Why PIMCO Total Return Retained Its Gold Rating

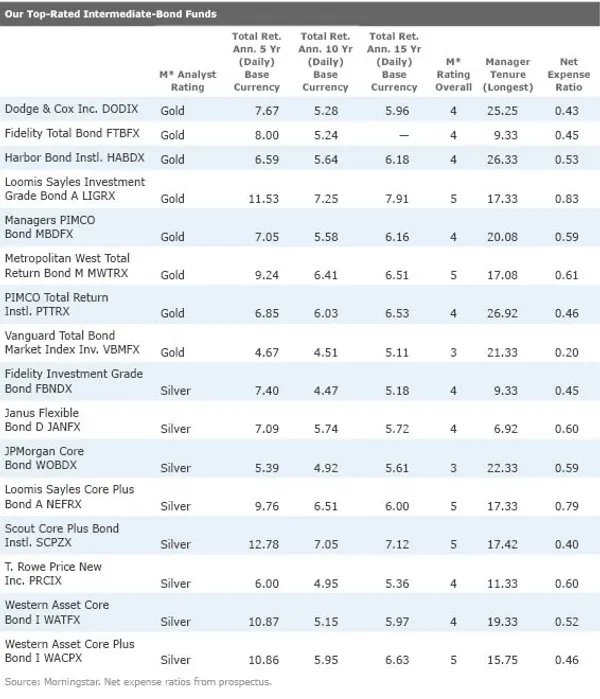

Viewed in the context of its competitors, you can see why PIMCO Total Return is still an elite fund.

Viewed in the context of its competitors, you can see why PIMCO Total Return is still an elite fund.

PIMCO has been swirling in controversy these days. Since Mohamed El-Erian left the firm, there have been a number of published reports highlighting heated arguments between El-Erian and Bill Gross. Some of the over-the-top quotes from Gross have undermined faith in his leadership just as El-Erian's departure left the firm without a clear heir apparent.

The news emphasized what we've long heard from ex-employees: PIMCO is a difficult place to work, where demands are so extreme that it's very hard to have a life outside the firm. You won't last long if your fund underperforms. This investment-bank-style culture has led to a steady stream of departures, though none as big as El-Erian's.

As a result of concerns about succession and culture, we've downgraded PIMCO's Stewardship Grade to Neutral.

However, the cupboard isn't bare. In fact, the firm is still the best in the business in many areas. Can anyone match PIMCO when it comes to managers, analysts, and traders? Can they match the breadth of expertise in corporate bonds, mortgages, sovereign credits, and derivatives?

Some can match or come close on some areas, but few are in PIMCO's league across the board. That's why we are maintaining our Morningstar Analyst Rating of Gold on PIMCO Total Return (PTTRX). The same goes for the fund's near-clones, Harbor Bond (HABDX) and Managers PIMCO Bond (MBDFX).

After hashing out the various issues facing the fund, we then turned to the ratings of other intermediate-bond funds. Looking at the Gold- and Silver-rated funds in the category, we considered where PIMCO Total Return belonged. Are Fidelity Total Bond (FTBFX), Dodge & Cox Income (DODIX), and Metropolitan West Total Return Bond (MWTRX), among others, better than or equal to PIMCO Total Return? Does PIMCO Total Return belong with those Gold-rated funds, or is it a better fit with Janus Flexible Bond (JAFIX), JPMorgan Core Bond (WOBDX), and others?

Our answer was that PIMCO Total Return is still one of the best in class. We have highly rated funds from PIMCO in a wide array of bond categories, and that speaks to the depth of talent that is brought to bear at PIMCO Total Return. Bill Gross' name may be on the fund, but in fact lots of people contribute to the fund's success. And while Gross hasn't come off well in recent interviews, he's quite adept at bringing PIMCO's resources to bear for the fund's benefit.

Work environment is an important part of investment culture and therefore relevant for fund investment decisions. But striving for investment excellence is another element of investment culture, and PIMCO certainly has that, even if it isn't the nicest place to work.

Way back in the day, I covered Mutual Series when Michael Price was there. One article called him the "meanest SOB on Wall Street." I don't know if that's true, but my conversations with him didn't lead me to think the description was on the wrong track. Yet his funds were great for shareholders. They drove a hard bargain with corporate America in order to produce great returns for investors.

On the other hand, Dick Strong at Strong Funds had a rather destructive side (chair throwing, tantrum tossing) that sometimes hurt the funds--it certainly hurt the fund company when the SEC barred him from the fund industry for life and forced him to sell the firm.

At Morningstar, we have to evaluate how a fund leader's aggression affects corporate culture, and there's plenty of evidence that PIMCO's pressure cooker has had more positives than negatives for fundholders. Should a number of key lieutenants jump ship, I'd have a different view of the culture and the appeal of its funds. In the meantime, I'd suggest sending PIMCO your money--but not your resume.

For a list of the open-end funds we cover, click here.

For a list of the closed-end funds we cover, click here.

For a list of the exchange-traded funds we cover, click here.

For information on the Morningstar Analyst Ratings, click here.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.