came to a head in 2013 with a heated proxy fight. To management's credit, the subsequent turnaround plan was executed with discipline. Any signs of improvement were obscured by the 2015 collapse in global crude prices, however, which obliterated the entire oil sector. The outlook has since brightened for many peer companies, but Hess is still unable to earn its cost of capital, a key indicator of moat potential in our framework.

That’s counterintuitive, because although the Bakken has the edge on overall profitability, Guyana oil is still a low-cost resource and probably sits low enough on the global cost curve to be considered "moaty" in a vacuum. But Hess is still being held back by its past profligacy. The company recognized $1.8 billion of impairments for 2010-13, and in 2015-17 it wrote off another $5.9 billion. These amounts sum to a third of the company’s current enterprise value. Including them in the capital base drastically reduces the company’s projected returns on invested capital. Economic profits are unlikely before 2024.

Hess’ ability to generate excess returns is improving over time. That would normally suggest an underlying improvement in its competitive positioning and point to a positive moat trend. The justification for our stable moat trend rating is largely semantic: Hess’ profitability is improving because more lucrative assets (Guyana and the Bakken) are displacing less profitable legacy volumes (derived from the Gulf of Mexico, Southeast Asia, and Libya) in its production mix. But all of these assets are static on the cost curve, which is what the trend rating is getting at. The company’s moatiness is set to increase eventually, but not quickly enough for a narrow moat rating, and not due to a change in the competitiveness of any of its assets (which precludes a positive trend).

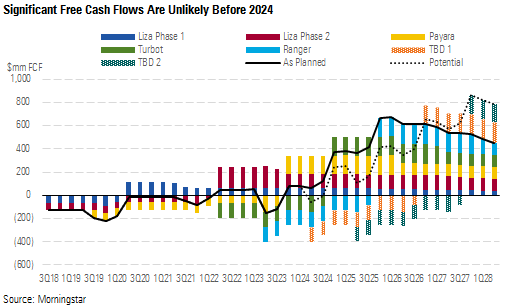

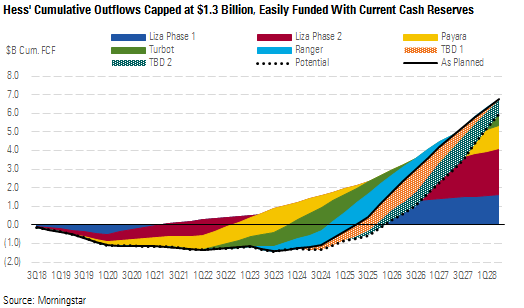

Long-Term Game Changer but Short-Term Money Pit There's another reason Guyana isn't driving up Hess' corporate returns before 2024: It isn't generating material free cash flows until then. Liza Phase 1 is on track for first production in late 2019 and will be a source of cash shortly thereafter. But the partnership is already close to sanctioning Liza Phase 2, and Hess has said that Payara will follow with a delay of only 12-18 months, which implies greenlighting in late 2019. The development spending associated with these follow-ups will soak up most of the cash flows from Liza Phase 1. This assembly line process will continue with Turbot and Ranger, keeping Guyana free cash flows near zero until the second half of 2024. If we're right that further phases will be announced as the delineation of the region continues, then the cash flow buildup could take even longer.

Finally, we note that the scale of the project means that Hess is locking in steep capital commitments amid oil price uncertainty. We remain convinced that current prices are unsustainable in the long run, and if another downturn comes along, Hess may want to dial back on Guyana spending. However, Exxon, as operator, is the main decision-maker, and the Stabroek Block will account for a much smaller portion of that company’s spending, making it less likely to change its capital-allocation plans in response to commodity fluctuations.

We see little cause for concern on this front. Liza Phase 1 was sanctioned with a budget of $3.2 billion ($960 million net to Hess). For the five-phase development program currently planned, we estimate that Hess’ portion of the budget sums to about $6 billion. The staggered nature of the overall development plan should cap the cumulative outflow at about $1.3 billion. Recognizing that this commitment was on the horizon, Hess has raised upward of $3.5 billion since July 2017 (by exiting Norway, Equatorial Guinea, Ghana, and certain U.S. onshore areas). It still holds $2.9 billion in cash, so even after an additional $500 million of share repurchases planned for the second half of 2018, Hess should have ample liquidity to keep Guyana rolling, no matter what happens to oil prices.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)