Vanguard's New Venture: Indexing Muni Bonds

Stable market conditions and client demand signal the right time for the firm to launch the first tax-exempt index open-end mutual fund.

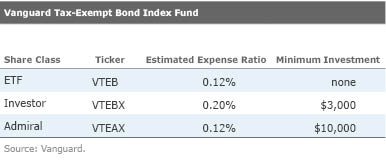

In August 2015, Vanguard launched the market's first tax-exempt index open-end mutual fund, Vanguard Tax-Exempt Bond Index VTEAX, which also features an exchange-traded fund share class, Vanguard Tax-Exempt Bond VTEB.

Muni indexing isn't a new concept for the firm. Vanguard had filed to launch three new muni index funds several years ago, and representatives argue that it had the mechanics in place to successfully track the indexes at that point. However, Vanguard withdrew the request with the Securities and Exchange Commission in January 2011 amid market turbulence and outflows. Volatile market conditions and a surge of outflows didn't augur well for a successful muni index fund launch. More recently, however, muni market conditions have stabilized, with investors having returned anew to muni funds in 2014 and early 2015 amid improving issuer fundamentals and receding headline risk. This should allow a newly launched index fund to build assets more quickly and therefore better track its index.

While relatively stable market conditions go a long way toward answering the question of "Why now?", client demand was also an important factor. Ultimately, Vanguard notes that the launch of Vanguard Tax-Exempt Bond Index was a response to a growing number of requests from clients looking for passive exposure to the muni market. Also, the ETF share class opens up a wider distribution network for investors interested in the strategy.

Run by muni portfolio manager Adam Ferguson, the fund tracks the S&P National AMT-Free Municipal Bond Index, a broad, market-value-weighted index designed to mirror the performance of the investment-grade muni market in the United States. By design, this benchmark focuses on the muni market's most liquid issuers by requiring a minimum credit rating of BBB- for bonds included in the index and a minimum par amount outstanding, among other factors.

Given the benchmark's emphasis on larger, more-liquid, high-grade issues and a duration that's currently running longer than the category norm, Vanguard's fund will likely be more interest-rate-sensitive than the typical intermediate-term muni fund. Over time, it's expected that the fund's duration, a measure of overall interest-rate sensitivity, will land between five and eight years.

Weighing the Options: Muni ETFs Until the launch of Vanguard's fund, passive investment options for muni investors consisted exclusively of ETFs with a municipal focus. As of November 2015, 34 muni ETFs appeared in Morningstar's database. Of these 34 ETFs, 29 were passively managed, while the remaining five were actively managed. Only a handful of these funds offer broad-based coverage of the muni market and have garnered more than $1 billion in assets to date.

The largest of these is

Since its Sept. 7, 2007, inception, MUB's average total return of 4.4% per year (through October 2015) carries a modest average annual tracking error of 12 basis points, indicating that the fund is performing as expected. Those results are also competitive when compared with active muni funds: Its since-inception annualized return has topped more than two thirds of actively managed muni funds in the category.

While the Vanguard and iShares funds are broadly similar, there are some initial differences to note. For one, MUB is a much larger fund, with more than $5.5 billion in assets versus VTEB's roughly $73 million (as of Oct. 31, 2015). In the realm of ETFs, size tends to beget liquidity, as measured by trading volume in an ETF's shares. Indeed, the iShares ETF is far more liquid than the Vanguard ETF at this point. Also, size also lends itself to broader sampling and thus (in theory) more-efficient tracking. However, it should be noted that VTEB has shown very modest tracking error to date despite its much smaller asset base.

Active or Passive: Things to Consider Those looking for broad, high-quality exposure to the national investment-grade muni market would be well-served in considering a muni index fund. As with other high-quality index-based strategies, the passive nature of the structure significantly reduces manager risk. At the same time, rock-bottom fees on these strategies can burnish long-term results, especially in the current low-yield environment.

With that, the index's longer duration and only limited exposure to the more risky segments of the market mean that it will have a different performance profile than funds in the muni-national intermediate category. It will likely be more rate-sensitive than the category and will lag more-aggressive peers, at least on a gross-returns basis, when muni markets are healthy and credit risk is rewarded.

Investors looking for a specific interest-rate risk profile, either shorter or longer than the average muni index, should consider an actively managed strategy tailored to that segment. Active managers typically stick to a defined interest-rate band but can add value by favoring different parts of the yield curve or by identifying mispricings in call risk.

Reasonably priced actively managed strategies are also a good option for those looking for more yield and total return from mid- to low-quality fare and a more credit-intensive approach. That's particularly true post-credit crisis given the collapse of a number of muni-bond insurers and the shrinking of the AAA segment of the muni market. The combination of thousands of unique debt obligors, ambiguous legal pledges to repay debt, and the lack of timely and consistent disclosure on the part of municipal borrowers can create opportunities for active managers to add value through detailed research and analysis when investing in lower-quality securities. This is particularly true for below-investment-grade muni bonds, as this segment represents just a small portion of the overall municipal market but often offers higher yields for those willing to take on the risk.

/s3.amazonaws.com/arc-authors/morningstar/11772336-913b-401e-8a52-aceef6752c90.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11772336-913b-401e-8a52-aceef6752c90.jpg)