Allegion's Brands Secure Pricing Power

This wide-moat security products company is attractively valued.

Most of Allegion’s revenue and almost all of its segment adjusted operating income, which excludes corporate expenses, are generated from the company’s Americas segment. The Americas segment generates approximately 70% of its revenue from commercial end markets. Management has noted that about half of Allegion’s consolidated revenue comes from product replacements, retrofits, and upgrades. Based on U.S. dollar-denominated revenue, we estimate that Allegion is the third-largest security products company in world, but it’s the second largest in North America.

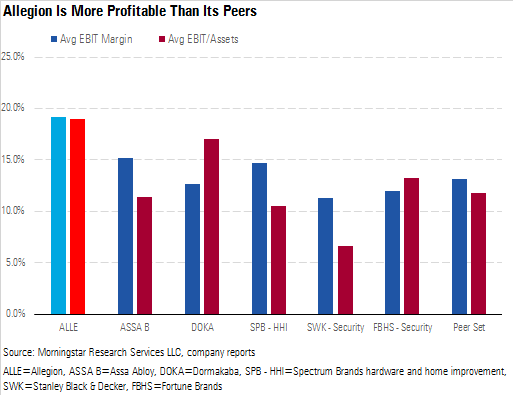

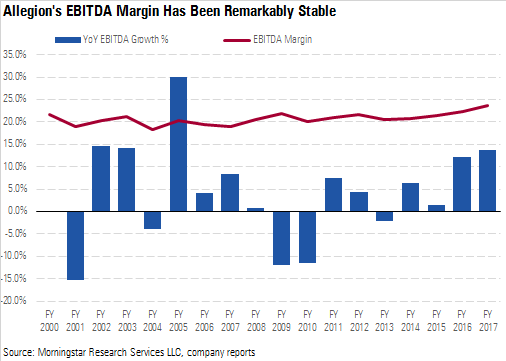

Over the past five years, we calculate that Allegion’s consolidated adjusted operating margin and operating income/assets ratio have both averaged around 19%, while peers achieved a 13% average operating margin and a 12% average operating income/assets ratio over that same period. Allegion’s strong margins have been remarkably stable throughout the business cycle. In fact, margins improved during the 2008-09 global recession. We believe this margin performance is a testament to the company’s market presence and pricing power.

Allegion Has a Wide Economic Moat Despite competition from formidable rivals, Allegion has consistently capitalized on its brand equity, strong distribution network, and large installed base to drive excess returns. Since its 2013 spin-off from Ingersoll-Rand, we estimate that Allegion has generated an average return on invested capital of about 22%, well above its 8.4% weighted average cost of capital. We believe the company is well positioned to maintain its competitive advantages over the next 20 years. As such, we believe it has a wide economic moat, supported by intangible assets and customer switching costs.

Allegion has a portfolio of well-recognized and long-established brands associated with superior quality and durability in both residential and commercial markets. Perceived quality and durability are critical considerations, given that the cost of failure can be very high. In North America, Schlage, Von Duprin, and LCN hold leading market positions in their respective product categories, while CISA and Interflex are leading brands in some European markets. We think Allegion’s leading brands have garnered meaningful brand equity, which supports pricing power.

Allegion has built a valuable network of channel partners in North America, which supports continued growth of its installed base. The company has strong relationships with a large network of architects, homebuilders, security integrators, general contractors, and locksmiths that drive residential and commercial new construction business and generate aftermarket sales. The company also has a strong foothold in big-box retailers (Home Depot, Lowe’s, and Menards, for example) and e-commerce platforms (Amazon) that further supports aftermarket replacement sales. Overall, we see Allegion’s broad distribution network as a barrier to entry because we think it would be very difficult for a new entrant to quickly build these key relationships, especially without a strong reputation for quality and durability.

We believe Allegion benefits from customer switching costs, especially in its commercial installed base. To earn the right to compete in the commercial security market, security products manufacturers must have a proven ability to meet or exceed stringent building code standards and manage the complexities of large-scale projects. With a deep expertise in building code standards and a long list of successful commercial projects, Allegion has earned that right. Its commercial record is one factor that allows the company to capture incremental sales as its commercial customers expand or retrofit existing security solutions. The desire for continuity is another factor that drives high retention rates on add-on spending. When commercial customers expand or renovate their facilities, they generally look to preserve the existing aesthetics and maintain harmonious security functionality.

Although we acknowledge that customer switching costs are much weaker on the residential side of the business, we do believe homebuilders have incentives to install well-known, premium security products in their homes. Indeed, according to Builder magazine's 2018 builder brand use study, Schlage enjoys strong brand familiarity and loyalty among U.S. builders and contractors. Locking systems represent a very low percentage of total home construction cost yet are very visible to customers. Installing popular, high-rated locking systems is a very inexpensive way to improve the perceived quality of a home. Although cheaper options exist, the potential savings is not nearly enough for homebuilders to risk impairing their reputation on low-quality, malfunctioning hardware.

Allegion’s Europe, Middle East, India, and Africa and Asia-Pacific businesses also boast popular brands and similar capabilities to the Americas business, but we believe these segments lack sufficient scale to generate consistent excess returns. As such, we do not believe these two businesses have an economic moat. Still, given the strength of the Americas business and the limited contribution from the EMEIA and Asia-Pacific segments (11% of segment operating income), we believe that the consolidated entity enjoys a wide economic moat.

Positioned to Benefit From Secular Tailwinds Allegion is well positioned to capitalize on growing retrofit and upgrade spending and strong U.S. residential construction activity. Over the coming years, we expect elevated retrofit and upgrade spending as both commercial and residential customers replace mechanical security products with electronic products that offer improved functionality and interconnectivity and appeal to a growing base of tech-savvy end users. For example, Allegion now sells Schlage smart locks that can connect to popular virtual assistant applications such as Google Home, Apple's Siri, and Amazon's Alexa. We also expect increased incidents of random acts of violence across workplaces, schools and universities, and other public venues to fuel spending on security products.

Despite rising mortgage rates, we remain bullish on U.S. new residential construction over the coming years, which should benefit Allegion’s residential business. We see a favorable demographic tailwind driven by the large population of millennials who are reaching the prime age to buy a first home. While there’s currently an undersupply of existing entry-level homes, more homebuilders, such as LGI Homes and D.R. Horton, are beginning to fill this void. We expect more homebuilders to follow suit over the next decade.

Already-strong operating margins should benefit from a mix shift to higher-priced electronic products, operating leverage on increased volume, and improved foreign segment profitability as those businesses mature and gain scale through organic growth and strategic acquisitions.

Aftermarket Exposure, Operational Flexibility Reduce Cyclicality Allegion's sales growth depends on cyclical residential and commercial construction end markets, as well as retrofit and replacement spending. The company's end markets can be sensitive to numerous economic factors that can change drastically over a business cycle and are often challenging to accurately predict. Still, Allegion's aftermarket exposure (that is, retrofit, replacement, and upgrade spending), which represents about half of overall revenue, helps damp sales volatility, and the company has generated remarkably stable operating margins and solid free cash flow, which we believe are testaments to its operational flexibility, strong market positioning, and pricing power in North America, its largest market.

Allegion Looks Attractively Valued Allegion currently trades in 4-star territory. Our $91 fair value estimate equates to about 15.5 times and 20.5 times our 2018 EBITDA and earnings per share estimates, respectively. Those multiples are in line with Allegion's three-year average forward enterprise value/EBITDA and price/earnings multiples.

Between 2014 and 2017, Allegion’s top line grew at about a 4.5% compound annual rate. However, we expect revenue growth to accelerate over the next few years as the company capitalizes on the secular tailwinds we have discussed. Over our five-year explicit forecast, we model consolidated sales growing at about an 8% compound annual rate (about 6% organic) to just over $3.5 billion by 2022.

We see a confluence of factors driving improved profitability, including better operating leverage on higher sales volume, a continued mix shift to electronic products with higher selling prices, and improved EMEIA and Asia-Pacific segment profitability as those businesses mature and gain scale. We think the last two factors will be sustainable over the longer term, which explains our elevated 21% midcycle operating margin assumption relative to Allegion’s 18% historical average operating margins.

Risks to Our Thesis We see five key risks for Allegion. First, a prolonged downturn in new commercial and residential construction would hurt the company's financial performance; however, aftermarket exposure helps damp Allegion's cyclicality.

Second, Allegion competes with well-established and capable rivals (for example, Assa Abloy and Dormakaba), and it must stay on the cutting edge of technology to remain competitive as electronic and mechanical security technology converge. Falling behind the technology curve could impair the company’s pricing power and market share.

Third, Allegion continues to invest in its subscale foreign businesses, which, based on our calculations, do not generate excess returns. If the company is not able to build sufficient scale and brand power in its foreign markets, such investments could destroy shareholder value.

Fourth, now that Allegion is a stand-alone business that no longer competes for capital from a conglomerate parent, we expect it will engage in more frequent mergers and acquisitions across its three geographic segments. Of course, the success of acquisitions is uncertain, and a variety of factors, such as unfavorable deal terms, integration issues, and subsequent acquisition underperformance, could destroy shareholder value.

Finally, approximately 32% of Allegion’s revenue is derived in foreign countries. Although the company’s international presence provides new growth opportunities, diversifies revenue, and damps cyclicality, it also exposes the company to foreign currency, economic, operational, and political risks.

Financial professionals are accessing this research in our investment analysis platform, Morningstar Cloud. Try it today.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)