August Ratings Heat Up

No summer holiday for new analyst ratings.

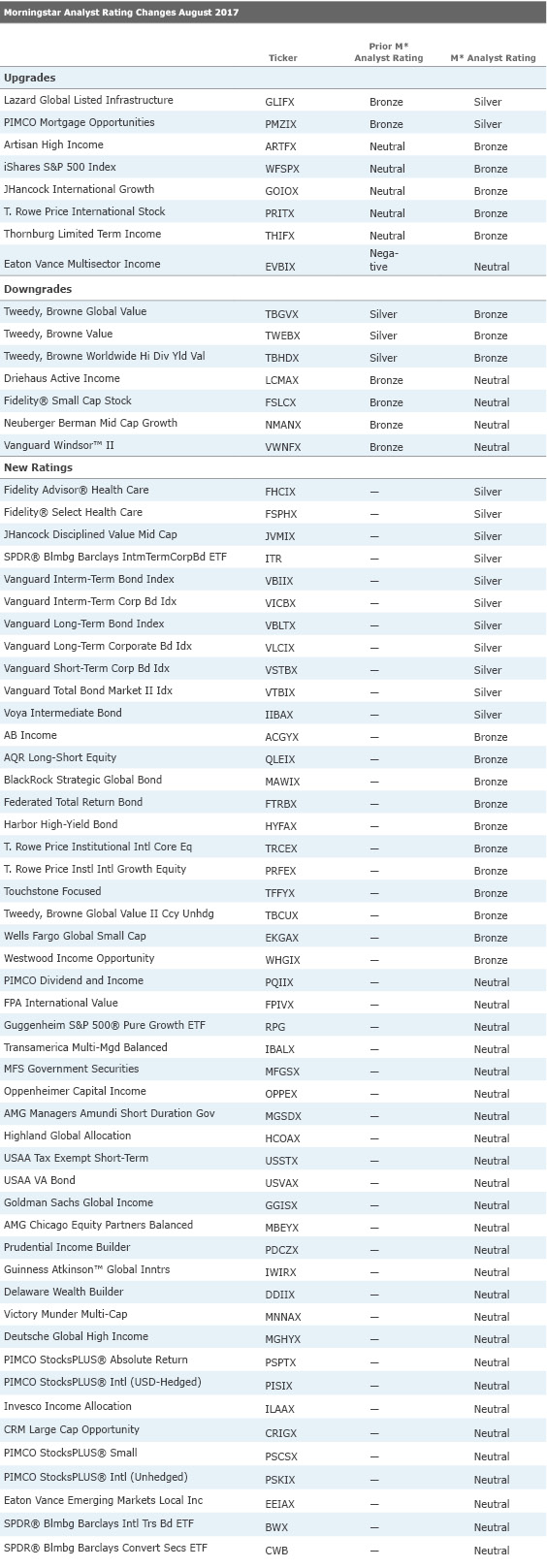

In August, Morningstar manager research analysts affirmed the Morningstar Analyst Ratings of 95 funds and two target-date series, upgraded the ratings of eight funds, downgraded the ratings of seven funds, and assigned new ratings to 48 funds. Below are some of August’s highlights, followed by the full list of ratings changes.

Upgrades:

The rating for

Compared with peers in the nontraditional bond Morningstar Category, the fund sticks mainly to mortgage-related investments, which have boosted returns since its inception. This go-anywhere approach can introduce risk, as exhibited by the fund’s increasing mortgage derivative exposure, but due to strong bottom-up security selection and the firm’s deep analytical advantages, Hyman and his team have demonstrated an ability to manage risk prudently.

The rating for

Downgrades:

Due to uncertainty over an upcoming manager change, the rating for

New Ratings:

source: Morningstar

/s3.amazonaws.com/arc-authors/morningstar/19600385-fb06-404d-9876-a1d5f7cdae8a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/19600385-fb06-404d-9876-a1d5f7cdae8a.jpg)