Getting a Second Opinion on Retirement Readiness

As their retirement date draws close, a married couple seeks a second opinion on their portfolio, their plan, and their anticipated in-retirement spending.

Editor’s Note: This portfolio makeover is from 2022. Keep in mind that the current market environment may be different than when this makeover was executed.

“Our financial goals are simply to live comfortably during our retirement, without changing our lifestyle.”

Garrett and Angela’s aims will resonate with the many Morningstar readers who write in each year seeking a check on their plan’s long-term viability as they are on the cusp of retirement. Like this couple, readers want to make sure that their portfolios will enable them to maintain their standards of living over the whole retirement.

For Garrett and Angela, that’s at least a 30- or 35-year time horizon. While Garrett is 72 and already receiving Social Security benefits, Angela is just 61. In 1 of 3 marriages, one of the spouses lives to be age 95 or older.

One tricky part of planning for this couple is that their full retirement date is uncertain, so their portfolio spending is apt to vary, along with their work income, over the next few years. Thankfully, this couple is placing only modest demands on their portfolio currently, because they’re both still working. Garrett is still employed at the small company where he spent most of his career; he enjoys staying engaged as well as his flexibility. “I have the ability to exercise a great deal of control over how much I work and when I work,” he noted. Angela is a healthcare technician and would also like to continue working for at least a few more years. “We are both fortunate that we enjoy the work we do, and the people we work with are happy to see us come to work,” Garrett wrote.

Because her job is physically taxing, though, Angela would like to retire within the next few years, ideally at age 63. But whether she is able to do so will depend in part on the affordability of health insurance until she’s eligible for Medicare.

Garrett and Angela have two daughters and six grandchildren and prioritize visiting with them for several weeks each year. The couple also has myriad other interests, including hiking, biking, and serving on boards and as volunteers for not-for-profit organizations in their community.

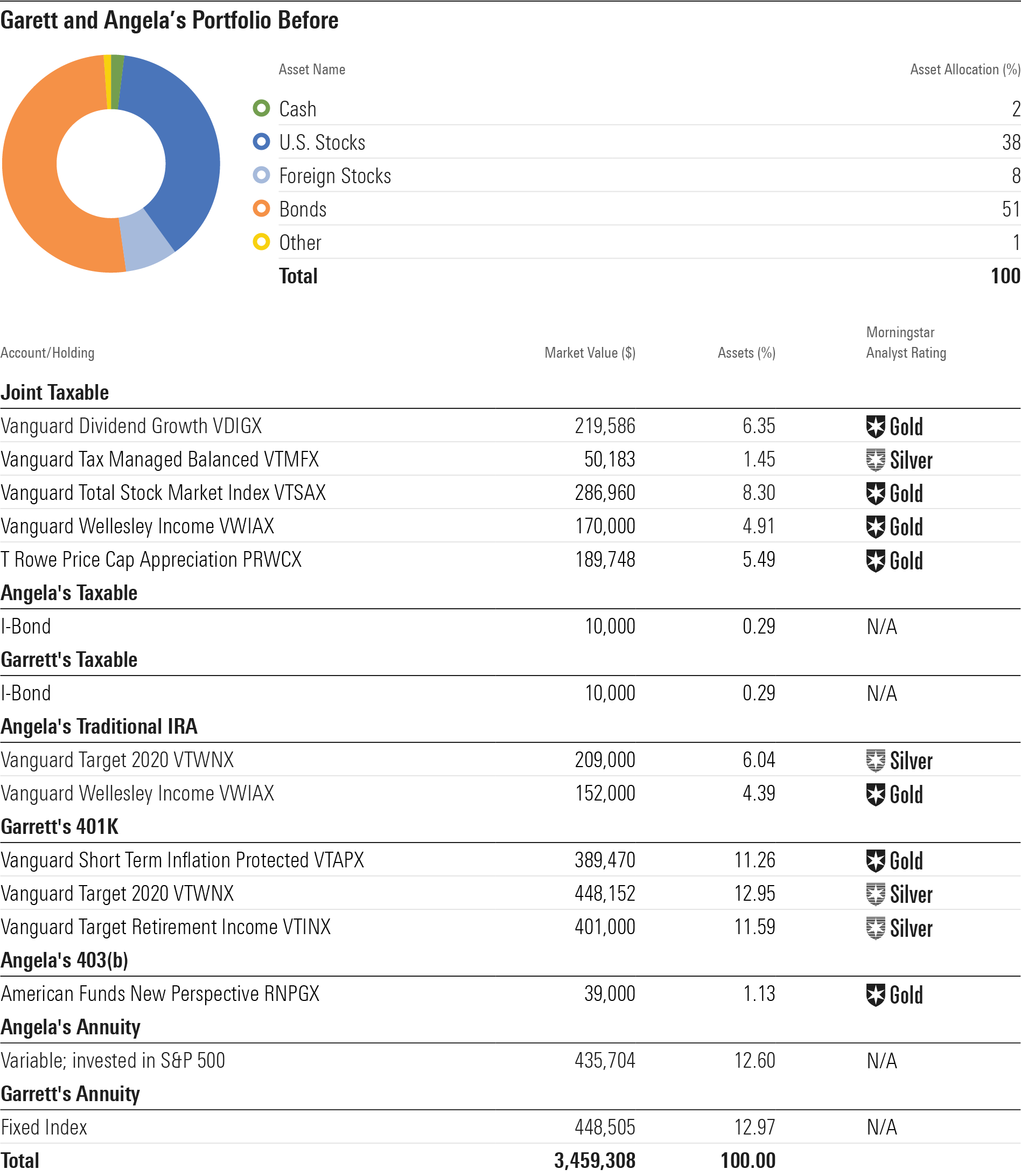

The Before Portfolio

Garrett and Angela have established a commendable nest egg: They have $2.6 million in liquid in various retirement and investment accounts and also hold more than $900,000 in two annuity contracts.

Given their net worth, their portfolio is admirably compact. That owes in part to their use of multi-asset funds that provide them with a lot of diversification in a single shot. Their asset allocation across their various retirement and taxable accounts (excluding the annuity assets) is evenly balanced across stocks and bonds, with a heavy emphasis on U.S. large caps. Their liquid portfolio also shows a strong attention to costs: Its weighted average expense ratio is 0.15%, versus an average weighted expense ratio of 0.75% for a similarly allocated basket of funds with average expense ratios.

Additionally, Garrett’s fixed index annuity will pay about $35,000 annually beginning next year. Angela’s variable annuity has a guaranteed minimum withdrawal benefit that will pay out $22,000 starting in 2026. It’s invested in the S&P 500, so if her account value increases, her payout could increase as well.

Garrett’s $1.2 million 401(k) features two near-dated target-date funds as well as a fund that buys short-term inflation-protected securities. The couple’s taxable account, the next largest pool of assets, holds Gold-rated Vanguard funds with ultralow costs. The couple has also taken advantage of recently attractive inflation-adjusted yields on I-Bonds to add small positions in each of their accounts. (Purchase constraints on I-bonds limit annual purchases to just $10,000 per taxpayer ID, with an additional $5,000 available via a tax refund.) Angela also has a small 403(b) consisting of a single fund, American Funds New Perspective RNPGX.

The couple also owns several properties with a combined value of about $1 million. In addition to their primary residence, they own a beach house a few states away from their primary residence. They also own the home that Angela’s 92-year-old mother currently resides in. Garrett notes that they will likely sell that house when she passes away.

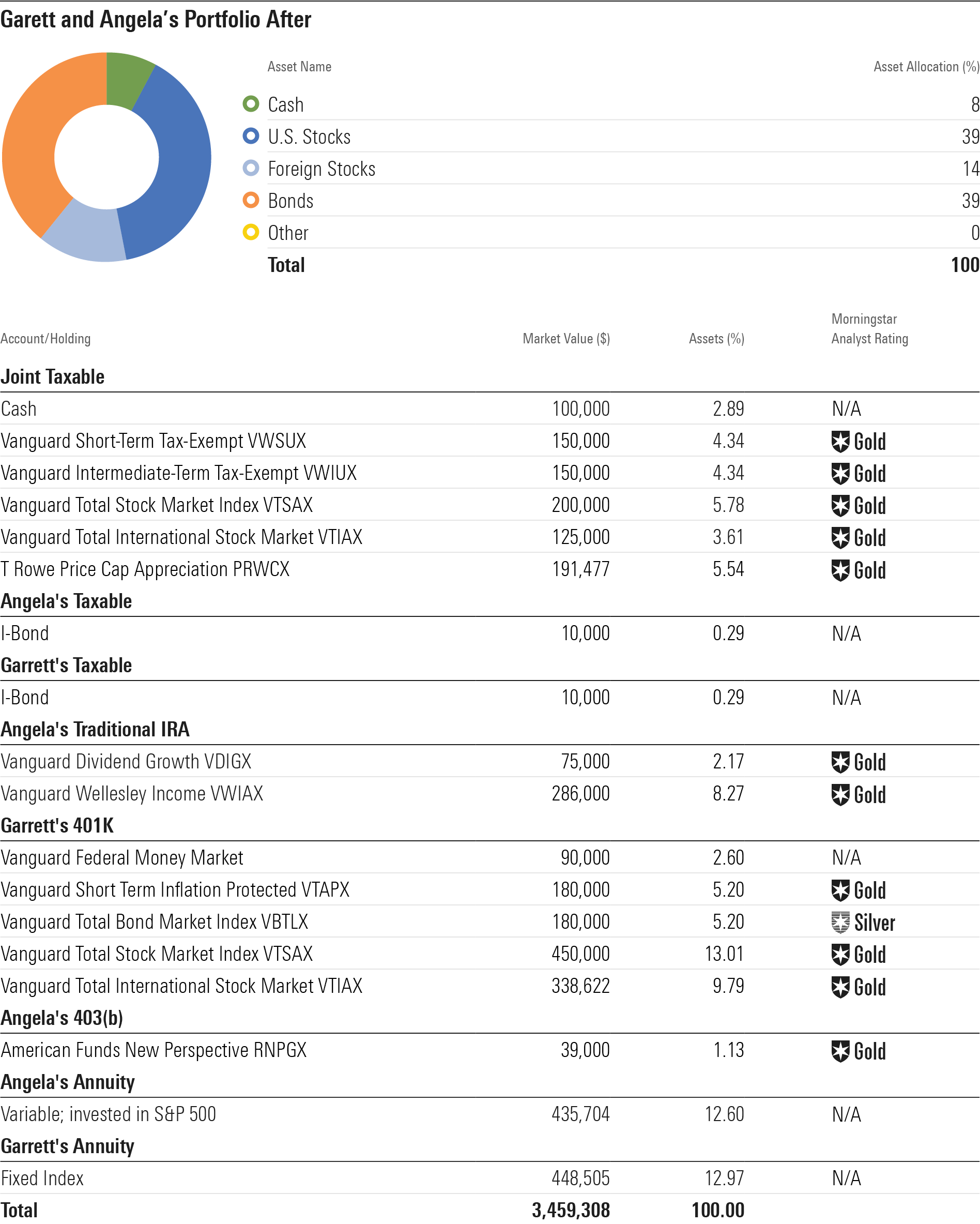

The After Portfolio

The first and most important job when assessing Garrett and Angela’s current plan is to check if any cash flow demands they’ll be placing upon it can be maintained. As with many people phasing into retirement, the couple’s cash flow needs will come in stages depending on their income from work and various other sources. Garrett notes that they’re not spending from their portfolio currently, thanks to their incomes from their jobs and his Social Security benefits. Nor will he be subject to required minimum distributions on his 401(k) because he’s still working. In fact, he and Angela are still contributing to their company retirement plans in order to earn employer matching contributions.

Garrett says that he’d like to continue to work for at least a few more years, and Angela may do so, too, with full retirement for both of them in 2026. That’s the best-case scenario for the financial health of their plan, in that they’ll be able to continue to make retirement plan contributions and defer portfolio withdrawals. Garrett notes that they’d like to have about $200,000 in total income, on a pretax basis, from all sources in the go-go years of their early retirement. With roughly half of their income needs coming from Social Security and their annuities in 2026, they’d be taking a roughly 4% portfolio withdrawal for additional cash flow needs at that time, assuming today’s portfolio levels.

If they retire sooner, that obviously puts more pressure on their portfolio and how well their plan can be maintained, especially before Angela’s annuity payments commence and she claims Social Security. Garrett’s Social Security and annuity payments will fund about $76,000 of their annual cash flow needs, with the remainder coming from their portfolio, from 2023 through 2025. That translates into a withdrawal rate of about 5% in those years.

That’s higher than the starting withdrawal amounts that much of the research would consider an amount that can be maintained, and the fact that it could coincide with a weak market environment and high inflation is also worrisome. But a few factors help allay those worries. For one thing, the couple expects that their withdrawal rate will trend down later in retirement, and research on retiree spending supports that that’s often the pattern. Moreover, the couple’s anticipated sale of one of their properties will add additional funds to their coffers eventually.

While the couple’s 50/50 allocation is reasonable, my After portfolio includes a larger stake in non-U.S. stocks, which are just a small share of the Before portfolio. More importantly, the After portfolio is set up to support eventual withdrawals in a more explicit way, whether they occur soon or a few years from now.

Because Garrett’s 401(k) and the couple’s taxable assets will likely supply the bulk of their portfolio withdrawals in the early years of retirement, I used a bucket-type strategy for those two accounts. (Garrett could also roll over his 401(k) into an IRA, but I left the 401(k) assets intact because he’s still contributing to the account and the lineup is solid.) Within both accounts, I added discrete positions in cash and bonds, to support eventual withdrawals, above and beyond what the income from their holdings can supply. Intermediate-term bonds have encountered tough sledding amid this year’s interest-rate increases, but short-term bonds have held up much better.

Garrett’s 401(k) includes a few fine target-date funds from Vanguard, but discrete cash, stock, and bond holdings will give him the latitude to take his withdrawals from whichever asset class has enjoyed the best performance recently. As in my bucket portfolios, I organized the holdings from most conservative (cash and short-term bonds) to least (stocks). I used Garrett’s anticipated first RMD amount of about $45,000 to help rightsize the allocations to each of the buckets, targeting roughly 10 years’ worth of starting RMDs in cash and bonds and the rest in stocks.

Similarly, my changes to the joint taxable account are designed to make it easier to source cash flow needs as well as to improve tax efficiency. As with Garrett’s 401(k), I organized the portfolio by risk level, from most conservative to least. I used municipal bond funds for fixed-income exposure and broad-market index funds for equity exposure. T. Rowe Price Capital Appreciation is a better option for a tax-sheltered account than it is a taxable one, but the fact that it’s closed and its strength comes from an investment standpoint outweighs tax considerations.

Note that my After portfolio makes changes to the couple’s joint taxable account, but the couple should check the cost basis in their holdings before undertaking any changes, because selling appreciated positions will trigger a tax bill.

Angela is nowhere near RMD age, so her accounts can be positioned more aggressively. I enlarged her position in Vanguard Wellesley Income and added a stake in Vanguard Dividend Growth.

Long-term care is a wild card for this couple. They don’t have long-term-care insurance and plan to self-fund long-term-care needs if they should arise. A logical source of funds in this instance would be the sale of one or more of the couple’s properties to help meet long-term-care costs.

Note: Names and other potentially identifying details in the makeovers have been changed to protect the investors’ privacy. Makeovers are not intended to be individualized investment advice, but rather to be illustrations of possible portfolio strategies that investors should consider in the full context of their own financial situations.

Correction: This article was updated to make clear that the author has a position in VWIUX.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)