Morningstar Awards for Investing Excellence: Exemplary Stewardship Nominees

We recognize three asset managers for nurturing cultures that put investors first.

Today, we share the 2022 nominees for the fourth annual Morningstar Awards for Investing Excellence: Exemplary Stewardship. The winner, with the Outstanding Portfolio Manager award recipient, will be announced next week.

Past winners include The Vanguard Group (2019), T. Rowe Price (2020), and Dodge & Cox (2021). Since 2019, our inaugural year, Exemplary Stewardship nominees must have earned a Morningstar Parent Pillar rating of High, which signals Morningstar analysts’ highest conviction in their stewardship. The potential list of nominees is limited--currently only nine U.S.-based firms, including previous winners. In the past, we left previous winners out of the nomination pool, considering the long-term nature of Morningstar’s assessment of investment firms and our desire to highlight more good works in the early years of these awards, but we included them in 2022.

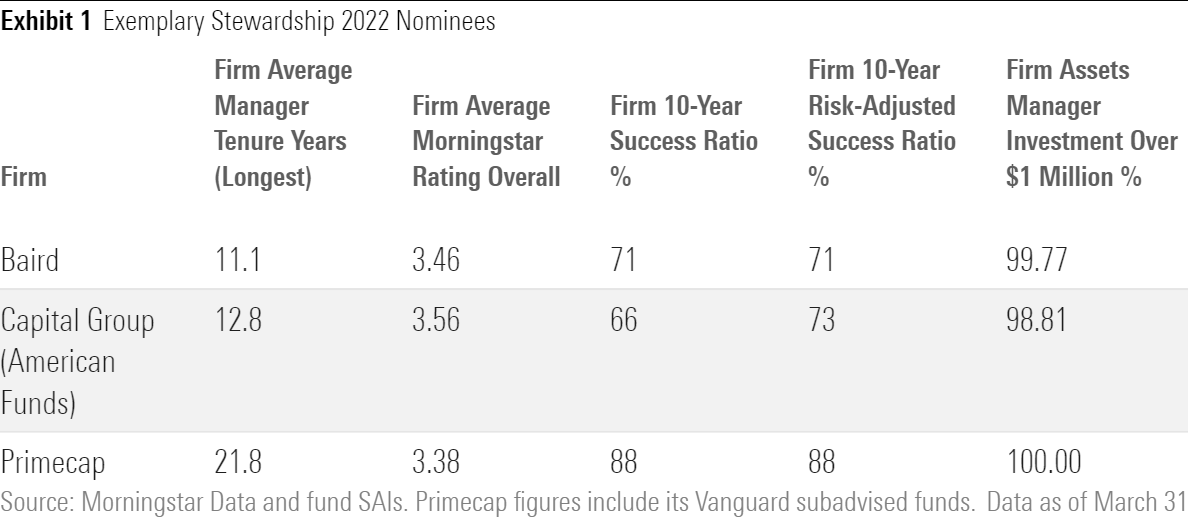

The strongest stewards have long track records of putting investors’ interests first. Each has built and nurtured investment and commercial cultures that stand above the competition. From that group, Morningstar has nominated three firms for its Exemplary Stewardship award this year: Baird Asset Management, Capital Group, and Primecap.

Baird Asset Management

Baird Asset Management's long-standing commitment to investor success, transparency in strategy management, and cost-consciousness merit its nomination. The firm, which managed just shy of $140 billion at the end of 2021, stands out among investment boutiques. Rather than attempt to create a fund for every market and investor type, Baird has long focused on what it knows and does best.

Its success stems in large part from the influence of Baird Asset Management co-chief investment officer Mary Ellen Stanek, who joined the firm with a tight-knit group of collaborators from Firmco in 2000 and helped revive its asset-management business. The firm’s taxable fixed-income strategies encompass more than 90% of the firm’s total assets and sport a collaborative and growing team, sensible investment processes, and low fees. The firm’s municipal-bond offerings also have posted attractive results and attracted strong investor interest. Although its equity effort is much smaller, Baird’s tenured domestic small- and mid-cap equity managers have been successful, as has the firm’s Chautauqua Capital Management international equity affiliate.

Beyond asset management, the firm is a well-regarded equity research shop and capital markets advisor with a growing wealth management arm. CEO Steve Booth has emphasized the same attributes Stanek has stressed at asset management across the firm. The firm values cultural fit when hiring, and investment team and overall departures are rare. Two thirds of employees are owners of the private firm, and fund managers invest in the strategies they run. Although Baird may not have the scale of some of its larger rivals, few of its competitors have as enviable a stewardship record.

Capital Group (American Funds)

Capital Group has been an Exemplary Stewardship nominee every year since the award's 2019 inception. Long known for its equity investing prowess, Capital has invested heavily in its fixed-income and multi-asset groups in recent years. The former has improved since the 2008 credit crisis, which has bolstered the latter’s prospects. The firm’s target-date series is now one of only five distinct offerings whose cheapest share classes receive Morningstar Analyst Ratings of Gold.

The firm eschews trend-chasing but doesn’t stand still. This has been an active investing firm since its 1931 founding and one of the few big asset managers that doesn't offer any passive strategies. Yet Capital in February 2022 launched its first exchange-traded funds: six actively managed, transparent strategies. The firm’s clean F3 shares, which don’t charge any distribution fees, promote mutual fund pricing transparency in the United States.

Capital remains an investor-led organization that attracts, develops, and retains talented analysts and managers. The multimanager approach it has used since 1958 underpins much of the firm’s success. It combines multiple high-conviction portfolios run in a variety of styles on each strategy, which helps Capital manage capacity and manager changes in its relatively compact fund lineup. The firm’s large roster of proven investors have achieved superior investment results over very long stretches. Finally, Capital’s scale--$3 trillion under management as of December 2021--enables it to keep expense ratios low.

Primecap

Primecap, a U.S.-stock-focused investment boutique, can be contrarian but generally follows a growth-oriented philosophy. The firm offers just three funds under its own Primecap Odyssey brand, but it has been a key subadvisor for Vanguard since November 1984, just 14 months after Primecap’s founding. In fact, Vanguard remains its largest client. Vanguard’s Primecap offerings are unsurprisingly cheap, but the Primecap Odyssey bunch is also very competitively priced. Although at times the firm’s high-conviction portfolios can endure rough stretches of performance, Primecap’s strategies boast excellent long-term results overall.

Like fellow repeat nominee Capital Group, Primecap uses a multimanager approach to running its strategies, which helps with capacity management, succession planning, and portfolio manager transitions. Its portfolio managers are also deliberate and engaged in the long-term strategy and management of the firm, and they have made some uncommon but exemplary choices. For example, they have prioritized investment results for a select number of clients over expanding the firm’s reach across the globe and into asset classes beyond equities; although Primecap managed $153 billion as of December 2021, its fund lineup remains straightforward and focused compared with most. The firm has also proved capacity-conscious in closing one of its Odyssey strategies to new investors. (All of its Vanguard funds currently have limited availability.)

Investment talent recruitment is another area where Primecap stands out. Three firm principals and portfolio managers directly involve themselves in the process. They often hire standout, culturally aligned MBA graduates even when there is no immediate need and even when the candidates had not explicitly considered investment careers.

Gabriel Denis; Tom Nations, CFP; and Alec Lucas contributed to this article.

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)