The Almighty Dollar

Options for capitalizing on the dollar's rise.

On March 2, 2015, the U.S. Dollar Index--a trade-weighted index of the U.S. dollar versus six major currencies--reached its highest level since 2004. In the year to date, the index has gained 5.33%, on the back of a 12.25% gain in 2014. The dollar’s rise has been quick and steep, negatively affecting the returns of most international-equity, local-currency bond, and multicurrency funds in 2014. For the year, the Morningstar foreign large-blend category fell 4.98%, and the multicurrency category lost 1.64%--much of that weakness caused by currency exposure.

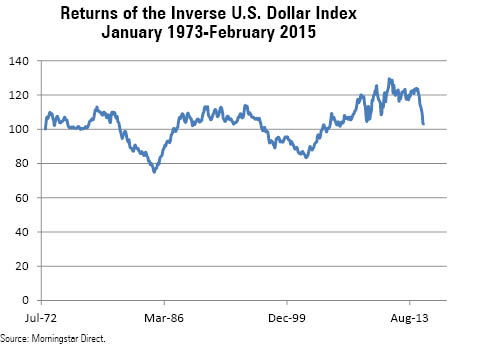

However, over the previous 12 years, foreign-currency exposure benefited investors. For the six-year period from February 2002 through March 2008, the U.S. Dollar Index slid 43.9%, a trend that greatly benefited funds with unhedged foreign-currency exposure. In the subsequent six years, from March 2008 to March 2014, the U.S. dollar traded relatively flat, apart from short-lived flight-to-safety rallies in late-2008 and mid-2010. The chart below shows the Inverse U.S. Dollar Index, which expresses the returns of a trade-weighted basket of foreign-currency exposure.

The Inverse U.S. Dollar Index has gone through several multiyear cycles of appreciation and depreciation. Over a multidecade time horizon, passive exposure to the U.S. Dollar Index has added only volatility, not additional return to a portfolio. As discussed by my colleague Ben Johnson in an earlier article, "To Hedge or Not To Hedge," hedging foreign-currency exposure most often results in lower volatility and a higher Sharpe ratio. However, over shorter periods, which sometimes can last for years, such as from 2002 to 2008, investors can benefit from taking a directional approach.

Where Is the Dollar Headed? Unfortunately for investors with foreign-currency exposure, predicting the dollar's direction is no easy feat. While stocks and bonds possess price/earnings ratios and yields, which provide at least reasonable estimates of future returns, most of the pricing of currencies is based on government policy and investor psychology, both of which are fickle.

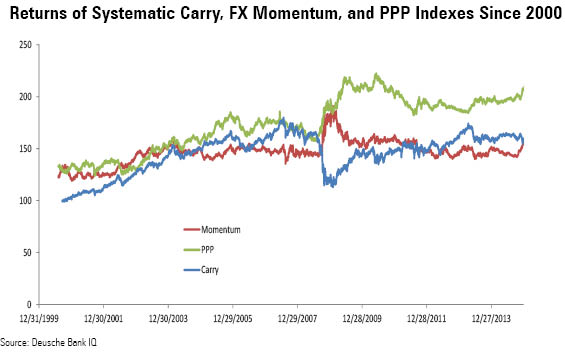

However, there is strong evidence that suggests currency markets exhibit certain tendencies that could help predict the direction of the dollar. Three systematic strategies have delivered excess returns consistently in the 40 years since the collapse of the Bretton Woods system in the 1970s (which precipitated the first free-floating currencies). These are carry, momentum, and valuation (purchasing power parity).

There are several reasons why these strategies should work. The Deutsche Bank indexes that represent them, shown above, represent the core investment approaches observed in many foreign currency-only funds and are supported by decades of academic studies. The indexes are systematically constructed using the 10 most actively traded currencies, investing long in the top three currencies and short in the bottom three currencies exhibiting their respective factors.

The DB Currency Carry Index borrows money in low-interest currencies and lends in markets that pay high interest. This strategy is paid a premium for taking currency depreciation risk. As of March 2, 2015, the index was long the Norwegian krone, New Zealand dollar, and Australian dollar, and short the euro, Japanese yen, and Swiss Franc.

The DB Currency Momentum Index invests based on 12-month price momentum. Price momentum has proved a successful strategy in many financial markets. The segmentation of currency market participants, with some acting quickly on news and others responding more slowly, is one reason why trends may emerge and be protracted. The index is currently long British pound, U.S. dollar, and Swiss francs, and short euro, Norwegian krone, and Swedish krona.

The DB Currency Valuation Index uses purchasing power parity, or the exchange rate that equalizes the purchasing power of different currencies, to gauge fundamental under- and overvaluation. The index uses Organisation for Economic Co-operation and Development estimates for purchasing power parity, which uses a basket of about 3,000 consumer goods and services, 30 occupations in government, 200 types of equipment goods, and 15 common construction projects to determine a country’s price level. The index is currently long the U.S. dollar, euro, and Japanese yen, and is short the Norwegian krone, Australian dollar, and Swiss franc.

Careful readers may note that the U.S. dollar is currently favored by two out of three of the currency factor indexes. On both the valuation factor and the momentum factor, the U.S. dollar is one of the top three currencies. Furthermore, with regards to the carry factor, it is near the middle of the pack (neutral). Based on this evidence, which collectively has shown some ability to predict currency behavior, we may be in store for an extended period of dollar strengthening.

Investment Strategies to Prepare for a Rising Dollar How can investors concerned about a continued rise in the dollar best prepare? The most logical first step is to eliminate the foreign-currency exposure currently present in one's portfolio, which is typically housed in international-equity, local-currency bond, and multicurrency funds.

Several international-equity mutual funds hedge their foreign-currency exposures, such as hedged

Local-currency bond funds can easily be swapped for regular global or emerging-markets bond funds, which typically hedge their currency risk. Many local-currency bond funds have held up rather well during the dollar’s rise, in part due to their reliance on pegged emerging-markets currencies. However, the reaction of emerging-markets policymakers in adjusting their peg is often delayed, making these funds a risky option to hold. Even better, some global-bond funds make currency management an integral part of their process, such as Gold-rated

The Morningstar multicurrency category mostly represents funds which are short the U.S. dollar, and thus are generally poor options to hold through a rising dollar environment. However, several funds in the category offer a tactical, dollar-neutral approach, which means they can benefit from a stronger U.S. dollar. Such funds are typically labeled "absolute return currency" funds. The largest of these funds is Neutral-rated

Because the dollar’s relative position versus other currencies changes over time, active currency management, such as that offered through dollar-neutral currency funds, is the preferred way to enact a strong dollar thesis. In theory, actively managed funds allow investors to systematically buy the dollar as it becomes more attractive, and sell when it becomes less so, taking advantage of the currency factors of return.

The Morningstar managed futures category bears a mention here as well. It contains currency momentum currency strategies--but they are typically embedded as only one component of a multiasset trend trend-following portfolio. For example, Silver-rated

The Inverse U.S. Dollar Index has fallen more than 17% over the past 12 months, and the currency factors of return suggest this trend may continue. Active management of currency risk is the ideal way to capitalize on this trend, and there are several funds mentioned here that fill this need directly and have earned positive Morningstar recommendations. Passive ETFs are also a solid option for global equity exposure. Undoubtedly more options will emerge as the strong dollar thesis plays out, and Morningstar will do its best to bring these options to light.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OSPGGQHXJVCGLBHR5CUUQWH3NQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)