A Medicare Open Enrollment Checklist

For many, it can pay to re-shop coverage.

It's a fight against inertia.

Medicare enrollees can save hundreds of dollars on premiums and out-of-pocket costs by doing a checkup on their coverage in the weeks to come. But few bother to review what they've got or make changes.

Medicare's annual open enrollment period runs from Oct. 15 to Dec. 7--the period when enrollees can shop for new coverage.

If you use traditional fee-for-service Medicare and have a Medigap supplemental plan--and you're happy with what you have--there's no need to do anything during annual enrollment. But if you have Part D prescription drug coverage, or are enrolled in Medicare Advantage (the managed care alternative to traditional fee-for-service Medicare), it can pay to kick the tires.

A recent study by the Kaiser Family Foundation found that just 10% of enrollees in Medicare Advantage re-shop their coverage.

Focus group research by the foundation reveals that many enrollees don't check their coverage because they think "all the coverage is basically the same," says Tricia Neuman, a senior vice president of the foundation and director of its program on Medicare policy. Yet those who did change coverage between 2013 and 2014 saved $190 annually on their monthly premiums on average, and lowered their annual out-of-pocket limit by $401.

"Advantage premiums have remained stable, but median out of pocket limits have risen considerably," she says.

An earlier study by the foundation found that Part D prescription drug enrollees could save an average of 5% on their premiums by switching.

Savings isn't the only reason to do a coverage checkup. Part D plans routinely change their formularies--the list of medications that are covered--and the rules under which they are covered. For example, a plan might decide to restrict the quantity of a medication or impose a "prior authorization" requirement--essentially a lot of red tape paperwork that gets in the way before you can get a medication that your physician ordered. Or a plan can require "step therapy"--a requirement that you try a less expensive alternative to the drug prescribed by your doctor. The plan also could drop coverage of a medication altogether.

Medicare Advantage plans often include prescription drug coverage, so that coverage should be checked in the same way that you would review a standalone drug plan. But Advantage plans also can make changes--at any time--in the list of healthcare providers considered in-network. The annual enrollment period provides the opportunity for enrollees to review the list of included providers, to make sure they meet your needs.

"Your health needs change, and Medicare private insurance plans change," says Philip Moeller, a journalist and author of an informative new consumer guide to Medicare, Get What's Yours for Medicare: Maximize Your Coverage, Minimize Your Costs (Simon & Schuster, October 2016).

"Open enrollment is great annual do-over opportunity to make sure you're getting not only best price, but the best coverage," he says.

At a minimum, Medicare enrollees should take the time to review the Annual Notice of Change that Medicare sends by mail each year at the end of September. The notice lists all changes to your coverage for the coming year.

"It may not always be worth the effort to change, but seniors should at least stop and look," says Neuman.

Have I convinced you? Read on for shopping tips and resources.

Premium Trends Premium prices are on the move in Medicare. The Medicare Part B premium may jump 22% to $149 or more for some enrollees, although final numbers won't be released until later this month The higher premium amount would be billed to enrollees who are not "held harmless" under the program's rules, which don't allow the Part B premium to rise at an amount greater than the annual Social Security cost-of-living adjustment. This year's COLA is expected to be nominal; that would spread the rising premium across a limited group of beneficiaries, including new enrollees, people not yet receiving Social Security, and more affluent beneficiaries subject to high-income premiums.

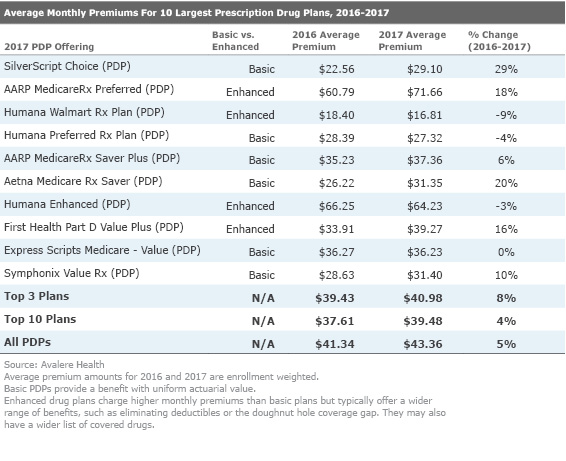

In Part D prescription drug plans, premiums among the 10 most popular plans--which control 88% of all enrollments--will rise an average of 4% next year, according to Avalere Health. Deductibles vary among plans, but the maximum deductible allowed by Medicare in 2017 will be $400, up $40 from this year.

In the Medicare Advantage market, premiums look stable for next year--in fact, the average monthly premium will fall 4%, to $31.40, according the federal Centers for Medicare & Medicaid Services.

Shopping for Part D Coverage Avalere notes that three of the most popular stand-alone PDP plans will have premiums that are 8% higher on average next year. In some cases, the increases will be much larger. For example, the largest plan--SilverScript Choice--will post average monthly increase of 29%, to $29.10. Aetna Medicare RX Saver will be up an average of 20%.

Avalere says the overall number of Part D plans offered next will decrease 23%, part of an ongoing Medicare-driven effort to eliminate duplicative offers. But the minimum number of offerings across all states is 16, and the maximum is 22.

"That is still fairly substantial," says Kelly Brantley, a vice president at Avalere. Most beneficiaries whose plans are discontinued will be transitioned into new plans offered by the same carrier--but be sure to evaluate the new plan's coverage to make sure it is a good fit. You can elect a new plan during the annual enrollment period.

Plan drug formularies are listed in the Annual Notice of Change, and full formularies can be found on the plan's website; you can also request it by phone.

Also pay attention to the method of delivery used by plans. One way drug plans keep prices down is by working through "preferred pharmacy" networks--often a big box retailer or through the mail. Make sure that a plan network meets your needs.

Another decision is whether you need an "enhanced" plan that covers you in the so-called doughnut hole--the coverage gap that requires most beneficiaries to pay out of pocket after reaching a cap. In 2017, the gap starts when spending by you and your insurance company reaches a combined $3,700; coverage resumes when your out-of-pocket spending reaches $4,950. In 2017, there will be a 60% discount on brand name drugs (up from 45% this year); generic drugs will be discounted by 49% (compared with 42% this year).

Shopping for Medicare Advantage Coverage When joining an Advantage plan, make sure you will be able to see the healthcare providers that you prefer--that they are in the plan network and taking new patients.

Reviewing the list of in-network providers can be a challenge. Providers are not listed on the Medicare Plan Finder, and a recent study by the Kaiser Family Foundation found that the information available from plan providers can be difficult to review, out of date, and frequently contain inaccurate information.

"Seniors have to contact the plan, go to their websites, or request a directory--and they come in all shapes and sizes," says Neuman. "It can be very difficult to do simple comparisons across plans."

The foundation's review also found shortcomings in the quality of providers in some Medicare Advantage provider networks. One out of every five plans did not include a regional academic medical center--institutions which usually offer the highest quality care and top specialists. And only 40 percent of Advantage provider networks included top-quality cancer centers, as indicated by membership in the National Cancer Institute's network.

Moeller recommends asking your doctors which Advantage plans they are in or can recommend.

"I always recommend going to the care providers you know," he says. "Have your annual notice of change handy so that you can review your options with them."

Help With Shopping The best online tool for shopping plans is the Medicare Plan Finder at the Medicare website. It eliminates much of the guesswork in navigating plan choices; it allows you to plug in your Medicare number and drugs (you'll need each drug's name and dosage). The tool then displays a list of possible plans likely to meet your needs; their estimated cost, premiums, and deductibles; which drugs are covered; and customer-satisfaction ratings. The finder also will give you advice about drug utilization and restrictions.

The Medicare Rights Center maintains a free telephone hotline (1-800-333-4114) that can walk beneficiaries through differences between traditional Medicare and Advantage plans, and help with selecting PDP and Advantage plans.

Federally funded State Health Insurance Assistance Programs can also provide this kind of free assistance. Funding for these programs are under threat of elimination in Congress, but dollars to keep them open were included in the recently passed continuing resolution to keep the government open, so they will be available during open enrollment. Congress will revisit funding the programs after the elections (find your local SHIP here).

If you're willing to pay to get advice and help with paperwork, hire an independent, fee-based counseling service such as Allsup Medicare Advisor or GOODCARE.com.

Talking to individual-plan sponsors by phone can help get your questions answered, but do your actual enrollment over the phone with Medicare (1-800-MEDICARE) or online in order to create an official record of your selection. That's crucial if you later find any errors in your enrollment and need to backtrack with Medicare.

Mark Miller is a retirement columnist and author of The Hard Times Guide to Retirement Security: Practical Strategies for Money, Work, and Living. The views expressed in this article do not necessarily reflect the views of Morningstar.com.

Mark Miller is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ES7BXTSJ6N4RT5GG2X7PQAHRLI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)