Housing Recovery Should Gain Ground in 2015 and Beyond

Conditions are looking better, but headwinds remain for housing.

- 2014 was a difficult year for housing, as high prices, stagnant income growth, and ballooning student loan balances all limited 2014 sales of new single-family and existing homes.

- Higher wages, favorable long-term demographics, pent-up demand, skyrocketing rents, and moderating home prices should aid the conventional home market in 2015 and beyond.

- Nonetheless, remodeling expenditures, interest in apartment living, and more demand for centrally located housing could alter the complexion and the length of this housing recovery.

2014 was a disappointing year for the housing market. Although most expectations were high, even our modest forecast of 1.05-1.10 million starts proved to be too optimistic. After a lethargic 2014, we believe that the housing market will pick up in 2015 and beyond. Higher wages, improved labor market conditions, skyrocketing rents, and improving long-term demographics all provide a more favorable outlook. However, although conditions are becoming better, the housing recovery continues to battle significant headwinds.

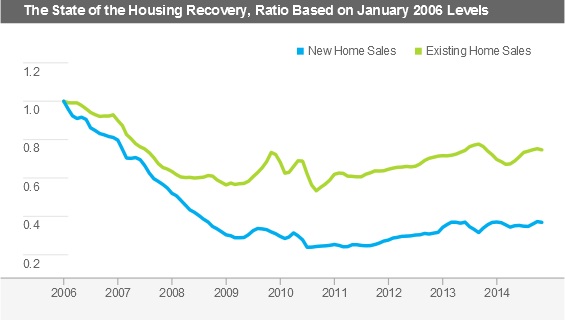

The severity of the housing bust destroyed basic construction and financial infrastructure that continues to weigh on the recovery. Between 2006 and 2009, existing home sales dropped over 40%, and new home sales plummeted more than 70%. Moreover, according to FHFA, which tracks values of homes based on Fannie- and Freddie-approved mortgages, national home prices fell over 20%, but in certain regions the decreases were much more drastic. A drop of this proportion was devastating to homeowners because of how highly leveraged they were prior to the recession.

Given those dramatic declines, many economists predicted a strong recovery that would take the housing sector back to its long-term average historical levels. Sadly, the recovery they pictured has never materialized, at least not yet. Instead, the improvements have been relatively modest so far.

Existing-home sales have done considerably better than new-home sales, recovering about 80% of the pre-recession highs, while new-home sales recaptured only a meager 37% of their previous peak (Exhibit 1). Furthermore, based on 11 months of data already available, housing starts in 2014 will most likely just break above a meager 1 million units, for the first time since 2007. That's much lower than the 1.5-2.0 million starts the U.S. economy experienced in the late 1990s. This disappointing pace of the recovery is rooted in many headwinds that the housing market continues to face.

Exhibit 1

Source: National Association of Realtors, Census Bureau, Morningstar Calculations

First-Time Homebuyer Blues The first issue contributing to the sluggish housing recovery is a lack of first-time homebuyers in the market. According to the National Association of Realtors, the share of homebuyers who were purchasing a home for the first time fell to a 27-year low of 33% in 2014. Historically this number has averaged around 40%, but it has been trending down since 2009, when a special first-time buyer tax break stimulated demand.

The lack of first-time buyers is driven by the fact that real incomes for many young adults have been stagnant for years. In fact, after adjusting for inflation, young adults who would typically be shopping for a home have not seen their incomes increase at all since the recession.

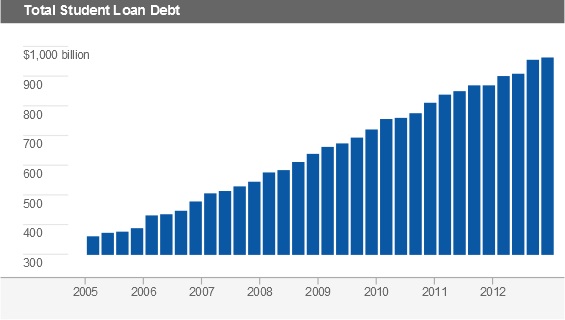

At the same time, student loans have skyrocketed 166% since 2005, as illustrated in Exhibit 2. Stagnant real incomes and ballooning student loan balances are digging deep holes in the pockets of many prospective homebuyers.

Exhibit 2

Source: Federal Reserve Bank of New York

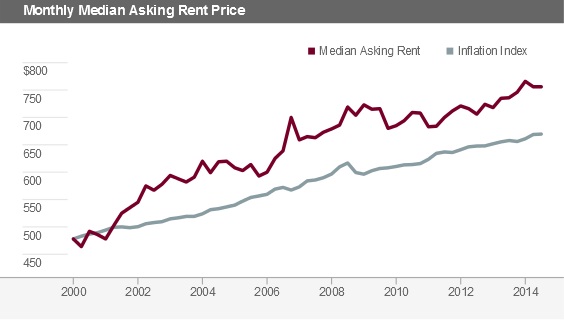

Another force working against first-time buyers is high rent prices, which have been increasing above the rate of inflation since 2001. High rents, combined with stagnant real incomes and large student loans, severely limit the ability to save for a down payment.

On top of those already-harsh headwinds, lending standards remain relatively tight. The average FICO score for GSE-approved mortgages was 744 as of the third quarter of 2014, according to Fannie Mae. Although this is an improvement from average scores above 760 from 2009–2012, it is still much higher than the average score of 716 recorded in 2007.

The absence of adequate savings, high debt levels, and a tight lending environment have made it difficult for young people to purchase their first home, and it certainly is one of the explanations why the housing recovery has never taken off.

Housing Hope? Despite the headwinds, there are reasons to be optimistic about the future of the housing market. Although we do not expect a housing boom anytime soon, we anticipate that steady improvements will continue to materialize.

First, we think that the labor market will tighten considerably in 2015. With the unemployment rate and the number of unemployed workers per job opening ticking down, it appears that there are more jobs and increasingly fewer available workers. This should result in greater worker scarcity in many industries, and it should ultimately lead to higher real wages.

Second, home-price growth has moderated noticeably since late 2013. Price growth is now at a much more sustainable and healthy rate of 4.5%, according to the latest FHFA data. Modest home price growth will help underwater mortgage holders without ruining affordability for prospective homebuyers.

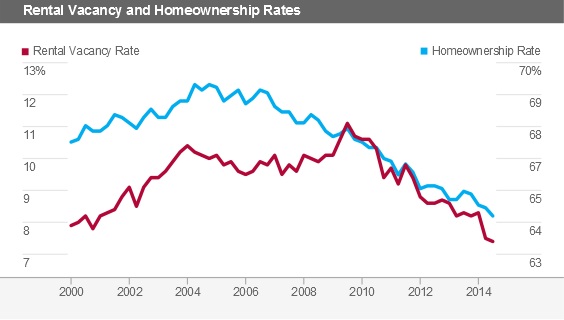

Third, we do not believe that the current relationship of historically low rental vacancy and homeownership rates is sustainable. The current high preference for renting should eventually reverse, as the supply of available rental units continues to decrease (Exhibit 3) and rent prices continue to rise (Exhibit 4).

Exhibit 3

Source: Census Bureau

Exhibit 4

Source: Census Bureau, Bureau of Labor Statistics, Morningstar Calculations

Moreover, homebuilders appear to be more optimistic about the state of the housing industry. After crashing hard during the recession, builder sentiment is finally returning to a more optimistic range. This by itself does not suggest a boom, but after a pause in 2013, optimism is finally improving again. Higher optimism could translate into better 2015 new home sales compared with a poor 2014.

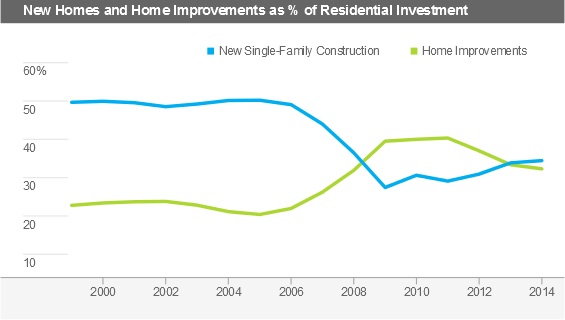

Finally, the relationship between investment in new homes and remodels has begun to reverse. After the housing collapse in 2007, remodeling became more prevalent as the new-construction business collapsed. This relationship is finally turning in favor of new single-family-home construction (Exhibit 5). Still, remodeling could represent a much bigger source of housing investment than in past recoveries.

Exhibit 5

Source: Bureau of Economic Analysis, Morningstar Calculations

2014 proved to be a particularly difficult year for housing as high prices, stagnant incomes, and high student-loan balances all hurt results. We believe that higher real wages, more favorable long-term demographics, pent-up demand, and skyrocketing rents combined with moderating prices should all aid the conventional home market in 2015 and beyond. Still, this may prove to be a very difficult housing recovery with much higher interest in condos, centrally located single-family homes, and remodeling of existing homes.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)