Morningstar Awards for Investing Excellence: Exemplary Stewardship Nominees

These three firms have a long history of putting investors’ interests first.

Today, Morningstar revealed the nominees for the 2023 Morningstar Awards for Investing Excellence: Exemplary Stewardship. The winner, alongside the recipient of the Outstanding Portfolio Manager award, will be announced later this month.

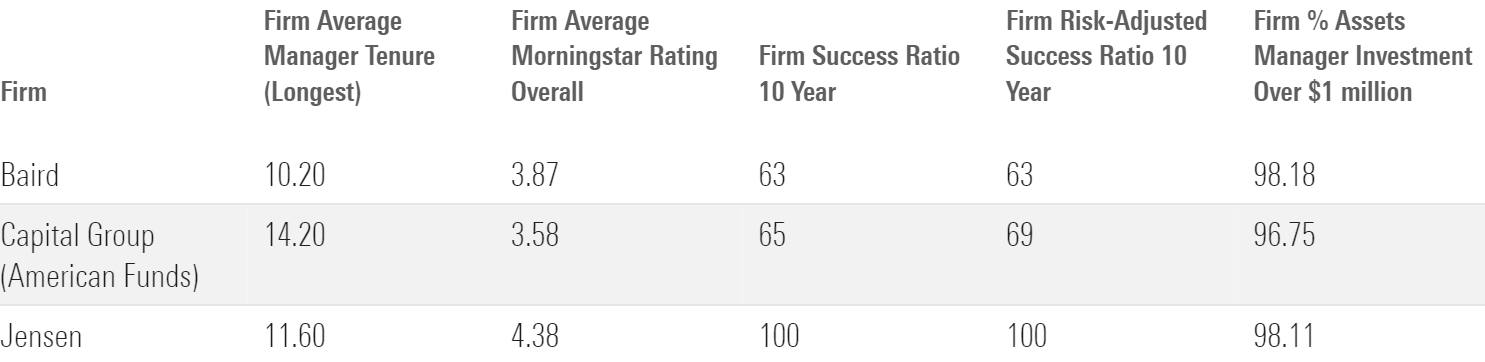

Nomination itself is an honor. Eligible candidates are limited to U.S.-based firms that have earned a Morningstar Parent Pillar ratings of High, which signals our utmost confidence in their stewardship of investor capital. Only nine firms meet this exacting standard, including previous winners The Vanguard Group (2019), T. Rowe Price (2020), Dodge & Cox (2021), and Primecap (2022). Each has developed and maintained investment and commercial cultures that stand above the competition, and that’s no less true of this year’s three nominees. They are Baird, Capital Group, and Jensen.

Baird

Previously nominated in 2021, Baird features a best-in-class fixed-income franchise and a smaller, but competitive, group of equity teams. Managing just over $110 billion at the end of 2022, Baird plays to its strengths and offers strategies that largely boast tightknit teams, sensible investment processes, and low fees.

Co-chief investment officer Mary Ellen Stanek, who joined the firm with a small crew of seasoned collaborators from Firmco in 2000 and spearheaded the firm’s asset-management business, stands out as a key contributor to Baird’s success. She and co-CIO Warren Pierson eschew a star manager system and instead have made their taxable fixed-income franchise—which oversees more than 90% of the firm’s total assets under management—a prime destination for talent in the upper Midwest, where the firm is based. As a result, the team that they shepherd rarely sees non-retirement-related departures. Their colleagues Duane McAllister and Lyle Fitterer, who Stanek recruited in 2015 and 2019, respectively, run a smaller but rapidly growing municipal-bond franchise that shares a lot of the taxable team’s structure, and each group has posted highly competitive results across a variety of market conditions. Baird’s equity effort hasn’t attracted as many assets as these groups, but its domestic growth, international-equity, and all-cap teams all sport tenured managers.

Stanek and her fellow fixed-income investors were not afraid to compete on cost from the start. And though they have not cut fees as assets have grown, each fund’s price tag remains among the more attractive in its respective Morningstar Category. Further, she and her fellow leaders have engineered compensation plans that encourage investment teams to work in a risk-aware and collaborative fashion while investing heavily alongside their clients. These investor-friendly qualities go all the way up to the privately owned parent R.W. Baird, where CEO Steve Booth oversees a firm where cultural fit is a primary input to hiring decisions, but diversity is prioritized, too. Employee ownership is also widespread and well-distributed. Baird may not have the scale of some of its leviathan competitors, but its stewardship record remains tough to beat.

Capital Group (American Funds)

It is no surprise that Capital Group has been an Exemplary Steward nominee every year since the award’s 2019 inception, as few firms have as enviable a track record and as respectable a stewardship philosophy across nearly every asset class available to U.S.-based investors. It is by far the largest firm under consideration with roughly $2 trillion under management at year-end 2022, and Capital Group has used its size and scale to keep its fees low and its reach wide.

Capital Group, which primarily uses the American Funds brand in the United States, gained its reputation off the back of its venerable and largely excellent active equity funds, but it has been willing and able to make the investments needed to diversify its lineup. Though its fixed-income and multi-asset strategies were slower to gain the same recognition as its equity offerings, Capital Group invested heavily in the teams that managed these strategies over the past decade, and today several are Morningstar Medalists. The firm has also shown flexibility in meeting investor demand without compromising its core investing philosophy. Long known for open-end mutual funds, Capital Group broke into the exchange-traded fund market in 2022 with a series of actively managed equity and fixed-income offerings. Unlike many of its titanic rivals, Capital Group has avoided launching an in-house passively managed product, but it did begin overseeing active-passive model portfolios using third-party offerings in February 2023.

The firm is currently undergoing a planned leadership transition. Longtime CEO and chair Tim Armour and vice chair Rob Lovelace will step down from their executive positions in October 2023, though Lovelace will keep his portfolio management duties. Fixed-income veteran Mike Gitlin will succeed Armour as CEO while equity investors Martin Romo and Jody Jonsson will become chair and vice chair, respectively. The three have pledged to maintain the firm’s focus on investors and cultivation of an inclusive culture. Inclusivity, in fact, is at the heart of the firm’s signature multimanager approach, first pioneered in 1958. Balancing collaboration with individual autonomy, it has allowed the firm to deftly navigate manager transitions across the lineup for decades. Unplanned investment team departures are rare, though. Indeed, portfolio managers stick around for the long haul and invest heavily alongside their clients.

Jensen

Among Jensen’s most attractive qualities is its unyielding commitment to its core competency in high-conviction equity investing. Since Val Jensen founded his eponymous firm in 1988, Jensen has refined, but not strayed from, that approach. In fact, the firm has launched only three strategies (and closed none) during its nearly 35-year history.

Jensen Quality Growth JENSX is the firm’s oldest and largest strategy. At the close of 2022, it held the lion’s share of the firm’s roughly $13 billion in assets under management. Although lesser known, sibling strategies Jensen Quality Value JNVSX and Jensen Global Quality Growth JGQSX use similar structured processes and tightknit investment teams that have provided the flagship strategy with such success over its multidecade life span.

All Jensen investors thus benefit from the same time-tested process. Each strategy’s investment universe consists only of those business that have generated a return on shareholder equity of 15% or greater in each of the past 10 years, the investment team then conducts detailed bottom-up research on stocks that make the cut. This simple but sensible research process alongside deep fundamental research have spurred the lineup’s outstanding long-term performance. Fees are neither cheap nor expensive but also are not a barrier to entry or long-term success. Jensen also provides detailed and transparent methodologies estimating each strategy’s potential capacity constraints.

Jensen managers successfully navigated Val Jensen’s retirement in the early 2000s and subsequent leadership transitions over the 2010s, and today it is well-prepared for the eventual retirement of current leaders. The firm has done a good job hiring a capable bench of talent to support its compact lineup. The firm also has one of the highest retention rates in the industry, in part, because it spreads firm ownership around its employees. It remains 100% employee owned today.

Morningstar directors Alec Lucas, Dan Culloton, and Bridget Hughes and senior analyst Stephen Welch contributed to this article.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/0958c43c-2dc5-46a0-b177-cde33d8349e5.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0958c43c-2dc5-46a0-b177-cde33d8349e5.jpg)