A Self-Described 'Late Bloomer' Eyes Retirement Readiness

Heavy saver is making up for lost time, but grueling job has her longing for a better work/life balance.

Editor's note: This article is part of Morningstar's 2017 Portfolio Makeover Week.

Abby is feeling a tug in two directions. From a financial standpoint, this 55-year-old feels like she still needs to make up for lost time. She was a late bloomer on the career front, dabbling in academia before embarking on a career in technology about 15 years ago.

"My first decent paycheck came in my early 40s," Abby said.

She now earns a healthy salary of more than $180,000 per year and another $10,000 in rental income from a condo she owns.

"Being poor for so long," she wrote, "I'm still not a big spender and saving quite a bit."

To date, she has managed to stash away $1 million in assets. She would like to add to that amount in the years ahead, because she knows she has to make up for her late start.

On the other hand, she maintains a grueling work schedule and dreams of a day when she can downshift. She would like to cut back to part-time as soon as it's financially feasible. Alternatively, she'd like to continue to work be but switch to a more gratifying, less demanding position.

In addition, like many people at her life stage, Abby is involved in caring for an elderly parent. While her 90-year-old mom lives at home with paid caregivers, Abby oversees their schedules and maintenance of her mother's house and accompanies her mom to frequent healthcare appointments.

Abby wrote seeking advice on her retirement portfolio's current positioning; she'd like a check on its viability and positioning for her eventual retirement, and would also like guidance on reducing sprawl across so many holdings.

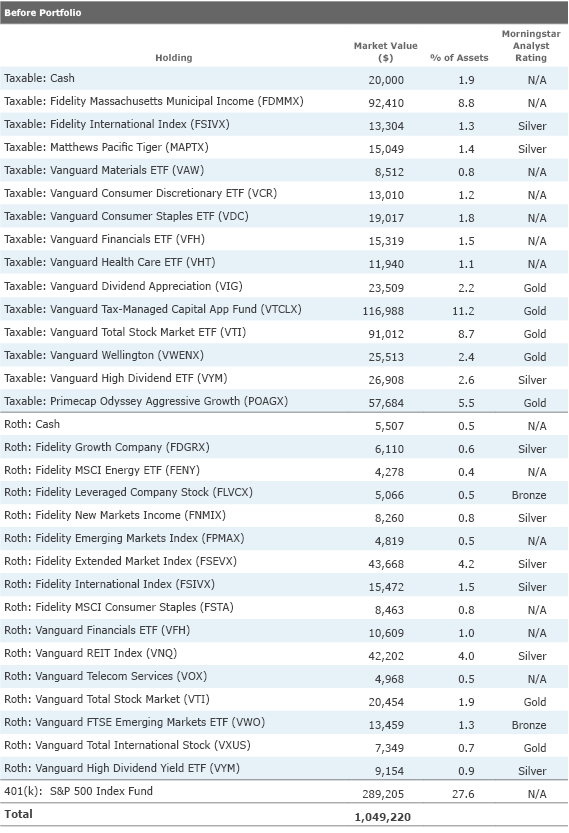

The Before Portfolio

Abby's portfolio is aggressive. She holds nearly 90% of her assets in stocks and the remainder in cash and bond funds. Not only is her asset allocation aggressive, her holdings selection is, too. While her largest positions are equity index funds and a single-state municipal bond fund, she also has many positions in sector-specific exchange-traded funds, both in her Roth IRA and her taxable account. She also owns several worthwhile but aggressive niche funds, including

Abby holds her assets in three main silos: a taxable account, a Roth IRA, and a 401(k) plan. Her taxable account, at more than $500,000, is the largest pool. Its size is an outgrowth of the fact that Abby, as a high-income investor, has only so many tax-sheltered vehicles available to her; the taxable account is her only main option for additional savings. She makes the maximum allowable contribution to her 401(k) plan each year--$24,000, since she's older than 50--and her employer contributes an additional $20,000. She also been using the "backdoor Roth IRA" maneuver to get money into a Roth IRA each year, but the limit $6,500 per annum for savers older than 50. (Abby's total Roth IRA assets are fairly large because she previously rolled over an old 403(b) into an IRA, then converted those assets to Roth during a period of unemployment when her tax bracket was lower.)

Abby's taxable account is anchored by some superb tax-efficient holdings:

Her Roth IRA account, totaling about $210,000, likewise features a combination of broad core funds and ETFs as well as more specialized offerings. Abby has gone bold with her 401(k) allocation, noting that the S&P 500 index fund that holds 100% of her assets is the only low-cost fund in the lineup. That sort of concentration--especially in such a well-diversified fund--can be a great way to approach a weak 401(k) plan. After all, an investor like Abby can readily augment it with other holdings in other slots in her portfolio.

Abby has a 15-year mortgage on her home with a 2.75% interest rate and a balance of about $290,000. She also has a small car loan with a 1% interest rate that she'll pay off next year. In addition, she owns the aforementioned rental property that brings in $10,000 per year.

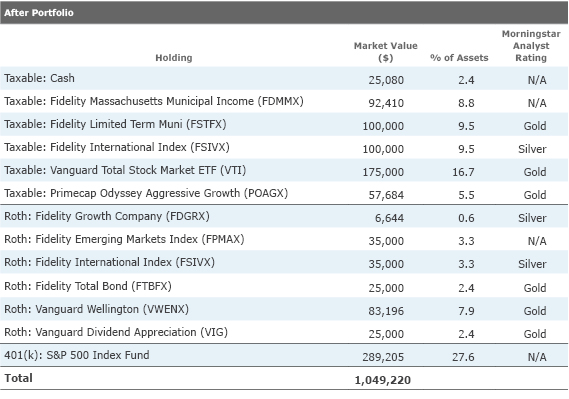

The After Portfolio Abby's stock-heavy portfolio has experienced strong growth over the past decade, but I'd argue it's a bit too risky given her life stage and the possibility of an early(ish) retirement. With a still-long time horizon of 35-40 years, she still needs plenty of growth. But if for some reason she can't work in the decade ahead--or decides not to--it makes sense to build up a bigger cushion that she could fall back on in a pinch. I targeted an equity allocation of 75% with the remainder in cash and bonds.

Because Abby would likely tap her taxable account first if she had a spending need, it makes sense to build up liquidity and safety in that account. Having more in safe assets will also provide a psychological cushion if the equity markets fall--something that becomes more important in the years leading up to retirement. Abby's Fidelity Massachusetts muni fund is a good start but its duration (a measure of interest-rate sensitivity) is high--as is often the case with single-state muni funds. I would augment it with a shorter-term muni-national fund like

In addition, my "after" portfolio seeks to reduce some of the moving parts in Abby's taxable and Roth accounts. My preference is for more "core" and less "explore," so I eliminated the sector-specific ETFs in both of those accounts. While these sector ETFs have low expense ratios and are usually tax-efficient, her total portfolio's sector positioning is fairly close to the S&P 500's. That's an indication that that she's probably better off with broad equity index funds and ETFs. And while trading-related taxes are a nonissue for her Roth account, trading the ETFs within her taxable account has the potential to increase her capital gains. Abby will want to be careful about selling out of the ETFs indiscriminately within her taxable account, however. If these positions have gained in value since purchase, a market downturn will provide a more opportune time to undertake the repositioning. This would be a good spot to seek out tax advice.

I redeployed those assets into core-type equity holdings, using a mix of index products and actively managed ones. Abby's portfolio has great examples of each, so I stuck with her existing choices. Her portfolio is light on international equity, so I boosted her exposure to core international index funds. My "after" portfolio also repositions dividend-focused funds, shifting them from her taxable account, where their dividend distributions add to her tax bill, to her Roth. Of course, such a shift entails tax consequences, so as with the move out of ETFs within her taxable account, she'll want to be careful about triggering capital gains with the repositioning.

Left behind in the taxable account are truly tax-efficient funds. While I'm a fan of Vanguard Tax-Managed Capital Appreciation, its tax-cost ratio has been trending up recently. Meanwhile, its expenses, while a very low 0.09%, are twice that of the broad-market ETF. Thus, I used broad-market ETFs to populate this portion of the portfolio.

In terms of assessing retirement readiness, there are a lot of variables in the mix. If Abby decides to downshift her work and/or retire early, that will translate into a smaller nest egg and reduced cash flow in retirement. Working longer and delaying Social Security will result in a higher benefit when Abby eventually claims. Pre-Medicare healthcare expenses are another variable with a high degree of uncertainty swirling around them. It's also likely that market performance over the next decade will be less impressive than it was in the past one. All of those variables point to the virtue of working longer, in some capacity. Yet the financial aspect of decisions about work/life balance and early retirement are just one component of them; Abby will have to weigh the financial benefits of continuing to work against potential ramifications for her health and quality of life.

It's also worth noting that from a financial standpoint, Abby has an important asset: She's frugal, and her aggressive savings rate has meant that she is used to living on well less than she's making. Abby reckons that she can get by on $60,000, though she'd need to withdraw a larger dollar amount from her portfolio to translate into that amount on an aftertax basis. For planning purposes, her actual spending needs will be more helpful than using an artificial "percentage of current salary" figure when determining her retirement readiness.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YBH7V3XCWJ3PA4VSXNZPYW2BTY.png)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)