Gold Rush: The Performance Chase Is on Again in Gold ETFs

Gold's resurgence is driving what will likely be another cycle of bad investor behavior.

A version of this article was published in the April 2016 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

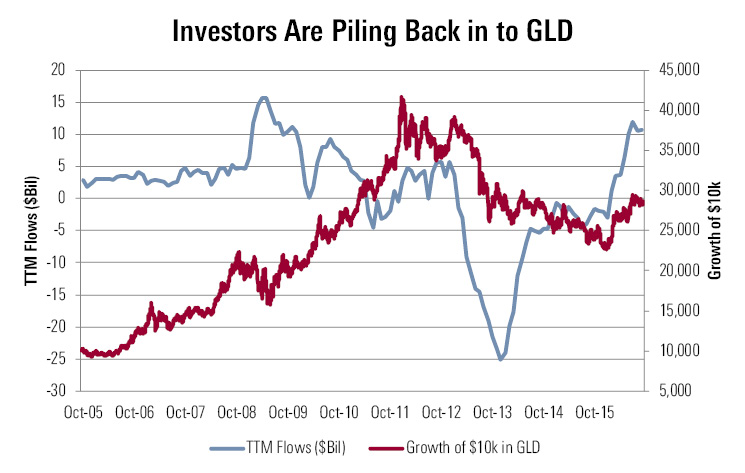

In the accompanying table, I’ve plotted trailing 12-month estimated net flows for

As you can see, investors steadily filed into GLD for a number of years before participating in a full-on gold rush that not-so-coincidentally coincided with the worst of the global financial crisis in late 2008 and early 2009. For a brief span in late 2011, GLD surpassed

Morningstar Direct. Data as of Sept. 30, 2016

Years later, as investors’ worst fears about inflation failed to materialize and the U.S. dollar strengthened, gold prices gave back ground. As the yellow metal began to lose its luster, investors capitulated. Flows into GLD ebbed at first before turning negative in the first months of 2013. Outflows ultimately peaked in April 2013.

GLD experienced net redemptions in 24 of the 33 months from April 2013 through December 2015. During that span, investors pulled a total of $23.5 billion from the fund. Meanwhile, GLD’s price declined 34%. When the market tanked during the first weeks of 2016, investors grabbed their pickaxes and shovels and headed for the hills. In the first three months of this year, investors poured $6.8 billion into GLD and another $1.3 billion into its chief rival iShares Gold Trust IAU. By the end of September, GLD had gathered nearly $12.3 billion in net new assets—putting it atop the flows leaderboard on a year-to-date basis. Flows have continued to follow performance. As of early August, GLD’s price had risen nearly 30% for the year.

But since the beginning of August, gold’s comeback has lost a bit of its shine. Safe-haven flows have slowed as the market has continued to chug along after stumbling out of the gate to begin the year, the dollar’s renewed strength has become a headwind, and inflation continues to be tame.

What’s next for gold? I’ve said it before and I’ll say it again: I have no idea, and frankly neither does anyone else. Anyone who tells you they know what an ounce of gold will be worth tomorrow, the next day, or 10 years from now is probably trying to sell you something (odds are that it is shiny and yellow).

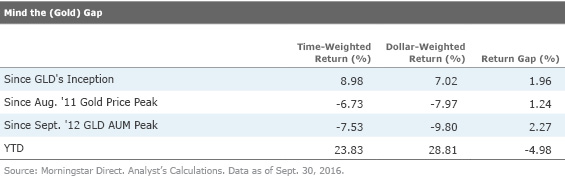

What I do know is that investors in gold-backed exchange-traded products appear to have a tendency to pay premium prices for volcano insurance once lava has already burned down their front porch. This is evidenced by the gap between GLD’s time-weighted returns and dollar-weighted returns. The return gaps displayed in the table below show that investors in GLD have generally done a poor job of timing their purchases. And while their timing has been better than average thus far in 2016, I’d expect that most will once again hold on too long and sell too late—thus repeating the same pattern of behavior that has resulted in the long-term shortfall seen here.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)