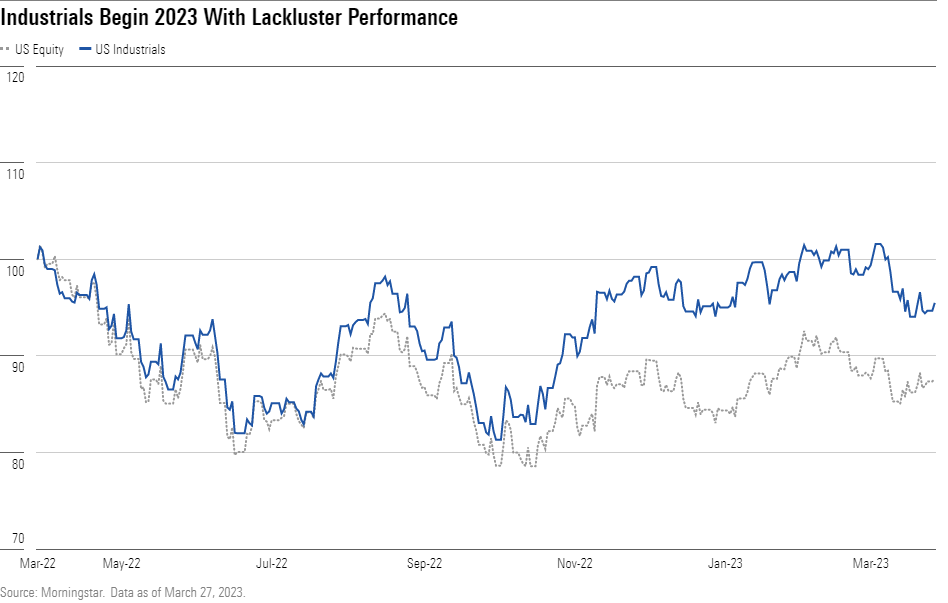

Industrials Sector Stock Outlook: Opportunities Still Available as Stocks Post Lackluster Start to 2023

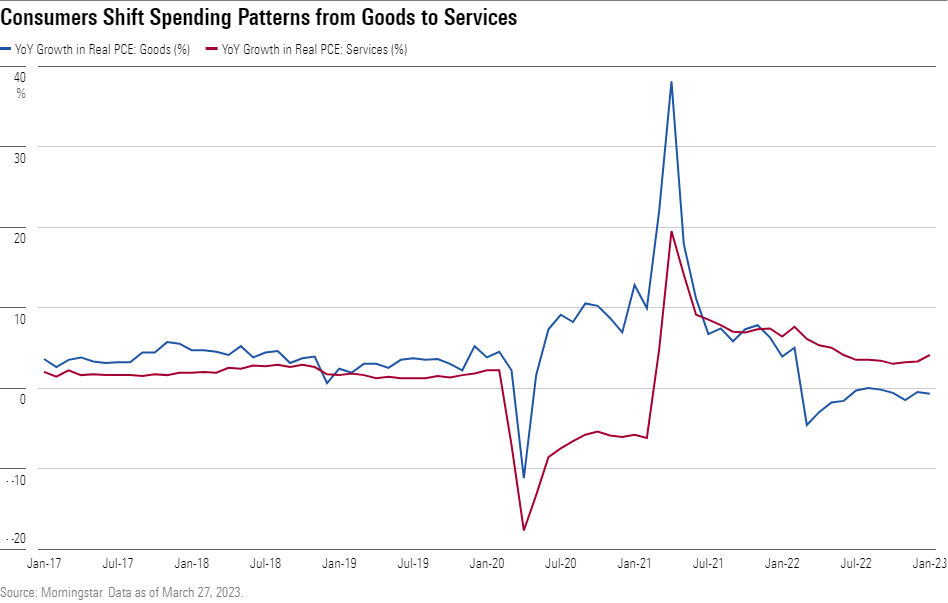

Airlines in particular have benefited from a rebound in services spending.

The Morningstar US Industrials Index’s year-to-date performance lagged the Morningstar US Market Index by approximately 330 basis points as of March 27. The industrial distribution, industrial products, and transportation and logistics industries were top performers, while the farm and heavy construction machinery and aerospace and defense industries were notable laggards.

Industrial products and distribution companies generally reported solid fourth-quarter results and signs of continued end market strength helped alleviate investor concerns of a more pronounced deterioration in the demand environment. However, if an economic downturn were to unfold, industrial distribution investors can take solace in these firms’ proven track record of monetizing working capital to bolster free cash flow. Despite this industry’s outperformance, Wesco and MSC Industrial still have attractive valuations, in our view.

Shares of transportation and logistics businesses rallied at the beginning of 2023 as investors eyed more favorable market conditions in the latter half of the year. However, investor trepidation was subsequently reestablished amid further evidence of a pullback in spending on consumer goods. Contrarily, airlines have benefited from a rebound in services spending as air travel demand continues to approach prepandemic levels. We forecast leisure and business travel volumes to surpass 2019 levels by 2024. Despite positive demand trends, a valuation disconnect still exists across the airline industry, in our view, as investor sentiment remains lackluster.

Shifts Foreseen in Years Ahead

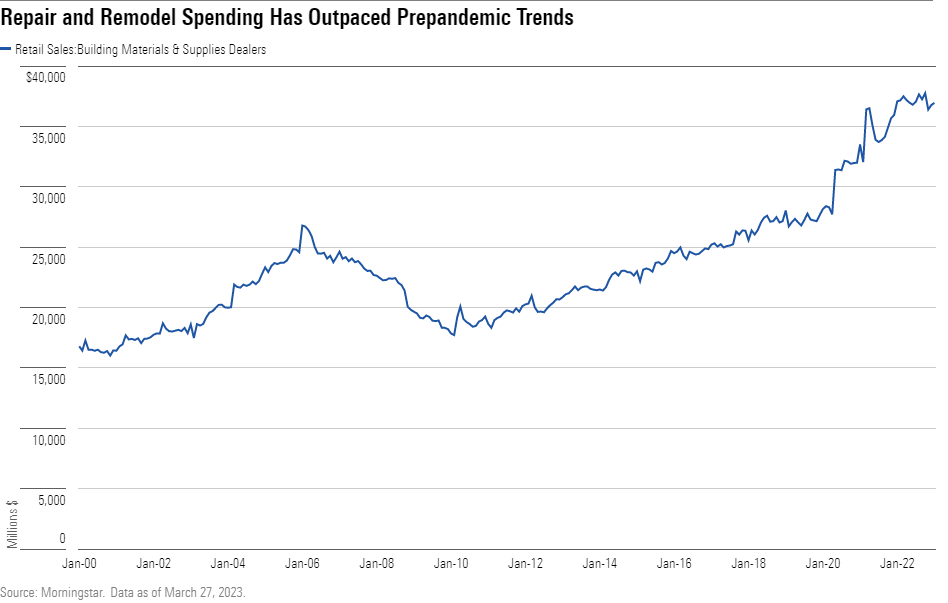

The past two years featured elevated residential construction activity and robust spending on home improvement projects. However, a rapid ascension of interest rates and persistently high housing prices have greatly affected housing affordability and prompted consumers to delay home purchases and begin to curtail improvement spending.

Repair and remodel spending has historically been less cyclical than residential construction and we expect that dynamic to continue in 2023 with R&R spending down by a low-to mid-single-digit percentage compared with over a 20% decline in housing starts.

However, we expect both markets will begin to rebound in 2024 as affordability improves.

Top Industrials Sector Stock Picks

WESCO WCC

- Fair Value Estimate (USD): 189.00

- Star Rating: 4 Stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Narrow

Wesco operates as an industrial distributor for various electrical, security, and broadband end markets. Industrial distribution is a highly fragmented industry, but Wesco’s large scale, global footprint, expansive product portfolio, and robust supplier base differentiate the firm from smaller local competitors. The company also provides various services—such as product repair and efficiency assessments —that help deepen existing customer relationships. We believe Wesco’s strong customer base, its recent acquisition of Anixter in 2020, and exposure to end markets with secular tailwinds culminate in favorable growth opportunities.

Delta Air Lines DAL

- Fair Value Estimate (USD): 60

- Star Rating: 5 Stars

- Uncertainty Rating: High

- Economic Moat Rating: None

Delta Air Lines operates one of the largest airlines in North America, serving both the leisure and business travel markets. We anticipate a continued recovery in passenger volumes from the pandemic-induced lows and expect long-term secular growth to be consistent with GDP. The company provides favorable product segmentation enabling premium options for customers, along with traveler benefits such as co-branded credit cards and frequent-flyer miles. Despite an increasingly commoditized and fragmented industry, we believe Delta remains the highest quality legacy carrier and trades at an attractive valuation.

Masco Corp MAS

- Fair Value Estimate (USD): 71

- Star Rating: 4 Stars

- Uncertainty Rating: High

- Economic Moat Rating: Wide

Masco manufactures plumbing fixtures, paint, and other building products that primarily serve the repair and remodel market. Masco’s plumbing segment is led by the Delta and Hansgrohe brands, each with extensive histories of industry leadership. Masco’s decorative architectural products segment is driven by Behr paint, a leading brand in the U.S. do-it-yourself coatings market. The company benefited from robust home improvement spending during the pandemic but is facing near-term demand softness; nevertheless, we believe Masco’s portfolio of well-known brands will return to growth in 2024.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PEXHY2NG2ZPQBNXNNFWY76ZU5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)