A Burst of New Ratings to Start the Year

Nineteen new ratings debuted in January.

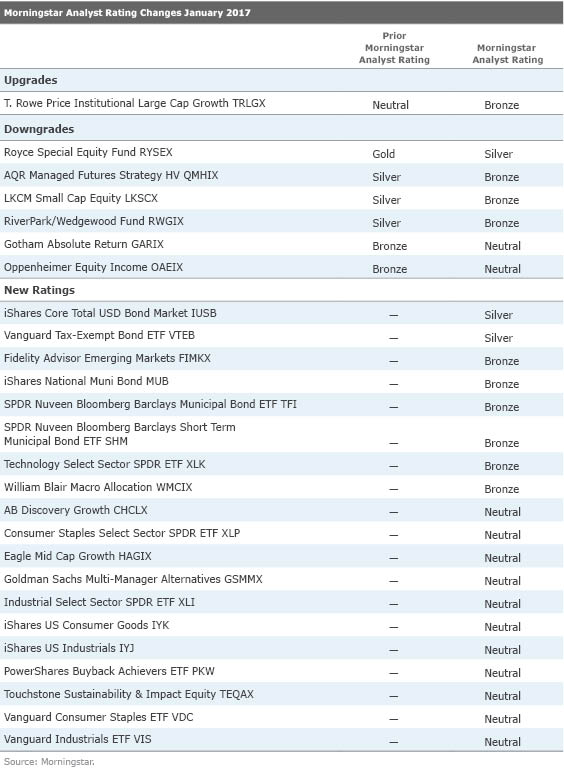

In January, Morningstar Manager Research analysts upgraded the Morningstar Analyst Rating of one fund, downgraded six funds, affirmed ratings on 69 funds, and assigned new ratings to six mutual funds and 13 exchange-traded funds. Below are some of January’s highlights, followed by the full list of ratings changes.

Upgrades

T. Rowe Price Institutional Large Cap Growth

TRLGX was upgraded to Bronze from Neutral, despite a new manager taking over at the start of the year. Taymour Tamaddon replaced Rob Sharps, who ran this fund for 15 years, after Sharps became the firm’s co-head of global equity. Tamaddon joined T. Rowe in 2004 and has experience running a healthcare fund, though this is his first diversified charge. He spent six months working with Sharps on the fund transition and will leverage the research of T. Rowe’s equity analyst team, which has contributed to strong results for the firm’s growth offerings. Combined with low fees and a strong parent in T. Rowe Price, the fund’s building blocks are in place for a strong future.

Downgrades

LKCM Small Cap Equity

LKSCX was downgraded to Bronze from Silver owing to persistent performance problems and an increased reliance on macroeconomic portfolio decisions. Steve Purvis has been the fund’s lead manager since 1999 and posted a strong showing in the early 2000s bear market and in turbulent years such as 2011. However, the fund has struggled as of late, and it hasn’t beaten its Russell 2000 Index benchmark or small-growth peer since 2011. The fund has gotten leaner during its slump, with fewer stock holdings and an increased weighting in Purvis’ top ideas, which include bets on energy and industrial names, and a recent move into cyclical stocks. Despite the struggles, Purvis is well-resourced, supported by an experienced group of small-cap analysts and firm founder Luther King. Outflows are an additional concern, however, as the fund’s $285 million asset base as of year-end 2016 is far below its peak of more than $1 billion in late 2013.

Royce Special Equity

RYSEX was downgraded to Silver from Gold owing to key-manager risk. Charlie Dreifus, who is more than 70 years old, has served as this fund’s manager since its May 1998 inception, running it solo for most of his tenure. Steven McBoyle was added as an assistant portfolio manager here in October 2014, to lay the groundwork for future succession, though Dreifus has not announced plans to step down. Together the two implement a bottom-up, risk-conscious research process, holding small-cap stocks for the long term. Dreifus’ penchant for avoiding risk has been highlighted in the fund’s long-term returns: From the fund’s May 1998 inception through January 2017, its 9.5% annualized return has bested the Russell 2000 Value Index’s 8.3%, with much lower volatility. Despite the strong long-term record and appointment of McBoyle as assistant manager, the fund’s future is less certain with Dreifus in the later stage of his career.

New Ratings

Eagle Mid Cap Growth

HAGIX features a sensible research process and has performed well since lead manager Bert Boksen founded the strategy in August 1998. Despite the fund’s past success, there are concerns going forward. Boksen has nearly 40 years of experience, but at age 68, he is nearing the end of his career. His assistant managers have taken on more responsibility. Asset growth is a concern: The fund doubled in size from 2014 to 2016. During the same period, the portfolio grew to 100 stocks from around 75, raising the question of whether asset growth has had an impact on the fund’s process. The fund starts off with an Analyst Rating of Neutral.

Technology Select Sector SPDR ETF

XLK offers market-cap-weighted exposure to the largest U.S. information technology and telecommunication sector stocks. This is the only one of the 10 Select Sector SPDR ETFs that combines two sectors (technology and telecommunications) into one portfolio. The fund targets technology and telecom stocks in the S&P 500 and weights them by market cap, which makes it particularly top-heavy. The fund’s concentrated portfolio increases risk, but its top positions are not as strongly correlated with each other as at other sector funds. The fund’s low expense ratio and low turnover should benefit investors, supporting its Analyst Rating of Bronze.

William Blair Macro Allocation

WMCIX features a long-tenured management team with a successful record. The team’s experience, combined with low expenses relative to peers, merit a Bronze rating. Comanagers Brian Singer and Thomas Clarke have worked together at various firms since 2000, joining William Blair in 2011. The managers and 11 others form William Blair’s Dynamic Allocation Strategies team. Singer and Clarke are responsible for portfolio construction, placing the fund in long and short positions in global equities, currencies, and fixed income by using ETFs and derivatives, all while avoiding commodities. The fund recently reached its five-year mark, posting strong results. Singer and Clarke target a 5%-7% annualized return in excess of the Consumer Price Index over a full market cycle. The fund’s 5.4% annualized gain from inception through January 2017 has thus far met that goal.

/s3.amazonaws.com/arc-authors/morningstar/19600385-fb06-404d-9876-a1d5f7cdae8a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/19600385-fb06-404d-9876-a1d5f7cdae8a.jpg)