Enhance Fund Analysis With Study of Its Parent

Our annual stewardship survey shows firm-level analysis matters, too.

Morningstar's second annual U.S. Mutual Fund Industry Stewardship Survey, released June 26, 2015, finds that asset managers with better stewardship practices reward investors with better results.

The survey of U.S. asset-management firms' data on manager tenure, manager retention, and investment in mutual fund shares, as well as firmwide fee levels, continues our study of investment firms' stewardship practices, or evidence that shows how a firm balances its own interests with those of its fundholders.

As we established in our 2014 Morningstar U.S. Mutual Fund Industry Stewardship Survey, asset managers that practice good stewardship, as evidenced by stronger firmwide data, reward investors with superior results. In the 2015 report, we re-examine four firm-level data points and their relationship to the Morningstar Success Ratio and Morningstar Risk-Adjusted Success Ratio.

The firmwide data investigated in 2015’s study are important to the Morningstar Stewardship Grades we assign to the 20 largest fund companies based on assets under management, as well as to the Morningstar Analyst Ratings assigned to individual mutual funds. In addition to using qualitative analysis and judgment during these evaluations, we use these data points as inputs to our Stewardship Grade methodology, which hinges on five key firm-level components: Corporate Culture, Manager Incentives, Fees, Regulatory History, and Fund Board Quality. We also evaluate a firm's stewardship practices when determining their Parent Pillar ratings, designated as Positive, Neutral, or Negative. Because we have found a link between strong stewardship practices and better outcomes for fundholders, the Parent Pillar plays a prominent role in the Morningstar Analyst Rating; it represents one of the five underlying pillar ratings that help determine a fund's Analyst Rating.

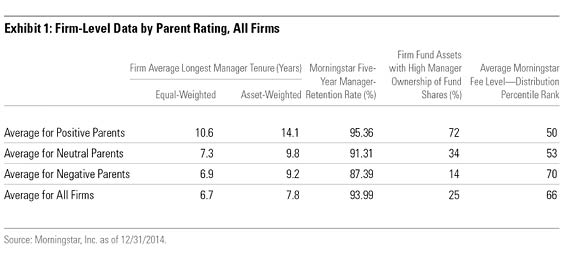

This year’s study updates our 2014 examination of four firmwide data points: firm average longest manager tenure, Morningstar five-year manager-retention rate, firm fund assets with high manager ownership of fund shares, and average Morningstar Fee Level--Distribution. Because we emphasize these data in our assessments of asset-management firms, it's not surprising to see that, on average, firms with Positive Parent ratings have better stewardship metrics than Neutral-rated ones, which have better stewardship metrics than Negative-rated firms.

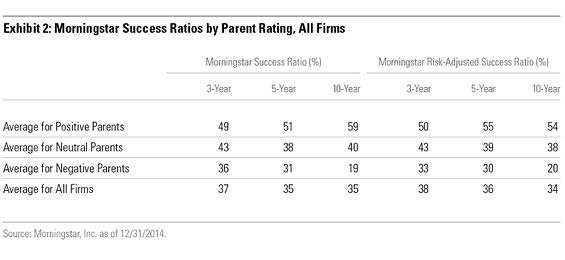

To gauge whether firms with strong stewardship metrics have produced good results, we consider Success Ratios and Risk-Adjusted Success Ratios. These ratios report what percentage of an asset-management firm's mutual fund offerings have both survived and outperformed their respective Morningstar Category median fund's results over a given time period. Across the board, firms with a Positive Parent Pillar rating have the best results, followed by those with a Neutral rating. Parents with Negative ratings turned in the worst performance, on average.

Other key take-aways from the study include the following:

- Across the industry, manager tenure remains short: Nearly a third of the firms in the industry have average manager tenures in the zero- to three-year range.

- Investment firms tend to be fairly stable, with the supermajority of U.S. mutual fund firms exhibiting five-year manager-retention rates above 90%. A smaller percentage of firms have five-year manager-retention rates below 85%.

- Manager investment in fund shares continues to be low overall; only about 20% of industry firms have high manager ownership firmwide.

- Most firms do not offer low-priced share classes across their lineups. Most firms have several share classes that have Morningstar Fee Levels of Above Average or High relative to competitors' strategies.

To see the firmwide data on the fund families represented in your portfolio, check out the full Stewardship Survey here. Morningstar calculates this information on more than 800 mutual fund managers. Currently, we assign a Parent rating to 160 mutual fund firms.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)