Staying on Target for Retirees?

Recent market turbulence has rocked some target-date funds more than others.

In a Fund Spy from late July, we highlighted some of the ways that target-date managers build portfolios for those in retirement. Since then, market turmoil has put the safety of this segment of target-date funds to the test.

In this Fund Spy, we look at which features have helped some target-date funds hold up better than others.

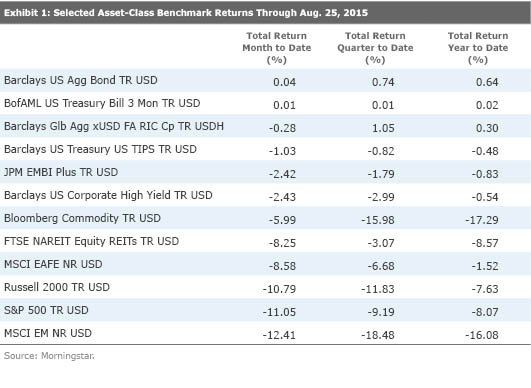

Seeing Red: Few Places to Hide Exhibit 1 shows the negative short-term returns for most broad asset-class benchmarks through Aug. 25, 2015. Emerging-markets equities fell the furthest month to date, but U.S. equities as represented by the S&P 500 didn't fare much better.

Of these benchmarks, only the Barclays U.S. Aggregate Bond Index and short-term Treasury bills managed to stay positive, and they barely did so.

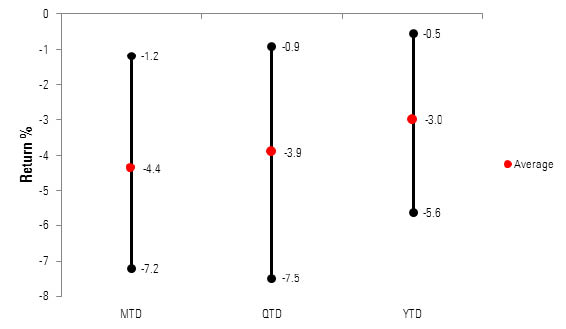

Given this backdrop, even target-date funds designed for retirees with a more conservative bent have lost money. (In fact, no target-date fund--whether meant for retirees or new workers--posted positive results during these periods.) The extent of the losses varies by target-date series, though. Exhibit 2 illustrates the wide range of short-term results for target-date funds that fall within the three Morningstar Categories intended for retiree assets--Retirement Income, Target Date 2000-2010, and Target Date 2011-2015. Of course, target-date investors should typically pay more attention to longer-term results, but this look at shorter-term performance also provides insight into target-date series' various approaches to investing.

Exhibit 2: Performance Ranges of Target-Date Funds for Retirees Through Aug. 25, 2015

Source: Morningstar.

Prepared for the Storm? A target-date series' glide path reveals its managers' stance on the appropriate balance between the appreciation and preservation of capital across different phases of life. Managers most concerned with investors' vulnerability to sudden, steep losses tend to hold less in stocks, opting to focus on bonds and alternatives. The latter two asset classes have helped some series weather the recent stormy markets relatively well, but that's not without exception.

Bonds Still the Tried-and-True Refuge … Mostly

The Wells Fargo Advantage Dow Jones Target series has held up better than all peers.

Similarly, a sizable bond allocation populated with conservative underlying strategies helped

Not all bond-heavy series held up that well, though.

Alternative Investments: Another Safe Haven? A couple of target-date series have long stood out far from the pack with their alternatives-oriented approaches, and both fared better than most amid the recent market turmoil. Putnam RetirementReady 2015 PRRHX fell just 2.6% month to date, and that fund invests more than 55% of assets in the firm's suite of Absolute Return funds. None of those funds generated a positive month-to-date return, but their biggest loss was just 4.5%--considerably less severe than those of any of the major equity benchmarks.

Invesco also consciously leans away from stocks in its Balanced-Risk Retirement series, which helped Invesco Balanced-Risk Retire Now IANAX post a relatively minor 3.0% loss month to date. The fund invests 60% of its assets in a risk-parity strategy--

Alternatives don't automatically ensure a smooth ride, though. In 2010, AB injected a volatility management strategy into its Retirement Strategies target-date series--it represents 20% of assets at the target date--in an effort to smooth returns during volatile markets. This tactic doesn't appear to have done much to protect investors' capital, as the

Meanwhile, small doses of alternatives appear to have an inconsequential effect on a number of target-date funds' recent shorter-term results, even if the underlying alternatives fund held up relatively well. For instance,

Losses Matter, More So for Retirees Should investors be worried about short-term losses? Morningstar's 2015 Target-Date Fund Landscape showed that investor returns for target-date funds are higher than their total returns on average, suggesting that target-date investors generally don't engage in ill-timed transactions, such as chasing rising returns or selling at market troughs. Target-date funds' prominent role as default investments within 401(k) plans undoubtedly supports that trend because those investors typically make regular, steady contributions regardless of the market environment. This setup helps investors stay the course in the face of market losses, allowing them to participate in subsequent rebounds instead of panicking and abandoning a strategy. However, target-date investors already in retirement may be withdrawing assets to meet income needs, thereby locking in losses and shrinking the amount of assets exposed to a recovery. As such, investors should seek a sound understanding of a target-date series' trade-off between capital appreciation and capital preservation, particularly within the retirement phase.

/s3.amazonaws.com/arc-authors/morningstar/0c1d596a-78d2-477f-acfc-a1ff33479805.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0c1d596a-78d2-477f-acfc-a1ff33479805.jpg)