Amid Sell-Off, Multi-Asset Investing Looks Smart Again

Recent volatility provides a reminder for investors to carefully consider their asset allocation.

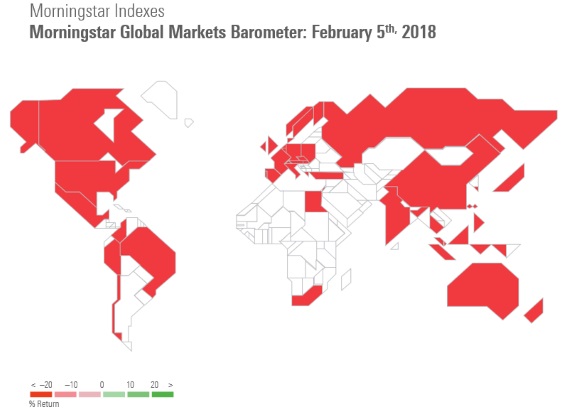

Sometimes when markets come crashing down, there's nowhere to hide. Consider the synchronized fall of Morningstar's 46 equity market indexes on Feb. 5. The Morningstar Global Markets Index lost 3.6% in dollar terms that day. The Morningstar US Market Index was down 4%. Sadly, losses have not been limited to that one day.

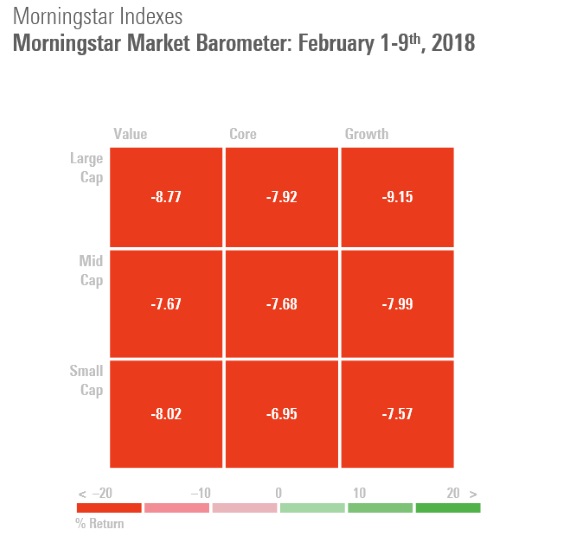

Within the U.S. stock market, it hasn't much mattered if you hold large caps or small, growth or value, quality or junk.

But stocks are not the only asset class in town. While equities have been roiled across the board, bond markets have not witnessed mass carnage, despite the proximate trigger for market turmoil--fear of rising interest rates--posing danger to fixed income. The Morningstar US Core Bond Index has lost just 0.4% so far in February while its short-term counterpart has gained 0.9%. Morningstar bond indexes focused on Japan, the eurozone, and the UK are also in positive territory.

Investors who are diversified by asset class have therefore experienced far milder recent losses. Of course, a little volatility should not trouble a long-term investor. But years of stock market gains have left many heavy on equities, and low volatility has bred complacency. Recent days have reinforced the benefits of multi-asset investing--diversification among stocks, bonds, and beyond.

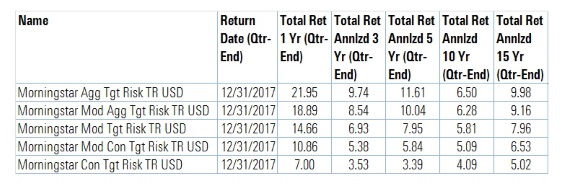

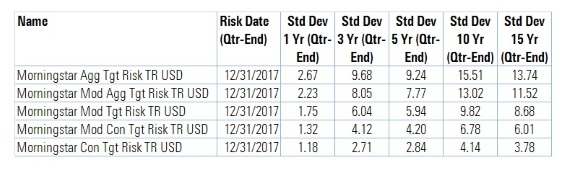

Risk Has Been Rewarded To appreciate just how lavishly the bull market has rewarded equity investors, consider trailing returns for Morningstar's suite of Target Risk indexes at the close of 2017. These benchmarks offer fairly static exposure to a mix of stocks, bonds, commodities, and real estate, with asset allocation provided by Morningstar Investment Management. Investors can be forgiven for looking at these numbers and wondering why they should hold anything but stocks in a portfolio.

For each period, the rank order is identical and monotonic. The Aggressive index, with more than 90% equity exposure, has performed best. Conservative, which is 70%+ bonds, brings up the rear.

These indexes are the benchmarks for Morningstar's US Allocation Fund categories, which line up similarly. Funds in Morningstar's Allocation--85%+ Equity Category have the highest average returns over the trailing one-, three-, five-, 10-, and 15-year periods. Funds in the Allocation--15% to 30% Equity category own the lowest.

But trailing returns have a fatal flaw: time-period dependence. The US equity market averaged a staggering 15%+ average annual gain from 2009-17--well above its long-term norm. Massive recent equity gains inflate the trailing return numbers. They're even strong enough to compensate for the precipitous losses of 2008, which are embedded in the 10-year and 15-year numbers.

Simply put: A globally diversified mix of assets generated by a value-driven asset allocation methodology has looked sluggish next to a portfolio of high-flying equities.

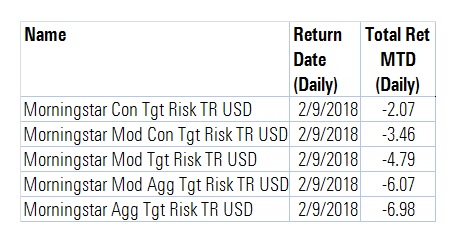

Until it doesn't. Consider the performance of the Target Risk Family during this freaky February. The more conservative, or bond heavy, the better the performance.

Let's Roll The truth is that there have been other bumps along the road since 2009 that trailing returns numbers obscure. Those come into focus with the help of rolling returns, which offer a wider lens through which to view performance. Rolling forward monthly, there have been 180 12-month periods over the past 15 years (January to January, February to February, and so on). There's obvious overlap in these time periods, but rolling returns provide more observations than trailing returns, which assume that investors deployed their capital at the start of one of just five periods displayed above. Consider Aggressive versus Conservative on a rolling returns basis.

Morningstar Aggressive Target Risk Index

Morningstar Conservative Target Risk Index

Aggressive posted positive returns in 77% of the 12-month rolling periods, while losing money in 23%. Its worst 12-month decline, ending in November 2008, saw a 43% decline. Steep losses were also experienced during the bear market post-dot-com bubble.

Conservative, for its part, produced positive returns in 91% of the 12-month periods over the past 15 years. Its bond-heavy portfolio served its purpose in 2008, cushioning the fall of plummeting equities. The Conservative index did not post a single double-digit 12-month decline over the past 15 years.

There's no question that the aggressive allocation offers the most upside, and the argument that long-term investors are best served by heavy equity exposure is borne out. But we know that investors hate losses, and the Conservative portfolio wins in the crucial "sleep at night" department. Consider the perspective of a risk-averse investor or simply one with a short time horizon--the parent of a college-bound high schooler, an aspiring homebuyer, a wedding saver, or a retiree.

Even extending the time horizon to three years, an investor takes a big risk with an equity portfolio. An investment of $10,000 in the Aggressive portfolio on March 1, 2006, would have dwindled to $6,480 three years hence. The Conservative portfolio would have grown to $10,490 over that same span.

So rolling returns give investors a fuller picture of what the range of possible outcomes than do trailing returns.

What About Risk? It's also critical to look at risk-adjusted returns, which account for volatility. When considering the standard deviation of returns over trailing time periods, the rank order of Morningstar's Target Risk index family is again identical and monotonic.

As expected, the more equities in a portfolio, the more returns have bounced around. The bond-heavy Conservative index has predictably provided the smoothest ride.

The more interesting question is: Have investors been adequately compensated for the additional risk taken?

One might think that with equity market volatility low, the trailing time periods would flatter the stock-heavy portfolio. Comparing the Target Risk indexes on the basis of Sharpe Ratio—return per unit of risk taken—paints a mixed picture.

Over the 10-year and 15-year periods, which consider the bear market of 2008, the Conservative index actually boasts the best Sharpe Ratio. Even over shorter time periods, the more aggressive portfolios do not always look best.

According to academic theory, investors are willing to sacrifice return for greater certainty. They feel the pain of loss more acutely than the joy of gain. The most "efficient" portfolio is often less aggressive.

The Reckoning Diversification is said to be the only free lunch in investing, but in recent years, it has stuck investors with the check. Market behavior in early February 2018 has served to remind investors that stocks are volatile and capable of sharp losses. When stocks fall, investors--especially the risk-averse--appreciate owning a diversified mix of assets that are zigging and zagging in different directions. Amidst choppier market conditions, the rank order of Morningstar's Target Risk index returns, allocation fund categories, and any multi-asset portfolios will look far different than in the periods through 2017. Rolling returns and risk-adjusted return analysis both provide reasons for investors to carefully consider their allocations.

All charts and data from Morningstar Direct.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)