2016 Shows That Factors Are Fickle

Last year demonstrated that diversification and discipline are required to put factors to good use.

A version of this article was published in the December 2016 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

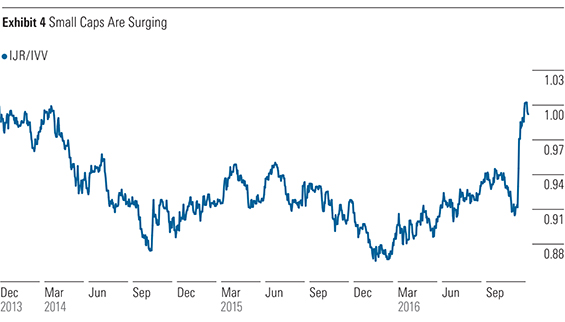

Last year was marked by some dramatic changes in factor leadership. Value made a comeback, while growth lagged. Small-cap stocks had been steadily gaining ground on large caps through much of the year and spiked higher in the weeks following the U.S. election. Low-volatility stocks, which had been outperforming the market at large as well as more-volatile names, were getting left in high-beta stocks' dust.

To be clear, this sort of reshuffling is a regular feature of not just factors, but sectors, asset classes--you name it. The lessons to be learned from these perpetual games of leapfrog are essential. Implementing those lessons is hard.

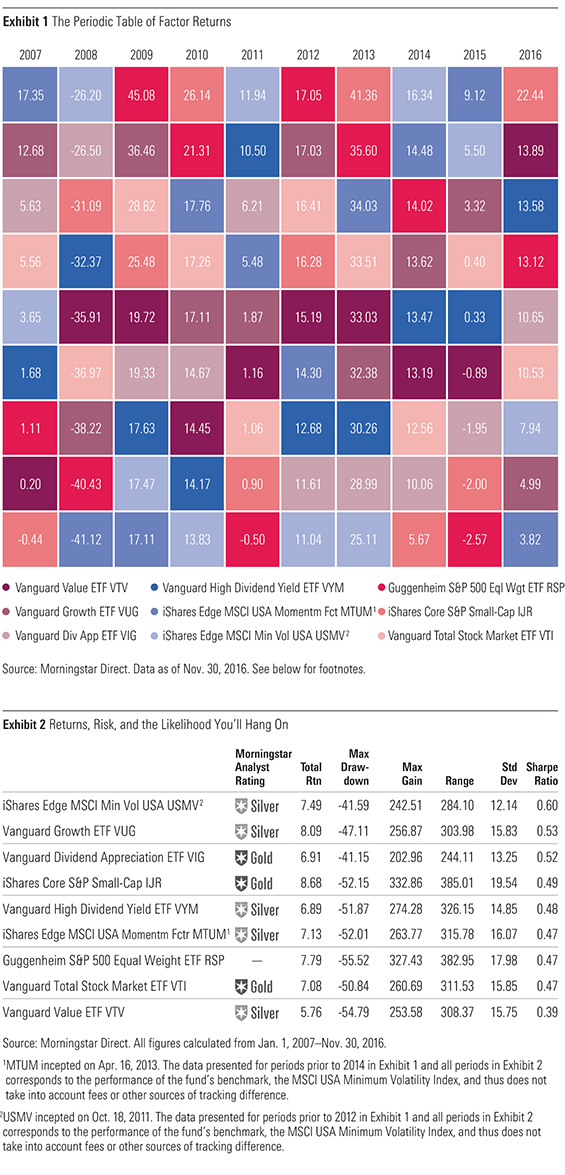

Reminder: Factors Are Cyclical Exhibit 1 is the periodic table of factor returns, in which I use various strategic-beta exchange-traded funds as factor proxies. It is immediately apparent that a regular scramble is the norm. I call these factor proxies, as it is important to remember that there is typically a yawning gap between the performance of factors as derived in academia and the investable versions of those same factors represented by these funds. Nonetheless, these funds are some of your best options for harnessing these factors in your portfolio.

Exhibit 2 provides a longer look at the behavior of these funds over the past nine-plus years (for the sake of consistency, I stopped a month shy of including a full 10 years' data). There are a number of important reminders in this data. First, while over multidecade time horizons each of the factors represented by these funds has been shown to produce excess returns relative to the market at large, each can lag the market for long stretches. This is evidenced by the fact that dividend-oriented strategies and value have lagged the broad market over the near decade-long period in question. Second, those excess returns have a cost. That cost can be measured in greater relative drawdowns and overall volatility--as was the case for three of the five funds that outperformed the

Morningstar FundInvestor

editor Russ Kinnel has documented over the years, more-volatile funds tend to be used poorly by investors. Capitalizing on these factors requires that you be on the platform, ticket in hand, when the value, size, or dividend train arrives at the station. These factors have tried many investors' patience, which is coincidentally part of why they exist to begin with. Hanging on requires discipline.

Ch-Ch-Ch-Ch-Changes Last year was marked by some swift and sizable changes in factor leadership. There were some common themes among them. Each is a reminder of what I believe to be the core tenets of successful factor investing: discipline and diversification.

Exhibits 3, 4, and 5 are relative wealth charts. They plot the relative performance of the growth of an investment in one fund versus another over time. When the line slopes upward, the fund in the numerator is outperforming the fund in the denominator. For example, in Exhibit 3, you'll notice the line spikes upward beginning at the end of October 2016. During this span

Value vs. Growth VTV has lagged VUG for over a decade. As I discussed in "Value Investors Are Vexed" in the January 2016 issue of Morningstar ETFInvestor, this has tried the patience of even some of the most faithful value investors. But value made a comeback in 2016. For the year through Nov. 30, VTV outperformed VUG by nearly 9 percentage points. This wasn't magic, but classic value investing in action. The largest contributors to VTV's performance through the first 11 months of the year were stocks in the GICS financials, industrials, and energy sectors. These stocks entered 2016 battered and bruised and took some additional lumps early in the year. Fast-forward to the end of November, and these three sectors were the best performers within the S&P 500. At the risk of stating the obvious, value works best when there are values in the market.

Source: Morningstar Direct. Data from Dec. 1, 2013 through Nov. 30, 2016.

Small vs. Large

Small-cap stocks, represented here by

Source: Morningstar Direct. Data from Dec. 1, 2013 through Nov. 30, 2016.

High Beta vs. Low Volatility

Low-volatility stocks have been market darlings in recent years as investors have flocked to relatively safer equities in search of income and the prospect of a smoother ride for the equity sleeves of their portfolios. Higher-beta stocks, represented here by PowerShares S&P 500 High Beta ETF SPHB, have lagged their less risky peers, represented here by

Key Take-Aways 1 | Factors have cycles. They will experience stretches of out- and underperformance relative to other factors as well as the broader market. No two cycles are identical. These periods can be spurred by different fundamentals and will vary in length. Oftentimes, they will lag for a duration that is many multiples the duration of an average investor's patience.

2 | The payoff to any given factor may be concentrated in a short period of time. Think of value after the bursting of the tech bubble. Predicting these spurts is impossible.

3 | Factors' cyclicality is also part of why they exist. Investor behavior is a key driver of factors' ups and downs.

4 | Timing is a bad idea. It is all but impossible to do well, and the payoff of implementing a successful timing strategy isn't likely great enough to justify the risk.

5 | As is virtually always the case, diversification is probably your best bet. Combining a number of single-factor funds or investing in a multifactor fund could diminish the likelihood of bad behavior and thus increase the odds that you'll put factors to good use.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)