You Can't Eat Risk-Adjusted Returns, but They Still Might Nourish

Investors captured a greater share of the returns of funds that succeeded in balancing risk and reward.

- Our research finds a relationship between funds' long-term risk-adjusted performance and the extent to which investors capture the returns their fund investments generate. Specifically, we find that higher risk-adjusted performers have narrower "timing gaps," on average, than lower performers, which have wider gaps. In effect, investors are participating in a greater share of the performance of funds that succeed in balancing risk and reward and in a lesser share of the performance of funds that fail to do so.

There's the saying "You can't eat risk-adjusted returns."

It has the ring of truth to it. Left to their own devices, many investors will shrug off risk as long as their returns are good. After all, a high capital asset pricing model alpha or Sharpe ratio won't pay the bills. Rather, it's cold, hard returns--the compounding of gains and accumulation of income--that matters to them in meeting a goal or sustaining a standard of living. Besides, a skeptic might ask, if you're seeing a risk-adjusted return for a fund, isn't it only because the fund's raw returns are lagging and the manager is trying to hold off restive investors?

All that said, our research finds that risk-adjusted performance can play a valuable, if oft-overlooked, role in fund selection: It can indicate how much of a fund's return investors are likely to be able to actually capture…er, eat. Here we examine the relationship between funds' risk-adjusted returns and the returns investors realize in those funds.

Study We examined the relationship between mutual funds' risk-adjusted returns and the timing gaps their investors experienced. "Timing gap" refers to the difference between a fund's dollar-weighted returns (that is, the estimated return of the average dollar invested in it) and its time-weighted returns (that is, the fund's return assuming a lump-sum investment at the beginning of the period). The smaller the gap, the more of a fund's return investors captured; the wider the gap, the more they missed out on.

We compiled 10-year Sharpe ratios of all share classes of U.S. open-end funds as of June 30, 2018. Using those 10-year Sharpe ratios, we sorted the funds into deciles within their Morningstar Categories based on their Sharpe ratios. Then we averaged the 10-year timing gaps of all of the funds in each decile and compared them. (The study excludes dead funds, as well as funds that had acquired other funds via merger since July 1, 2008.)

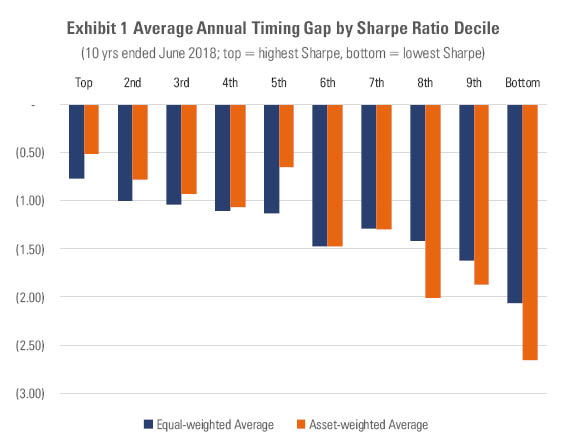

Findings We found investors captured the greatest share of their funds' returns when those funds were standout risk-adjusted performers (top decile) over the decade ended June 2018, as shown in Exhibit 1. Conversely, investors tended to miss out the most when their funds were dismal risk-adjusted performers (bottom decile).

- Source: Morningstar

("Equal-weighted Average" is the arithmetic average of the 10-year annual timing gaps of all funds in each decile. "Asset-weighted Average" is the asset-weighted average of the 10-year annual timing gaps of all funds in each decile using each fund's 10-year average net assets.)

Starkly, there was a nearly 130-basis-point annual difference between the timing gaps of the top and bottom deciles when we equally weighted the funds, and an even wider 214-basis-point differential when we asset-weighted. What this means is that investors in the worst risk-adjusted performers suffered a double whammy of sorts: Their funds delivered relatively poor returns and they managed to capture only a portion of that by mistiming their investments.

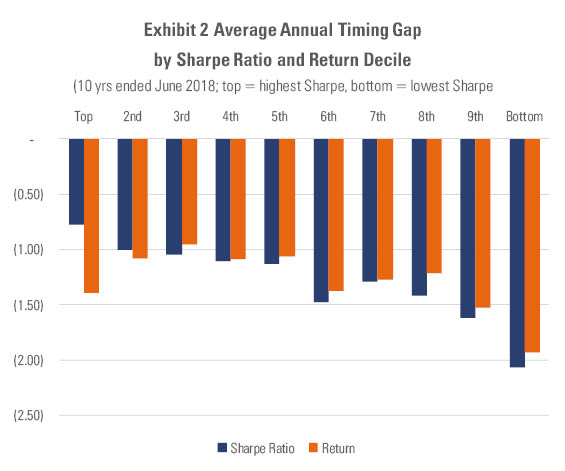

To put those findings into context, we compared the average annual timing gaps sorted by risk-adjusted returns to the average annual gaps sorted by raw returns. In that way, we can approximate how much of a difference the risk adjustment made to investors' success in capturing funds' returns. That comparison appears in Exhibit 2.

- Source: Morningstar

(The average annual return gaps shown are arithmetic averages of the 10-year annual timing gaps of all funds in each decile.)

While the average annual gaps were directionally similar, they differed meaningfully at the top and bottom of the range--for instance, in the top decile where the best risk-adjusted performers experienced much smaller gaps than the best performers based on raw returns alone. Likewise, in the bottom three deciles, the worst risk-adjusted performers experienced larger gaps than funds sorted on returns only.

To be sure, it's possible that some of these differences emanate at least indirectly from fee disparities. For, all else being equal, a cheaper fund will boast better risk-adjusted returns than a pricier offering, and investors have shown a strong preference for low-cost funds and aversion to high-cost funds. If they're piling into cheaper funds that land toward the top of the performance charts and fleeing more expensive ones near the bottom, all at a time performance was generally trending higher, perhaps this could explain why the gaps are narrower in the higher deciles and wider in the lower deciles.

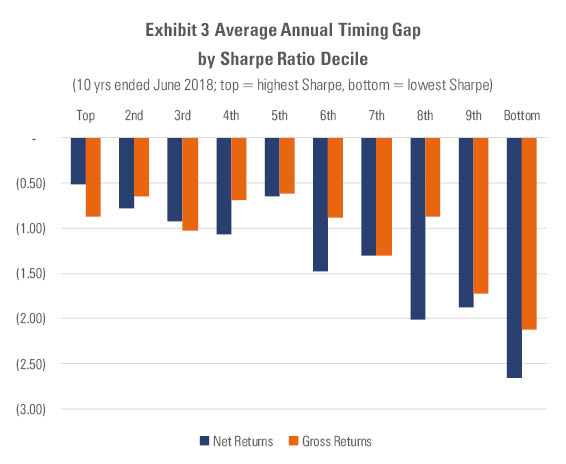

With that in mind, we reran the original analysis, this time calculating the Sharpe ratios using gross rather than net returns. By removing fees in this fashion, we can control for fee disparities and assess whether the same relationship--narrower gaps in higher risk-adjusted performers, wider gaps in lower risk-adjusted performers--persists. That analysis is shown in Exhibit 3.

- Source: Morningstar

(The average annual return gaps shown are asset-weighted averages of the 10-year annual timing gaps of all funds in each decile; the asset-weighting of each decile was done using each fund's average net assets over the 10 years ended June 2018.)

When we remove fees and resort funds into deciles based on their gross Sharpe ratios, we still find significantly narrower timing gaps among high risk-adjusted performers and wider gaps among laggards. This suggests that fee differences, and the demand for lower-cost funds, aren't primary drivers behind the differences in timing gaps we observed in Exhibit 1.

In short, it appears that risk-adjusted performance did make a difference in investors' ability to capture as much of their funds' returns as possible, especially among the highest-performing funds.

The saying is true: You really can't eat risk-adjusted returns. But it appears that higher risk-adjusted performers are easier for investors to use, as evidenced by their smaller average annual timing gaps, than lower risk-adjusted performers. In effect, investors can derive greater nourishment from the returns their fund investments generate by considering not just return potential but also the risk a fund is likely to court in the process, emphasizing managers that have a track record of successfully balancing the two.

Financial professionals are accessing this research in our investment analysis platform, Morningstar Cloud. Try it today.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)