Venture Capital: Less Is More?

Coming off a record fundraising year, total VC invested remains strong despite completed transaction counts trending lower.

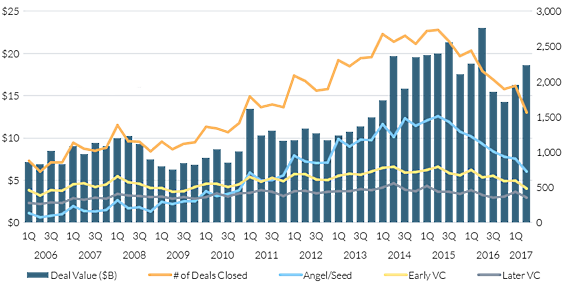

- While completed financings have trended lower toward historical norms, the largest contributor to this remains an outsized decrease in financings at the angel/seed level, rather than a blanket decline across all venture stages.

- With more than $5.1 billion raised via VC-backed IPOs midway through the year, 2017 has already seen roughly 75% more capital raised via public offerings than all of 2016 saw. Four venture-backed companies valued at $1 billion+ ("Unicorns") have entered the public markets. Two more (Blue Apron and Forescout) have also filed. Should the latter two companies go public, 2017 will set a record for the most Unicorns to IPO in a single year.

- Private equity ("PE") has shown heightened interest in the IT sector, with nearly one-fifth of all PE deals completed to date coming in the space. With a large group of venture-backed companies playing in the IT sector, we believe PE firms will account for a heightened proportion of VC-backed exits moving forward. PE can serve as an attractive option to founders looking to remain private in today's market, while also providing coveted liquidity to VCs, which is an issue that has become increasingly publicized as companies continue to hold off on exit processes.

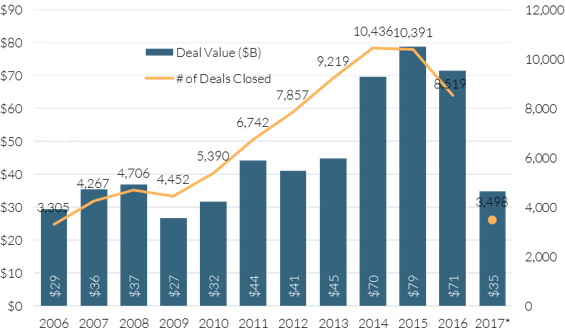

Midway through 2017, nearly $35 billion in VC has been deployed across an aggregate of 3,498 completed U.S. financings. At the current pace, 2017 would see total VC invested come in higher than what we experienced in 2016 and at the second-highest level we’ve tracked over the last decade. On a quarterly basis, the second quarter has seen $18.6 billion invested across 1,560 financings as of June 16, 2016, representing a quarter-over-quarter jump of nearly 15% in terms of capital invested with still a couple of weeks of data yet to be collected.

U.S. VC Activity by Year

Source: PitchBook | Data as of 6/16/2017

We believe the consistent decline we’ve seen in VC funding counts since the beginning of 2016 has been much more isolated than many have presumed. As we’ve written in previous research, the chief driver of this trend has primarily stemmed from investments at the angel and seed level. We’ve continued to see headlines over the past few quarters speaking to a trend of VCs investing less as they’ve ostensibly become more stringent and selective with the companies they choose to back. And while we believe there is validity to that argument, investments across both early- and late-stage deals have remained relatively stable, as highlighted in the chart below.

U.S. VC Activity by Quarter

Source: PitchBook | Data as of 6/16/2017

Instead, the venture markets have seen angel/seed investments jump 236% between 2010 and 2015, driven by the proliferation of seed-stage and micro VC firms, along with the prevalence of accelerator graduates and angel groups. Naturally, earlier-stage VCs operating (just past the angel/seed stage) have been forced to be a bit more selective and disciplined as they evaluate quality in a market where the number of companies looking to raise capital has increased. We don’t envision this trend going away as we move through the remainder of 2017 and expect to see angel/seed rounds continue at a more subdued pace.

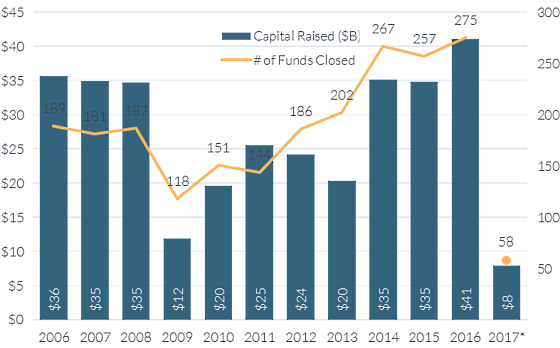

Although we do see long-term round volume clawing back to more normalized levels after peaking in 2014 and 2015, we see potential for volume across the entire venture market to increase in the back-half of the year, or at least remain stable as we rebound from an enormous VC fundraising cycle. $41 billion was raised in 2016 across 276 funds, both the highest figures we’ve tracked since at least 2006. First-time fund managers also raised the most capital last year since 2008, a trend that has stayed in place through the first half of 2017.

As managers were busy on the fundraising trail, we believe some of the slight retrenchments in round counts could be chalked up to VCs prioritizing closing their fundraising. To be sure, much of that capital will come to market in the form of larger, later-stage rounds as companies continue to push back exit plans. Yet at this point, many managers should have begun to shift their focus to vetting and sourcing transactions that could close within the next couple of quarters.

U.S. VC Fundraising by Year

Source: PitchBook | Data as of 6/16/2017

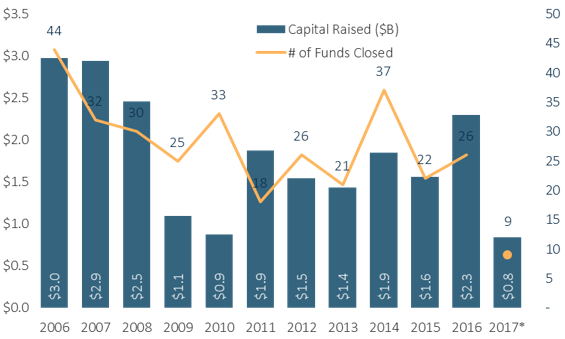

U.S. VC First Time Funds by Year

Source: PitchBook | Data as of 6/16/2017

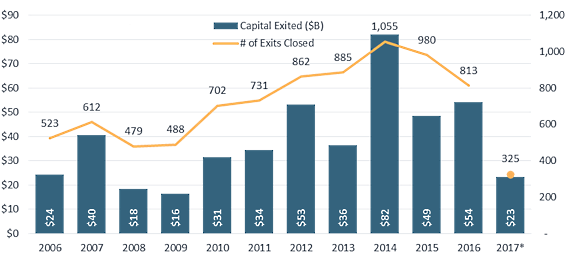

VC-backed exit flow has remained a bit constrained, yet we’ve recently noticed a couple of positive signals. The IPO markets have seemed to open up a bit, and 2017 is already on pace to see more VC-backed listings come to market than we saw in 2016. More notably, 2017 to-date has already seen total capital exited via the public markets ($5.1 billion) surpass what we saw in the entirety of 2016—by 75%.

U.S. VC Exits by Year

Source: PitchBook | Data as of 6/16/2017

We also continue to see a more prominent role and opportunity for private equity to play within the late-stage venture markets, primarily on the IT and enterprise software front. Nearly one-fifth of all PE deals completed thus far into 2017 have involved companies in the IT sector, above the 10%-15% range we’ve seen for most of the last decade. In addition, software transactions have accounted for a whopping 66% of all completed PE deals within IT.

We’ve seen the likes of major PE players such as Vista Equity Partners and KKR raise multi-billion-dollar funds to focus on technology. While the above-mentioned funds could put capital to work via larger take-privates or growth rounds, late-stage venture companies could serve as enticing opportunities for PE firms, which can help them become increasingly efficient operators and ultimately sponsor a future exit. Year-to-date, PE buyouts have accounted for 18.5% of all completed VC-backed sales as well as 19% of all VC capital exited, both the highest figures we’ve tracked in our datasets.

More Quarter-End Reports

Market Stock Market Outlook: Equity Valuations Look Lofty

Economy Midyear Economic Forecast: Lower Inflation, Slow Growth

Credit Markets Credit Market Insights: Bond Indexes Perform Well in a Quiet Market

Equity Sectors Basic Materials Outlook: Propped Up and Too Expensive

Communication Services: AT&T and Verizon--A Duopoly No More

Consumer Cyclical: Amazon Reshapes Retail in Real Time

Consumer Defensive: Retailer Consolidation Sparks Concerns, but Opportunities Exist

Energy: Despite OPEC Cuts, a Crude Awakening Is Near at Hand

Financial Services: Our Take on U.S. Tax Reform and Bank Deregulation

Healthcare Outlook: ACA Repeal Efforts Unlikely to Yield Major Legislative Changes

Industrials: China Shows Signs of Softening, but the Sector Remains Healthy Overall

REITs: Some Scattered Opportunities in a Fairly Valued Sector

Tech: A Tectonic Shift Toward Enterprise Cloud Computing

Utilities: Tough to Stop This Sector's Powerful Performance

Mutual Funds First Half Winners and Losers for Funds

Second Quarter in U.S. Stock Funds: Growth on Fire

International-Stock Funds Continue to Prosper

Bonds in the Second Quarter: The Flattening

Portfolio Planning With Christine Benz Trends and Takeaways From 2017's First Half

PitchBook Reports Tapping the Brakes on M&A

Private Equity: Capital Deployment Remains a Challenge

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D653LVS4SJBYREMM6W6TGIX2DQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)