30 Undervalued Stocks

Our equity analysts share their favorite picks at the end of the third quarter.

The Morningstar Global Markets Index has returned more than 17% year to date and 18% over the past year. The ongoing bull market in stocks has driven up valuations: The market-cap-weighted price/fair value estimate ratio for our equity analysts' coverage universe was 1.04 near the end of the third quarter (up from 1.02 one quarter earlier), indicating that the median stock under our coverage is slightly overvalued.

Elizabeth Collins, Morningstar's director of equity research for North America, notes in her quarter-end wrap-up that there are a dearth of undervalued 5- and 4-star opportunities today.

Despite overall high prices, there are pockets of value to be found in today's market. Here are some undervalued stocks that are among our analysts' best ideas.

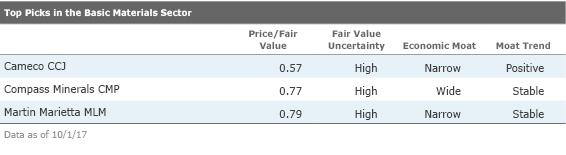

Basic Materials Like last quarter, the basic materials sector remains the most expensive sector in aggregate, with a price/fair value estimate ratio of 1.37. Sector director Dan Rohr notes in his quarterly update that valuations in the sector are being propped up by shaky China fundamentals--and the team doesn't expect that to last.

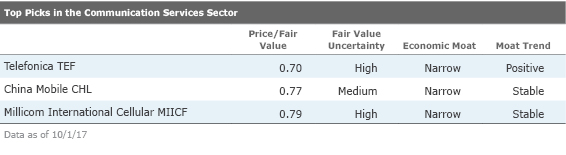

Communication Services

The communication services sector is the most undervalued sector overall, trading at a price/fair value ratio of 0.94. In his quarterly commentary, Brian Colello, director of technology, media, and telecom equity research for Morningstar, details the disruption in the U.S. wireless market being caused by

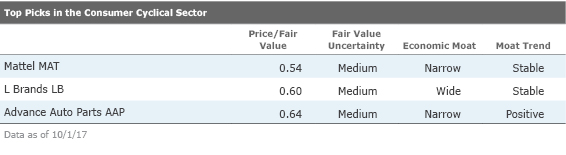

Consumer Cyclical

The consumer cyclical sector is slightly undervalued, with a weighted average price/fair value ratio of 0.98, down from 1.01 the prior quarter. In her quarterly report, senior equity analyst Bridget Weishaar attributes the decline to fears about

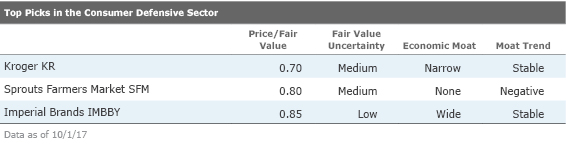

Consumer Defensive Consumer defensive stocks have pulled back a bit, with the sector trading at just a 1% premium to our fair value estimates. Director Philip Gorham notes that M&A activity took center stage during the quarter, and activist investors are increasingly forcing companies to focus on cost cutting amid weak growth. Competition from discounters and Amazon could weigh on medium-term growth, he adds.

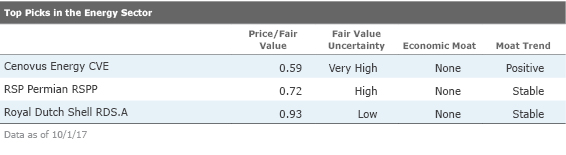

Energy The energy sector is trading at an average price/fair value of 0.95. Analyst Joe Gemino acknowledges in his quarterly update that fundamentals for crude look healthy, due largely to the supply shortage engineered by OPEC. Once the OPEC cuts are lifted, says Gemino, full production paired with rapidly growing output by U.S. shale producers could tip the industry back into oversupply in 2018.

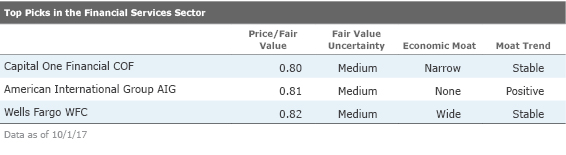

Financial Services The financial-services sector is slightly overvalued, trading at a 3% premium to our fair value estimates. In his quarterly commentary, sector director Michael Wong notes that the least pricey subsectors are global banks, regional European banks, and diversified insurance companies.

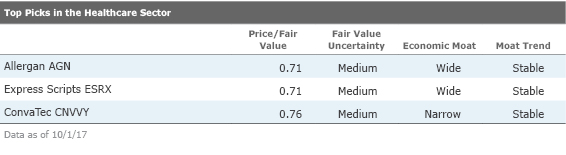

Healthcare Valuations in the healthcare sector rose during the third quarter, finishing at 1.02 up from 1.00 at the end of the second quarter and 0.87 at the start of the year. Sector director Damien Conover expects the U.S. government will focus less on major changes in healthcare, and large companies in the sector will continue to redeploy their cash flows through stock buybacks, steady dividends and accelerated M&A activity.

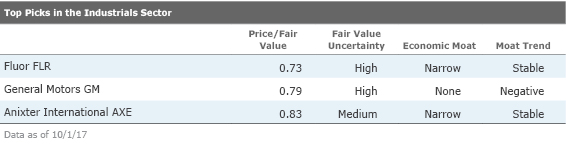

Industrials Industrial stocks are overpriced, trading at a 4% premium to our fair value estimates on average. Analyst Nick Mokha writes in his quarterly note that worldwide growth is resilient despite nearly of a decade of expansion, which has led many companies under coverage to announce higher growth rates in their international segments.

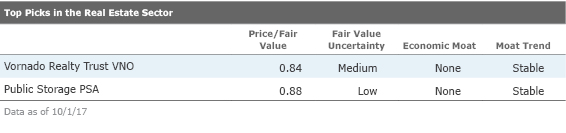

Real Estate Morningstar's real estate coverage is slightly undervalued, trading at a 2% discount to our fair value estimates. In his quarterly update, analyst Brad Schwer says actions by the Trump administration and the potential for increased interest-rate activity could lead to volatility in the near term. That said, much of Morningstar's U.S. REIT overage enjoys healthy underlying operating performance.

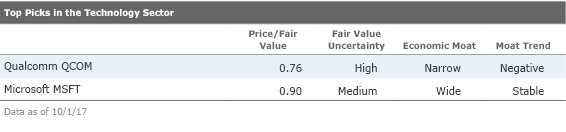

Technology The technology sector remains overvalued at a price/fair value of 1.09. Colello writes that the single most important trend in the sector remains the shift toward cloud computing, leading infrastructure-as-a-service and software-as-a-service vendors to experience tremendous growth while legacy IT vendors face headwinds. Semiconductor equipment makers are some of the most overvalued names in the sector, he adds.

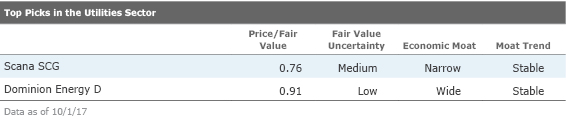

Utilities On a global basis, utilities continue to be overvalued, with a 1.08 market-cap-weighted price/fair value ratio at quarter's end. Nevertheless, low market interest rates make utilities' dividend yields look attractive to income-seekers, notes sector strategist Travis Miller. M&A in the sector remains active and will likely to remain so as long as interest rates stay low. Fundamentally, the sector is healthy, he adds.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)