A Journey through Emerging Markets' Ups and Downs

Using Morningstar's indexes as platforms, we explore the cyclicality of emerging-markets stock returns over the past decade.

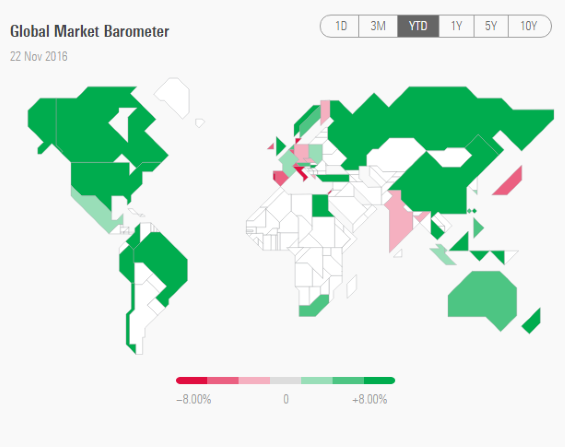

The recent sell-off in emerging markets has interrupted what had been a nice rebound in 2016. The Morningstar Emerging Markets Index has shed 6% for the one-month ended Nov. 21 (in USD terms). Investors have been selling emerging-markets assets in the wake of sliding local-market currencies and increased fears of trade protectionism under U.S. President-elect Donald Trump. Nonetheless, the index has made strong gains this year; it is up 8.9% for the year to date.

By contrast, the Morningstar Developed Market Index USD has gained just 5.2%. Judging from the Global Market Barometer heat map, Western Europe and Japan have weighed on developed-market returns. Emerging markets across Asia and Latin America have been volatile in recent weeks. But Latin American markets have posted strong gains this year, along with Russia and South Africa.

- source: Morningstar Analysts

Commodity prices, China, and Central Banks (what PIMCO calls "The 3 C’s") have been offered up as explanatory variables. But don’t discount the power of reversion to the mean as a force in its own right.

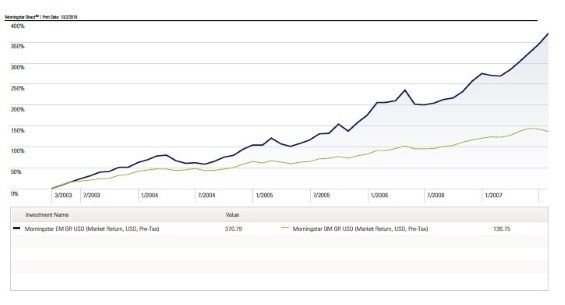

Consider the cyclicality of emerging markets' versus developed markets' performance in recent years. During the period depicted below, deemed by Morningstar’s manager research team as the "Easy Money Recovery" from the early 2000s' bear market, emerging markets went on an absolute tear. After the TMT bubble burst, there were BRICS (Brazil, Russia, India, China, and South Africa). Lesson: Beware investment acronyms!

- source: Morningstar Analysts

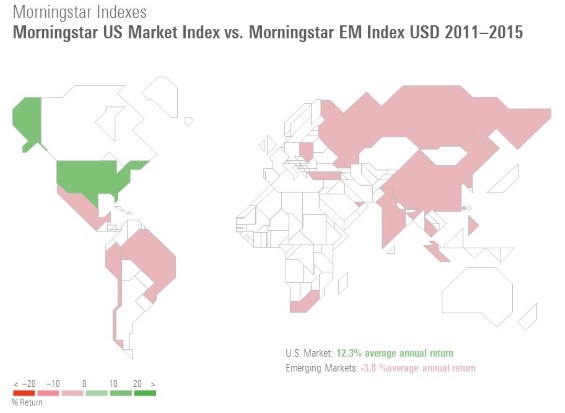

Then the financial crisis happened, and emerging markets crashed hard. Though they bounced back in 2009, they struggled mightily in recent years along with other riskier assets. The five-year period between 2011 and 2015 was all about sharp contrasts: developed markets over emerging, large caps over small, growth stocks over value, and quality over junk.

- source: Morningstar Analysts

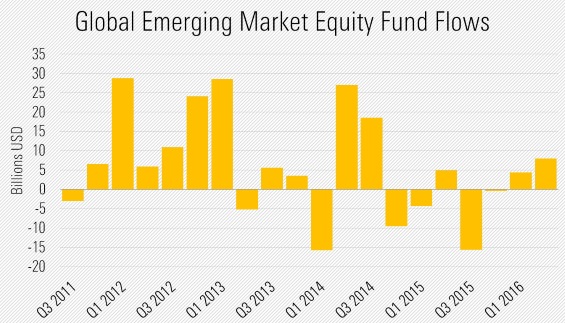

Unfortunately, investors have not been positioned to reap the full benefits of the emerging-markets rebound. Looking at asset flows for the past few years, Morningstar's global category for emerging markets equity experienced net outflows in 2015, though flows have notably perked up during the 2016 rebound. This means the Morningstar Investor Return (money-weighted) will lag total returns for emerging markets.

- source: Morningstar Analysts

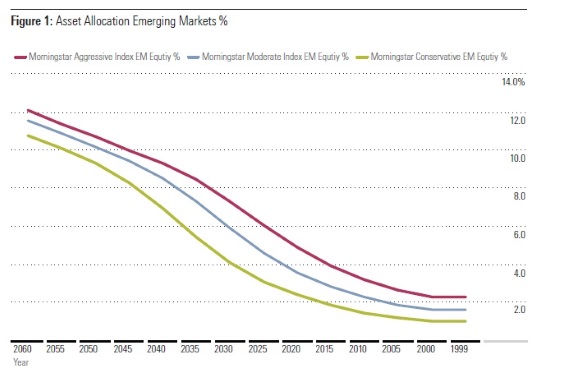

Value-driven asset allocators--including the folks at Morningstar Investment Management--have been keen on emerging markets for some time. As of July 2016, they still saw value in the asset class. At the July 2016 reconstitution for the Morningstar Lifetime Allocation Indexes (a target-date series), Morningstar increased the allocation to emerging-markets equities across index vintages in response to improved long-term expectations.

- source: Morningstar Analysts

The ups and downs of emerging markets over the years have served as a poster child for the cyclicality of asset classes and the power of reversion to the mean. Sticking to a long-term strategic asset allocation and riding out the cycles, or even increasing exposure when the asset class is out of favor, seems to be the winning strategy.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)