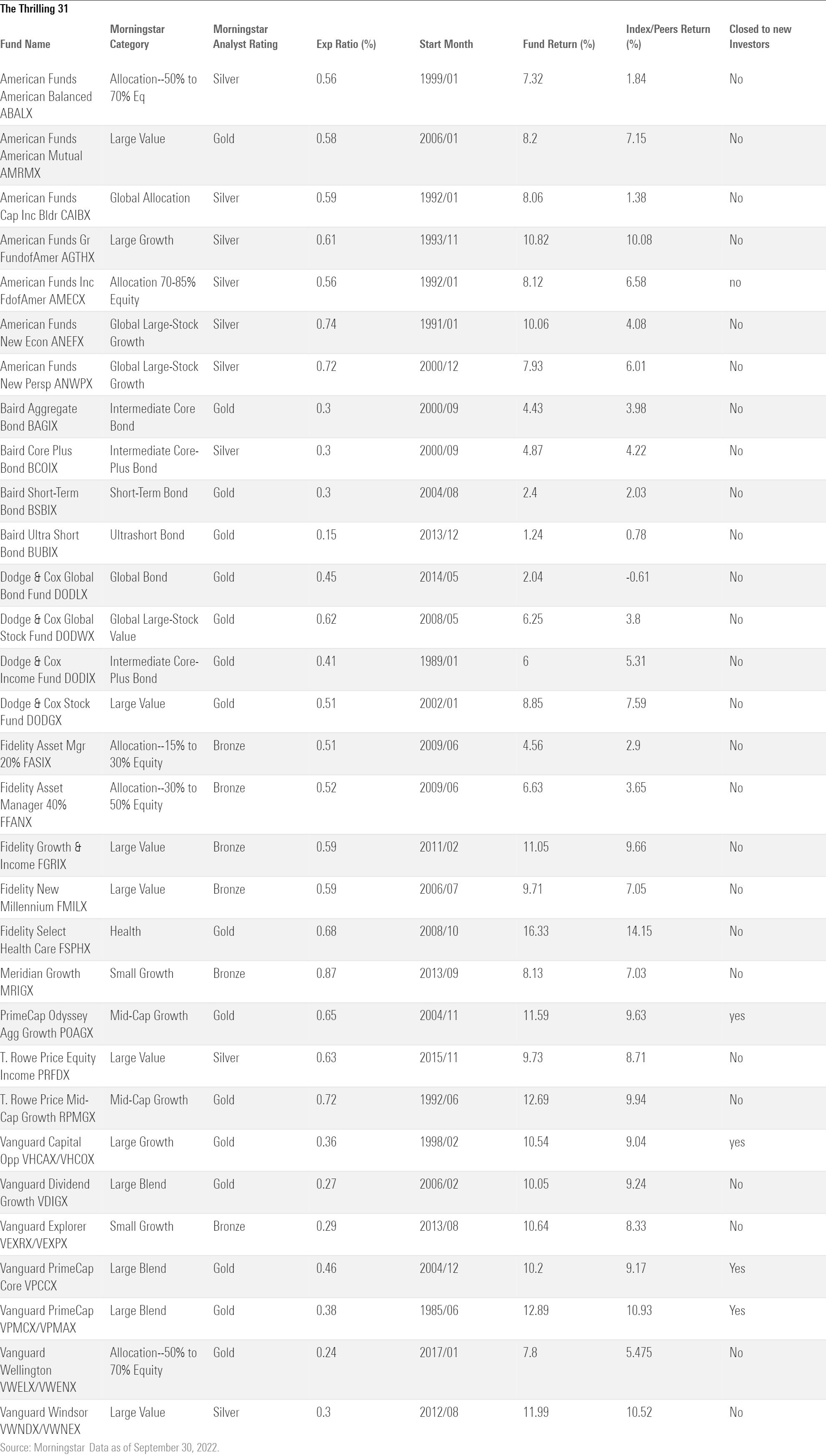

The Thrilling 31: A List of Great Funds

A few screens will shrink the fund world down to a manageable number.

Editor’s Note: This is an updated version of an article that originally appeared in the July 2022 issue of FundInvestor. Russ owns POAGX, RPMGX, VPCCX.

It’s time once again for our popular Thrilling 31 feature. As you may recall, this is a list I generate with a few simple, strict screens to narrow a universe of 15,000 fund share classes to a short list ranging between 25 and 50. It’s purely a screen; I don’t make any additions or subtractions. So, if your favorite fund didn’t make the cut, it is because it failed a test, not because I hate it.

The basic idea is that with so many funds out there you can be choosy. It’s better to be choosy by setting high standards on the most important factors rather than screening on a lot of minor data points. I emphasize fees, the Morningstar Analyst Rating, long-term performance, and fund company quality.

There’s also a risk measure that throws out funds with Morningstar Risk ratings of High because investors have a hard time using the most volatile funds well—they’re hard to hold on to in downturns and tempting to buy after they’ve already rebounded from past lows. The Morningstar Risk measure is relative to peers, meaning there are emerging-markets funds with Low risk ratings and short-term bond funds with High risk ratings. It tells you about relative risk, not absolute risk. Specifically, it tells you about downside volatility over the trailing three, five, and 10 years.

Here are the tests:

- Expense ratio in the Morningstar Category’s cheapest quintile. (I use the prospectus adjusted expense ratio, which includes underlying fund fees but does not include leverage and shorting costs. In addition, I screen out active funds charging less than 10 basis points if those funds are limited to platforms that charge other fees.)

- Manager investment of more than $1 million in the fund (the top rung of the investment ranges reported in SEC filings).

- Morningstar Risk rating lower than High.

- Morningstar Analyst Rating of Bronze or higher.

- Parent Pillar rating better than Average.

- Returns greater than the fund’s category benchmark over the manager’s tenure for a minimum of five years. In the case of allocation funds, I also used category averages because benchmarks are often pure equity or bond and therefore not good tests.

- Must be a share class accessible to individual investors with a minimum investment no greater than $50,000.

- No funds of funds.

I don’t change the tests, but I do have a new wrinkle for subscribers to Morningstar Direct, our institutional fund database. We have created a notebook that you can use to run this screen any day. The only difference is that I didn’t screen out institutional share classes. Look for the Fantastic Funds notebook in the Analytics Lab. For those who don’t have Direct, there’s a simple tool on the FundInvestor site that lets you enter a ticker and see how your fund stacks up on the tests.

This Year’s Model

It’s been an incredibly tumultuous 12 months since I last ran the test. Yet, the result was similar to last year’s. In all, 31 funds made the grade. I think that stability speaks to the soundness of the process and these funds’ ability to persevere. It also reflects the long-term focus of these screens. They look at the full length of a manager’s record, and they use data that are linked to strong long-term performance.

Let’s look at the five funds that returned to the fold this year. I like that three of them are growth funds at a time when growth has been crushed. There’s no reason it can’t go down more.

I own two of these Gold-rated gems, so let’s start there. (If they lose another 30% from here, you’ll still curse me but at least you’ll know you have company.)

The closed Primecap Odyssey Aggressive Growth POAGX is more of a mid-cap fund, but it also packs a punch. The fund’s 22% year-to-date loss is less than the mid-growth index because it leans toward biotech and pharma a little more than tech, but it is still bold. Primecap’s investors are among the very best, and they tend to stay at the firm their whole careers.

The recently reopened T. Rowe Price Mid-Cap Growth RPMGX is another brilliant growth fund. Run by Brian Berghuis, it has stayed ahead of the curve in tech and healthcare for many years, and that’s not easy. The fund’s 20% loss is better than peers because Berghuis was wary of growth valuations and got somewhat defensive. T. Rowe Price has outstanding analysts supporting this fund, and this should be a welcome long-term holding.

Gold-rated Vanguard Wellington VWENX represents one of the best bargains in investing. The fund charges just 0.16% for Wellington’s excellent team to run a 65/35 stock/bond portfolio. The fund recently made a generational shift as Wellington veterans Daniel Pozen and Loren Moran took over the equity and bond sleeves in 2020 and 2021, respectively. We’re optimistic about these experienced but “new” managers.

Bronze-rated Fidelity New Millennium FMILX is not quite as impressive over the long term, but it’s looking better this year as John Roth’s bold bet on energy stocks has paid off nicely. The fund is off 7% for the year to date but is modestly ahead of its benchmark over Roth’s tenure. Roth tries to choose industries about to enjoy a spike in demand when picking value stocks, and he looks for companies that dominate their industries when picking growth stocks.

Correction: American Funds EuroPacific Growth was originally in the Morningstar FundInvestor article and the first version of this article. It is now just 1 basis point above the fee cutoff and so has been removed from the article.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)