Investing Taxable Money in Active Stock Funds? Bad Idea

Active U.S. equity funds seldom beat a comparable index fund after taxes.

So, you've got a bucket of taxable money to invest and you're thinking of plowing it into active stock funds in hopes of beating the market. Think again.

We conducted a study recently in which we examined the aftertax returns of all U.S. equity funds compared with relevant Vanguard index funds. What we found was that very few of those funds beat the Vanguard index alternative after taxes. In fact, your odds of succeeding would have been about the same as landing a coin on heads three times in a row.

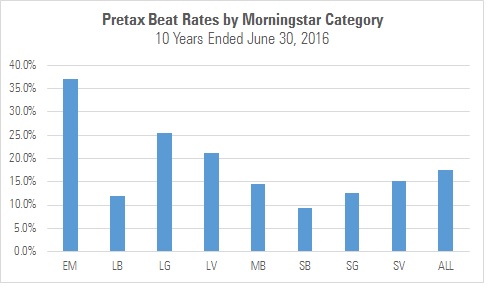

Starting Point To understand why that's the case, let's review how often active stock funds beat their indexes (or, in this case, comparable Vanguard funds) before taxes. Here's a chart that shows the number of active U.S. equity funds that beat a relevant Vanguard fund over the 10-year period ended June 30, 2016.

Source: Morningstar Direct. Data as of 06/30/2016.

The beat rate equals the number of successful active funds in a category. We defined a "successful" active fund as one whose 10-year annualized return as of June 30, 2016, exceeded that of a relevant Vanguard index fund. We calculated the beat rate by dividing the number of successful active funds by the total number of funds that began the period in that category. Funds that began the period but did not finish because of merger or liquidation were treated as failures. The relevant Vanguard index fund is the one that began the period in the category concerned. EM=Emerging Markets; LB=Large Blend; LG=Large Growth; LV=Large Value; MB=Mid-Blend; SB=Small Blend; SG=Small Growth; SV=Small Value. Hereafter, these categories will be referred to as the "subject categories."

As you can see, relatively few funds succeeded before tax. That's not a new thing, as shown in the next chart.

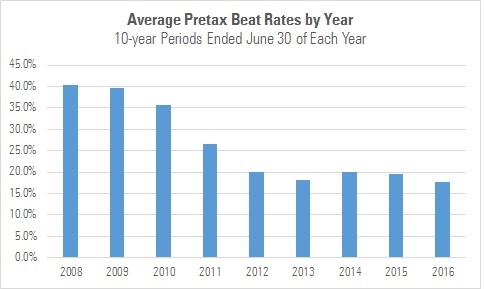

Source: Morningstar Direct. Data as of 06/30/2016.

The beat rate of all active funds that began the relevant 10-year periods in the subject categories.

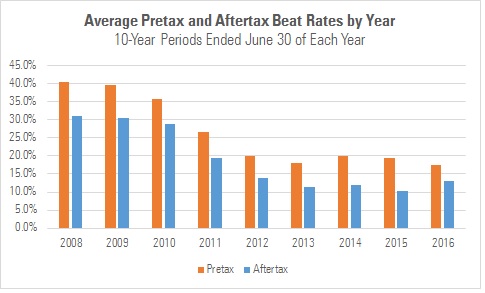

The chart tells the tale--active U.S. stock funds have consistently struggled to beat a comparable index fund before taxes. Given these long odds of success, most investors are probably better off indexing.

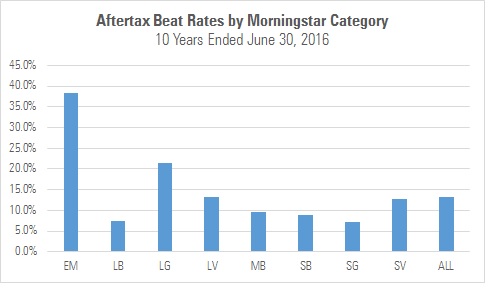

Aftertax Odds The case for passive investing grows stronger still after tax. After all, the starting point for aftertax performance is pretax performance, which we've already seen is shabby. Predictably, we find that very few active U.S. equity funds have succeeded after tax.

Source: Morningstar Direct. Data as of 06/30/2016.

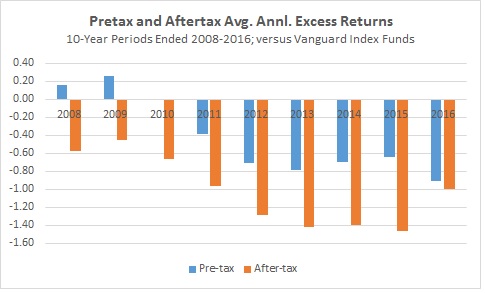

Whereas active equity funds have lagged a comparable Vanguard index fund by about 50-100 basis points per year pretax, that shortfall widened to 1% or more after taxes.

Source: Morningstar Direct. Data as of 06/30/2016.

Taxes have taken a larger toll in recent years because of an unusual confluence of factors. Namely, investors have been selling out of active stock funds amid an extended bull market (versus after a bear market, which is more typical). Consequently, those funds have had relatively few losers to sell, forcing them to trim winning positions to meet redemptions, racking up taxable gains in the process.

If there's a silver lining, it's that aftertax success rates appear to have bottomed, with the 13% success rate for the 10 years ended June 2016 improbably marking a slight improvement over the prior year.

The beat rate of all active funds that began the relevant 10-year periods in the subject categories.

(Note: The study incorporates dead funds, which are treated as "failures" for purposes of calculating success rates. However, these dead funds were not included in the excess return calculations, which are survivorship-biased. In addition, per SEC guidelines, aftertax returns are load-adjusted. While this depresses the aftertax returns of load funds, we measured success over 10-year rolling periods so as to mitigate the impact of the load adjustment.)

Best Practices Investing successfully in active equity funds is very difficult. That said, we've found that investors can boost their odds of success by favoring low-cost funds run by longer-tenured managers who eat their own cooking and are backed by a shareholder-friendly parent firm. (Not coincidentally, these are traits we look for and evaluate when we're rating funds.)

Investors intent on investing taxable money in active equity funds can improve their chances by following a few rules of thumb:

- Favor lower-turnover and capital-appreciation-oriented strategies.

- Monitor "potential capital gains exposure."

- Seek funds that have built up stores of losses.

Turnover and Style: Lower-turnover strategies are less prone to realizing capital gains. While it doesn't make sense to favor a certain style (that is, value versus growth) solely for tax reasons, keep in mind that because dividends are more immediately distributable, they're taxed sooner and in some cases, more punitively. By contrast, realization of capital gains can be deferred indefinitely in theory.

Potential Capital Gains Exposure: A fund that owns a big stake in stocks that have appreciated sharply through the years is essentially sitting on a large embedded taxable gain. That heightens the risk that the fund could be forced to make a capital gains distribution in the future. By checking a fund's "potential capital gains exposure," which expresses a fund's embedded capital gain as a percentage of its net assets, you'll mitigate the risk of getting clobbered with large taxable distributions down the road.

Loss Carryforwards: Related to the previous, active funds can use loss carryforwards to offset gains, thereby lowering their tax bill. Usually, the best time to find opportunities like these is once the smoke has cleared following a bear market (and the redemptions that inevitably follow), as funds will have built up stores of losses that can be used to burnish tax efficiency in the future.

Conclusion Most U.S. active equity funds failed to beat a relevant Vanguard index fund before and after taxes. This is not an isolated occurrence, as the clear majority of these funds have failed to beat a comparable index fund over most of the 10-year periods we studied. Given these long odds, investors should think twice about putting taxable money to work in active stock funds.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)