PIMCO Put on Notice

We break down the SEC's inquiry into the firm's exchange-traded fund BOND.

On Aug. 3, 2015, PIMCO announced that it had received a Wells notice from the SEC regarding

What Is a Wells Notice and Why Did PIMCO Receive One? A Wells notice indicates that the SEC is considering charges against a firm based on a specific set of events. PIMCO received a Wells notice following a preliminary SEC investigation into how the firm priced certain nonagency mortgage-backed securities purchased by BOND during the period in question. Our understanding is that the SEC is looking at how PIMCO may have assigned prices to "odd lots" of those securities.

Odd lots are smaller lots of bonds than those that are typically traded by large institutions, which tend to trade bonds in increments of $1 million. That convention may vary for some types of mortgage-backed securities. In our opinion, it's likely PIMCO was able to purchase odd lots at prices below what third-party pricing services would assign to round lots of identical or very similar securities.

What Is the SEC's Concern? The SEC appears to be investigating whether PIMCO improperly priced odd lots of nonagency mortgage-backed securities in such a way that BOND may have enjoyed an unfair performance advantage. At a maximum, those securities made up less than 10% to 15% of BOND's assets--and likely a much smaller portion than that. If the SEC finds fault with how PIMCO priced those securities, it could also take issue with how PIMCO reported the performance of BOND or with the policies and procedures PIMCO used to price less liquid securities.

The SEC is also likely considering whether fund shareholders in BOND were harmed. Theoretically, early shareholders in BOND may have benefited from those securities' price appreciation. But if those securities' prices were artificially inflated, then subsequent buyers of BOND may have been negatively impacted if BOND's share price was affected by an artificially high net asset value.

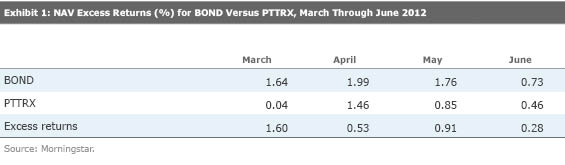

How Big of a Performance Difference Was There Between BOND and the Open-End Mutual Fund? BOND was initially positioned as an actively managed ETF employing the same strategy as PIMCO Total Return PTTRX. BOND wasn't set up as a share class of PIMCO Total Return, so it would have been unreasonable to expect identical performance from the two funds, in large part because of the significant differences in the funds' sizes, flows, and opportunity sets. Even so, the early differences in monthly performance on a NAV basis were eye-catching, as reflected in Exhibit 1:

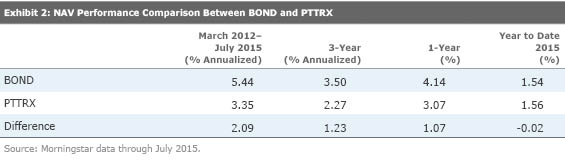

Between BOND's Feb. 29, 2012, inception through June 30, 2012, its 6.26% gain far exceeded PIMCO Total Return's 2.84%, driven in part by the strong performance of its nonagency mortgage-backed stake. Since then, the funds' gains on a NAV basis have tracked more closely together, as reflected in Exhibit 2:

Although PIMCO group CIO Dan Ivascyn has repeatedly mentioned that PIMCO is working toward less performance dispersion across similar accounts, the portfolios, flow patterns, and opportunity sets of BOND and PIMCO Total Return PTTRX will continue to be different, so even if both funds are guided by PIMCO's macroeconomic outlook, performance between the two funds won't be identical going forward because of their different portfolios.

Does This Alter Morningstar's Opinion on BOND or Other PIMCO Funds? Thus far, it appears the SEC is focusing on BOND and the specific time period in question, not a broader set of PIMCO funds or time periods. We're not aware of any other SEC inquiries into the pricing of securities at other PIMCO funds or during other time periods. While we'll continue to closely monitor the situation, there is nothing definitive about a Wells notice, and therefore PIMCO's receipt of one doesn't alter our view of BOND, PIMCO's other funds, or the firm as a whole. PIMCO's Stewardship Grade remains a C, and its Parent Pillar score remains Neutral. We may revisit that stance as more information comes to light.

How Might the SEC Investigation Unfold? Some Wells notices lead to disciplinary actions, others do not. In this case, PIMCO has an opportunity to respond to the SEC, ostensibly to demonstrate that its pricing policies and the pricing of the securities in question were consistent with relevant pricing regulations and market standards. If the SEC finds fault, it will likely bring administrative proceedings, during which PIMCO and the SEC may settle. That settlement could include restitution to BOND shareholders, fines, and PIMCO either admitting to or not admitting to charges brought by the SEC. If PIMCO chose to fight the charges, ultimately the case would be tried before a judge for a final verdict.

In a number of other pricing-related investigations that we've monitored in the past where the SEC ultimately did bring disciplinary actions against asset managers, part of the disciplinary action did involve the asset manager making the fund shareholders whole; that is, the asset manager essentially paid to the affected funds whatever amount the SEC determined to have been lost by fund shareholders because of the events that occurred. We'd expect PIMCO to do the same. We don't know specifically what a settlement might look like, or whether the SEC might pursue additional actions against individuals at the firm, such as the chief compliance officer, portfolio managers, members of the pricing committee or pricing group, or others involved in the actions under investigation.

Is This a PIMCO Problem, a Bond-Pricing Problem, or an ETF Problem? Without more information, we can't speculate whether PIMCO acted appropriately or inappropriately. But we do know that the broader fixed-income pricing issues at hand are neither unique to PIMCO nor intrinsic to ETFs. Based on many conversations with fixed-income market participants during the past 20-plus years, our understanding is that smaller funds that traffic in less liquid parts of the fixed-income markets--particularly those that are growing quickly--may have grappled with similar issues and likely benefited from purchasing less liquid securities at bargain prices.

Here's why: Unlike most equity markets, bonds are generally traded over the counter rather than on an exchange. Exchange-listed equities are priced with one price, and market participants react to that single price. In over-the-counter markets, a buyer like PIMCO can work with multiple sellers and receive multiple prices for the same security. That's because each seller may have a different opinion on what a security is worth or have varying motivations for selling securities--one may want to sell a security more urgently than others, in which case it may legitimately sell the security at a lower price. Part of the skill and expertise of active fixed-income managers is their ability to assess various prices and to spot securities they believe are undervalued by individual sellers or the broad market.

A second piece of the equation is that many traditional fixed-income market makers, such as the trading desks within large banks, have been scaling back their inventories since 2008's crisis, particularly in less liquid securities, including nonagency mortgage-backed securities.

Now consider that smaller funds are able to benefit more from smaller positions in discounted securities than bigger funds: A $1 million position in a deeply discounted bond that appreciates in price can have a bigger impact on a $100 million portfolio than on a $100 billion portfolio. From a different angle, smaller funds by necessity need to own smaller positions to remain diversified, including odd lots that might be overlooked by larger portfolios.

Add those pieces together and it's very plausible that an asset management firm with any bargaining power (and PIMCO by reputation is a fierce negotiator) could offer to take odd lots of less liquid nonagency mortgage-backed securities off a dealer's hands for a discounted price, or that a dealer looking to get those securities off its books or curry favor with PIMCO could make those securities available to the firm at a discount. If a third-party pricing service doesn't make distinctions between how it prices odd lots and round lots of those same securities, there could very well have been material differences between the prices BOND paid for various odd lots and the prices that third-party pricing services would assign to those same securities. We don't know for sure that's what happened, but trading and pricing in the fixed-income markets are such that it could have.

These types of issues existed well before 2008's financial crisis. But theoretically, given the extended outperformance of nonagency mortgaged-backed securities since the crisis, it's possible that other open-end and exchange-traded fixed-income funds that opened since then grew quickly in the ensuing 12 months and held significant chunks of less liquid securities (for example, high-yield bonds from smaller issuers, nonagency mortgage-backed securities, other securitized bonds like asset-backed securities or collateralized loan obligations, and so on) could have faced a similar situation and/or benefited to a similar degree from purchasing securities at bargain-basement prices.

All told, we will continue to monitor the situation closely and weigh in as more information about PIMCO's particular situation or the SEC's approach to these broader pricing issues comes to light.

Associate director of fixed-income strategies Sarah Bush and senior analyst Eric Jacobson contributed to this article.

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)