Valuations Across the Sectors of the S&P 500

It can be helpful to evaluate both fundamental and relative equity valuations, with a few caveats.

Evaluating equity exchange-traded funds for tactical investments is not unlike the process of selecting individual stocks. Equity ETFs are, after all, baskets of stocks. So naturally, we can apply many of the same valuation techniques we use when evaluating individual stocks.

A valuation-based view of the world is helpful when making all of your investment decisions. Even the most avid proponents of passive investing estimate expected returns for various asset classes when establishing their strategic asset allocation. Active investors with more of a tactical bent are likely to rely on valuation metrics to a greater extent. Investors in this more active camp assume that over a given period of time the market gets asset prices wrong but eventually corrects itself as new information becomes available.

Let's take a closer look at the two most common valuation methods: fundamental valuation and relative valuation. Whether your strategy (or personal preference) favors fundamental or relative valuation, it can still be helpful to check both methods. Scrutinizing your investment ideas from every possible angle will only help bolster your confidence.

Getting Fundamental Discounted cash flow analysis forms the basis of fundamental valuation. With the DCF approach, the value of a stock is not how much someone else thinks it is worth or is willing to pay for it. Rather, the value of a stock is the present value of its expected future cash flows, which are discounted back at a rate that reflects the uncertainty of those cash flows.

As with all models, the information you get out is only as good as the information you put in. Making accurate, or useful, forecasts relies on using sound assumptions. This requires an intimate knowledge and familiarity with a company's business model as well as the competitive dynamics of the given industry and the regulatory environment surrounding it. If you're feeling intimidated, don't worry.

Morningstar has a team of 125 equity and credit analysts who conduct fundamental analysis and derive fair value estimates for more than 1,800 companies worldwide. Think of it as your very own army of fundamental equity research analysts. Because these data can be aggregated to the fund level, we can form an estimate of intrinsic value for equity ETFs*, which are simply worth the sum of their constituent parts.

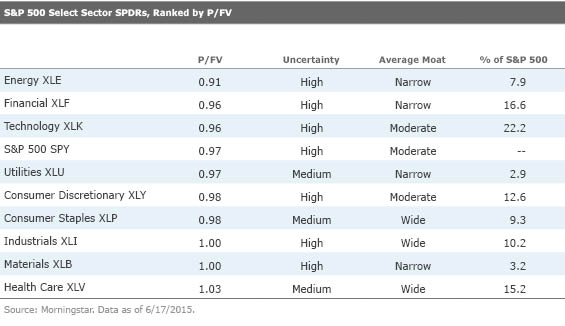

Access to Morningstar's vast equity research resource gives us a unique advantage in that we can use the research to form thematic ideas about which sectors appear attractive and which sectors investors should avoid. The following table highlights the S&P 500 sectors, ranked from lowest price/fair value to highest.

Currently, Morningstar analysts believe the market is just slightly undervalued. After the beating it took amid plunging oil prices, energy looks like the cheapest sector. At the other end, health care is currently trading at a slight premium to Morningstar analysts' estimate of fair value following a string of strong performance.

It's All Relative The popularity of relative valuation stems in part from its simplicity and convenience. Relative valuation estimates the value of an asset by comparing the pricing of similar assets relative to a common variable like earnings, cash flows, book value, or sales. This much simpler and more straightforward method of valuing stocks is most useful as a reference point, or sanity check. Investors should keep in mind that there are limitations to using multiples and that using them in isolation could produce misleading results.

Metrics like price/earnings ratios, or P/E, often contain a lot of "noise." By now we have probably all heard of those infamous special one-time noncash charges that can wreak havoc on earnings statements. But management also has several levers it can play with to "massage" the income statement. For example, the waters can be easily muddied by adjustments to the tax rate or an asset's depreciation schedule. Because earnings can be easily manipulated, many investors prefer using a price/sales ratio. But there are also drawbacks with P/S--namely, it tells you nothing about profitability.

Another common relative valuation metric is price/book value. This ratio can be useful when gauging sectors or industries that tend to have tangible assets, like factories and production facilities. We prefer this metric when comparing banks and financial firms, as the businesses are essentially an assembly of financial assets. On the other hand, it doesn't make much sense to use P/B when analyzing the technology or health-care sectors; P/B fails to reflect intangible assets such as intellectual assets, which are often the lifeblood of technology and health-care firms.

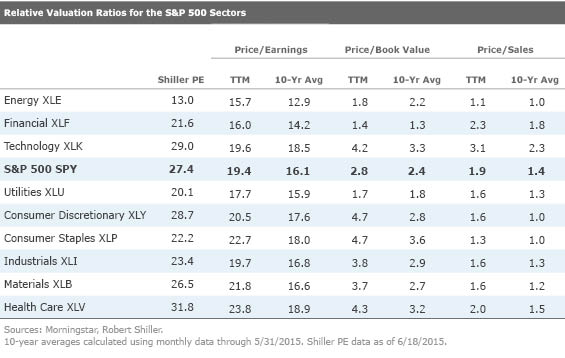

Understanding the shortcomings of various relative valuation techniques is important and should help you make more-informed investment decisions. Below we highlight the P/E, P/B, and P/S ratios, based on the trailing 12 months, or TTM, for each of the S&P 500 sectors. For context, we compare today's ratios with the historical 10-year averages. Shiller PE ratios are also included for comparison against TTM P/E ratios.

Using relative valuation multiples on index investments, such as ETFs, introduces another unique challenge. When interpreting valuation ratios for an index, make a note of how the index provider treats anomalies in the data, such as firms with negative earnings, which will impact overall results.

Use the Right Tool for the Job Before you go and screen valuations in the equity ETF universe, we should lay out some ground rules. The first step to any good investment requires developing a sound investment thesis. And to boost your chances of success, write it down. Putting the idea on paper and being able to articulate it to others will only help shape and strengthen your thesis.

Also, make sure to select the investment vehicle that most closely aligns with the thesis. ETFs are a great way to implement thematic ideas because the diversification inherent in a fund avoids the idiosyncratic risk of single stocks. On the other hand, picking individual stocks offers the potential for spectacular returns if you believe you have an edge or some sort of special insight into a given company.

For instance, if your tactical investment thesis is based on the success of a particular product, a specific corporate strategy, or estimated synergies from mergers and acquisitions, then investing in the individual stock will be the most effective way to express (and hopefully capitalize on) that thesis. In such cases, you are actually seeking exposure to the firm-specific risks that are diversified away in the ETFs.

However, if you have a more thematic investment thesis, like higher commodity prices in the future will boost profitability for resource firms, an ETF could be the way to go. With the ETF, as opposed to a single stock, we are essentially making a bet that a rising tide will lift all boats. An ETF would also be the vehicle of choice to take advantage of situations where you believe the market has greatly over- or underreacted to a particular news item.

For example, a health-care ETF would have fit the bill if you thought the market was unfairly punishing health-care stocks when reform was introduced and uncertainty skyrocketed. In this case, going with an ETF protects us from the risk of selecting a firm whose internal miscues outweigh the impact of broader industry trends on its performance. A surefire way to a poor investor experience is having the right thesis but wrong execution. Be sure to select the vehicle that most accurately reflects your investment thesis.

*Note that in order to apply fair value estimates to equity ETFs, Morningstar analysts must cover at least two thirds of the ETF's total assets. Currently this valuation metric is available for roughly 300 equity ETFs. Although this takes us most of the way, there are some ETFs with significant small-cap or international exposure that lack adequate coverage and therefore will not have fair value estimates.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

Note: A version of this article ran on Morningstar.com on June 13, 2012.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)