Tax Bracketology: Understanding Marginal vs. Effective Rates

And which one you should pay more attention to.

Question: What is the difference between marginal and effective tax rates, and which is more important?

Answer: The most straightforward way to think of the difference is that your marginal tax rate applies only to the last dollars you make over the course of the tax year while the effective tax rate represents the average rate you pay on all the money you make during the year.

The reason these two rates vary has to do with the progressive nature of our federal income tax system. Rather than tax everyone at the same rate--a so-called flat tax--the federal tax code uses a tiered system in which income up to a certain level is taxed at one rate and income beyond that level is taxed at a higher rate up to a certain level, at which a still-higher rate is applied, and so on. The top rate at which any of a taxpayer's income is taxed is considered his or her marginal tax rate, whereas the average rate the taxpayer pays across all that income is considered his or her effective tax rate.

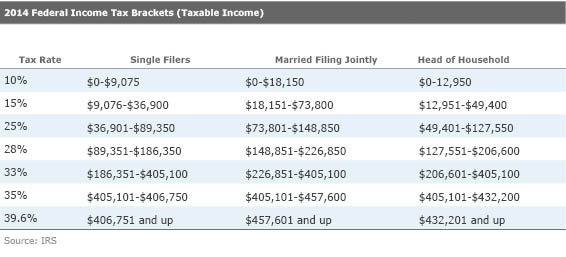

Calculating the Difference To illustrate how marginal and effective tax rates differ, let's first look at the marginal tax rates for the 2014 tax year.

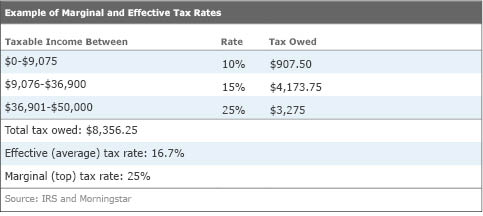

Using the above tax brackets, let's look at how marginal and effective rates come into play. For our example, we'll use a single taxpayer with $50,000 in taxable income. Here's how that $50,000 would break down in terms of the applicable tax brackets:

As you can see, the taxpayer's marginal tax rate--what she pays at the top end of her taxable income--differs quite a bit from what she pays as an overall average on her income. So, why do we hear so much about marginal income tax rates when effective income tax rates are arguably more important?

There are a few reasons. For one, political debates over income taxes often center on marginal rates, especially for upper-income taxpayers (the top rate of 39.6% currently applies to income above $406,750 for single filers or $457,600 for married couples filing jointly).

When Marginal Rates Matter However, the more important reason is that marginal rates come into play when making certain tax-management decisions. For example, let's say a taxpayer is considering whether to contribute to a Traditional (deductible) IRA, in which contributions are tax deductible, or a Roth IRA, in which contributions are not deductible but qualified withdrawals are tax-free (qualified withdrawals from a deductible IRA are taxed). Since a contribution to a deductible IRA lowers the investor's overall taxable income, the deduction is typically calculated based on the investor's marginal tax rate--that is, the rate paid on his or her last dollar of taxable income for the year. If the investor contributes $5,500 to a Traditional IRA for the year and falls in the 25% marginal tax bracket, the deduction on the contribution can be said to be worth a tax savings of $1,375 ($5,500 times 0.25).

Conventional wisdom says that if one expects his or her marginal rate to go down in retirement, the traditional deductible retirement account is preferable, while if he or she expects it to go up, the Roth is better. If the individual expects his or her marginal rate to remain the same in retirement, one could argue for either the traditional account or the Roth, as discussed in this article.

Marginal tax rates also play a role when considering other types of tax breaks as well. For those who choose to itemize rather than take the standard deduction, deductions that reduce the taxpayer's taxable income--such as mortgage interest, state and local property taxes, and charitable donations--represent a savings applied against the marginal rate. So, for someone with a marginal tax rate of 28% who paid $10,000 in mortgage interest last year, that deduction is worth $2,800 ($10,000 times 0.28). With enough deductions, that taxpayer could even fall into a lower marginal tax bracket (although taking too many deductions can subject taxpayers to the dreaded alternative minimum tax, or AMT, as discussed here).

Figuring Out Your Effective and Marginal Rates While the marginal tax rate focuses on what happens at the top of your taxable income amount, it's your effective tax rate that is typically more meaningful. After all, it's what you pay on all of your income combined that matters, not just the portion near the top.

To calculate your effective federal income tax rate, look at line 63 of your 1040 form to find your total tax (or line 12 if using the 1040EZ form). Divide this amount by your taxable income, found on line 43 (line 6 on the 1040EZ). Multiply the number by 100, and you get your effective tax rate. (This method looks at your tax rate on income after deductions and exemptions are applied; but if you wanted to use your income before these are taken out, you could instead use your adjusted gross income, found on line 37 of the 1040 and line 4 of the 1040EZ.) If you also pay state or local income tax, you can do a similar calculation using the relevant numbers.

To figure out your marginal federal income tax rate, use the table at the top of this article to see where your taxable income falls within the brackets.

Have a personal finance question you'd like answered? Send it to TheShortAnswer@morningstar.com.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)